What is the Restriction Enzymes Market Size?

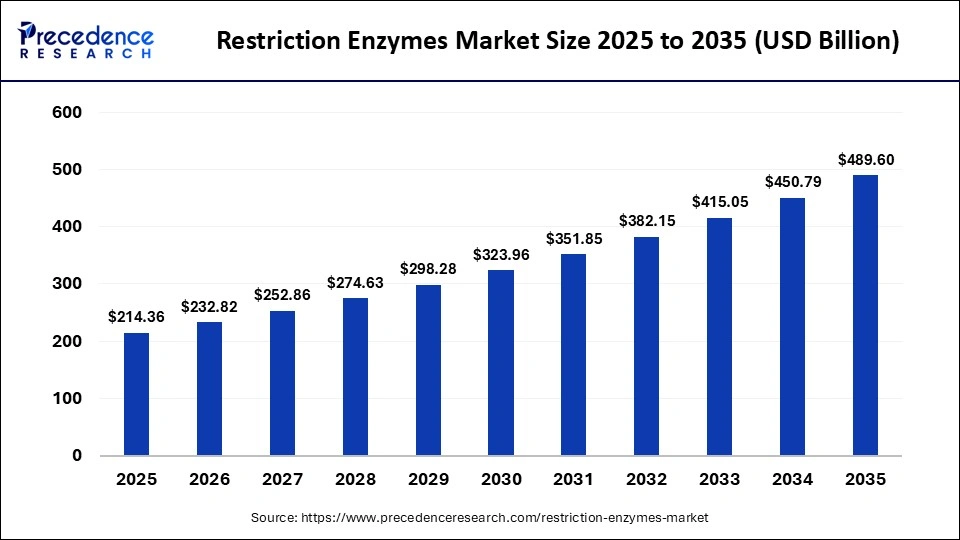

The global restriction enzymes market size accounted for USD 214.36 billion in 2025 and is predicted to increase from USD 232.82 billion in 2026 to approximately USD 489.60 billion by 2035, expanding at a CAGR of 8.61% from 2026 to 2035. The restriction enzymes market is witnessing steady overall growth, supported by expanding genomics research, rising molecular diagnostics adoption, and continuous advancements in gene editing and synthetic biology applications.

Market Highlights

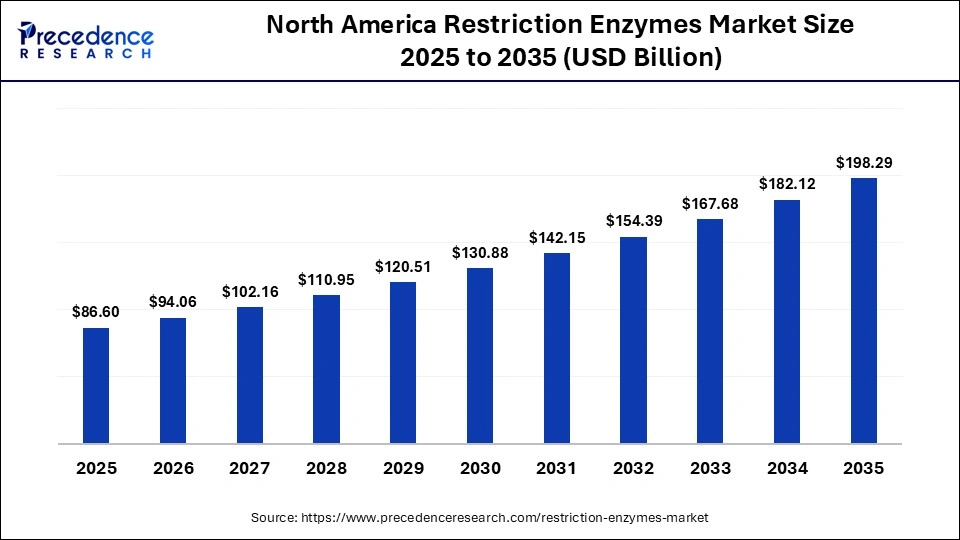

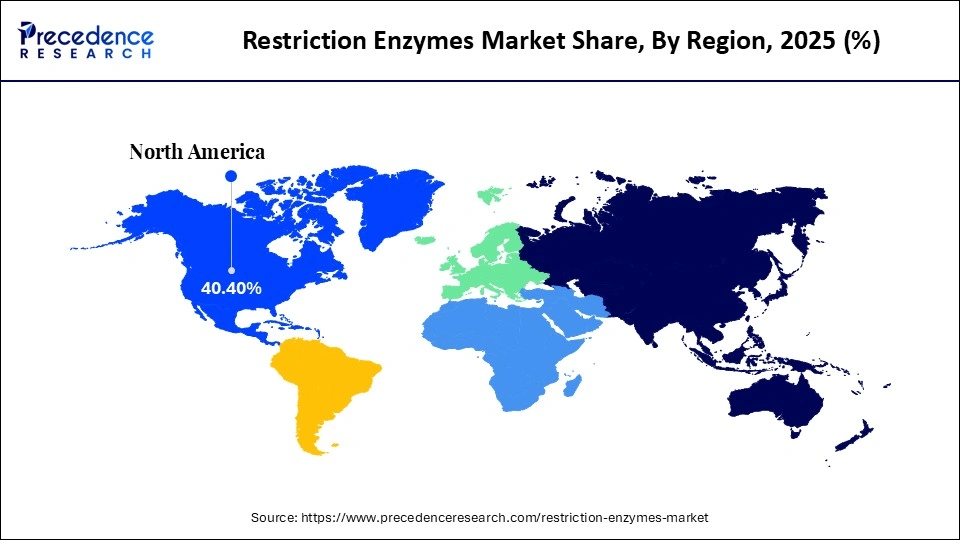

- North America led the market with a 40.4% of the total market share in 2025.

- The Asia Pacific is estimated to grow at a solid CAGR of 8.5% between 2026 and 2035.

- By product type, the type II restriction enzymes segment captured 41.1% market share in 2025.

- By product type, the type IV restriction enzymes segment is expanding at a notable CAGR of 7.4% between 2026 and 2035.

- By application, the cloning segment led the market and held the major market share of 38.7% in 2025.

- By application, the other application segment is expected to grow at the fastest CAGR of 7.5% from 2026 to 2035.

- By end-user, the academic & research institutes segment contributed the biggest market share of 46.8% in 2024.

- By end-user, the biotechnology & pharmaceutical companies segment growing at a CAGR of 7.7% between 2026 and 2035.

- By distribution channel, the direct sales segment captured 45.8% of the market share in 2025.

- By distribution channel, the E-commerce marketplaces segment is expected to expand at the highest CAGR of 7.6% between 2026 and 2035.

The Role of Restriction Enzymes in Modern Genomics

Restriction enzymes form the foundation of the restriction enzymes market, which focuses on the development, production, and distribution of enzymes that cleave DNA at highly specific nucleotide sequences. These enzymes are essential tools in molecular biology and genetic engineering, enabling precise DNA manipulation for applications such as gene cloning, DNA mapping, sequencing, and recombinant DNA construction. Their reliability and sequence specificity make them indispensable in both basic research and applied biotechnology workflows.

The market is experiencing steady growth due to the expanding volume of genomic and proteomic research, increased demand for synthetic biology applications, and wider use of molecular diagnostics in clinical and research settings. Restriction enzymes are routinely used in assay development, pathogen detection, and genetic analysis, which supports consistent demand from academic laboratories, biotechnology companies, and diagnostic developers.

Product innovation is further strengthening the market. Newer generations of restriction enzymes offer improved cutting specificity, higher thermal stability, reduced star activity, and better compatibility with high-throughput and automated platforms. These improvements increase laboratory productivity, reduce experimental error, and support large-scale genomic workflows, particularly in sequencing library preparation and synthetic construct assembly.

AI Driving an Enzyme Engineering Revolution

Artificial intelligence is reshaping the restriction enzymes market with discoveries, optimizations, and applications by fundamentally changing the pace and precision of enzyme engineering. AI-driven approaches are enabling researchers to move beyond trial-and-error experimentation toward data-guided design, where enzyme performance can be predicted and refined computationally before laboratory validation.

Advanced machine learning models analyze large enzyme sequence and structure datasets to predict DNA recognition sites, cleavage efficiency, stability, and off-target activity. This predictive capability has reduced enzyme development timelines from weeks or months to days by identifying promising sequence modifications and high-performance variants early in the design process. As a result, laboratories can focus experimental resources on the most viable candidates rather than broad screening.

Integration of AI with automated and robotic laboratory platforms is further accelerating progress. AI-guided robotic workflows allow enzymes to be designed, synthesized, expressed, and tested in closed-loop systems with minimal human intervention. These systems continuously learn from experimental outcomes, enabling rapid optimization of enzyme specificity, catalytic activity, and robustness for both research and industrial applications.

Restriction Enzymes Market Outlook

- Market Overview: Restriction enzymes represent a core technology in molecular biology by cutting, cloning, mapping, and all aspects of genetic research, diagnostics development, etc., across a global scale.

- Public Funding for Genomics: Increased funding from governmental agencies for genomics projects and national research grants means that laboratory capability will increase and the daily practice of performing DNA analysis will also expand.

- Remaining Important after CRISPR Explosion: Regardless of CRISPR having taken the world of science by storm, restriction enzymes are still critical to create plasmids, verify that the DNA is correct, and maintain the integrity of the data that has been generated in both academic and applied research laboratories.

- Growth in Biotechnology and Diagnostic Sector: Increased public funding for biotechnology, vaccines, molecular diagnostics, etc. results in an increased application of restriction enzymes in recombinant DNA processes, assay development, and pathogen detection research.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 214.36 Billion |

| Market Size in 2026 | USD 232.82 Billion |

| Market Size by 2035 | USD 489.60 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.61% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, End-User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why Do Type II Restriction Enzymes Dominate the Restriction Enzymes Market?

Type II Restriction Enzymes: The segment dominated the market in 2025 with a 41.1% share, because they offer very high accuracy and effectiveness when cutting at very specific DNA sequences. This accuracy leads to high reliability, which contributes to their heavy use in molecular biology laboratories for tasks such as cloning, generating mapping of genes, analyzing DNA, and so forth. Additionally, the typical features of Type II REs aid in developing confidence in their use. They are easy to use, have easily predicted digestion patterns, and comply with the common standard protocols that are used throughout both routine and advanced research applications.

Type IV Restriction Enzymes: This segment is set to be the fastest-growing one in the restriction enzymes market with a CAGR of 7.4%, driven by the rapid increase in the number of projects involving epigenetic and DNA methylation studies, which require researchers to utilize enabling technologies for exploring epigenomic regulation and host–pathogen interactions. Due to the tremendous time and resources being made available for support for projects related to epigenetics, along with their growing application areas in precision biology and microbial genomic sequencing, Type IV repressing enzymes are garnering increasing interest from researchers who specialize in these fields.

Application Insights

Why Does Cloning Still Have the Largest Market Share of Use?

Cloning: This segment remains the leading application segment with a 38.7% share, dominating the restriction enzymes market in 2025, due to the basis for cloning and cloning activities, as well as the continuous growth of molecular diagnostics and epigenetics in the research community and the biotech industry. Cloning is still the primary use of restriction enzymes, since scientists and clinicians need to insert DNA into their vectors or create Recombinant Protein Products (RPPs).

Others: The fastest growing applications for restriction enzymes are now diagnostics and epigenetics with an expected 7.5% CAGR, due to the increasing number of restriction enzyme assays that use restriction enzymes for biomarker detection and for uses related to determining if there are any epigenetic changes. the growing interest in personalized medicine, infectious disease monitoring, and cancer epigenetics includes the development of new assays incorporating restriction enzymes, especially those used early in the diagnosis, and clinical research and clinical diagnostics pipeline projects are being developed using epigenetics.

End User Insights

Which End User Dominated the Restriction Enzymes Market in 2025?

Academic & Research Institutes: The academic and research segment dominated the market with a 46.8% share, with the most demand from end users for restriction enzymes. This is because restriction enzymes serve as essential components of basic life science research within laboratories. Additionally, a majority of government-funded research projects and campus-wide genome projects will utilize restriction enzymes at a high volume. The continuous expansion of molecular biology programs and government-funded initiative research in this field promotes high-volume purchasing, making the academic and research institutions a stable and continuous contributor to overall market demand for restriction enzymes.

Biotechnology & Pharmaceutical Companies: This segment is set to be the fastest-growing with a 7.7% CAGR, due to the increasing amount of drug discovery, gene therapy, and biologics activity being performed by the biotechnology and pharmaceutical industries, these industries are the fastest-growing segment of end users for restriction enzymes. Restriction enzymes are used throughout the drug discovery process with significant contributions from vector design, cell line development, and genetic validation. The increase in private investment in genomic-based therapies and synthetic biology platforms has resulted in the rapid adoption of restriction enzymes in commercial R&D and manufacturing settings.

Distribution Channel Insights

Why Did Direct Sales Dominate the Restriction Enzymes Market During 2025?

Direct Sales: The segment comprises the majority of the distribution channel with a 45.8% share, as many institutions and biotech companies value being able to obtain restriction enzymes directly from the manufacturer so that they can obtain technical support and quality assurance. Bulk purchasing agreements/bulk purchasing options, custom enzyme solutions, and a strong cold-chain logistics system all enhance this channel. By working directly with suppliers, laboratories also benefit from the ability to receive application-specific recommendations. This is especially beneficial for highly accurate molecular biology workflows, where precision is required to ensure the success of experiments.

E-commerce Marketplaces: The segment is set to be the fastest-growing distribution channel with a CAGR of 7.6% due to an increasing number of labs around the world using digital channels to procure products. E-commerce provides users with easy access to a wide variety of enzymes, competitive prices, and quicker turnaround times. The growing number of biotech start-ups, remote laboratories, and the advent of improved cold chain logistics is leading to more laboratories choosing to purchase products online, as it allows for easier access for smaller-sized labs and mid-tier laboratories.

Regional Insights

How Big is the North America Restriction Enzymes Market Size?

The North America restriction enzymes market size is estimated at USD 86.60 billion in 2025 and is projected to reach approximately USD 198.29 billion by 2035, with a 8.64% CAGR from 2026 to 2035.

Why Is North America the Top Region for Restriction Enzymes Market?

North America has remained at the forefront of the restriction enzymes market, holding a 40.4% share, supported by a strong biotechnology ecosystem, a deep academic research base, and well-developed life sciences infrastructure. The region has a high concentration of genomics laboratories, biotechnology companies, and clinical research organizations that rely heavily on restriction enzymes for routine molecular biology workflows.

Molecular biology tools are widely used across genetics research, molecular diagnostics, and therapeutic development in the United States and Canada. Restriction enzymes are integral to cloning, sequencing library preparation, assay development, and validation steps in both research and regulated laboratory environments. Sustained investment in genomics, transcriptomics, and cell and gene therapy research continues to generate consistent demand for high-quality and highly specific enzymes.

North America also benefits from dense networks of academic institutions, government-funded research programs, and private sector collaboration, which accelerate the adoption of advanced molecular techniques and next-generation enzyme technologies. Cross-institutional and cross-border collaboration enables rapid translation of new enzyme innovations from research to commercial availability.

What is the Size of the U.S. Restriction Enzymes Market?

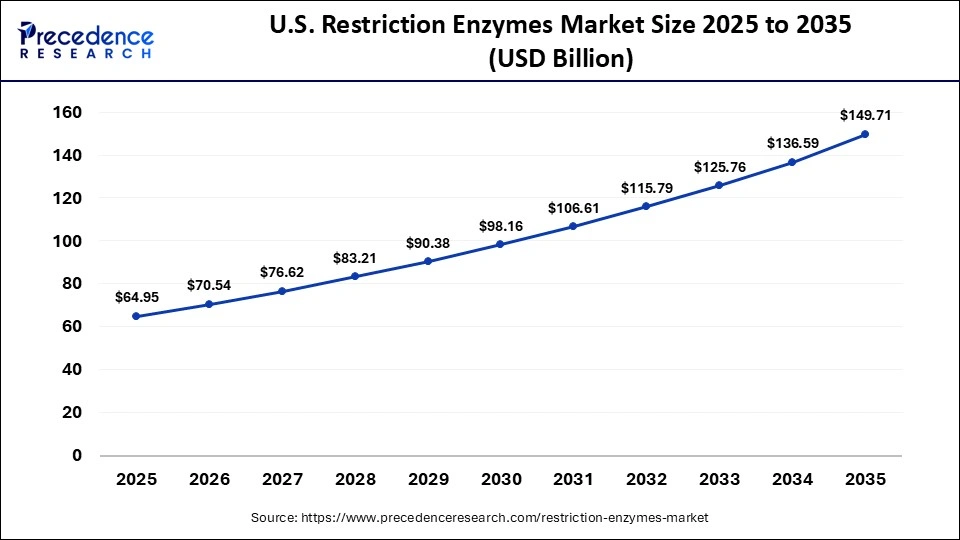

The U.S. restriction enzymes market size is calculated at USD 64.95 billion in 2025 and is expected to reach nearly USD 149.71 billion in 2035, accelerating at a strong CAGR of 8.71% between 2026 and 2035.

U.S. Restriction Enzymes Market Trends

The United States is the primary founding and supporting source of the region's success by virtue of engaging in extensive international trade along with a considerable and consistent manufacturing capacity. The extent of the growing market for enzyme products manufactured in the United States is substantiated by the significant increase in the volume of restriction enzyme shipments being exported from the U.S. to the world. Based on Volza's export database, the U.S. shipped 76 shipments of restriction enzymes during the period from April 2024 to March 2025 from seven U.S. exporters and sold them to seven different foreign customers. This increase in the number of shipments represents an 85% increase from the year before, thereby signaling the development of a global market for U.S.-manufactured enzymes.

Why Is Asia Pacific Experiencing the Fastest Growth of Restriction Enzymes Market?

The Asia Pacific region is experiencing rapid growth in the restriction enzymes market with an 8.5% CAGR, driven by sustained advances in biotechnology and life sciences research. Governments across China, India, Japan, and South Korea are expanding access to molecular biology research tools through increased public funding for healthcare infrastructure, national genomics programs, and academic research institutions. These initiatives are strengthening domestic research capacity and lowering barriers to enzyme adoption in both public and private laboratories.

The growing volume of genetics, genomics, and personalized medicine research publications across the region is directly increasing demand for restriction enzymes used in cloning, sequencing, assay development, and genetic analysis. Academic institutions and research hospitals are scaling molecular biology workflows, which requires a consistent supply of high-quality enzymes with reliable performance and specificity.

Asia Pacific is also witnessing rapid expansion of contract research organizations that support both local innovation and multinational research programs. These CROs play a critical role in executing genomics, diagnostics, and biopharmaceutical research projects, further accelerating enzyme consumption across discovery and validation stages. Their presence supports academic groups, biotech startups, and global pharmaceutical sponsors operating in the region.

China Restriction Enzymes Market Trends

China is at the center of this growth in Asia Pacific and is well positioned to benefit from significant government funding for research and the establishment of national scientific programs. China's expanding genomics projects, increasing development of biotech industry clusters, and collaboration between research institutions and manufacturers drive significant increases in demand for restriction enzymes in the region. Furthermore, with a focus on innovation and capability in molecular biology, China is expected to be an important hub for growth.

Why Is Europe Entering a New Era of the Restriction Enzymes Market?

Europe represents a strategically important and steadily expanding market for restriction enzymes, underpinned by a strong academic research base and a highly integrated cross-border scientific ecosystem. The region benefits from dense networks of universities, public research institutes, and translational research centers that consistently generate demand for molecular biology tools used in genomics, transcriptomics, and functional gene analysis.

A key growth driver is the emphasis placed by the European Union on collaborative and multi-country research programs. EU-backed funding frameworks and harmonized regulatory structures actively support biotechnology innovation, enabling large-scale projects that rely heavily on restriction enzymes for cloning, sequencing workflows, assay validation, and advanced diagnostics development. This coordinated approach allows research outputs and enzyme usage to scale efficiently across national boundaries.

High volumes of genetics and molecular biology research across countries such as Germany, France, and the United Kingdom sustain consistent demand for reliable, high-specificity enzymes. The ease of knowledge exchange, standardized laboratory practices, and shared research infrastructure across Europe further reinforce enzyme adoption in both academic and applied research environments.

Germany Restriction Enzymes Market Trends

Germany is the largest center of restriction enzyme use within Europe, with numerous world-class research institutions, a strong industrial biotech manufacturing base, and significant numbers of academic partnerships. The ongoing growth of German molecular biological and genetic research projects creates a continuous demand for restriction enzymes, together with the widespread use of enzyme technology in diagnostic testing, scientific research, and the development of new therapeutics throughout Germany's industrial biotechnology sector.

Why Is the Middle East & Africa Region Accelerating the Use of the Restriction Enzymes Market?

The Middle East and Africa region is emerging as a developing market for restriction enzymes, driven by increasing focus on building scientific research capacity and modern laboratory infrastructure. Governments across selected countries are directing funding toward biotechnology development, healthcare innovation, and expansion of academic research institutions, which is enabling broader adoption of molecular biology techniques.

At present, use of restriction enzymes is largely concentrated in major research hubs, university laboratories, and national reference centers, particularly within countries that have prioritized life sciences as part of economic diversification strategies. In parts of the Gulf Cooperation Council, investments in genomics research, clinical diagnostics, and translational medicine are gradually increasing demand for core molecular biology reagents, including restriction enzymes.

Growth is also supported by the expansion of higher education programs in biotechnology, genetics, and agricultural sciences, which is increasing laboratory-based training and routine enzyme usage. As targeted funding initiatives expand and laboratory standardization improves, restriction enzymes are expected to see wider adoption beyond academic research into applied healthcare diagnostics and crop genetics research.

UAE Restriction Enzymes Market Trends

South Africa is the primary country in the Middle East & Africa for the adoption of restriction enzymes, supported by established universities and research centers that are focused on molecular biology and genetic studies. Ongoing government support, together with funding provided by research institutions, supports the use of enzymes for academic and health science studies, which will allow South Africa to emerge as a center of excellence for this developing region.

Top Key in Players Restriction Enzymes Market

- Thermo Fisher Scientific Inc.

- New England Biolabs, Inc.

- Takara Bio Inc.

- QIAGEN N.V.

- Agilent Technologies, Inc.

- Promega Corporation

- Merck KGaA (Sigma-Aldrich)

- Bio-Rad Laboratories, Inc.

- Integrated DNA Technologies, Inc.

- Jena Bioscience GmbH

- Bioneer Corporation

- Zymo Research Corporation

- Roche (KAPA Biosystems)

- Enzynomics Inc.

- Illumina Inc.

Recent Developments

- In October 2025, Takara Bio USA expands its spatial biology offerings by updating and broadening its Trekker Single-Cell Spatial Mapping Kits and related technologies to support more applications, boosting spatial omics research capabilities.(Source: https://www.genengnews.com)

- In August 2024, Researchers discovered a small enterococci phage protein that inhibits diverse type IV restriction enzymes, revealing how phages overcome bacterial antiphage defense and advancing understanding of phage host interactions.(Source:https://www.nature.com)

- In October 2025, Endo launches the first and only FDA-approved generic version of RAVICTI (glycerol phenylbutyrate) oral liquid in the U.S., offering a new treatment option for patients with urea cycle disorders.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Product Type

- Type I Restriction Enzymes

- Type II Restriction Enzymes

- Type III Restriction Enzymes

- Type IV Restriction Enzymes

- Others

By Application

- Cloning

- Sequencing

- PCR

- Restriction Fragment Length Polymorphism (RFLP)

- Other Applications

By End-User

- Academic & Research Institutes

- Biotechnology & Pharmaceutical Companies

- Hospitals & Diagnostic Centers

- Others

By Distribution Channel

- Direct Sales

- Distributor/Reseller Networks

- E-commerce Marketplaces

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting