What is the Synthetic Graphite Market Size?

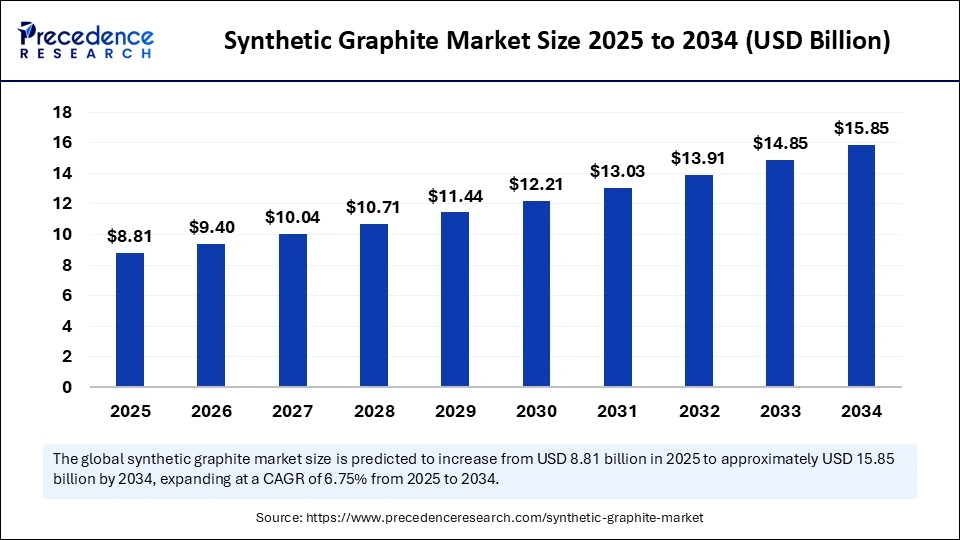

The global synthetic graphite market size accounted for USD 8.25 billion in 2024 and is predicted to increase from USD 8.81 billion in 2025 to approximately USD 15.85 billion by 2034, expanding at a CAGR of 6.75% from 2025 to 2034. The synthetic graphite market is experiencing significant growth, driven by increasing demand in various high-tech applications. Projections indicate a substantial increase in market value over the next decade, underscoring its growing importance in the electronics industry.

Market Highlights

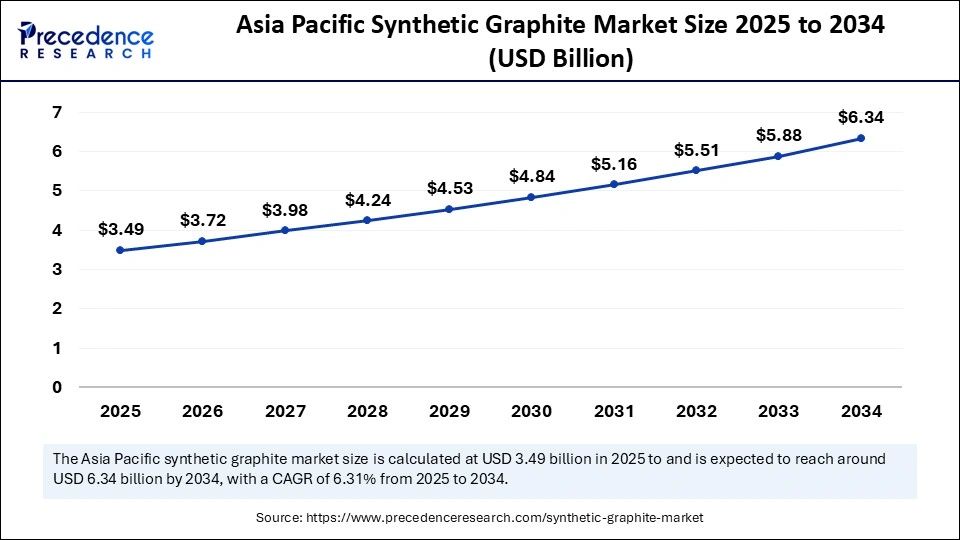

- Asia Pacific dominated the synthetic graphite market with the largest market share of 39.60% in 2024.

- By region, North America is expected to expand at the highest CAGR of 9.20% between 2025 and 2034.

- By product type, the graphite electrodes segment held the biggest share of 41.60% in 2024.

- By product type, synthetic graphite powder is expected to grow at a remarkable CAGR of 8.70% between 2025 and 2034.

- By raw material type, the needle coke segment captured the highest market share of 47.30% in 2024.

- By raw material type, petroleum coke is expected to grow at a high CAGR of 7.90% during the forecasted period.

- By manufacturing process type, the molded graphite segments contributed the maximum market share of 34.20% in 2024.

- By manufacturing process type, isostatic pressing is expected to grow at a remarkable CAGR of 8.30% between 2025 and 2034.

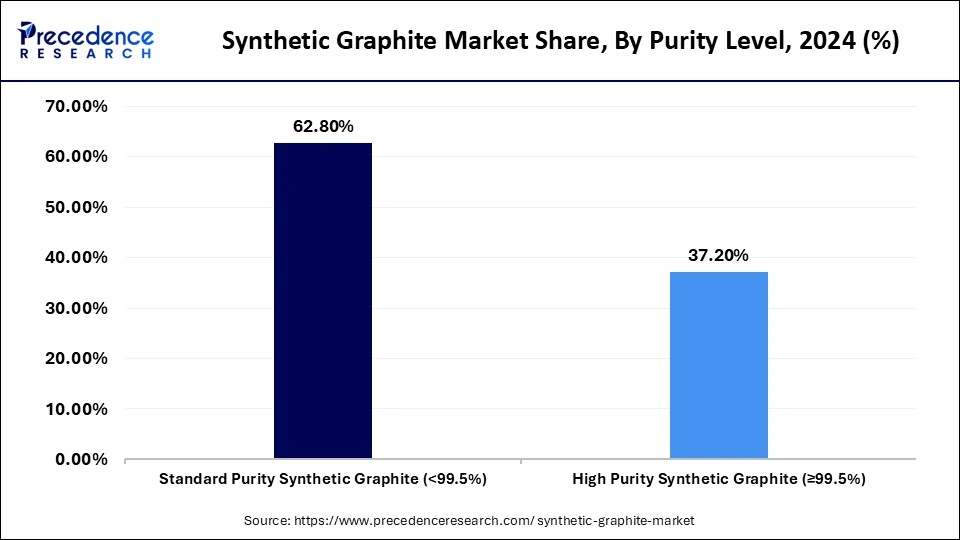

- By purity level type, the standard purity segments held the largest market share of 62.80% in 2024.

- By purity level type, high purity is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, metallurgy segment generated the major market share of 36.7% in 2024.

- By application, the batteries & energy storage segment is expected to grow at the highest CAGR of 10.4% in the forecasted period.

Market Size and Forecast

- Market Size in 2024: USD 8.25 Billion

- Market Size in 2025: USD 8.81 Billion

- Forecasted Market Size by 2034: USD 15.85 Billion

- CAGR (2025-2034): 6.75%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Why is Synthetic Graphite Market Dominating the Market?

The synthetic graphite market is experiencing steady growth driven by increasing demand from energy storage, electric vehicles, and metallurgical applications. As industries transition toward cleaner and more efficient technologies, synthetic graphite is gaining traction due to its superior purity, thermal stability, and conductivity compared to natural graphite. The growing emphasis on lithium-ion batteries has positioned synthetic graphite as a critical raw material for the anode segment, especially in EV manufacturing. Additionally, the steelmaking sector continues to consume a significant portion of artificial graphite in the form of electrodes, providing a stable demand base. The market is also benefiting from advancements in production processes that reduce costs and improve quality consistency. Collectively, these factors are enhancing the global footprint of synthetic graphite.

In parallel, market expansion is influenced by the rising investments in renewable energy storage and the broader electrification of transportation. The growing push for decarbonization and sustainable industrial practices has made synthetic graphite an indispensable material across multiple industries. However, the market faces challenges related to high production costs, energy intensity during manufacturing, and competition from natural graphite. Despite these challenges, synthetic graphite's superior structural and performance characteristics give it a strong competitive advantage in high-end applications. The integration of advanced processing technologies, recycling methods, and hybrid graphite materials is expected to create further opportunities. Overall, the synthetic graphite market stands at the crossroads of technological innovation and sustainability-driven demand.

How AI is Impacting the Synthetic Graphite Market?

Artificial intelligence (AI) is reshaping the synthetic graphite market through process optimization, quality control, and predictive analytics. AI-driven modelling enables manufacturers to reduce energy consumption in high-temperature processes while maintaining product consistency. In the EV battery space, AI is helping optimize anode material design, improving cycle life and performance. Predictive maintenance, powered by AI, reduces downtime in graphite electrode production plants, thereby enhancing cost efficiency. Moreover, AI-assisted supply chain analytics are improving procurement, logistics, and inventory management in the graphite value chain. This integration of AI is accelerating innovation while making synthetic graphite production more sustainable and cost-effective.

Market Key Trends

- Rising adoption of synthetic graphite in electric vehicle battery anodes.

- Growing use of recycled carbon materials in synthetic graphite production.

- Increasing R&D toward low-cost, energy-efficient manufacturing technologies.

- Expansion of graphite electrodes in the steel and aluminum industries.

- Hybridization of natural and synthetic graphite for performance optimization.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 8.25 Billion |

| Market Size in 2025 | USD 8.81 Billion |

| Market Size by 2034 | USD 15.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.75% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Raw Material, Manufacturing Process, Purity Level, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The Advent of Electric Vehicles Is Leading to Growth in the Synthetic Graphite Market

The synthetic graphite market is being driven by the increasing adoption of electric vehicles, where lithium-ion batteries heavily rely on graphite anodes for efficiency and performance. Rising global steel production, especially in emerging economies, continues to drive demand for graphite electrodes, one of the largest end uses of synthetic graphite. The push toward renewable energy and energy storage systems has further enhanced graphite's strategic importance as a key enabler of battery technology. Technological advancements are also reducing production costs and improving the quality of synthetic graphite, widening its industrial applications. Additionally, its superior purity, consistency, and thermal properties give it an edge over natural graphite in high-performance sectors. Together, these drivers are cementing synthetic graphite's role as a critical material in modern industrial and clean energy transitions.

Market Restraints

High Production Costs Inhibit Growth in the Market for Synthetic Graphite

Despite its advantages, the synthetic graphite market faces challenges from its high production costs, which make it less competitive compared to natural graphite in certain applications. Manufacturing synthetic graphite is an energy-intensive process, resulting in significant carbon emissions and raising environmental concerns that hinder its large-scale adoption. Price volatility of raw materials such as needle coke further disrupts the cost structure and profitability of producers. Additionally, the growing interest in alternative anode materials, such as silicon and lithium metal, is creating competitive pressure. Regulatory scrutiny around industrial emissions and sustainability is also adding compliance burdens on manufacturers. These factors collectively hinder the broader adoption of synthetic graphite across industries.

Opportunities

Continued Expansion of the EV Market Will Propel Growth

The rapid expansion of the electric vehicle market presents a major growth opportunity, with synthetic graphite playing a crucial role in next-generation battery technologies. Advancements in recycling technologies can unlock value by recovering graphite from spent batteries, creating a circular economy model. Expanding nuclear energy projects also present prospects, as synthetic graphite is used as a moderator in high-temperature reactors. Innovations in greener production methods and AI-driven process optimization can reduce costs and environmental impacts, widening accessibility. Additionally, regional governments are supporting domestic battery supply chains, creating incentives for the expansion of synthetic graphite manufacturing. These opportunities position synthetic graphite as a pivotal material in the global energy and technology transformation.

Segment Insights

Product Type Insights

Why Graphite Electrodes Are Dominating the Market?

Graphite electrodes are expected to dominate the synthetic graphite market with a share of 41.60% in 2024, primarily due to their indispensable role in electric arc furnaces for steelmaking. The global demand for steel remains strong, particularly in the construction, automotive, and heavy machinery sectors, which keeps electrode consumption steady. Their ability to withstand extremely high temperatures and conduct electricity efficiently makes them critical in metallurgical operations. Needle coke-based graphite electrodes provide unmatched durability, further enhancing their market leadership. Emerging economies, such as China andIndia, with their expanding steel output, continue to fuel demand. Thus, graphite electrodes remain the backbone of synthetic graphite applications worldwide.

Stable consumption patterns also reinforce the dominance of graphite electrodes compared to other graphite products. Even though technological disruptions are taking place in battery materials, metallurgy's role as a cornerstone industry ensures sustained demand. Steel recycling, which relies on electric arc furnaces, is also gaining traction, further supporting electrode usage. Global infrastructure projects, urbanization, and industrialization continue to sustain this demand. In addition, long-term contracts between steel producers and electrode manufacturers provide market stability. Together, these factors secure the position of graphite electrodes as the largest product type segment.

Synthetic graphite powder is the fastest-growing product type, expanding at 8.70% CAGR between 2024 and 2034. This surge is directly tied to its role in lithium-ion batteries, where graphite powder forms the bulk of the anode material. With EV adoption accelerating worldwide, demand for battery-grade graphite powder is increasing rapidly. Its high purity, tenable particle size, and performance reliability make it a preferred material over natural graphite in high-end battery applications. Beyond batteries, synthetic graphite powder is also gaining traction in lubricants, conductive coatings, and thermal management systems. This versatility positions it as a driver of multi-sector growth.

The rapid growth of synthetic graphite powder is driven by substantial R&D investment aimed at enhancing energy density and improving charge-discharge cycles in lithium-ion batteries. Countries in Asia, North America, and Europe are ramping up gigafactory production, further scaling demand for graphite powder. Additionally, advances in purification technologies are making powder-grade graphite more efficient and affordable. Its expanding role in next-generation solid-state batteries also provides long-term opportunities. The strong alignment of this product with the energy transition narrative ensures its fast-paced growth.

Raw Material Insights

Why Needle Coke is Dominating the Synthetic Graphite Market?

Needle coke dominates the raw material category, accounting for a 47.30% share in 2024, largely due to its unique role in producing high-quality graphite electrodes. Its unique crystalline structure provides superior strength, conductivity, and resistance to thermal stress. As steelmaking remains the largest consumer of synthetic graphite, needle coke maintains an unshakable position in the value chain. The use of electrode-intensive electric arc furnace steel production further supports demand. High-performance applications, such as those in nuclear and aerospace, also rely on needle coke-based graphite. These advantages keep needle coke firmly at the center of raw material usage.

The dominance of needle coke is reinforced by supply-demand dynamics, as steel producers prioritize consistency and durability in electrodes. Even though supply constraints occasionally challenge availability, its technical superiority ensures ongoing reliance. Asia Pacific, home to large-scale steelmaking, remains the largest consumer of needle coke-derived graphite electrodes. Long-term contracts between graphite and steel producers further stabilize its demand base. The material's strong market presence is expected to persist despite the rise of lower-cost alternatives. Thus, needle coke remains the cornerstone raw material for the manufacture of synthetic graphite.

Petroleum coke is the fastest-growing raw material segment, with a CAGR of 7.90% during 2024–2034. Its growth is driven by its availability and cost advantage over needle coke, making it attractive for a diverse range of graphite applications. Petroleum coke–based synthetic graphite is increasingly being adopted in anodes for lithium-ion batteries, particularly where cost efficiency is critical. Additionally, its use in refractories and other industrial products is expanding due to the increasing global industrial activity. As manufacturers seek alternatives to needle coke, petroleum coke is emerging as a viable solution. This flexibility underpins its strong growth momentum.

The expansion of petroleum coke is also supported by investments in refining capacity, which ensures a steady supply of raw material. Advances in purification processes are enhancing the quality of petroleum coke-derived graphite, thereby broadening its applications. Growth in EV adoption and battery manufacturing is expected to further accelerate its demand, especially in Asia and North America. Its lower-cost profile also makes it an appealing choice for emerging markets. As industries diversify their graphite raw material base, petroleum coke is becoming a strategic enabler of supply chain resilience. This positions it as the fastest-growing raw material segment in the coming decade.

Manufacturing Process Insights

Why Molded Graphite is Dominating the Synthetic Graphite Market?

Molded graphite leads the market in terms of manufacturing process with a share of 34.2%. It is widely used in metallurgical and electrode applications, where strength and uniformity are critical. The process offers high mechanical stability, making it suitable for large-scale industrial applications. Molded graphite is also essential in refractory materials, extending its dominance beyond the steelmaking industry. Its cost-effectiveness compared to more advanced processes ensures broad adoption across industries. This wide applicability anchors its market leadership.

The resilience of molded graphite stems from its ability to strike a balance between performance and affordability. While not as advanced as isostatic pressing, it provides sufficient structural and thermal properties for mainstream industries. Its production process is well established, with suppliers capable of scaling output efficiently. Steelmakers in Asia and emerging economies prefer molded graphite due to its cost-to-performance advantage. Its extensive presence in both established and developing regions secures its continued dominance. Consequently, molded graphite is expected to remain the leading manufacturing process category.

Isostatic pressing is the fastest-growing process, projected to expand at 8.30% CAGR through 2034. It enables the production of ultra-high-density graphite with exceptional strength, purity, and consistency. This makes it ideal for advanced applications such as semiconductors, nuclear power, and high-performance batteries. As industries demand precision-engineered materials, isostatic graphite is gaining preference. The rise of electronics manufacturing in Asia and North America is further boosting demand. This trend underscores its rapid adoption in high-tech industries.

Advancements in process automation and quality control also fuel the growth of isostatic pressing. Although more expensive to produce, its superior performance justifies the cost in critical applications. Demand from the aerospace and energy storage sectors is expected to accelerate significantly in the coming decade. Research into next-generation battery technologies also supports the long-term role of isostatic graphite. Its alignment with high-value, high-growth industries ensures sustainable expansion. As industries prioritize performance, isostatic pressing will outpace traditional processes.

Purity Level Insights

Why Standard Purity is Dominating the Synthetic Graphite Market?

Standard purity synthetic graphite dominated the market with a share of 62.8% growth in 2024, primarily due to its wide use in steelmaking and metallurgy. Most industrial applications do not require extremely high purity, making this category cost-effective and widely adopted. It provides sufficient conductivity, stability, and structural properties for electrodes and refractories. The sheer scale of the steel industry ensures a consistent demand for high-purity graphite. Emerging markets, with strong construction and manufacturing sectors, are driving bulk consumption. This broad industrial reliance keeps standard purity as the leading segment.

The dominance of standard purity graphite is also tied to its production economics. Manufacturers can produce it in larger volumes and at lower costs, supporting its mass adoption. While the demand for high-purity grades is growing, the demand base for standard graphite remains significantly larger. It continues to meet the needs of mainstream industries without requiring expensive upgrades. Industrialization in Asia, Latin America, and Africa continues to sustain demand for this category. As a result, standard purity graphite is expected to retain its top position in the near term.

High-purity synthetic graphite is the fastest-growing category with a CAGR of 9.1%. Advanced applications in semiconductors, nuclear reactors, and lithium-ion batteries drive its growth. High purity grades offer enhanced stability, conductivity, and consistency, making them essential for cutting-edge technologies. The transition to renewable energy and EVs is particularly boosting high-purity demand. Semiconductor manufacturing hubs in Asia and North America are major consumers of this category. This increasing alignment with advanced industries underpins its rapid growth.

Technological improvements in purification and manufacturing processes further support the expansion of high-purity graphite. While more expensive, its performance advantages make it indispensable in high-value sectors. Growing investment in nuclear energy projects, especially in Asia and Europe, is also contributing to demand. The ongoing miniaturization of electronic devices requires high-precision materials, creating long-term opportunities. Governments supporting clean energy initiatives are reinforcing demand for ultra-pure materials. Overall, high-purity synthetic graphite is poised to become a key driver of growth for the industry.

Application Insights

Why does Metallurgy Dominate the Synthetic Graphite Market?

Metallurgy is a primary application of synthetic graphite, dominating the market with a . Steelmaking, aluminum, and foundry operations are the primary consumers of graphite electrodes and refractories. The sector's massive scale ensures steady global demand for synthetic graphite. Industrialization and infrastructure growth in Asia, Latin America, and Africa are key drivers of metallurgical demand. Electric arc furnace steelmaking, which relies on graphite electrodes, continues to expand as recycling rates increase. This entrenched role makes metallurgy the largest application category.

The dominance of metallurgy is also due to its resilience against technological disruption. Unlike batteries, which face competing anode materials, metallurgy depends almost exclusively on graphite electrodes. Long-standing supply chains between steel and graphite producers ensure stability. Metallurgical processes also require large volumes of bulk graphite, thereby strengthening its demand base. The ongoing global demand for construction and manufacturing guarantees sustained growth. Consequently, metallurgy maintains its leading position among applications.

Batteries and energy storage are expected to be the fastest-growing applications between 2024 and 2034. This expansion is directly tied to the surging adoption of EVs and renewable energy storage systems. Synthetic graphite is the dominant anode material in lithium-ion batteries, securing its role in the energy transition. Governments worldwide are incentivizing battery production, further boosting demand. The sector's rapid scaling is reshaping synthetic graphite consumption trends. This positions energy storage as the key driver of future growth.

The growth of this segment is also supported by continuous research and development (R&D) efforts aimed at improving energy density and battery performance. Gigafactory expansions in Asia, North America, and Europe are facilitating the widespread adoption of large-scale synthetic graphite. Recycling of graphite from spent batteries is emerging as a complementary supply source. Additionally, solid-state and next-generation batteries are expected to further enhance the role of synthetic graphite. Its alignment with clean energy and electrification makes this category strategically critical. As a result, batteries and energy storage will outpace traditional applications in the next decade.

Regional Insights

Asia Pacific Synthetic Graphite Market Size and Growth 2025 to 2034

The Asia Pacific synthetic graphite market size was exhibited at USD 3.27 billion in 2024 and is projected to be worth around USD 6.34 billion by 2034, growing at a CAGR of 6.31% from 2025 to 2034.

Why is Asia Pacific Dominating the Synthetic Graphite Market?

The Asia Pacific region leads the global synthetic graphite market, driven by strong industrial demand, particularly from China, Japan, and South Korea. The region accounts for the majority of global lithium-ion battery production, which directly boosts synthetic graphite consumption in the EV sector. China remains the hub for both battery and electrode manufacturing, supported by government policies encouraging electric mobility and renewable energy storage. Steelmaking industries across India and Southeast Asia continue to contribute to the growing demand for graphite electrodes. This strong demand base, coupled with manufacturing cost advantages, positions Asia Pacific as the undisputed market leader. Moreover, the rapid pace of urbanization and industrialization continues to fuel market expansion.

Additionally, the Asia Pacific is witnessing heavy R&D investments aimed at developing sustainable and high-performance synthetic graphite materials. Japanese and Korean companies are at the forefront of innovating advanced graphite anodes tailored for next-generation EV batteries. Local governments are also investing in greener production technologies to reduce the carbon footprint of graphite manufacturing. The rise of domestic EV brands in China and India further strengthens regional consumption trends. Export-oriented production clusters in China ensure a stable supply chain to global markets. Overall, Asia Pacific's dominance is expected to persist, supported by both domestic and international demand drivers.

How Is North America Seeing Notable Growth in the Synthetic Graphite Market?

North America is emerging as a prominent hub of growth for synthetic graphite, primarily fueled by rapid EV adoption and government-backed energy transition policies. The U.S. and Canada are investing heavily in lithium-ion battery gigafactories, creating robust demand for synthetic graphite anodes. A growing emphasis on reducing dependency on Asian imports has prompted local manufacturing expansion, supported by favorable policy frameworks, such as the U.S. Inflation Reduction Act. North America's well-developed steel and aluminum industries further contribute to consistent demand for graphite electrodes. Additionally, the region's focus on renewable energy and grid-scale storage solutions enhances market opportunities. This makes North America a high-growth region with substantial untapped potential.

Furthermore, technological innovation in the region is driving advancements in the production of low-cost and sustainable synthetic graphite. U.S.-based startups and research institutions are experimenting with alternative raw materials and AI-enabled production methods to reduce costs. Collaborations between automotive OEMs and battery producers are securing long-term supply agreements, ensuring market stability. The availability of investment capital and advanced R&D infrastructure positions North America as a hub for next-generation synthetic graphite materials. Rising environmental awareness is also pushing industries to adopt recycling and greener graphite solutions.

Synthetic Graphite Market Companies

- GrafTech International

- SGL Carbon

- Tokai Carbon

- Shanshan Technology

- Nippon Carbon

- Showa Denko

- Fangda Carbon New Material

- SEC Carbon

- HEG Limited

- Graphite India Limited

Recent Developments

- In September 2025, amid the rapid growth of the electric vehicle market, ExxonMobil unveiled a major technological breakthrough, the development of a new synthetic graphite that can extend EV battery lifespans by up to 30%. This advancement has drawn considerable attention across the industry and infused fresh momentum into the future evolution of electric mobility.(Source:https://nam.org)

Segments Covered in the Report

By Product Type

- Graphite Electrodes

- Synthetic Graphite Powder

- Graphite Blocks / Plates

- Graphite Rods / Cylinders

- Specialty Graphite

- Carbon Fibers (Graphitized)

- Others (E.g., Graphite Foam)

By Raw Material

- Petroleum Coke

- Needle Coke

- Coal Tar Pitch

- Natural Graphite Blend

- Others (Resins, etc.)

By Manufacturing Process

- Molded Graphite

- Isostatic Pressing

- Extrusion Molding

- Vibrational Molding

- Others (Continuous Molding, etc.)

By Purity Level

- Standard Purity Synthetic Graphite (<99.5%)

- High Purity Synthetic Graphite (≥99.5%)

By Application

- Metallurgy

- Electric Arc Furnace (EAF) Electrodes

- Ladle Furnaces

- Non-ferrous Metal Smelting

- Continuous Casting and Molding

- Others (E.g., Foundry Crucibles)

- Batteries & Energy Storage

- Lithium-ion Battery Anodes

- Electric Vehicle (EV) Battery Packs

- Consumer Electronics (Phones, Laptops)

- Grid-scale Energy Storage Systems (ESS)

- Others (e.g., Wearables and Portable Devices)

- Electronics & Semiconductors

- Heatsinks & Thermal Spreaders

- Semiconductor Etching/Processing Equipment

- Graphite Substrates and Components

- Others (High-Temperature Insulation (Furnaces), etc.)

- Automotive

- EV Battery Components (Anodes, Conductive Additives)

- Thermal Management Materials

- Brake Linings and Lubricants

- Others (Lightweight Composites (Carbon Fiber Parts), etc.)

- Aerospace & Defense

- High-Temperature Structural Components

- Aircraft Brake Systems

- Missile & Spacecraft Nozzle Liners

- Others (e.g., Lightweight Carbon Composites)

- Refractories & Foundry

- Furnace Linings

- Graphite Molds & Dies

- Refractory Crucibles

- Others (Continuous Casting Dies, etc.)

- Lubricants & Coatings

- Dry Film Lubricants

- Conductive Coatings

- Anti-corrosion and High-Temp Coatings

- Others (Graphite Greases and Oils, etc.)

- Nuclear Applications

- Moderator and Reflector Components

- Graphite Blocks for Nuclear Reactors

- Others (e.g., Radiation Shielding Materials)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting