Bioprocessing Market Revenue to Attain USD 124.42 Bn by 2035

Bioprocessing Market Revenue and Trends 2026 to 2035

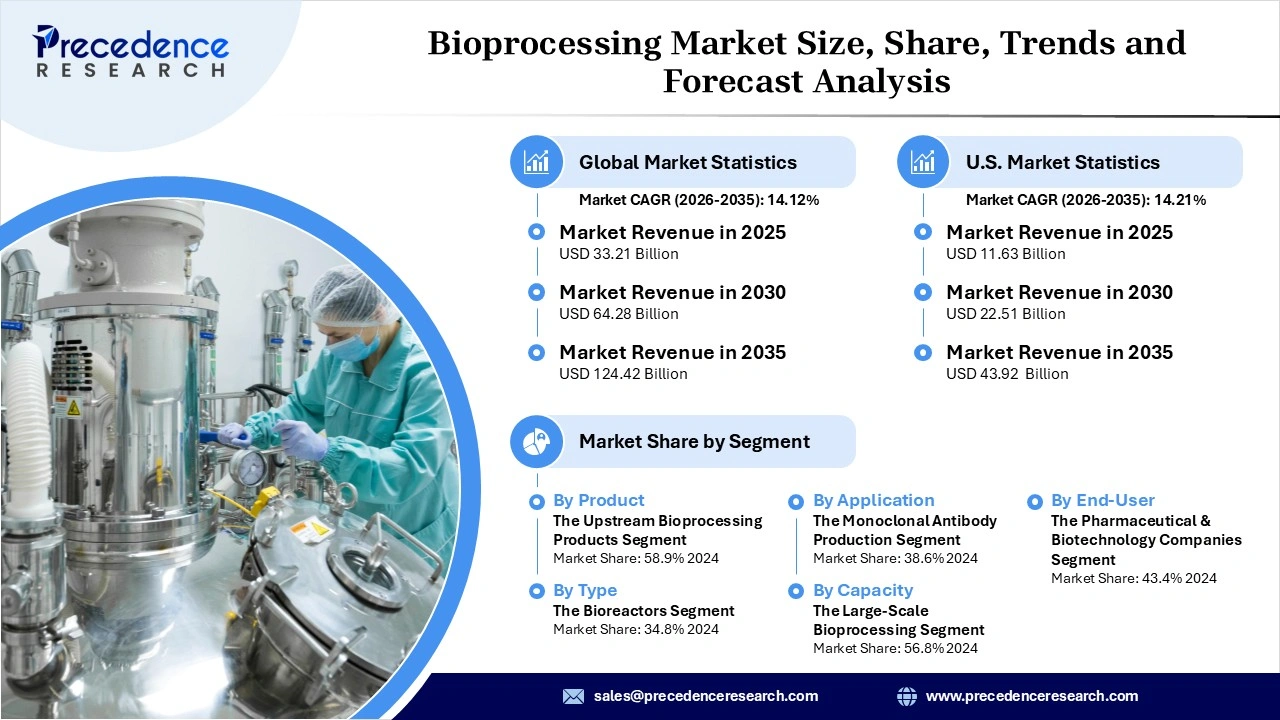

The global bioprocessing market revenue surpassed USD 33.21 billion in 2025 and is predicted to attain around USD 124.42 billion by 2035, growing at a CAGR of 14.12%. The market is witnessing robust growth driven by increased demand for biologics to address the global burden of disease, the expansion of the biotech and pharmaceutical industry, and government incentives to support the healthcare sector.

What are the Key Trends of the Bioprocessing Market?

The bioprocessing market is fueled by key driving trends, including the incorporation of automation and digitalization in bioprocessing, the expansion of single-use systems, increased scalability in bioprocessing, and the rapid evolution of advanced therapies such as gene and cell therapies. The biggest revolution the market is witnessing is the integration of advanced software with AI to optimize real-time production in the bioprocessing market. Moreover, technologies like digital twin will predict outcomes through simulation before applying them in real-world settings, making the process more effective and cost-effective while enhancing final product quality.

Segments Insights

- By product, the upstream bioprocessing products segment held the largest market share in 2025 due to the crucial effects of upstream operations on final output, cell growth kinetics, and process efficiency requirements.

- By type, the bioreactors segment held the largest market share in 2025 as many biopharmaceutical companies are expecting offer more biologic products by using high-density cultures.

- By application, the monoclonal antibody production segment held the largest market share in 2025, owing to the huge demand for monoclonal antibody products, especially in autoimmune disease treatments and the oncology domain.

- By capacity, the large-scale bioprocessing segment held the largest market share in 2025 due to the high-scale production of monoclonal antibodies, vaccines, and recombinant proteins.

- By end user, the pharmaceutical and biotechnology companies segment held the largest market share in 2025 due to their extensive investment to build their pipeline for therapeutic products and the capability to manufacture biologics in-house.

Regional Insights

North America held the largest market share in 2025, supported by a well-established biomanufacturing ecosystem and substantial government investment to advance biologics production technologies. The region benefits from deep integration among biotechnology firms, contract development and manufacturing organizations, and academic research centers, accelerating the translation of research into large-scale manufacturing. Public funding mechanisms in the United States, including sustained support from agencies such as the National Institutes of Health and the Biomedical Advanced Research and Development Authority, continue to strengthen capabilities in advanced biologics manufacturing.

The region hosts a high concentration of biotechnology companies focused on monoclonal antibodies, mRNA-based therapeutics, and viral vectors used in gene and cell therapies. Manufacturing facilities across the United States and Canada increasingly deploy single-use bioreactors, continuous processing systems, and advanced analytical technologies to improve yield, consistency, and scalability. These capabilities are particularly critical for complex modalities such as CAR-T therapies and mRNA vaccines, where process control and regulatory compliance are essential. Strong regulatory clarity and established quality standards further reinforce North America’s leadership position.

Asia Pacific is projected to grow at the fastest CAGR during the foreseeable period, driven by government-backed incentives and rapid expansion of advanced biomanufacturing infrastructure. Countries across the region are investing heavily in facilities designed to support large-scale production of biologics, biosimilars, and next-generation therapies. National strategies in China, South Korea, Singapore, and India prioritize domestic biologics manufacturing to strengthen healthcare resilience and reduce reliance on imports.

The region is increasingly recognized as a frontier for biomanufacturing growth, driven by flexible facility configurations that support multi-product production and rapid scale-up. Manufacturers are deploying modular cleanroom designs, single-use processing equipment, and digital manufacturing systems to shorten construction timelines and reduce capital intensity. These facilities are well-suited for mass-scale production of monoclonal antibodies, vaccines, and emerging cell and gene therapies. Growing participation of regional contract manufacturing organizations in global supply chains further supports Asia Pacific’s rapid expansion in advanced biologics manufacturing.

Bioprocessing Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 33.21 Billion |

| Market Revenue by 2035 | USD 124.42 Billion |

| CAGR from 2026 to 2035 | 14.12% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Development

- In December 2025, a leading marketer, Thermo Fisher Scientific, made an expansion of its bioprocessing capabilities in the Asia Pacific, including leading countries like India, Korea, and Singapore, to support the increasing demand for biologics.(Source: https://www.europeanpharmaceuticalreview.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7224

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344