What is the Thermal Management for Data Centers Market Size?

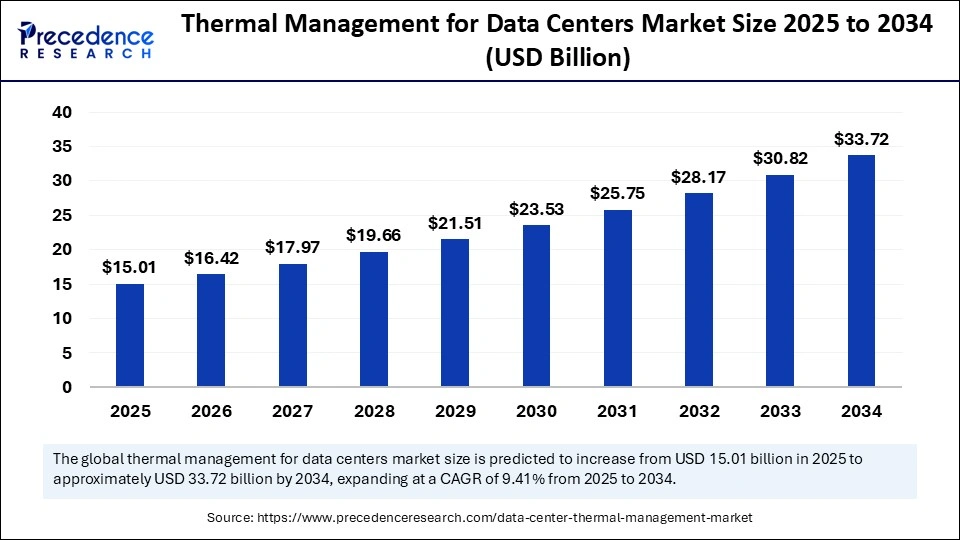

The global thermal management for data centers market size accounted for USD 15.01 billion in 2025 and is predicted to increase from USD 16.42 billion in 2026 to approximately USD 33.72 billion by 2034, expanding at a CAGR of 9.41% from 2025 to 2034. The market is driven by the increasing demand for energy-efficient cooling solutions to manage rising data processing loads and heat generation.

Market Highlights

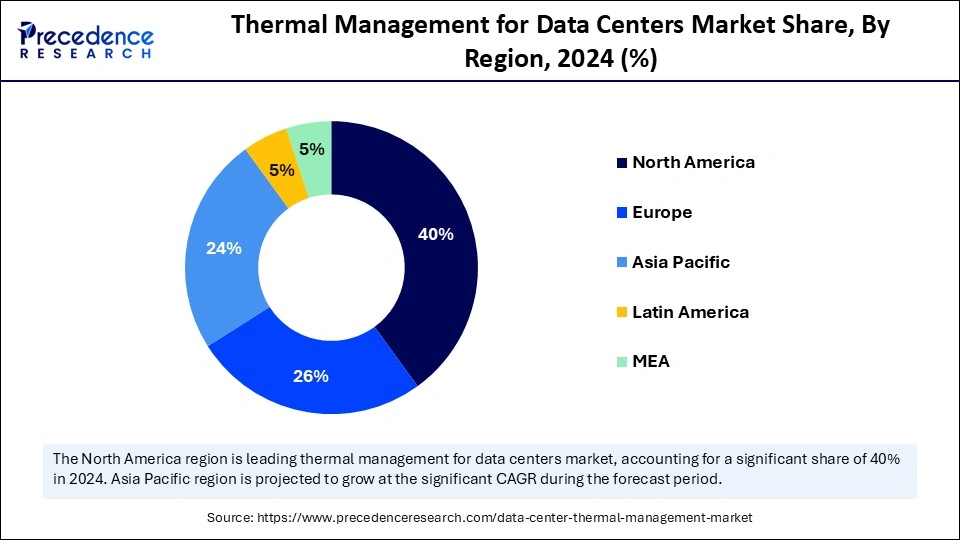

- North America dominated the global market with the largest share of 40% in 2024.

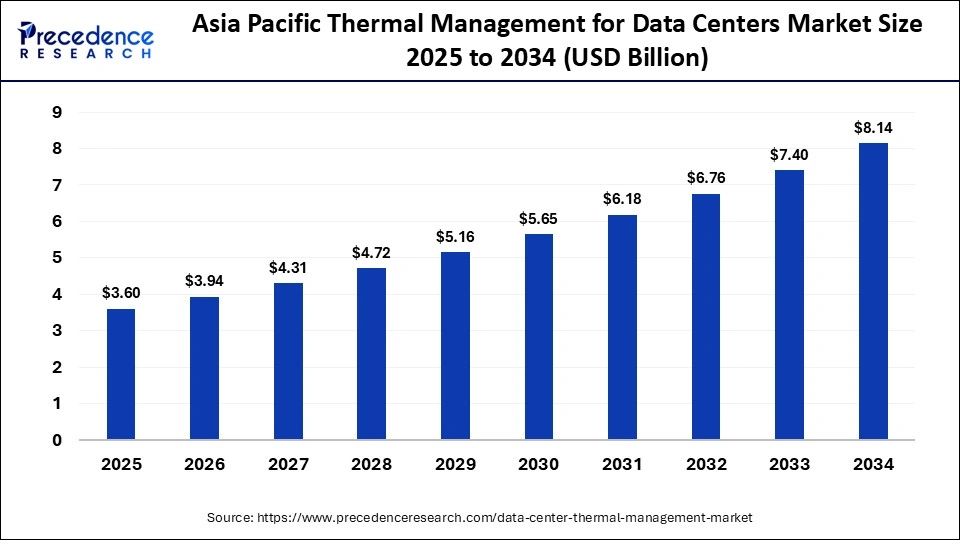

- The Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

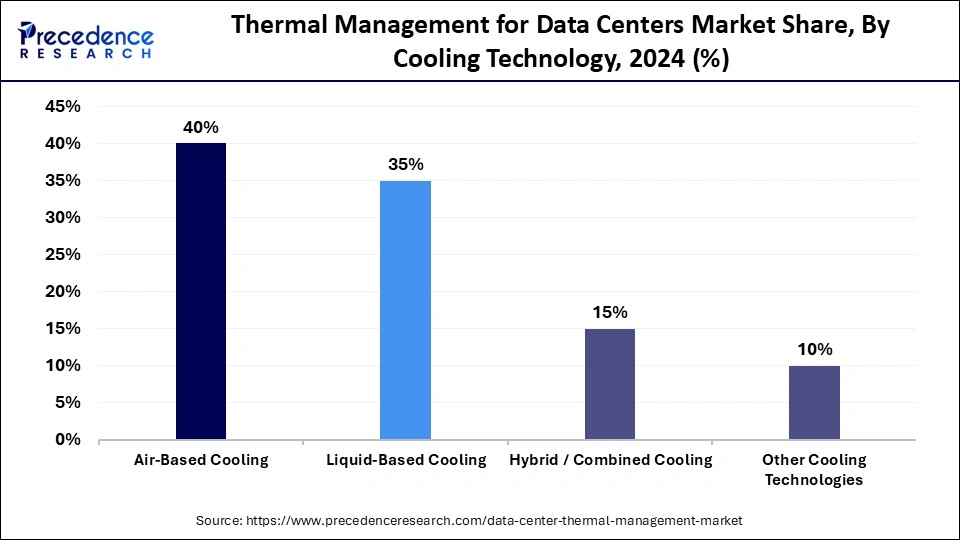

- By cooling technology, the air-based cooling segment captured a 40% market share in 2024.

- By cooling technology, the liquid-based cooling segment is growing at the fastest CAGR from 2025 to 2034.

- By component, the cooling units/chillers segment led the market while holding a 38% share in 2024.

- By component, the heat exchangers/heat sinks segment is projected to grow at a significant CAGR from 2025 to 2034.

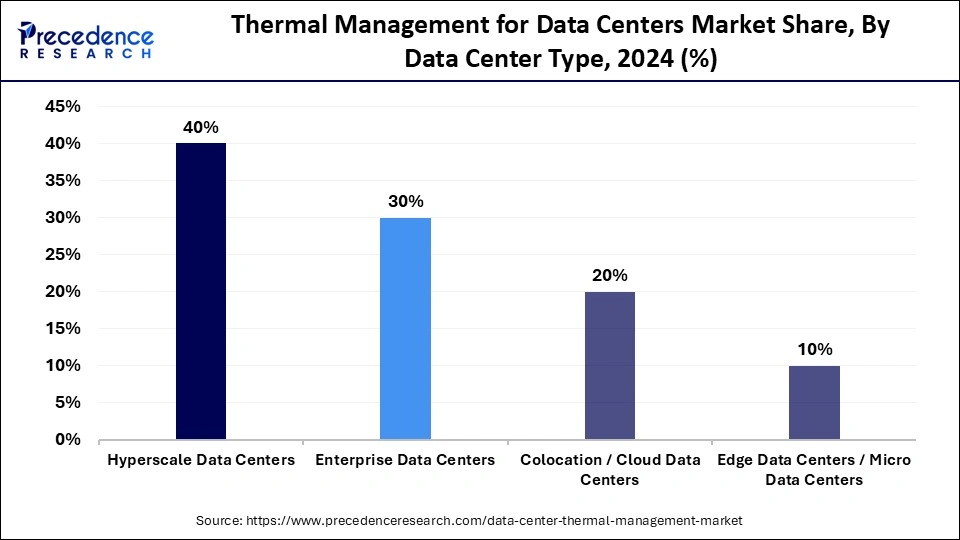

- By data center type, the hyperscale data centers segment contributed the highest market share of 40% in 2024.

- By data center type, the colocation/cloud data centers segment is expected to grow at the highest CAGR between 2025 and 2034.

- By end-user / industry vertical, the IT & telecom segment led the market while holding a 45% share in 2024.

- By end-user / industry vertical, the retail & e-commerce segment is expected to grow at a significant CAGR between 2025 and 2034.

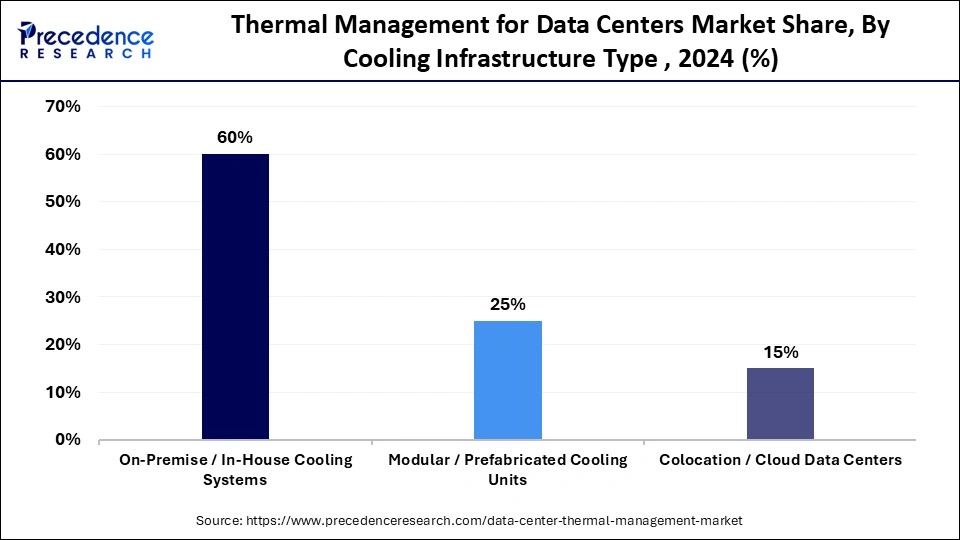

- By cooling infrastructure type, the on-premise / in-house cooling systems segment held a 60% share of the market in 2024.

- By cooling infrastructure type, the modular/prefabricated cooling units segment is expected to grow at the fastest CAGR between 2025 and 2034.

Market Overview

Thermal management in data centers encompasses a broad range of technologies and solutions that monitor and control temperature, humidity, and airflow to ensure optimal performance of IT equipment. With modern data centers housing thousands of servers and network devices operating 24/7, effective thermal management is critical to prevent overheating, equipment failure, and data downtime. Solutions include air-based cooling, liquid cooling, immersion cooling, and hybrid systems, enabling data centers to maintain safe thermal conditions while minimizing energy consumption.

The thermal management for data centers market is being driven by the exponential growth in global data traffic, accelerated digital transformation, and the expansion of hyperscale and edge data centers. Rising power consumption and heat generation from cloud services and high-performance computing workloads are creating an urgent need for efficient cooling solutions. Furthermore, integrating AI with IoT-enabled devices enhances thermal control through real-time monitoring and predictive maintenance, thereby improving operational efficiency and reducing energy costs.

Key Technological Shifts in the Thermal Management for Data Centers Market

The thermal management for data centers market is increasingly leveraging artificial intelligence to enable real-time, intelligent control of cooling systems. AI applications use predictive analytics, machine learning, and IoT sensors to monitor temperature, humidity, and airflow, optimizing energy consumption without compromising equipment reliability. These systems dynamically adjust cooling capacity, fan speed, and liquid flow based on workload and heat generation, improving operational efficiency and lowering power usage effectiveness (PUE). Vendors and startups are integrating AI across air, liquid, and hybrid cooling solutions, making data centers more efficient, scalable, and sustainable to support growing cloud, edge, and advanced digital workloads.

Thermal Management for Data Centers Market Outlook

The market is expected to expand at a rapid pace between 2025 and 2034, as data centers increasingly adopt energy-efficient, high-density, and sustainable cooling systems. Rising workloads from AI, cloud computing, and big data are driving demand for advanced air, liquid, and hybrid thermal management solutions.

North America represents the most mature market with extensive hyperscale data centers, while Asia Pacific is rapidly developing due to digitalization and cloud adoption. Europe is focusing on green, sustainable cooling, with modular, liquid-based systems gaining traction globally due to their efficiency.

Hyperscale cloud providers, telecommunication companies, and industrial suppliers are heavily investing in thermal management technologies. Schneider Electric, Vertiv, Emerson, and Rittal are funding infrastructure upgrades, R&D, and environmentally friendly cooling solutions.

Startups are innovating in AI-driven monitoring, immersion cooling, and energy-efficient thermal technologies. These ventures attract venture capital and strategic partnerships, complementing larger vendors in optimizing data center efficiency and sustainability.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.01 Billion |

| Market Size in 2026 | USD 16.42 Billion |

| Market Size by 2034 | USD 33.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Cooling Technology, Component, Data Center Type, End-User / Industry Vertical, Cooling Infrastructure Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Thermal Management for Data Centers MarketSegment Insights

Cooling Technology Insights

The air-based cooling segment accounted for a 40% share of the thermal management market for data centers in 2024. This is due to its low cost, ease of implementation, and wide use in both traditional and enterprise data centers. Systems that use air, such as direct air cooling, rear door heat exchangers, and hot/cold aisle containment, remain popular because they are proven to be reliable and require less maintenance. These systems effectively manage airflow and temperature distribution with the help of computer room air conditioners (CRAC) or air handlers (CRAH), ensuring optimal operation conditions. This segment also remains dominant because of the large existing base of air-cooled infrastructure, making retrofitting more practical than redesigning systems. Additionally, innovations in intelligent airflow management, containment design, and energy-efficient fans have improved cooling performance, reducing power consumption.

The liquid-based cooling segment is expected to grow at the fastest rate in the coming years. Advanced technologies, such as direct-to-chip cooling, immersion cooling, and liquid rear door heat exchangers, efficiently manage the high thermal loads from AI, machine learning, and high-performance computing systems. Liquid cooling offers superior thermal efficiency compared to traditional air systems, enabling higher server density with lower energy consumption. Additionally, its sustainability benefits, including reduced carbon footprint and water usage, align with global green data center initiatives. Major vendors are heavily investing in modular, scalable liquid cooling solutions that can be integrated into existing data center architectures.

Component Insights

The cooling units & chillers segment led the market, capturing a 38% share in 2024, due to their vital role in maintaining optimal environmental conditions in data centers. These systems, known as Computer Room Air Conditioners (CRAC), Computer Room Air Handlers (CRAH), and chillers, are commonly used to manage the high heat produced by continuous data processing. They are critical for ensuring the dependability and longevity of essential IT infrastructure because they offer precise control of temperature and humidity. The strength of this segment is also supported by the integration of advanced controls, variable speed compressors, and energy-efficient refrigerants, which help lower operational costs and reduce environmental impact. CRAC and CRAH units are also preferred in enterprise and colocation data centers due to their flexibility and proven reliability.

The heat exchangers / heat sinks segment is projected to grow at a significant CAGR over the forecast period due to increased adoption of high-performance and energy-efficient cooling technologies. Liquid-to-liquid and air-to-liquid heat exchangers are gaining prominence as data centers shift toward liquid cooling and hybrid cooling solutions. These devices efficiently transfer heat from densely packed computing equipment to cooling liquids, maintaining precise temperature regulation while consuming minimal energy. The demand has been further driven by the rising use of immersion cooling and direct-to-chip liquid systems, which has increased the need for highly thermally conductive materials and compact designs in advanced heat exchangers. Their compatibility with both air and liquid-based cooling systems positions them as central components of the next-generation, environmentally friendly data centers.

Data Center Type Insights

The hyperscale data centers segment led the market with a 40% share in 2024, as these data centers require efficient and scalable thermal management systems to handle massive workloads. The growth of AI, machine learning, and big data analytics has increased power consumption and heat generation, necessitating advanced cooling solutions such as liquid and hybrid systems to maintain optimal performance. The focus on energy efficiency, cost-effectiveness, and sustainability drives investments in innovative technologies, including direct-to-chip cooling, hot aisle containment, and smart airflow management.

The colocation/cloud data centers segment is expected to grow at the fastest rate in the upcoming period, driven by rising demand for scalable, cost-efficient IT infrastructure. As more companies outsource IT systems to colocation and cloud services, rapid facility expansion has increased the need for thermal management solutions. Key priorities such as flexibility, uptime reliability, and sustainability have driven the adoption of modular air-based cooling, liquid cooling, and AI-driven temperature optimization. The proliferation of hybrid cloud deployments and regional edge data centers further reinforces this segment as a major growth driver in the global thermal management ecosystem.

End-User / Industry Vertical Insights

The IT and telecom sector led the market with a 45% share in 2024 due to its high reliance on mass data analysis, cloud computing, and high-bandwidth networks. As cloud service providers and telecom operators continue to grow rapidly, the demand for hyperscale and edge data centers has surged to support 5G networks, IoT applications, and digital transformation initiatives. These facilities generate significant heat loads, making effective and stable thermal management systems essential for ensuring continuous operation and minimizing downtime. Additionally, major vendors such as Amazon Web Services, Google Cloud, and large telecom providers are investing heavily in developing green and sustainable data center infrastructure. This combination of scalability, technological progress, and energy-efficient operations enhances their ability to maintain the segment's dominant position in the market.

The retail & e-commerce segment is projected to grow at a significant CAGR over the forecast period, driven by increased digitalization and the rise of online shopping. Data center demands have surged as retailers rely heavily on data analytics, cloud computing, and real-time transaction processing, necessitating efficient thermal management solutions to ensure high availability, fast response times, and secure operations. The adoption of AI-driven personalization, logistics automation, and omnichannel strategies further expands computing requirements, creating a need for advanced cooling solutions. Retailers and e-commerce giants are investing in modular, scalable, and energy-efficient data centers to maintain performance while reducing their carbon footprint. Additionally, seasonal traffic fluctuations and rapid data growth are prompting the adoption of hybrid and colocation data centers with flexible thermal control capabilities.

Cooling Infrastructure Type Insights

The on-premise / in-house cooling systems segment held a 60% share of the thermal management for data centers market in 2024 due to the proliferation of traditional data centers for enterprise and hyperscale, with dedicated, in-house thermal management infrastructure. Generally, air-based cooling systems, liquid-based cooling systems, or hybrid cooling systems have more control, customization, and reliability to achieve optimal environmental conditions. On-premise cooling allows organizations to design systems based on detailed workloads, temperature densities, and security requirements, making it best suited for IT and telecommunication operations that are mission-sensitive. Infrastructure capital has also encouraged enterprises to upgrade and retrofit their in-house systems rather than fully switching to modular solutions. Moreover, AI-based monitoring and automation should be integrated into conventional configurations to improve efficiency and minimize downtime.

The modular / prefabricated cooling units segment is set for significant growth in the market, driven by the increasing demand for scalable, flexible, and quickly deployable solutions in data centers. These are pre-engineered, factory-assembled modular systems that can be installed faster, cost less upfront, and be expanded more easily than traditional cooling systems. As the number of cloud service providers, colocation facilities, and edge data centers grows globally, there is a rising trend in using modular cooling units because they can effectively manage workload fluctuations and environmental changes. The modular systems support modern technologies like liquid and hybrid cooling, helping operators meet energy efficiency and sustainability goals.

Thermal Management for Data Centers MarketRegion Insights

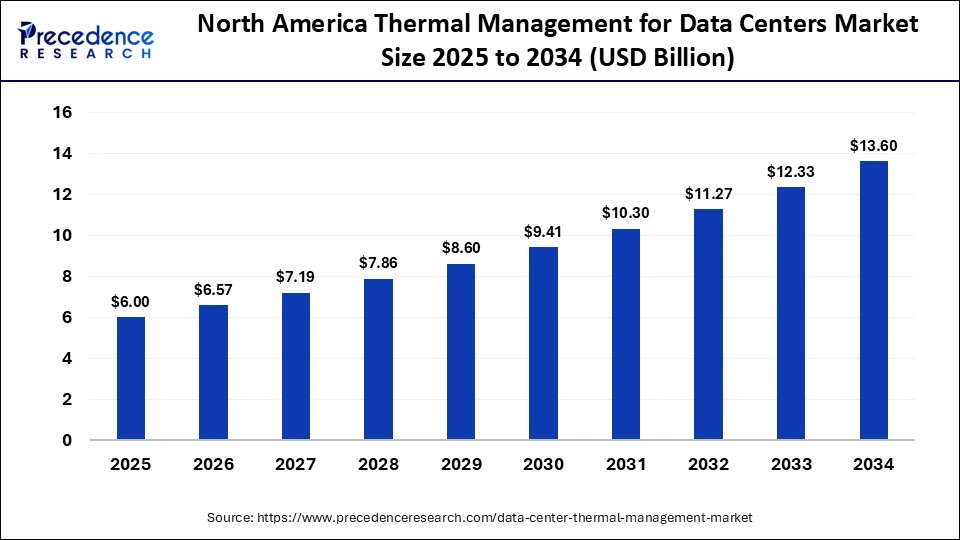

The North America thermal management for data centers market size is estimated at USD 6 billion in 2025 and is projected to reach approximately USD 13.60 billion by 2034, with a 9.50% CAGR from 2025 to 2034.

Why Did North America Lead the Global Thermal Management for Data Centers Market in 2024?

North America led the global thermal management for data centers market in 2024, capturing a 40% share, due to its extensive network of hyperscale data centers, mature cloud infrastructure, and early adoption of advanced cooling technologies. The presence of major technology giants, including Amazon Web Services (AWS), Google, Microsoft, and Meta, has driven significant investment in large-scale, energy-efficient infrastructures. Rising demand for cloud computing, artificial intelligence, and big data analytics is generating substantial heat loads, necessitating efficient thermal management solutions. Furthermore, supportive government policies promoting sustainability and renewable energy facilitate the deployment of green, low-carbon cooling systems. The region's leadership is further reinforced by ongoing innovations in liquid and immersion cooling technologies, positioning North America at the forefront of global thermal management advancements.

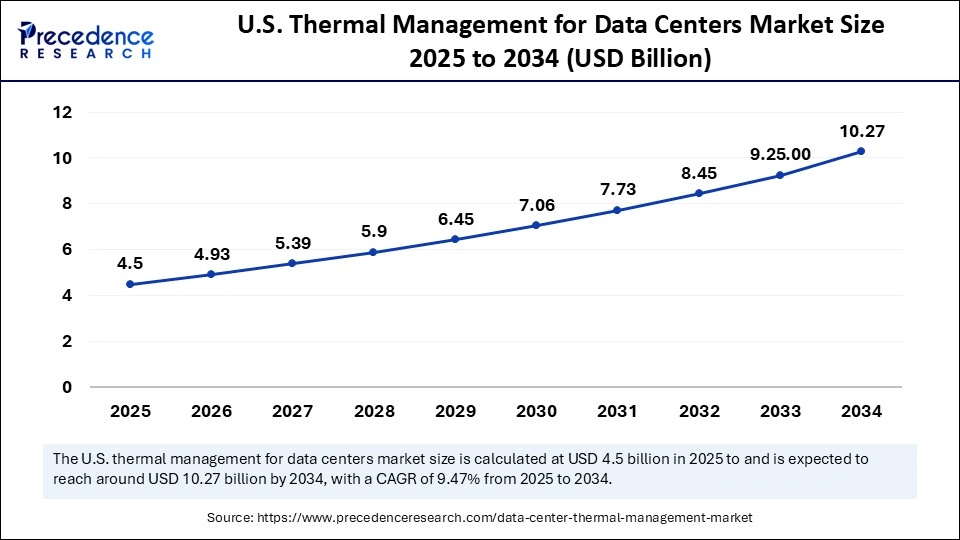

The U.S. thermal management for data centers market size is calculated at USD 4.50 billion in 2025 and is expected to reach nearly USD 10.27 billion in 2034, accelerating at a strong CAGR of 9.47% between 2025 and 2034.

U.S. Thermal Management for Data Centers Market Trends

The U.S. is a major player in the North American thermal management for data centers market, serving as the hub for hyperscale and leading cloud service providers. The country is rapidly adopting liquid cooling and AI-driven monitoring systems to improve energy efficiency and reduce operating costs at high-density data centers. Rising electricity prices and sustainability commitments are pushing operators toward carbon-neutral and water-efficient cooling solutions. States like Virginia, Texas, and Arizona are emerging as key data center hubs due to favorable regulations, robust power infrastructure, and renewable energy initiatives. Additionally, increased investments in prefabricated and modular data centers are creating new opportunities for advanced thermal management providers.

The Asia Pacific thermal management for data centers market size is expected to be worth USD 8.14 billion by 2034, increasing from USD 3.60 billion by 2025, growing at a CAGR of 9.48% from 2025 to 2034.

Why is Asia Pacific Experiencing the Fastest Growth in the Thermal Management for Data Centers Market?

Asia Pacific is expected to experience the fastest growth in the thermal management for data centers market over the forecast period. Rapid digital transformation in the region, driven by the expansion of cloud computing, 5G networks, artificial intelligence, and data localization policies, has spurred the development of new data centers. The growing population of internet users and the proliferation of interconnected devices have created significant heat management challenges, driving demand for efficient thermal management solutions. Regional governments are emphasizing sustainable infrastructure upgrades, promoting energy-efficient and liquid-based cooling systems. Additionally, factors such as low-cost labor, favorable climate conditions, and robust industrial growth further reinforce APAC's position as the fastest-growing region within the global thermal management for data centers ecosystem.

China Thermal Management for Data Centers Market Trends

China represents a major growth driver within the market in Asia Pacific, fueled by the expansion of the cloud services sector, the proliferation of hyperscale data center networks, and government-led initiatives promoting digital infrastructure. Leading technology players, including Alibaba Cloud, Tencent, and Huawei Cloud, are investing heavily in next-generation data centers that necessitate advanced cooling technologies to support dense computing workloads. Additionally, the rapid growth of edge data centers, driven by IoT adoption and smart city initiatives, is increasing demand for compact and modular thermal management solutions. As China continues to spearhead digital transformation in the region, its focus on innovation, energy efficiency, and sustainable cooling solutions is poised to shape broader trends in data center development across Asia Pacific.

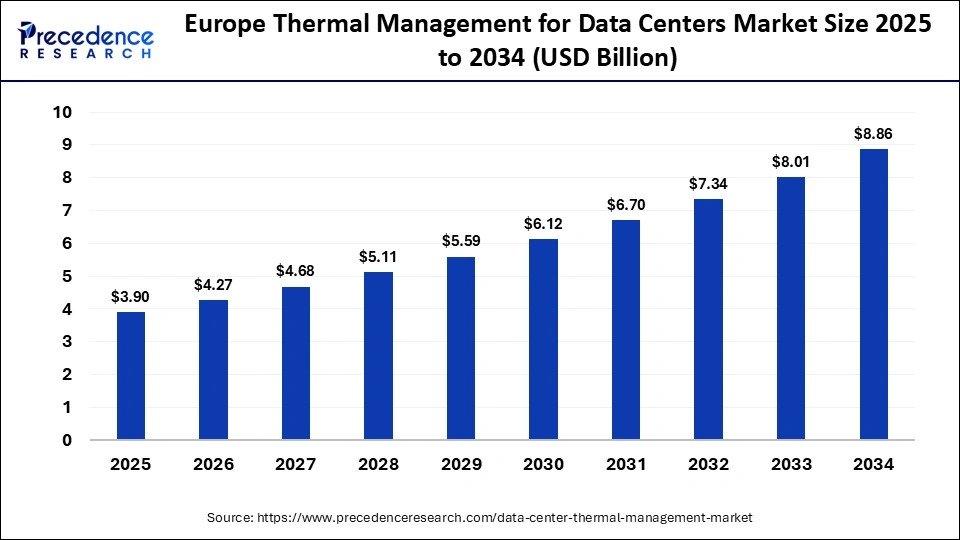

The Europe thermal management for data centers market size has grown strongly in recent years. It will grow from USD 3.9 billion in 2025 to USD 8.86 billion in 2034, expanding at a compound annual growth rate (CAGR) of 9.52% between 2025 and 2034.

Why is the European Thermal Management for Data Centers Market Experiencing Notable Growth?

The European thermal management for data centers market is witnessing steady growth, driven by a strong emphasis on energy conservation, environmental regulations, and the expansion of cloud and colocation facilities. Europe is emerging as a hub for next-generation data center infrastructure, fueled by the rising adoption of AI, IoT, and 5G technologies, which generate substantial computational workloads and heat. Significant investments by hyperscale operators and cloud service providers in countries such as the UK, Germany, the Netherlands, and France are aimed at developing high-performance, environmentally friendly facilities. Furthermore, growing interest in renewable energy adoption, along with the development and deployment of liquid and hybrid cooling systems, is accelerating the transition toward sustainable and efficient data center operations.

UK Thermal Management for Data Centers Market Trends

The UK is emerging as a leading player in the European thermal management for data centers market, supported by its mature digital economy, high cloud adoption rates, and well-established data center ecosystem. The government's commitment to achieving net-zero emissions by 2050 is accelerating the deployment of energy-efficient cooling solutions, including liquid cooling, free-air cooling, and AI-driven thermal optimization systems. Additionally, the rapid expansion of edge data centers to support smart city initiatives and IoT applications is driving demand for compact, modular, and scalable cooling systems, further reinforcing the UK's position as a key growth market in Europe.

There was a convergence of rapid hyperscale and edge data center builds, accelerating AI and cloud workloads, and strong public-private investment in digital infrastructure, all of which pushed cooling needs beyond traditional air conditioning to advanced solutions like liquid cooling, immersion cooling, hot-aisle/cold-aisle containment, and AI-driven thermal management systems. In 2024, major technology partnerships and investments signaled the region's shift toward hyperscale capability, for example, Microsoft's strategic engagement with UAE-based AI firms in 2024, according to AP, which underscored growing onshore AI compute demand and the need for more efficient, high-density cooling.

At the same time, sustainability and energy-efficiency mandates, combined with water-scarcity concerns in parts of the region, encouraged operators to adopt closed-loop liquid systems, air-side economization where climate allows, and on-site renewable power integration to reduce PUE and operating costs, trends widely reported across regional tech coverage in the last three years. These drivers, together with a strong push to host latency-sensitive services locally, made the Middle East an active market for next-generation thermal management technologies in 2024, according to multiple industry and news sources.

U.A.E. Market Analysis

In 2024, research shows the country emerging as a regional leader in adopting advanced thermal management for data centers, driven by rapid AI, cloud and smart-city deployments, and government strategies to localize critical digital infrastructure. In 2024 and 2025, high-profile investments and partnerships in the UAE, including major cloud and AI partnerships reported in 2024 by AP, accelerated construction of high-density facilities that require immersion cooling and direct-to-chip liquid cooling solutions, as well as intelligent monitoring for hotspot mitigation.

The UAE's focus on energy efficiency, resilience, and sovereign capability has led operators and system integrators to trial and deploy modular data halls, closed-loop coolant systems, and waste-heat recovery pilots, while regulatory and sustainability goals prompted more stringent energy performance targets and incentives for low-water cooling technologies. For vendors and integrators, the UAE represents a strategic market for engineered thermal solutions that balance power density, water use, and carbon footprint, driven by growing demand for AI compute and the government's broader digitalization agenda.

Thermal Management for Data Centers Market Companies

- Headquarters: Columbus, Ohio, United States

- Year Founded: 2016 (origin traces back to Emerson Network Power)

- Ownership Type: Publicly Traded (NYSE: VRT)

History and Background

Vertiv was formed in 2016 following the divestiture of Emerson Network Power from Emerson Electric Co. and its acquisition by Platinum Equity. In 2020, Vertiv became a publicly traded company through a merger with GS Acquisition Holdings. The company’s roots date back over 50 years through the Emerson Network Power and Liebert legacy brands, pioneers in uninterruptible power supply (UPS), thermal management, and critical infrastructure solutions.

Vertiv has grown into a global leader in digital infrastructure and data center solutions, providing power, cooling, and IT management systems that ensure reliability and efficiency for mission-critical environments. The company plays a central role in supporting the exponential growth of cloud computing, edge data centers, and high-density AI workloads.

Key Milestones / Timeline

- 2016: Formation of Vertiv following Emerson Network Power’s divestiture from Emerson Electric

- 2018: Expansion into edge computing solutions and software-driven monitoring systems

- 2020: Public listing on the New York Stock Exchange (NYSE: VRT)

- 2022: Acquisition of E+I Engineering, strengthening power distribution capabilities

- 2024: Announced global data center cooling initiative for high-density AI applications

Business Overview

Vertiv designs, manufactures, and services critical digital infrastructure for data centers, communication networks, and industrial applications. Its portfolio includes power systems, precision cooling, thermal management, and monitoring software. Vertiv’s integrated solutions are essential to maintaining uptime and energy efficiency across hyperscale and enterprise facilities.

Business Segments / Divisions

- Critical Power

- Thermal Management

- Integrated Rack Systems

- Services and Software

Geographic Presence

Vertiv operates in more than 130 countries, with regional headquarters in the United States, the United Kingdom, Italy, China, and Singapore. Major manufacturing and R&D centers are located in North America, Europe, and Asia-Pacific.

Key Offerings

- Uninterruptible Power Supply (UPS) systems

- Liquid and air-based data center cooling solutions

- Power distribution and management systems

- Data center racks, enclosures, and monitoring software

- AI-driven thermal optimization and automation platforms

Financial Overview

Vertiv reports annual revenues exceeding $7 billion USD, reflecting robust demand for data center infrastructure and AI-driven cooling systems. The company has demonstrated consistent growth through expanded global service operations and increased adoption of modular and liquid cooling solutions.

Key Developments and Strategic Initiatives

- February 2023: Introduced next-generation liquid cooling solutions for high-density AI and HPC data centers

- September 2023: Opened new manufacturing facility in Pune, India, to support regional infrastructure growth

- April 2024: Expanded Vertiv Liebert cooling line with advanced refrigerant technologies for sustainability compliance

- August 2025: Announced Vertiv AI Infrastructure Program to enhance data center efficiency and thermal performance

Partnerships & Collaborations

- Collaborations with hyperscale cloud providers and colocation operators for next-generation cooling systems

- Strategic alliances with chip manufacturers to co-develop direct-to-chip and immersion cooling solutions

- Partnerships with universities and R&D institutions for sustainability and power efficiency research

Product Launches / Innovations

- Liebert XDU SmartCool direct-to-chip liquid cooling system (2023)

- Vertiv SmartMod modular data center infrastructure platform (2024)

- AI-driven predictive maintenance and monitoring suite for data centers (2025)

Technological Capabilities / R&D Focus

- Core technologies: Power management, thermal management, liquid cooling, AI-based monitoring, and modular infrastructure

- Research Infrastructure: Global R&D centers in the United States, Italy, and China

- Innovation focus: Liquid cooling for AI workloads, modular data centers, and energy-efficient power conversion

Competitive Positioning

- Strengths: Strong global brand, end-to-end data center infrastructure expertise, and service capabilities

- Differentiators: Integration of power, cooling, and AI-driven monitoring solutions for hyperscale and edge facilities

SWOT Analysis

- Strengths: Comprehensive infrastructure portfolio, global footprint, strong brand reputation

- Weaknesses: Exposure to cyclical capital expenditure in data center markets

- Opportunities: AI-driven data center growth, sustainability initiatives, expansion in emerging markets

- Threats: Competition from Schneider Electric and Johnson Controls, supply chain volatility

Recent News and Updates

- June 2024: Vertiv announced a new sustainability roadmap for carbon-neutral operations by 2030

- October 2024: Vertiv unveiled liquid cooling portfolio enhancements at the OCP Global Summit

- January 2025: Vertiv reported a record order backlog driven by AI data center infrastructure demand

Other Companies in the Market

- Schneider Electric: Schneider Electric is a global leader in integrated data center cooling and power management solutions. Its EcoStruxure platform combines precision cooling, energy optimization, and real-time monitoring for efficient thermal management. The company focuses on sustainability, modular design, and AI-driven automation to reduce energy consumption and improve uptime in hyperscale and edge data centers.

- STULZ: STULZ specializes in precision air conditioning and liquid cooling systems for mission-critical data center environments. Its product range includes CRAH units, chillers, and direct-to-chip cooling technologies. Known for engineering reliability and energy efficiency, STULZ provides customized cooling solutions for hyperscale and colocation facilities worldwide.

- Rittal: Rittal offers advanced IT cooling systems, enclosures, and modular data center infrastructure. Its Liquid Cooling Package (LCP) and rack-based solutions provide efficient thermal management for high-density computing environments. Rittal's innovations emphasize scalability, automation, and energy-efficient operation.

- Airedale International: Airedale International, part of Modine Manufacturing Company, designs precision air conditioning and chiller systems for large-scale data centers. Its SmartCool and DeltaChill systems optimize energy use through adaptive control and free-cooling technologies.

- Johnson Controls: Johnson Controls provides intelligent HVAC and cooling solutions for data centers, integrating automation, energy management, and sustainability. Its YORK chillers and building management systems enhance efficiency while reducing operational costs in large data environments.

- Mitsubishi Electric Hydronics & IT Cooling Systems: Part of the Mitsubishi Electric Group, the company offers high-efficiency chillers and precision cooling systems. Its Climaveneta brand delivers advanced hydronic and IT cooling solutions designed for data center optimization.

- Asetek: Asetek is a pioneer in liquid cooling technology, known for its direct-to-chip and immersion cooling systems. Its solutions enable significant power savings and improved heat dissipation for high-performance computing and AI servers.

- Chilldyne: Chilldyne develops patented negative-pressure liquid cooling systems that provide leak-proof, efficient thermal management. Its technology is widely adopted in HPC and hyperscale environments for enhanced reliability and reduced cooling costs.

- LiquidCool Solutions: LiquidCool Solutions specializes in dielectric fluid-based liquid submersion cooling. Its sealed chassis systems eliminate air conditioning requirements, significantly improving energy efficiency and reducing noise.

- Air Enterprises: Air Enterprises manufactures custom air handling systems for data center cooling, focusing on energy-efficient airflow management and modular design for large-scale installations.

- Climaveneta: Climaveneta (Mitsubishi Electric) delivers advanced hydronic-based cooling systems, integrating chillers, free cooling, and heat recovery for sustainable data center operations.

- Coolcentric: Coolcentric provides rear-door heat exchangers and liquid-cooling solutions for high-density IT racks. Its technology reduces PUE and supports efficient cooling of advanced computing systems.

- Dell: Dell integrates liquid cooling and thermal management technologies into its server systems, offering efficient rack-level heat removal solutions for hyperscale data centers.

- Nortek Air Solutions: Nortek designs large-scale air handling and precision cooling systems optimized for data centers. Its solutions combine reliability, redundancy, and smart airflow management.

- NTT: NTT operates global data centers implementing advanced cooling systems, including direct-to-chip and liquid immersion technologies. Its sustainability strategy targets carbon-neutral operations.

- Thermal Care: Thermal Care provides industrial chillers and cooling systems designed for efficient heat removal in data-intensive facilities.

- Danfoss: Danfoss develops compressors, heat exchangers, and variable-speed drives used in advanced data center cooling systems. Its solutions emphasize energy optimization and COâ‚‚-reducing technologies.

- Green Revolution Cooling (GRC): GRC is a leader in immersion cooling, offering ICEraQ systems that submerge IT hardware in dielectric fluid for ultra-efficient, silent, and sustainable heat management.

- Vigilent: Vigilent uses AI-driven energy management software to optimize cooling efficiency and airflow in real time. Its predictive algorithms reduce energy costs and enhance reliability in mission-critical environments.

- Pentair: Pentair provides thermal management systems, including heat exchangers and liquid cooling components, for industrial and IT applications. Its solutions focus on performance, reliability, and sustainability.

- Data Aire: Data Aire manufactures precision air conditioning and cooling systems for data centers. Its intelligent controls ensure consistent temperature and humidity management for critical IT environments.

Recent Developments

- In March 2025, Vertiv Group Corp. partnered with Tecogen Inc., a U.S.-based clean energy company, to deploy Tecogen's natural gas-powered chiller technology in Vertiv's global data commerce solutions. The collaboration aims to help Vertiv address power limitations, support large-scale AI deployments, and enhance its range of advanced cooling solutions.(Source: https://www.vertiv.com)

- In December 2024, Schneider Electric announced AI-ready data center solutions in partnership with NVIDIA, including a 132 kW-per-rack liquid-cooled AI cluster reference design, and promoted them as AI-compatible. The company also introduced the small Galaxy VXL UPS, which offers 52% space savings and higher power density, capable of supporting AI and data centers more efficiently.(Source: https://www.se.com)

- In October 2024, Wieland acquired Onda S.p.A., an Italian producer of advanced heat exchangers, to strengthen its market position in data center cooling and thermal solutions. The acquisition merges Onda with Wieland's Thermal Solutions division and advances its sustainable cooling and innovative heating technologies.(Source: https://www.wieland.com)

Exclusive Analysis

The global thermal management for data centers market is poised for robust expansion, driven by the accelerating proliferation of hyperscale data centers, cloud infrastructure, and edge computing deployments. Escalating demand for high-density compute environments has intensified the imperative for energy-efficient, scalable cooling solutions, positioning thermal management as a critical operational lever for minimizing TCO (Total Cost of Ownership) and optimizing PUE (Power Usage Effectiveness).

From a strategic vantage point, the market demonstrates a pronounced bifurcation: Tier I incumbents continue to consolidate their dominance through integrated hardware-software cooling ecosystems, advanced liquid-immersion technologies, and predictive thermal analytics, while Tier II and III entities are unlocking incremental growth through specialized modular cooling solutions, retrofitting legacy infrastructure, and niche high-efficiency technologies. The confluence of rising sustainability mandates, stringent regulatory benchmarks, and escalating operational costs underpins substantial growth potential for energy-efficient and AI-driven thermal management platforms.

Emerging opportunities are particularly pronounced in liquid cooling adoption, direct-to-chip immersion cooling, and smart IoT-enabled monitoring systems that provide granular real-time thermal profiling. Additionally, the rapid expansion of edge data centers and 5G-enabled micro-facilities presents a fertile substrate for innovative, space-constrained cooling solutions, further augmenting market penetration prospects for agile mid-tier and emerging players.

In summary, the thermal management for data centers market is not merely a cost-containment instrument but a strategic enabler for operational resilience, energy optimization, and sustainability compliance. Market entrants and incumbents alike are well-positioned to capitalize on the intersection of technology-driven efficiency gains and the inexorable growth of digital infrastructure globally.

Thermal Management for Data Centers MarketSegments Covered in the Report

By Cooling Technology

- Air-Based Cooling

- Direct Air Cooling

- Rear Door Heat Exchangers

- Hot/Cold Aisle Containment

- Liquid-Based Cooling

- Direct-to-Chip Cooling

- Immersion Cooling

- Rear Door Heat Exchangers (Liquid)

- Hybrid / Combined Cooling

- Air-Liquid Hybrid Systems

- Other Cooling Technologies

- Thermoelectric Cooling

- Phase-Change Cooling

By Component

- Cooling Units / Chillers

- Computer Room Air Conditioners (CRAC)

- Computer Room Air Handlers (CRAH)

- Chillers

- Cooling Infrastructure / Piping & Distribution

- Pipes & Valves

- Pumps & Distribution Units

- Heat Exchangers / Heat Sinks

- Liquid-to-Liquid Heat Exchangers

- Air-to-Liquid Heat Exchangers

- Fans & Airflow Management Devices

- Other Components

By Data Center Type

- Hyperscale Data Centers

- Enterprise Data Centers

- Colocation / Cloud Data Centers

- Edge Data Centers / Micro Data Centers

By End User / Industry Vertical

- IT & Telecom

- Cloud Service Providers

- Telecom Operators

- BFSI (Banking, Financial Services & Insurance)

- Government & Defense

- Healthcare & Life Sciences

- Manufacturing / Industrial

- Education & Research Institutes

- Retail & eCommerce

By Cooling Infrastructure Type

- On-Premise / In-House Cooling Systems

- Modular / Prefabricated Cooling Units

- Cloud / Managed Cooling Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting