Renewable Energy Asset Management Market Size and Forecast 2025 to 2034

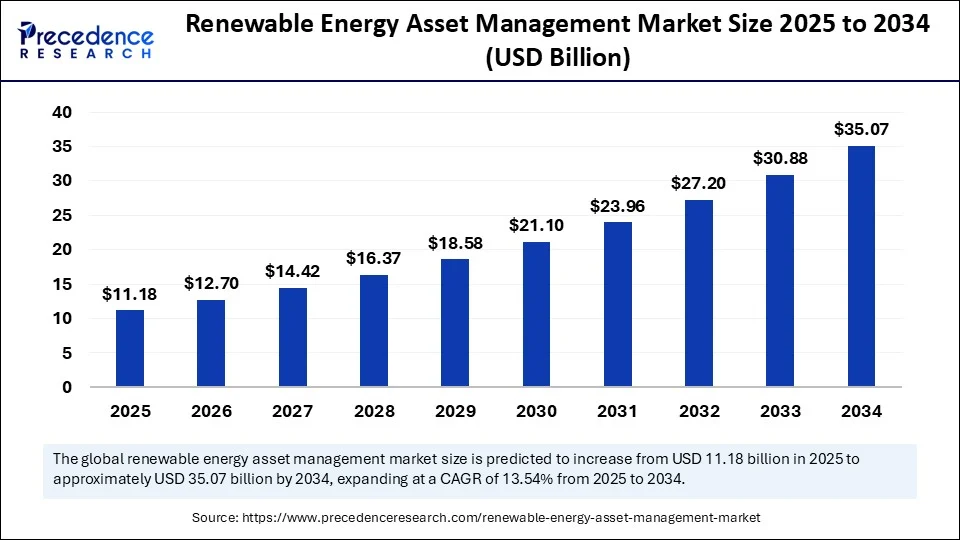

The global renewable energy asset management market size accounted for USD 9.85 billion in 2024 and is predicted to increase from USD 11.18 billion in 2025 to approximately USD 35.07 billion by 2034, expanding at a CAGR of 13.54% from 2025 to 2034. The market growth is attributed to the rapid expansion of renewable energy capacity, increasing adoption of digital asset management platforms, and rising investments in sustainability initiatives.

Renewable Energy Asset Management MarketKey Takeaways

- In terms of revenue, the global renewable energy asset management market was valued at USD 9.85 billion in 2024.

- It is projected to reach USD 35.07 billion by 2034.

- The market is expected to grow at a CAGR of 13.54% from 2025 to 2034.

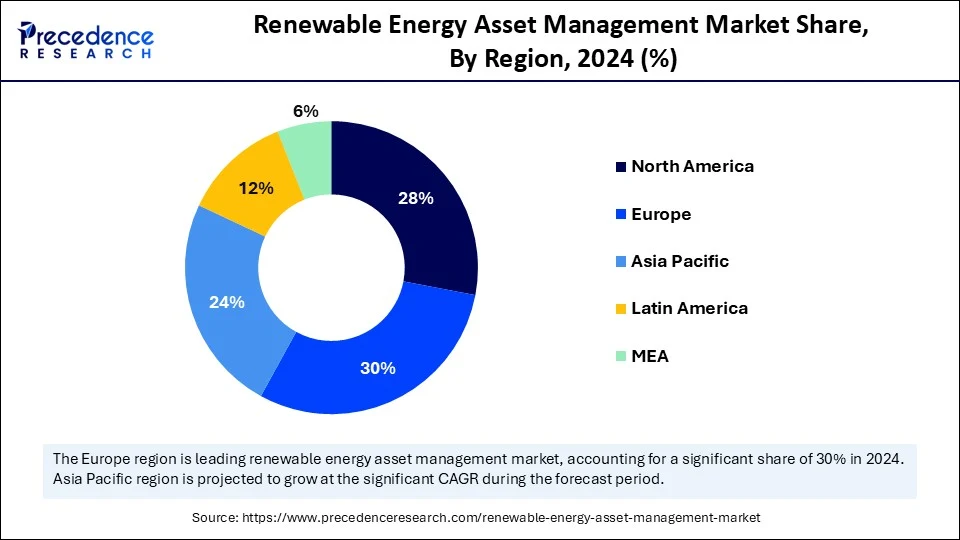

- Europe dominated the global renewable energy asset management market with the largest share of 30% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By energy source, the solar power segment held the major market share of 25% in 2024 and is expected to sustain the position in the coming years.

- By functionality/activity, the performance analytics segment contributed the biggest market share of 25% in 2024.

- By functionality/activity, the predictive & preventive maintenance segment is expanding at a significant CAGR between 2025 and 2034.

- By deployment model, the cloud-based/SaaS segment captured the biggest market share of 45% in 2024.

- By deployment model, the hybrid deployment segment is expected to grow at a significant CAGR over the projected period.

- By end-user, independent power producers (IPPs) generated the major market share of 30% in 2024.

- By end-user, the industrial & commercial energy buyers segment is expected to grow at a notable CAGR from 2025 to 2034.

What Has Been the Impact of Artificial Intelligence on the Renewable Energy Asset Management Market?

The artificial intelligence reshapes the renewable energy asset management market by providing operators with superior tools to continue their operation. Companies leverage AI-driven analytics to understand the health of individual assets and grid conditions in real-time to ensure turbines, solar panels, and storage systems perform optimally. Furthermore, the companies that use AI in this sphere become more intelligent with decisions, have bigger returns, and produce a stronger renewable energy environment.

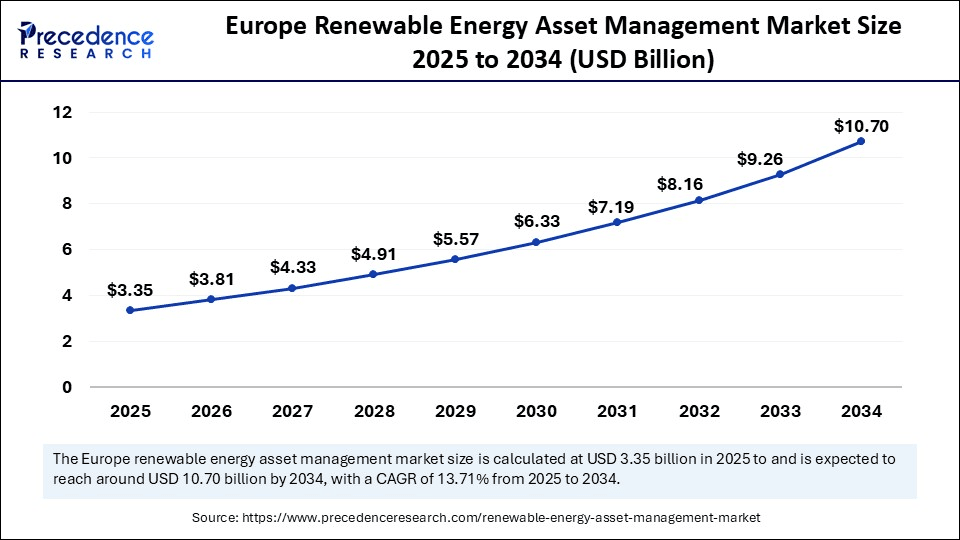

Europe Renewable Energy Asset Management Market Size and Growth 2025 to 2034

The Europe renewable energy asset management market size was exhibited at USD 2.96 billion in 2024 and is projected to be worth around USD 10.70 billion by 2034, growing at a CAGR of 13.71% from 2025 to 2034.

Why Does Europe Lead the Renewable Energy Asset Management Market Compared to Other Regions?

Europe led the renewable energy asset management market, capturing the largest revenue share in 2024, which held a share of about 30%, due to a renewable energy portfolio, a developed and robust policy framework, and a multi-faceted digital infrastructure. In 2024, it was confirmed by the European Commission that more than 47.3% of the EU's total electricity production was from renewable, solar, and wind power plants needed extensive monitoring of their performance, integration with the grid, and overall lifecycle management.

GWEC says European states added almost 17 GW of new wind power capacity last year, driving the total up to over 270 GW, and increasing the need to deploy AI-enhanced monitoring and turbine life optimization tools. Furthermore, it is expected that this regulatory and technological convergence will sustain the European leadership in the deployment of renewable asset management in the long term.(Source: https://www.gwec.net)

Asia Pacific is anticipated to grow at the fastest rate in the renewable energy asset management market during the forecast period, owing to the high-capacity addition, distributed energy, and robust government-led digitalization initiatives. IRENA notes that, in 2024, the region installed more than 320 GW of renewable capacity, led by China, India, Japan, and Australia, which increased asset portfolio complexity and scale to unprecedented levels to require digital management solutions. According to the publication of the National Energy Administration of China (NEA), over 217 GW of solar and wind capacity were installed in 2024. (Source: https://www.rivieramm.com)

This heightens the role of automated performance benchmarking and predictive maintenance solutions to limit downtime. MNRE revealed that India installed close to 18 GW of solar capacity in 2024, with Gujarat, Rajasthan, and Maharashtra driving the adoption with the highest rate, further augmenting the importance of cloud-based portfolio management https://www.precedenceresearch.com/software-market. Moreover, New investor-driven ESG requirements, especially among sovereign funds in Singapore, Japan, and South Korea, Asia-Pacific as the fastest-growing centre of renewable energy asset management in the coming decade. (Source: https://www.irena.org)

(Source: https://jmkresearch.com)

Market Overview

The growing deployment of renewable capacities internationally is likely to drive the growth in demand for advanced asset management platforms. The exponential development in the number of solar, wind, and hybrid energy facilities demands that operators resort to intelligent solutions sourced from the renewable energy asset management market players. They are capable of optimizing their metering, concentrating on real-time monitoring, and rationalizing the process of predictive maintenance. Digital platforms include sensor data and combine this with predictive algorithms to create actionable insights to enhance equipment reliability, reduce downtime, and maximize output.

As a support measure, the IEA predicts that renewable electricity generation will exceed 17,000 TWh by 2030, about an increase of 90% over 2023, with decreasing technology costs, strong policies, and the increased uptake of clean energy in power, heat, and transport sectors. These advances promote the strategic contributions of asset management platforms to efficiency in their operations, environmental regulation compliance, and transparency on portfolio-level renewable facilities. Furthermore, the employment on sustainability projects continues to drive the renewable energy asset management market since it is projected to have high investments in sustainability initiatives.(Source: https://www.iea.org)

Renewable Energy Asset Management MarketGrowth Factors

- Driving Adoption of Hybrid Renewable Systems: Rising deployment of integrated solar, wind, and storage systems fuels the demand for intelligent asset management platforms.

- Boosting Efficiency through Predictive Analytics: Growing use of AI and data-driven insights propels operational optimization and reduces downtime across renewable assets.

- Rising Integration of IoT in Energy Assets: Expanding IoT connectivity for turbines, inverters, and storage units drives real-time monitoring and enhanced performance control.

- Propelling Grid Flexibility Initiatives: Increasing development of smart grids and microgrid solutions boosts the need for platforms that manage distributed renewable energy effectively.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.07 Billion |

| Market Size in 2025 | USD 11.18 Billion |

| Market Size in 2024 | USD 9.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.54% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Energy Source, Functionality / Activity, Deployment Model, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Can Rising in Deployment of Renewable Energy Projects Accelerate the Growth of the Renewable Energy Asset Management Market?

Increasing deployment of renewable energy projects is expected to accelerate the renewable energy asset management market in the coming years. Countries and non-state entities make significant financial investments in solar, wind, and hybrid power plants, which require optimization systems and a prolonged service life. Digital monitoring systems allow asset managers to manage large-scale installations and remain profitable across a wide geographical spread. The growth of the renewable portfolios prompts the companies to utilize smart and intelligent software tools to monitor performance measures, monitor compliance, and address other concerns that keep the portfolios running.

This facilitated the power of specialized asset managers in ensuring that there is operational sustainability in an energy field that is ever polychromatic. According to the 2024 IRENA report, 585 GW of new renewable capacity has been installed, in the process breaking the renewable installation record of 2024. Governments are supporting grid integration across borders and streamlining the permitting process to speed deployment. This causes asset managers to invest in multi-regional monitoring dashboards that ensure real-time compliance and overall performance. Furthermore, the growing focus on cost optimization is projected to drive greater adoption of intelligent asset management platforms.(Source:https://www.weforum.org)

Restraint

Hamper High Upfront Implementation Costs

High initial investment in digital asset management platforms is expected to restrain growth in the renewable energy asset management market. This is especially true for small and mid-sized renewable project developers. Advanced analytics tools, including predictive analytics, digital twins, and IoT sensors, are capital-intensive in terms of hardware and software required, and the cost of integration services. Furthermore, the lack of standardized data protocols across different renewable energy technologies is anticipated to restrain the effectiveness of asset management systems.

Opportunity

Will Growing Investments in Sustainability Initiatives Reshape the Renewable Energy Asset Management Market?

High investments in sustainability initiatives are estimated to create immense opportunities for the asset management solutions market. International commitments to decarbonization are making utilities, corporations, and governments want to grow their renewable energy set portfolios and continue to perform at the level of excellence. Proper management of assets using asset management platforms enables investments to fall within the sustainability goals by accumulating maximum returns and minimizing wastage and environmental compliance. (Source: https://www.iea.org)

The World Energy Investment 2024 report, EA pointed out, 3.3 trillion dollars were invested globally in energy, having allocated 2 trillion dollars allocated to clean energy technologies and infrastructure. This exceeded the investments made in fossil fuels by twice the amount. NEP cited that 2024 had seen more than 150 countries either review or initiate net-zero strategies, which strengthen the global call on sustainability-driven investments in both infrastructure and markets. Furthermore, the spurring digitalization of the energy sector is likely to accelerate innovation within asset management practices. (Source:https://www.un.org)

Energy Source Insights

Is Solar Power the Driving Force Behind Renewable Energy Asset Management Market Growth?

Solar power segment held the major share of the renewable energy asset management market in 2024 and is expected to sustain the position in the coming years, accounting for an estimated 30% share, as the project pipelines pick up pace in utility-scale and distributed installations. In the International Energy Agency (IEA) 2024 assessment, in 2023, the world added more than 420 GW of solar capacity, a figure that constitutes more than three-quarters of all renewable capacity deployed. This growth has led to a huge amount of assets that need well-developed management systems.

- According to the International Renewable Energy Agency (IRENA) 2024 update, the installed solar photovoltaic systems had nearly 1.6 TW by the beginning of the year 2024, with more than 60% coming up in the continent of Asia. This is expected to fuel the demand for predictive O&M and digital optimization platforms. Furthermore, the high component reliability level, effective EPC supply chains, and consistent system patterns lowered the downtime and operational risks, making solar the best source of power under digital asset management. (Source: https://www.ren21.net)

Functionality / Activity Insights

Why Does Performance Analytics Hold the Largest Share in Renewable Energy Asset Management Market Activities?

Performance analytics segment held the largest revenue share in the renewable energy asset management market in 2024, accounting for 25% of market share, as operators implement KPI-based systems to wring operational value out of growing fleets. Furthermore, the effective use of these tools leads to more stringent performance baselines, accelerated repowering decisions, and quantifiable reductions of energy losses across utility and distributed assets.

The predictive and preventive segment is expected to grow at the fastest CAGR in the coming years, as operators move away from schedule-based work to condition-based efforts influenced by telemetry and edge analytics. Additionally, such a transition to predictive governance reduces erroneous outages, decreases unplanned shutdowns, and enhances fleet throughput of a fleet that is subjected to repowering and life-extension projects.

Deployment Model Insights

Why is Cloud-Based SaaS the Backbone of Deployment Models in the Renewable Energy Asset Management Market?

Cloud-based / SaaS segment dominated the renewable energy asset management market in 2024 that holding a share of about 45%, as operators seek to roll out quickly, have centrally-aggregated data, and have elastic compute to perform fleet-level analytics. Larger utilities and independent generators standardize on multi-tenant SaaS platforms to integrate SCADA and market signals into one dashboard that allows faster decision cycles and unified KPI reporting.

Additional traction was provided by the digitalization of renewable portfolios, with IEA noting that in 2023, global renewable capacity additions were exacerbated to 507 GW, and utilities were turning to SaaS solutions to monitor and optimize them. Moreover, SaaS integration was also pinpointed as a means to streamline cross-border operations of the energy market, further affirming cloud-based implementations as the backbone of efficient management of renewable assets.

The hybrid deployment segment is expected to grow at the fastest rate in the coming years in the renewable energy asset management market, owing to the operators negotiating the latency-sensitive processing and cloud-scale analytics, particularly in the distributed fleet and low-latency control needs. Project teams chose hybrid architectures as a way of maximizing bandwidth expense and achieving sustainability objectives by offloading dense compute to renewably powered regions where available. Additionally, the growing developments reveal that hybrid-type architectures are expected to prevail in future upgrades where stability, data security, and scalability meet.

End-User Insights

Do Independent Power Producers (IPPs) Dominate the Renewable Energy Asset Management Market End-User Segment?

Independent power producers (IPPs) segment held the largest revenue share in the renewable energy asset management market in 2024, accounting for an estimated 71% market share, due to their quicker to execute projects, bundling multi-location portfolios, and streamlining operational procedures, which favors centralized asset management.

Power producers increase their pipeline development with merchant and contracted development, commissioning utility-scale solar and wind fleets, driving SCADA integration, performance benchmarking, and contract compliance processes. Furthermore, the rising needs are likely to perpetuate IPP interest in integrated asset management stacks, providing quick access to information and comparable reporting across mixed fleets.

The industrial and commercial buyers segment is expected to grow at the fastest CAGR in the coming years, owing to the scaling of on-site generation, off-site PPAs, and energy-as-a-service deals to achieve decarbonization and resiliency goals. Moreover, the existing corporate promises of 24/7 clean energy procurement are expected to further catalyze demand in buyer-facing asset services performance guarantees, meter-to-PPA settlement, and predictive maintenance linked to buyer-side KPIs.

Renewable Energy Asset Management Market Companies

- ABB

- ABB-YY Grid

- Bosch Rexroth (Bosch)

- C3.ai

- Delta Electronics

- Eaton

- Emerson Electric

- Fuji Electric

- GE Renewable Energy

- Hitachi Energy

- Honeywell (Honeywell Process Solutions)

- Huawei Digital Power (HUAWEI)

- Ingeteam

- Mitsubishi Electric

- NARI Group (NARI-Grid)

- Schneider Electric

- Siemens Energy

- Sungrow Power Supply

- Toshiba Energy Systems & Solutions

- Wartsila (formerly Wärtsilä)

Recent Developments

- In July 2025, Exus Renewables secured a new 307 MW asset management mandate from Ingka Investments, the investment arm of Ingka Group, after winning a competitive tender covering more than 500 MW of renewable energy assets across Europe. The agreements cover 23 wind farms and one grid infrastructure project spanning seven countries. Under this deal, Exus will continue overseeing projects in France and Germany while entering the Polish market for the first time, marking a significant expansion of its third-party asset management footprint.(Source: https://www.exusrenewables.com)

- In November 2024, IBM announced the general availability of IBM Maximo Renewables, a purpose-built solution designed to help companies enhance the efficiency and management of renewable energy assets. The platform offers real-time monitoring, predictive maintenance, and performance analytics, enabling operators to pinpoint efficiency losses and streamline maintenance planning. Kendra DeKeyrel, VP of ESG & Asset Management Products at IBM, highlighted that as renewable portfolios grow in scale and complexity, asset owners face mounting costs from inspections, operations, and external disruptions.(Source: https://www.esgtoday.com)

- In November 2023, Macquarie Asset Management Launches Aula Energy.Macquarie Asset Management introduced Aula Energy, its dedicated onshore renewable energy platform for Australia and New Zealand. Aula Energy aims to develop, build, and operate utility-scale solar, wind, and hybrid battery projects, creating a pipeline of actively managed clean energy assets. The platform's initial portfolio includes projects with a planned capacity of 4 GW, signaling Macquarie's intent to play a leading role in driving renewable energy adoption in the region. (Source: https://www.greeninvestmentgroup.com)

- In April 2025, ALTÉRRA, the world's largest private climate investment fund, announced its inaugural co-investment of $100 million in Indian renewable energy company Evren. The deal, completed alongside Brookfield Asset Management and other partners, came via the ALTÉRRA Acceleration Fund and marked the group's first direct investment into the Global South. The partnership is anticipated to boost Evren's capacity to scale clean energy generation across India, supporting both domestic climate goals and global decarbonization efforts.(Source: https://www.alterra.ae)

Segments Covered in the Report

By Energy Source

- Wind Power

- Onshore Wind

- Offshore Wind

- Solar Power

- Utility-Scale PV

- Distributed/Rooftop PV

- Concentrated Solar Power (CSP)

- Hydropower

- Small Hydro (<10 MW)

- Medium Hydro (10–100 MW)

- Large Hydro (>100 MW)

- Biomass & Biogas

- Biomass Combustion

- Biogas / Anaerobic Digestion

- Geothermal Energy

- Marine (Tidal & Wave)

By Functionality / Activity

- Monitoring & SCADA Systems

- Performance Analytics & Reporting

- Predictive & Preventive Maintenance

- Asset Lifecycle & Work-Order Management

- Energy Trading & Integration Platforms

- Remote Operations & Virtual Power Plants (VPP)

- Risk & Compliance / Regulatory Reporting Tools

By Deployment Model

- On-Premises (Installed at Asset Site or Operator Facility)

- Cloud-Based / SaaS Platforms

- Hybrid (Combination of On-Premises + Cloud)

By End-User

- Independent Power Producers (IPPs)

- Utilities / Grid Operators

- Project Developers / Owners

- Asset Management Companies (AMCs)

- Power Trading Firms / Virtual Power Plant Operators

- Industrial & Commercial (Third-Party) Energy Buyers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East andAfrica

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting