Protein Characterization and Identification Market Size and Forecast 2025 to 2034

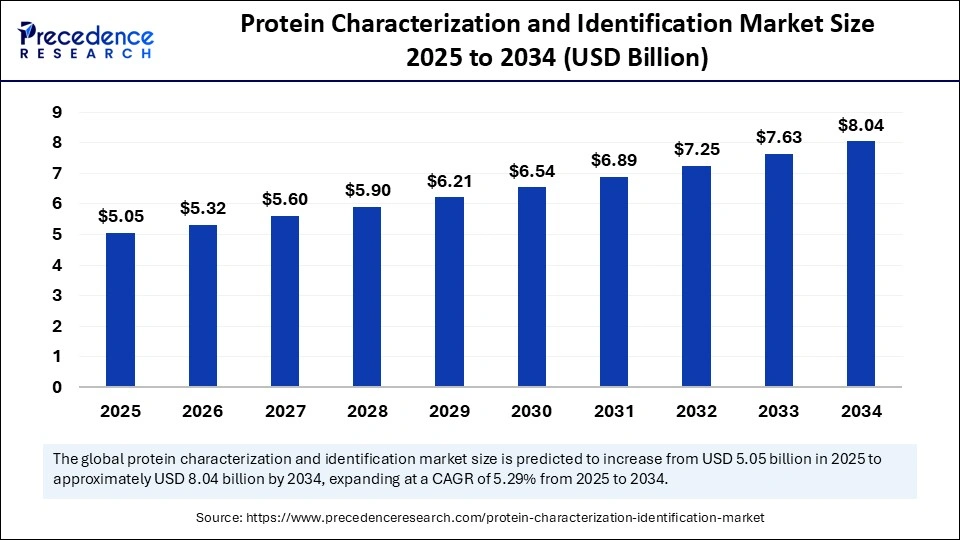

The global protein characterization and identification market size was calculated at USD 4.80 billion in 2024 and is predicted to increase from USD 5.05 billion in 2025 to approximately USD 8.04 billion by 2034, expanding at a CAGR of 5.29% from 2025 to 2034. The market is growing due to increasing demand for advanced analytical techniques in drug development, biotechnology research, and quality control across pharmaceuticals and life sciences.

Protein Characterization and Identification Market Key Takeaways

- In terms of revenue, the global protein characterization and identification market was valued at USD 4.80 billion in 2024.

- It is projected to reach USD 8.04 billion by 2034.

- The market is expected to grow at a CAGR of 5.29% from 2025 to 2034.

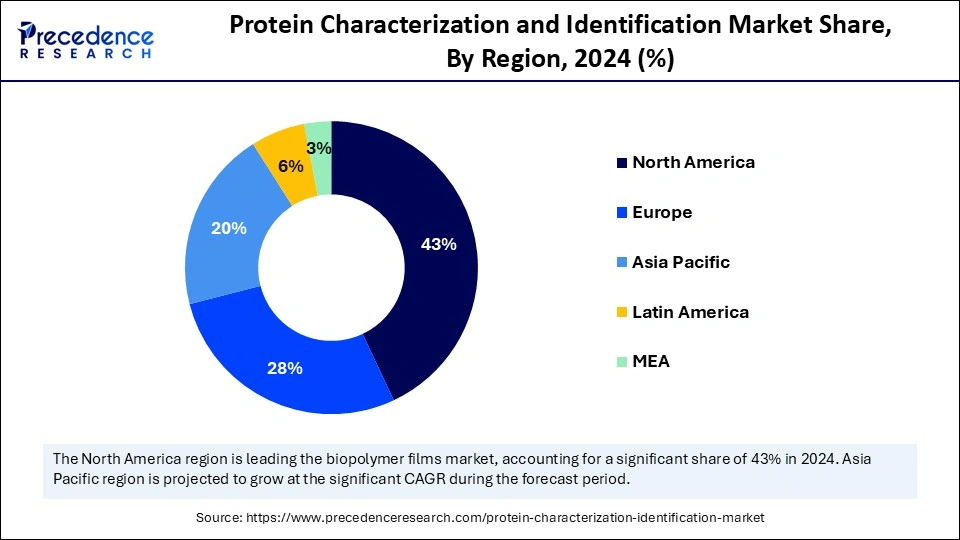

- North America dominated the protein characterization and identification market with the largest market share of 43% in 2024.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By product/offering, the instruments and systems segment held the biggest market share in 2024.

- By product/offering, the consumables and reagents (kits, columns, standards) segment is expected to grow at the fastest CAGR during the forecast period.

- By technology/method, the mass spectrometry (LC-MS/MS, MALDI-TOF, HR-MS) segment captured the biggest market share in 2024.

- By technology/method, the biophysical and interaction analysis (SPR, BLI, ITC, MST) segment is the fastest-growing during the forecast period.

- By workflow stage/use case, the protein identification and sequencing segment contributed the highest market share in 2024.

- By workflow stage/use case, the PTM analysis and mapping segment is emerging as the fastest growing.

- By sample type, the recombinant/biotherapeutic proteins (mAbs, ADCs) segment held the largest share in 2024.

- By sample type, the food and agricultural samples segment is expected to grow at the fastest CAGR during the forecast period.

- By end user/vertical, the biopharmaceutical and CROs (drug discovery, biologics development) segment generated the major market share in 2024.

- By end user/vertical, the contract testing and proteomics service providers segment is expected to grow at the fastest rate during the forecast period.

How is AI improving the accuracy and throughput of protein identification and characterization?

Artificial intelligence is improving the accuracy and throughput of protein identification and characterization by automating complex data analysis and enhancing predictive capabilities. To find patterns and correlations that are hard for humans to notice, machine learning algorithms can quickly process large proteomics datasets from methods like mass spectrometry and chromatography. AI reduces errors and variability in experimental results by more accurately predicting protein structures, post-translational modifications, and protein interactions. Furthermore, by facilitating high-throughput analysis, reducing manual intervention, and improving experimental conditions AI AI-driven automation speeds up workflows and improves protein characterization and identification, overall dependability, efficiency, and reproducibility.

U.S. Protein Characterization and Identification Market Size and Growth 2025 to 2034

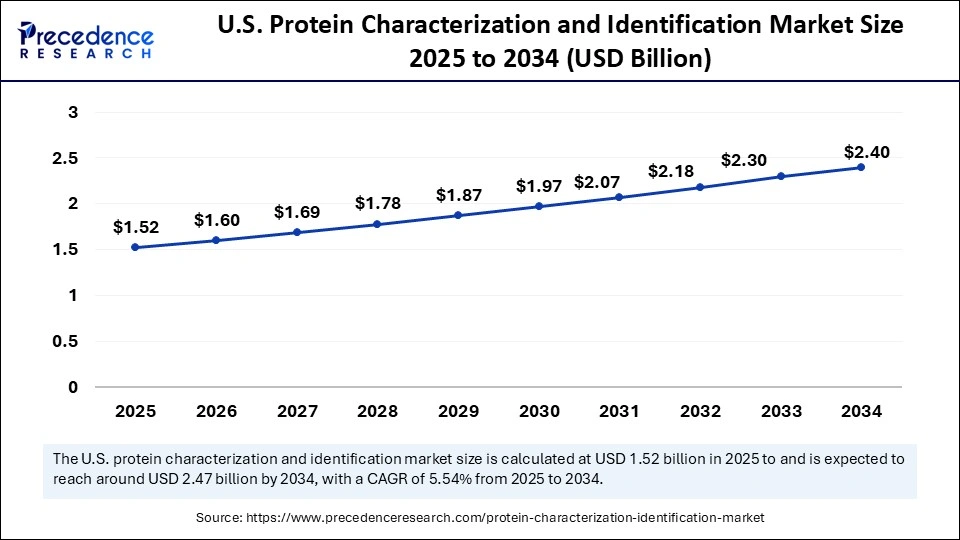

The U.S. protein characterization and identification market size was exhibited at USD 1.44 billion in 2024 and is projected to be worth around USD 2.47 billion by 2034, growing at a CAGR of 5.54% from 2025 to 2034.

Why did North America dominate the protein characterization and identification market in 2024?

North America leads the global protein characterization and identification market, propelled by a thriving biopharmaceutical sector, significant investment in R&D, sophisticated laboratory facilities, and advantageous regulatory environments. Strong industry-academic partnerships and the presence of top technology providers reinforce the region's supremacy. Strict quality standards and the rising demand for biologics and biosimilars support its dominant market position. Significant investments in next-generation proteomics platforms, which are speeding up the time it takes to find and develop new drugs, are also advantageous to the area.

Asia Pacific is the fastest-growing regional market, driven by the growing pharmaceutical and biotechnology sectors, government funding for life sciences research, and the growing use of cutting-edge analytical tools. Growing clinical trials activity and increasing investments in proteomics infrastructure are fueling the market's explosive expansion. The area is s center for contract research and proteomics services due to its cost advantages. Protein characterization solutions are also becoming increasingly popular due to the growing industry, academia partnerships, and the emergence of domestic biotech companies.

Market Overview

The protein characterization and identification market covers instruments, consumables, reagents, kits, software, and services used to determine protein identity, primary/secondary/tertiary structure, post-translational modifications (PTMs), molecular weight, purity, concentration, interactions, and functional properties. Core technologies include mass spectrometry, electrophoresis, chromatography, spectroscopy, biophysical interaction analysis, and immunoassays; end users span biopharma, academic and government research, clinical diagnostics, food and agriculture, and industrial biotech.

Protein Characterization and Identification Market Growth Factors

- Rising Biopharmaceutical Development: Increasing development of biologics, therapeutic proteins, and monoclonal antibodies requires precise protein characterization to ensure safety, efficacy, and quality.

- Technological Advancements: Innovations in mass spectrometry, chromatography, electrophoresis, and bioinformatics tools are enhancing the accuracy, speed, and throughput of protein identification and characterization.

- Regulatory Requirements: Strict regulations from authorities like the FDA and EMA mandate comprehensive protein analysis for drug approval, driving demand for robust characterization techniques.

- Increasing R&D Investments: Rising investment in life science, biotechnology, and pharmaceutical R&D globally fuels the adoption of advanced protein characterization methods.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.04 Billion |

| Market Size in 2025 | USD 5.05 Billion |

| Market Size in 2024 | USD 4.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.29% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product/Offering, Technology/Method, Workflow Stage/Use Case, Sample Type, End-User/Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Biopharmaceutical Production

Accurate protein characterization is necessary for growing development and commercialization of therapeutic proteins, biologics, and monoclonal antibodies in order to guarantee their safety, effectiveness, and quality. The need for in-depth structural and functional analysis is increasing as more complicated biologicals, such as fusion proteins and biosimilars, hit the market. To meet these demands and maintain regulatory compliance, businesses are making significant investments in analytical workflows.

Adoption of High Throughput Screening Techniques

The demand for effective high-throughput protein analysis in diagnostics and drug discovery drives market expansion even more. Drug development can proceed more quickly thanks to high-throughput platforms that analyze thousands of protein samples at once. This aids in the quick detection of post-translational changes, protein interactions, and possible disease biomarkers.

Restraints

High Cost of Advanced Instruments

The cost of purchasing and maintaining sophisticated analytical instruments like NMR systems, high-resolution mass spectrometers, and sophisticated chromatography setups is high. Adoption is constrained by this high capital expenditure, especially for small and mid-sized labs and educational institutions. For some organizations, investing in cutting-edge protein characterization platforms is difficult due to the additional operational costs associated with maintenance, consumables, and software licenses.

Technical Complexity and Need for Skilled Personnel

Scientists and technicians with advanced training are needed for protein characterization techniques. Adoption may be slowed down, and data analysis errors may result from a shortage of qualified staff. A barrier to market expansion is the difficulty that many businesses have in finding or training employees with knowledge of mass spectrometry, chromatography, and bioinformatics tools.

Opportunities

Expansion of the Biologics and Biosimilars Market

A major opportunity for protein characterization tools is presented by the growing development of biologics, monoclonal antibodies, and biosimilars. Regulators need analytical data to verify the safety, effectiveness, and structural consistency of new therapeutic proteins as they are introduced to the market. Businesses can identify post-translational changes, aggregation, or degradation with the aid of sophisticated characterization techniques, which are essential for product quality. There is a lot of room for expansion for instrument makers and service providers due to the increasing need for accurate protein analysis in drug development.

Growth of Proteomics and Personalized Medicine

The increased emphasis on biomarker discovery, proteomics research, and customized treatments opens new possibilities for high-resolution protein characterization technologies. By identifying disease-specific protein signatures through detailed protein profiling, researchers can expedite the development of targeted therapies. Understanding complex disease mechanisms is further improved by integration with genomics and metabolomics. It is anticipated that efforts in personalized medicine will increase demand for sophisticated protein analysis platforms in both clinical and research settings.

Product/Offering Insights

Why did the instruments and systems segment dominate the protein characterization and identification market in 2024?

The instruments and systems segment held the dominant share in the protein characterization and identification market, because they are essential for allowing precise high resolution, and real-time analysis of intricate protein research and drug development. Sophisticated systems like chromatography platforms, spectrometers, and electrophoresis units serve as the cornerstone, guaranteeing sensitivity, reproducibility, and regulatory compliance. Their widespread use in academic biotech and pharmaceutical labs solidifies their market dominance.

The consumables and reagents (kits, columns, standards) segment is emerging as the fastest-growing segment, fueled by their recurring demand in protein analysis workflows. For every phase of the experiment, from sample preparation to validation kits, columns, buffers, and standards are necessary to generate steady streams of income for suppliers. Increasing development of specialized reagents tailored for advanced techniques like LC-MS/MS and SPR further supports this rapid growth as labs seek consistent, high-quality materials for precise protein characterization.

Technology/Method Insights

Why did the mass spectrometry segment dominate the protein characterization and identification market in 2024?

The mass spectrometry (LC-MS/MS, MALDI-TOF, HR-MS) segment is dominant in protein characterization due to its unmatched sharpness, sensitivity, and capacity to examine intricate protein blends. For drug development, diagnostics, and clinical research, methods like LC-MS/MS, MALDI, and HR-MS are crucial because they allow for comprehensive proteomic profiling, protein sequencing, and biomarker discovery. Mass spectrometry is widely used in both industrial and research applications due to its scalability and versatility.

The biophysical and interaction analysis (SPR, BLI, ITC, MST) segment represents the fastest-growing segment, as there is a growing need for quantitative label-free real-time characterization of interactions between proteins and ligands. In fields like drug discovery, antibody engineering, and therapeutic protein optimization, where knowledge of binding kinetics and affinities directly affects efficacy and safety, these technologies are becoming increasingly important. Their contribution to expediting the development of biologics makes them a rapidly growing market frontier.

Workflow Stage/ Use Case Insights

Why did the protein identification and sequencing segment dominate the protein characterization and identification market?

The protein identification and sequencing segment dominates the workflow landscape, since they are the cornerstone of proteomic studies and the creation of new treatments. Researchers can learn about disease mechanisms, find new biomarkers, and develop biopharmaceuticals with the help of precise protein sequencing and identification. The most popular and essential use case in the industry is this stage, since these applications are essential to drug discovery pipelines.

The PTM analysis and mapping segment is the fastest-growing workflow, motivated by the understanding that PTMs like phosphorylation, glycosylation, and ubiquitination have a significant influence on the stability function and therapeutic effectiveness of proteins to guarantee the safety and effectiveness of protein-based medications. PTM profiling has become crucial with the growth of biologics and personalized medicine. The adoption of sophisticated analytical tools for accurate PTM characterization has accelerated due to this demand.

Sample Type Insights

Why did the recombinant/biotherapeutic proteins segment dominate the protein characterization and identification market in 2024?

The recombinant/biotherapeutic proteins (mAbs, ADCs) segment dominates the sample type segment. Extensive protein characterization is necessary to guarantee quality consistency and regulatory approval due to their crucial role in contemporary therapies, particularly for autoimmune diseases and cancer. These intricate molecules are the most important sample type available since biopharmaceutical companies place a high priority on their thorough analysis.

The food and agricultural samples segment is the fastest-growing application area, as protein characterization is applied to crop science, nutrition, and food safety, in addition to healthcare. Advanced protein identification techniques are becoming increasingly necessary in the agri-food industry due to the growing demand for foods high in protein allergen testing and genetically modified organism analysis. Beyond the conventional uses of pharmaceuticals, this diversification is creating new growth opportunities.

End User/ Vertical Insights

Why did the biopharmaceutical companies and contract research organization (CROs) segment dominate the market in 2024?

The biopharmaceutical and CROs (drug discovery, biologics development) segment dominates the end-user landscape, since they are leading the way in the creation and marketing of innovative biologics and biosimilars. They guarantee robust and long-term demand by depending on sophisticated protein characterization for quality assurance, regulatory compliance, and drug discovery pipelines. These stakeholders solidify their dominance by driving the majority of investments in tools, reagents, and services.

The contract testing and proteomics service providers segment represents the fastest-growing segment. Pharmaceutical companies are increasingly outsourcing specialized protein characterization tasks to cut costs and shorten turnaround times. Both big pharmaceutical companies and small biotech companies find these providers to be appealing partners due to their advanced analytical skills, regulatory support, and scalability. The market environment is changing due to their quick expansion, especially in emerging economies.

Protein Characterization and Identification Market Companies

- Thermo Fisher Scientific

- Agilent Technologies

- Waters Corporation

- Bruker Corporation

- SCIEX (Danaher group)

- Shimadzu Corporation

- Merck KGaA/MilliporeSigma

- Bio-Rad Laboratories

- PerkinElmer, Inc.

- Cytiva (GE Life Sciences alumni)

- Promega Corporation

- Bio-Techne Corporation

- Eurofins Scientific (proteomics and testing services)

- Charles River Laboratories (analytical and bioanalytical services)

- NanoTemper Technologies

Recent Developments

- On 15 June 2025, Agilent Technologies launched the Ultivo Triple Quandrupole LC/MS System. This compact and sensitive mass spectrometer aims to improve the efficiency and accuracy of protein analysis in clinical and research laboratories. (Source:https://www.agilent.com)

- In May 2025, Thermo Fisher Scientific announced the launch of the Orbitrap Exploris 240 Mass Spectrometer. This high-resolution mass spectrometer is designed to enhance proteomics research by providing detailed analysis of complex protein samples.(Source: https://www.thermofisher.com)

Segments Covered in the Report

By Product/Offering

- Instruments and Systems

- Consumables and Reagents (kits, columns, standards)

- Software and Informatics (analysis, spectral libraries, LIMS)

- Services (outsourced proteomics, method development, contract testing)

By Technology/Method

- Mass Spectrometry (LC-MS/MS, MALDI-TOF, HR-MS)

- Chromatography (HPLC/UPLC, SEC, ion-exchange, affinity)

- Electrophoresis and Western/Blotting (SDS-PAGE, 2D, capillary)

- Spectroscopy (CD, FTIR, UV-Vis)

- Biophysical and Interaction Analysis (SPR, BLI, ITC, MST)

- Structural/High-resolution (Cryo-EM, X-ray crystallography — typically outsourced/high-capex)

- Immunoassays (ELISA, multiplex assays)

By Workflow Stage/Use Case

- Protein identification and sequencing

- PTM analysis and mapping

- Quantitation (absolute/relative proteomics)

- Structural conformation and stability testing

- Interaction mapping and kinetics

- Purity and impurity profiling (including aggregates)

By Sample Type

- Recombinant/biotherapeutic proteins (mAbs, ADCs)

- Cell lysates and complex proteomes

- Plasma/serum and clinical samples

- Tissue samples and biopsies

- Food and agricultural samples

By End-User/Vertical

- Biopharmaceutical and CROs (drug discovery, biologics development)

- Academic and government research institutes

- Clinical and diagnostic laboratories

- Contract testing and proteomics service providers

- Food and beverage/agriculture

- Industrial biotech and manufacturing QA/QC

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content