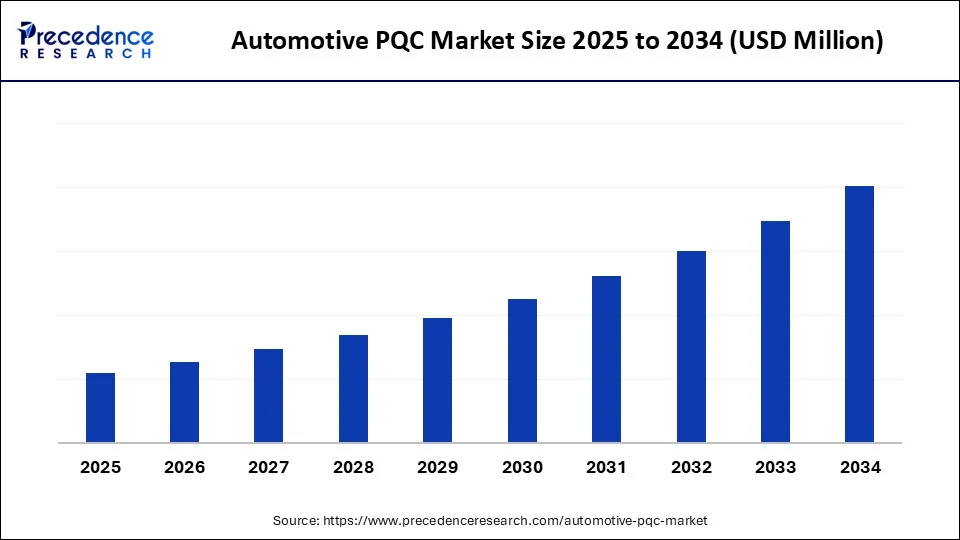

Automotive PQC Market Size and Forecast 2025 to 2034

The automotive PQC market is expanding as automakers adopt smart inspection systems such as machine vision, AI analytics, and robotics to improve vehicle component quality, safety, and efficiency throughout production. The market growth is attributed to the increasing complexity of vehicle electrical systems and the regulatory push for enhanced power stability and electromagnetic compatibility across EV and hybrid platforms.

Automotive PQC Market Key Takeaways

- Europe dominated the global automotive PQC market in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By component, the software-based PQC solutions segment held the major market share in 2024.

- By component, the hardware-based PQC solution segment is projected to grow at the highest CAGR between 2025 and 2034.

- By deployment type, the on-board (Vehicle-installed) segment contributed the biggest market share in 2024.

- By deployment type, the cloud-based segment is likely to expand at a significant CAGR between 2025 and 2034.

- By application, the over-the-air (OTA) updates segment led the market in 2024.

- By application, the autonomous driving & ADAS segment is expected to grow at a significant CAGR over the projected period.

- By vehicle type, the passenger vehicles segment generated the largest market share in 2024.

- By vehicle type, the electric vehicles (EVs) segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end-user, the automotive OEMs segment held the biggest market share in 2024.

- By end-user, the tier 1 & tier 2 suppliers segment is expected to grow at a notable CAGR from 2025 to 2034.

Market Overview

The automotive post-quantum cryptography (PQC) market refers to the ecosystem of cryptographic algorithms, hardware, software, and services designed to protect connected automotive systems and components from the security threats posed by quantum computers. As traditional cryptographic methods (like RSA and ECC) will become vulnerable to quantum attacks, PQC ensures long-term security for vehicle-to-everything (V2X) communication, over-the-air (OTA) updates, telematics, ADAS, autonomous driving systems, and critical ECU-to-ECU data exchanges. The PQC market in automotive spans across the supply chain, including OEMs, Tier-1 suppliers, cyber security vendors, andsemiconductor providers, and it plays a vital role in ensuring compliance, safety, and resilience in the face of next-gen cyber threats.

The rising demand for vehicle electrification and advanced driver assistance systems (ADAS) is increasing the need for vehicles with robust power quality and conditioning (PQC) within the automotive sector. Automobiles, as indicated by the U.S. Department of Energy (DOE), incorporate over 100 million lines of code and numerous interconnected control modules, all of which necessitate elaborate, non-interruptive power delivery. PQC systems enable efficiency in energy consumption, decrease part failure, and support thermal management in electric and hybrid vehicles. Furthermore, growing investment in zero-emission transportation and intelligent transportation systems globally is anticipated to promote PQC adoption, as OEMs compete to meet new performance and regulatory standards.

Impact of Artificial Intelligence on the Automotive PQC Market

Artificial intelligence (AI) is transforming the automotive PQC market by enabling the development of smarter power management technologies that dynamically address the complex electrical needs of automotive systems. With the rise of electric and hybrid vehicles, AI is instrumental in managing voltage control and harmonic correction. Moreover, automotive companies and key suppliers utilize AI algorithms to monitor power flows in real-time, enabling the prediction and correction of imbalances to extend battery life and protect sensitive vehicle electronics.

Automotive PQC Market Growth Factors

- Electrification of Vehicles: The shift toward electric vehicles (EVs) and hybrid electric vehicles (HEVs) boosts the growth of the market. EVs and HEVs require sophisticated power management to handle high-voltage systems, battery charging, and efficient energy distribution.

- Advanced Driver Assistance Systems (ADAS): The integration of ADAS features, such as autonomous driving capabilities, demands robust and reliable power supplies to ensure the proper functioning of sensors, cameras, and control units.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Type, Application, Vehicle Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rising Adoption of Electric Vehicles Driving the Demand for Power Quality and Conditioning Systems?

The increasing adoption of electric vehicles (EVs) is expected to drive the growth of the automotive PQC market in the coming years. EVs necessitate high-end power conditioning systems. Electric vehicles operate on high-voltage electrical systems, which present new challenges in maintaining stable power quality across various subsystems. Voltage and current instabilities can lead to system inefficiency and potential component failure. Power Quality and Conditioning (PQC) systems are crucial for providing a consistent energy supply, utilizing real-time control and predictive analytics. Smart PQC modules are being relied upon by manufacturers to effectively manage regenerative braking and propulsion requirements, driven by growing EV sales.

In 2024, the International Energy Agency (IEA) reported that Asia saw over 14 million EV sales globally, a 35% increase from 2023, highlighting the growing need for stable electrical support systems. The shift in EV demand is driving OEMs to invest in technologies that enhance power stability and safety, thus accelerating the high-performance PQC solutions market. Tesla, Hyundai, and BMW, among others, have unveiled new platforms with improved power management modules designed to support fast charging and advanced electronics. Moreover, the increasing complexity of automotive electronic systems is expected to further drive the demand for intelligent power quality solutions. (Source: https://www.iea.org)

Restraint

High Cost and Complexity in Integration of Advanced PQC

The complexity and cost of integrating advanced PQC systems are expected to limit market growth. The challenges in incorporating PQC into existing car architectures may restrict its use in mass production. This redesign is specialized, requiring extensive validation and Electronic Control Unit (ECU) compatibility. These technical and financial hurdles could slow adoption in vehicles where cost-efficiency is prioritized over system-level electrical optimization.

Opportunity

What Role Does Fast-Charging Infrastructure Play in Driving PQC Innovation Across the Automotive Sector?

The growing demand for fast-charging infrastructure is expected to offer significant opportunities. Fast charging puts stress on vehicle electrical systems, potentially causing voltage fluctuations and heat issues. Power conditioning technology can manage high-speed energy transfer while protecting internal electronics from voltage and ripple effects. Automakers and suppliers are investing in comprehensive PQC techniques to enable ultra-fast charging without compromising component lifespan. In 2024, the U.S. Department of Energy (DOE) reported that over 12,000 new DC fast-charging ports were added through federal and state EV infrastructure programs, increasing the load on EV systems. Furthermore, the focus on vehicle safety and regulatory compliance is projected to support steady PQC deployment.(Source: https://ev.com)

Component Insights

Why Did the Software-Based PQC Solutions Segment Dominate the Market in 2024?

The software-based PQC solutions segment dominated the automotive PQC market in 2024, driven by the increased demand for intelligent power management and system-level flexibility. These solutions offer real-time analysis, predictive control, and autonomous fault control, crucial for managing the electrical complexity of electric and hybrid vehicles. In 2024, the U.S. Department of Energy (DOE) began funding vehicle-to-grid interface research, emphasizing software's role in balancing two-way power flow and mitigating grid disturbances. (Source: https://ieeexplore.ieee.org)

The hardware-based PQC solutions segment is expected to grow at the fastest CAGR in the coming years due to their advantages, high-voltage EV platforms, and rapid charging infrastructures. Automakers are ensuring power flow stability using advanced capacitors, inductive filters, isolation transformers, and high-frequency switching circuits during periods of high operational power demand. Manufacturers such as Infineon Technologies, Eaton Corporation, and Schneider Electric have increased their production of vehicle-grade PQC hardware to meet rising demand. Additionally, the increasing availability and introduction of advanced hardware solutions will further support the segment's growth in the coming years. (Source:https://www.energy.gov)

In March 2025, STMicroelectronics launched hardware cryptographic accelerators and matching software libraries for both secure and general-purpose microcontrollers. As quantum systems begin to outperform classical computing in trials, industry players are bracing for widespread adoption. New government PQC standards now incorporate approaches based on quantum-resistant math, including the Keccak algorithm, co-developed by ST experts, to enhance embedded systems security.(Source: https://newsroom.st.com)

Deployment Type Insights

How Does the On-Board Segment Dominate the Automotive PQC Market in 2024?

The on-board (vehicle-installed) segment dominated the automotive PQC market while holding the largest share in 2024 due to its critical role in controlling electrical stability within the vehicle. On-board PQC systems provide real-time voltage regulation, transient suppression, and harmonic control, essential for maintaining the integrity of complex EV and hybrid powertrains. Compliance with electromagnetic standards within the vehicle further emphasized the need for embedded solutions, thereby boosting the segment.

The cloud-based segment is expected to grow at the fastest rate in the coming years. Cloud-based PQC systems enable centralized monitoring of power quality factors, simplifying updates and allowing automakers to implement predictive fault detection across fleets. Companies like Bosch, NXP Semiconductors, and General Motors have expanded their cloud-based diagnostics solutions with PQC features, providing real-time notifications about abnormal voltages and degradation trends. Furthermore, 5G and edge computing infrastructures are expected to drive market growth in the coming years.

Application Insights

What Made Over-the-Air (OTA) Updates the Dominant Segment in the Automotive PQC Market?

The OTA updates segment dominated the market in 2024 as developers began using software-focused vehicle architecture to manage powertrain, infotainment, and safety systems. These updates are expected to enhance the performance of power quality and conditioning (PQC) systems, enabling remote diagnosis and firmware updates, along with calibration, without physical servicing. Major industry players like Renesas Electronics and NXP Semiconductors have announced partnerships to introduce embedded OTA-compatible PQC microcontrollers, further fueling the segment.

The autonomous driving & ADAS segment is expected to grow at the fastest CAGR in the coming years, driven by the increasing need for a stable electrical environment for safe and precise operation. ADAS systems require a constant supply of power to support real-time decision-making by sensors, radar, lidar, and central processors.

The German Federal Motor Transport Authority (KBA) has published modified standards on EMC and transient immunity to address high-level ADAS and Level 3+ autonomous systems, emphasizing the growing need for comprehensive PQC integration. OEMs like Mercedes-Benz Group, Nissan, and Volkswagen Group are investing in low-latency PQC modules to maintain stable autonomous platforms. In 2024, the Fraunhofer Institute of Transportation and Infrastructure Systems identified power regulation failures as a significant contributor to ADAS faults, highlighting the increasing need for a reliable PQC infrastructure. The rising power reliability standards of self-driving systems are expected to accelerate advanced PQC integration within this segment.

Vehicle Type Insights

What Made Passenger Vehicles the Largest Revenue Contributor in the Automotive PQC Market?

The passenger vehicles segment held the largest revenue share of the automotive PQC market in 2024 due to their high production volume and the increasing reliance on electronic systems to enhance safety, performance, and entertainment features. Automakers in North America, Europe, and Asia-Pacific have adopted power quality and conditioning (PQC) technologies to stabilize voltage and reduce harmonic distortion in complex electrical systems. Government regulations encouraging the use of power quality monitoring systems in passenger cars also bolstered the segmental growth.

The electric vehicles (EVs) segment is expected to grow at the fastest rate over the forecast period, driven by their high reliance on high-voltage battery systems and precision-based power electronics, which require precise and clean power delivery. According to the International Energy Agency (IEA), electric car sales grew by 35% year-on-year in the first three months of 2025, reflecting rapid electrification and the increasing importance of efficient power quality management. (Source:https://www.iea.org)

PQC solutions such as active filters, real-time voltage stabilizers, and thermal management are likely to be adopted in battery-electric and plug-in hybrid vehicles. OEMs like BYD, Tesla, BMW, and Stellantis have been enhancing range, performance, and charging consistency by investing in PQC-compatible battery management systems. A 2024 study by the National Renewable Energy Laboratory (NREL) indicates that PQC technologies improve charge efficiency with dynamic grid interactions. Furthermore, increasing regulatory pressure and the next-gen EV architecture, which demands even greater precision, are introducing a mature PQC system to support enhanced EV performance.(Source:https://www.nrel.gov)

End-User Insights

Why Automotive OEMs are at the Forefront of PQC Adoption?

The automotive OEMs segment dominated the automotive PQC market in 2024, as they took the center stage in vehicle-wide electronic systems design and integration through precise power quality management. Major OEMs have increased their investments in in-house PQC solutions, ensuring seamless integration of propulsion, infotainment, and advanced driver-assistance systems. Additionally, OEMs are expected to maintain performance reliability and certification readiness for their vehicles, further driving the segment.

The tier 1 & tier 2 suppliers segment is expected to grow at the fastest CAGR in the coming years, as automakers increasingly rely on specialized vendors for PQC solutions. These suppliers continuously introduce efficient capacitors, converters, and control algorithms to support power conditioning in ECUs, traction inverters, and battery management systems. Furthermore, the rapid evolution of software-defined architectures and system decentralization will boost supplier contributions to PQC deployment, thereby driving segment growth in the coming years.

Regional Insights

What Made Europe the Dominant Region in the Automotive PQC Market?

Europe dominated the automotive PQC market, capturing the largest revenue share in 2024 due to its early adoption of power quality and conditioning (PQC) standards in automotive design and its pioneering role in the shift to electric mobility. Carmakers in Germany, France, and the Netherlands have implemented PQC systems to comply with ISO 7637, UNECE Regulation 10, and other EMC requirements, enabling stable electrical conditions in high-voltage designs. In 2024, the European Commission Directorate-General for Mobility and Transport further tightened legislation, encouraging new vehicles to enhance electromagnetic compatibility and power integrity, thereby boosting PQC adoption.

The European Automobile Manufacturers Association (ACEA) reported a significant increase in motor vehicles registered in the EU were electrified vehicles, increasing the demand for voltage compensators and transient suppressor models. European Tier 1 companies (Bosch, Valeo, and Continental AG) increased the integration of PQCs in hybrid and plug-in vehicles, further facilitating market growth in this region.

(Source: https://www.ccam.eu)

Asia Pacific is expected to experience the fastest growth during the forecast period, driven by the rapidly expanding electric vehicle ecosystem, government-led industrial policies, and increasing domestic demand for power-optimized auto parts. The China Association of Automobile Manufacturers (CAAM) reported a 35.8% year-on-year increase in EV production in 2024, leading to an overall rise in demand for PQC systems to balance energy transfers and insulate sensitive systems. Major regional competitors, including BYD, Hyundai Motor Group, Nissan, and Tata Motors, are integrating PQC-enhanced architectures to manage power variations in modular electric drivetrains. Additionally, the growth in automotive manufacturing activities and the localized development of electronics technology further fuel market expansion.(Source: https://www.iea.org)

Automotive PQC Market Companies

- Blackberry (Cylance)

- Bosch

- Continental AG

- Crypto Quantique

- ESCRYPT (a Bosch company)

- GuardKnox

- IBM

- Infineon Technologies

- ISARA Corporation

- Kudelski Group

- OnBoard Security (acquired by Qualcomm)

- PQShield

- Qualcomm

- Rambus

- Secunet Security Networks

- TelsaCrypt

- Thales Group

- Valeo

- Vector Informatik

- Karamba Security

Recent Developments

- In January 2025, The Post-Quantum Cryptography Alliance (PQCA), under the Linux Foundation, announced that its open-source Open Quantum Safe (OQS) initiative now integrates NVIDIA's cuPQC library. This integration allows OQS to offer GPU-accelerated cryptographic primitives via the LibOQS library, supporting the shift to quantum-resistant encryption and safeguarding against future quantum-based decryption threats. (Source:https://www.prnewswire.com)

- In June 2025, F5 has embedded PQC readiness into its Application Delivery and Security Platform to help enterprises future-proof digital operations. These enhancements allow businesses to implement quantum-resistant security for APIs and applications without sacrificing performance or scale, as cryptographic threats grow in the quantum age. (Source:https://www.channelinsider.com)

- In July 2025, Encryption Consulting, a recognized cybersecurity firm, has launched new Post-Quantum Cryptography (PQC) Advisory Services. Designed to tackle increasing quantum threats, this offering helps organizations transition from outdated encryption models like RSA and ECDSA to quantum-secure protocols, enabling long-term compliance and resilience.(Source:https://www.prnewswire.com)

- In March 2025, Unisys (NYSE: UIS) introduced a set of Post-Quantum Cryptography (PQC) capabilities as part of its cybersecurity suite. The company's cryptographic posture assessment service delivers a complete audit of an organization's cryptography landscape, identifying at-risk systems and proposing concrete steps to mitigate vulnerabilities ahead of quantum threats.(Source:https://www.unisys.com)

Latest Announcement by Industry Leader

- In June 2025, Patero, a pioneer in post-quantum cryptography (PQC), has introduced CryptoQoR, a high-performance, crypto-agile software module designed to secure communication channels and proactively reduce security vulnerabilities through hybrid post-quantum encryption. Easily integrable into existing infrastructure, the solution enhances current cryptographic defenses and provides immediate remediation for threats posed by quantum computing. “Today's encryption is already obsolete. Using Shor's algorithm, Quantum computers will decrypt data encrypted with asymmetric algorithms such as RSA or Elliptic Curve. Your data is no longer safe,” said Patero Chief Executive Officer, Crick Waters. “Sensitive, long-life data is being stolen every day to be decrypted tomorrow by cryptographically relevant quantum computers.” Waters continued, “CryptoQoR is also a crypto-agile software solution. It provides software-selectable PQC algorithms, allowing users to select their preferred algorithms in situ or upgrade to new quantum-resistant algorithms without requiring product recall or equipment replacement. All cryptography is eventually broken, but CryptoQoR's agility future-safes networks.”(Source: https://www.businesswire.com)

Segments Covered in the Report

By Component

- Hardware-based PQC Solutions

- Secure Elements (SE)

- Hardware Security Modules (HSM)

- Trusted Platform Modules (TPM)

- Software-based PQC Solutions

- Cryptographic Libraries

- Secure Boot & Firmware Validation

- OTA Security Software

- Services

- Integration & Implementation Services

- Consulting & Advisory

- Testing & Certification

By Deployment Type

- On-Board (Vehicle-installed)

- Cloud-based

By Application

- Vehicle-to-Everything (V2X) Communication

- Telematics & Infotainment

- Over-the-Air (OTA) Updates

- Autonomous Driving & ADAS

- ECU-to-ECU Communication

- Vehicle Access & Start Systems (Digital Keys)

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

By End-User

- Automotive OEMs

- Tier 1 & Tier 2 Suppliers

- Automotive Cybersecurity Vendors

- Fleet Management Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting