U.S. Digital Health in Neurology Market Size and Forecast 2025 to 2034

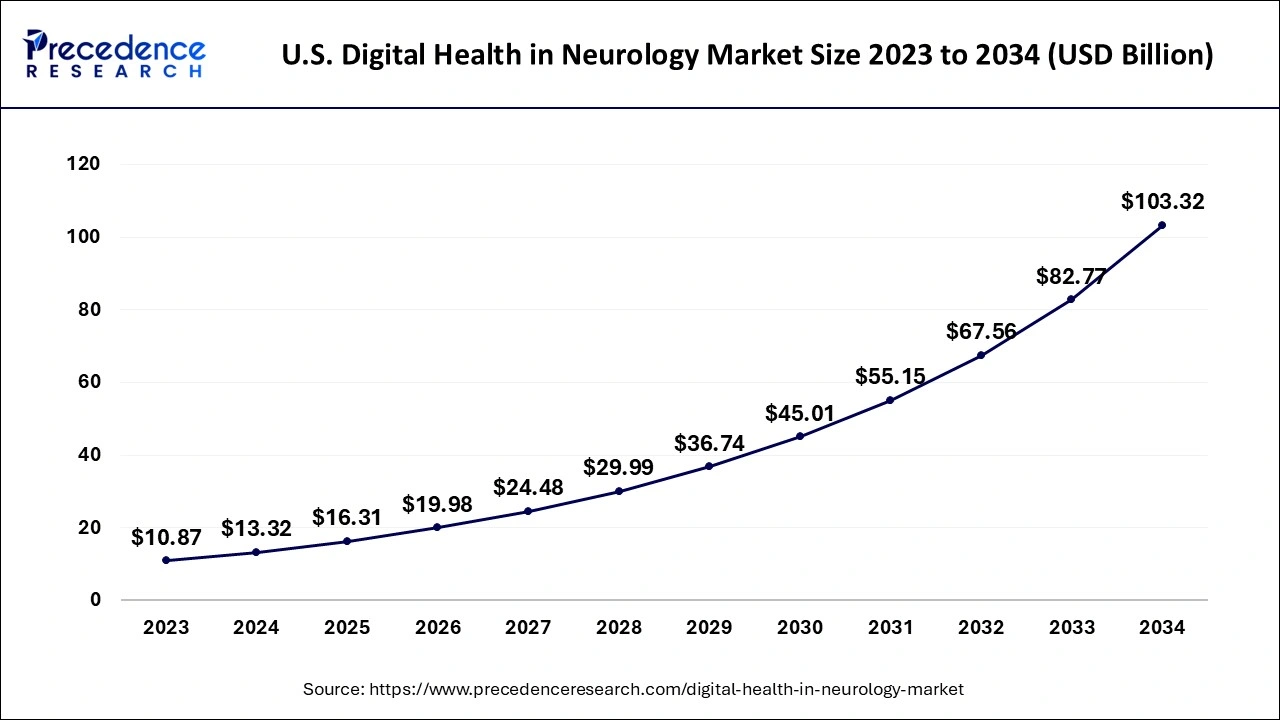

The U.S. digital health in neurology market size was calculated at USD 13.32 billion in 2024 and is predicted to increase from USD 16.31 billion in 2025 to approximately USD 103.32 billion by 2034, expanding at a CAGR of 22.73% from 2025 to 2034. The U.S. digital health in neurology market is growing due to the rising incidence of neurological disorders, developments in digital therapeutics, and the growing adoption of telehealth services.

U.S. Digital Health in Neurology Market Key Takeaways

- In terms of revenue, the U.S. digital health in neurology market was valued at USD 13.32 billion in 2024.

- It is projected to reach USD 103.32 billion by 2034.

- The market is expected to grow at a CAGR of 22.73% from 2025 to 2034.

- By component, the services segment held the largest market share in 2024.

- By component, the software segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use, the patients segment captured the biggest market share in 2024.

- By end-use, the providers segment is expected to grow at the fastest CAGR during the forecast period.

Impact of AI on the U.S. Digital Health in Neurology Market

Artificial intelligence is a key driver in the U.S. digital health in neurology market because it improves diagnostic accuracy via advanced pattern recognition in imaging as well as patient data, permits personalized treatment planning, and enhances patient monitoring via digital biomarkers and remote technologies. AI algorithms can determine complex datasets such as medical images (MRI, CT, PET scans) to identify subtle patterns as well as anomalies that humans might miss, leading to earlier along with more accurate diagnoses of conditions such as Parkinson's disease, stroke, Alzheimer's, and brain tumors.

The U.S. FDA's acceptance of AI-enabled medical devices, such as those for stroke detection and even ADHD treatment, signals regulatory acceptance and fosters thus innovation and adoption in the neurology space. The rising volume of patient data from clinical and non-clinical sources offers the necessary fuel for AI models to learn as well as improve their performance.

Market overview

The significance of the U.S. digital health in the neurology market lies in its potency to transform neurological care by enhancing diagnosis, treatment, and even patient management through technologies such as AI, wearables, and telehealth. AI, wearable devices, machine learning, and telemedicine platforms are revolutionizing neurological care by permitting remote patient monitoring, early detection, and even personalized treatment plans. Digital tools permit personalized treatments by associating real-time patient data with electronic health records, contributing to more efficient and effective care pathways.

- In December 2022, Accenture made a strategic investment, via Accenture Ventures, in BehaVR, a contributing innovator in virtual reality (VR) digital wellness and even digital therapeutics experiences. (Source: https://newsroom.accenture.com)

U.S. Digital Health in Neurology Market Growth Factors

- A rising number of people are diagnosed with conditions such as Alzheimer's, Parkinson's, and even ADHD, creating a greater requirement for innovative digital health solutions for diagnosis, monitoring, as well as management.

- Government initiatives to fund the digitization of healthcare systems as well as the regulatory propel for telehealth services as well as digital tools are vital drivers of market growth.

- The acceptance of digital health solutions by providers is rising, supported by initiatives from major market players to encourage their use in the neurology sector.

- Increasing investment in neurological treatments as well as diagnostics contributes to the growth of the digital health market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 103.32 Billion |

| Market Size in 2025 | USD 16.31 Billion |

| Market Size in 2024 | USD 13.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.73% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, and End-use |

Market Dynamics

Drivers

Rising need for remote patient monitoring and telehealth services

The increasing need for remote patient monitoring (RPM) and telehealth in neurology is driven by the growing prevalence of chronic neurological conditions, an aging population, and even the requirement for accessible care, mainly in rural areas. Remote monitoring and telehealth provide patients the convenience of receiving care from home, decreasing travel costs and wait times, and also making care more accessible, mainly in underserved rural areas. Telehealth platforms ensure continuous care for individuals with neurological disorders, which is crucial for managing chronic conditions. Real-time patient information from RPM devices permits timely interventions, which are especially beneficial in managing acute neurological events along with chronic care.

Restraint

Complex and evolving regulatory landscapes

Complex and evolving U.S. regulatory landscapes restrain digital health in the neurology market by rising compliance costs, mainly for smaller firms, slowing innovation because of regulatory uncertainty, and hampering market entry and acceptance of new technologies. Digital health technologies (DHTs) usually lack clear regulatory pathways, contributing to uncertainty for developers and hampering innovation. The FDA must establish new methods to estimate and guide these technologies, mainly those involving artificial intelligence.

Opportunity

Development and validation of digital therapeutics

The development and validation of digital therapeutics (DTx) present a significant opportunity for the U.S. digital health in neurology market by allowing personalized, evidence-based treatments, amplifying access to care for neurological conditions, decreasing costs via efficient delivery, and encouraging better patient engagement. Digital tools such as VR and serious games can create rehabilitation and even therapy management more engaging, contributing to higher adherence to treatment plans and even medication regimens.

Tools like VR are being expanded to deliver interactive therapeutic content and even personalized support, bridging clinical structure with consumer engagement to support scalable applications in mental healthcare.

Component insights

How did the services segment dominate the in the U.S. digital health in neurology market in 2024?

The services segment dominates the U.S. digital health in neurology market due to the ongoing demand for installation, training, maintenance, and few support services for digital health solutions such as EHRs and telehealth platforms. Market players often provide comprehensive service packages, training, bundling installation, and maintenance to offer end-to-end solutions and improve value for customers. Digital health solutions need significant support, which includes implementation, project planning, and even integration into existing healthcare workflows.

Telehealth networks are displaying faster treatment times for strokes, while AI-driven software assists in faster stroke detection, and the usage of advanced robotics is being investigated for remote mechanical thrombectomy.

The software segment is witnessing the fastest growth due to the rising adoption of AI-based diagnostic tools, the demand for managing patient data via cloud platforms and digitalized medical records, and the advancement of mobile health applications for remote monitoring and even decision support. Software-based mobile health applications are broadly adopted for tracking patient conditions and even offering real-time data, improving the ability to make informed clinical decisions.

End-use insights

How did the patients segment dominate the in the U.S. digital health in neurology market in 2024?

The patients segment dominates the U.S. digital health in neurology market due to a transfer towards patient-centered care, increased need for remote monitoring and telehealth, and the rising prevalence of neurological conditions demanding patient self-management. Patients with neurological conditions increasingly choose remote consultations along with the ability to monitor their symptoms together with health parameters from home utilizing digital platforms and wearables.Devices such as the Samsung Galaxy Watch permit remote monitoring as well as detection of health issues, like sleep apnea, directly from a patient's home.

The providers segment is witnessing the fastest growth due to the increased acceptance of digital solutions such as telemedicine and even digital therapeutics for personalized care, remote consultations, and even remote patient monitoring. Providers are increasingly using RPM to cover neurological conditions from a distance, contributing to more efficient and personalized care. However, providers are motivated to accept digital technologies to improve clinical efficiency, decrease healthcare expenses, and give more time to patient care.Providers utilize software for continuous neurological monitoring, permitting proactive management of chronic conditions such as Alzheimer's and Parkinson's disease.

Value Chain Analysis

- R&D

R&D in the U.S. digital health for neurology market targets on developing technologies such as AI-powered diagnostic tools, virtual reality (VR), wearable sensors, for pain management, and even digital therapeutics to permit earlier disease detection, personalized treatment plans, continuous patient monitoring, and enhanced patient adherence to therapies.

Key Players: Abbott and Medtronic

- Clinical Trials and Regulatory Approvals

Clinical trials in U.S. digital health for neurology are regulated investigations that establish the safety and even efficacy of novel digital health technologies (DHTs), like wearable sensors and apps, to treat neurological conditions.

Key Players: Biogen, BehaVR

- Patient Support and Services

Patient Support and Services in the U.S. digital health neurology market apply to digital tools, platforms, and even services that improve patient access, engagement, and even self-management of neurological conditions.

Key Players: Teladoc, AppliedVR, BetterHelp

U.S. Digital Health in Neurology Market Companies

- Teladoc

- Proteus Digital Health

- Omada Health

- Blackrock Neurotech

- AdvancedMD

- Aural Analytics

- BehaVR

- BetterHelp

- Big Health

- AppliedVR

Recent Developments

- In May 2025, Cognixion, a designer of noninvasive brain-computer interface (BCI) technology, declared that Blackrock Neurotech, a firm that makes implantable BCIs, will offer Cognixion's Axon-R wearable neural interface podium to research institutions through its distribution network. (Source: https://www.mobihealthnews.com)

- In March 2025, Teladoc Health declared new abilities to its purpose-built, proprietary care delivery platform, called Prism, that will build up its ability to coordinate care with digital health partners and even community care providers. (Source: https://ir.teladochealth.com)

- In March 2024, Linus Health, a digital health firm enabling early detection of Alzheimer's and dementias, declared it had obtained Aural Analytics, a chief in clinical-grade speech analytics. The deal comprises Aural Analytics' assets, including its technology and even intellectual property. (Source:https://linushealth.com)

Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By End-use

- Patients

- Providers

- Payers

- Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content