What is the Automotive TIC Services Market Size?

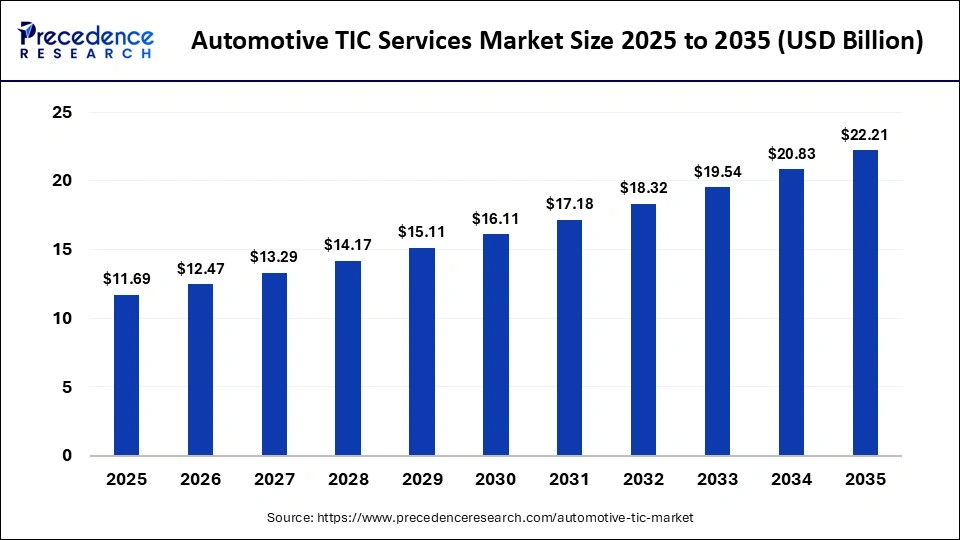

The global automotive TIC services market size accounted for USD 11.69 billion in 2025 and is predicted to increase from USD 12.47 billion in 2026 to approximately USD 22.21 billion by 2035, expanding at a CAGR of 6.63% from 2026 to 2035. The automotive TIC services market is driven by rising demand for vehicle quality inspections, regulatory compliance, and advanced safety standards.

Market Highlights

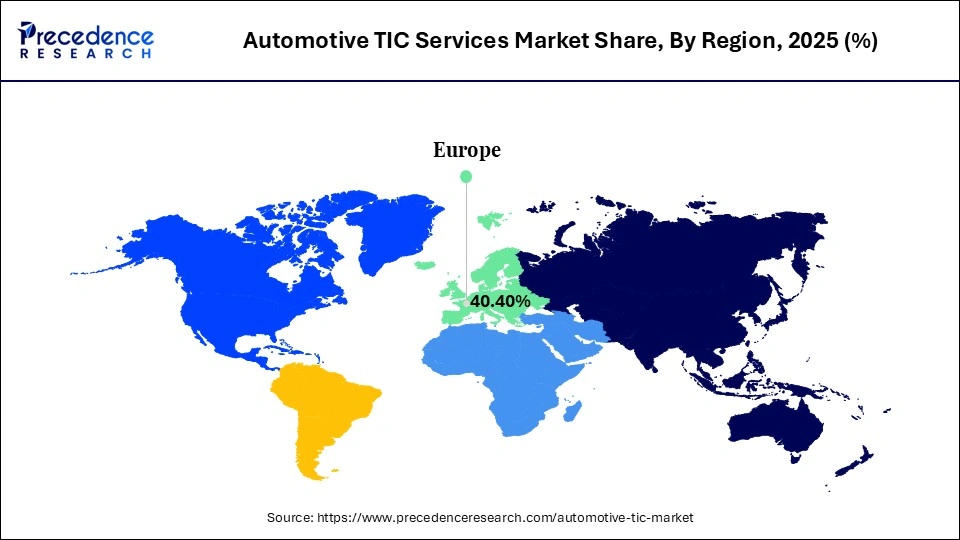

- Europe dominated the market, holding the largest share of 40.4% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 4.5% between 2026 and 2035.

- By service type, the testing segment held the largest market share of 58.4% in 2025.

- By service type, the certification segment is growing at a remarkable CAGR of 4.1% between 2026 and 2035.

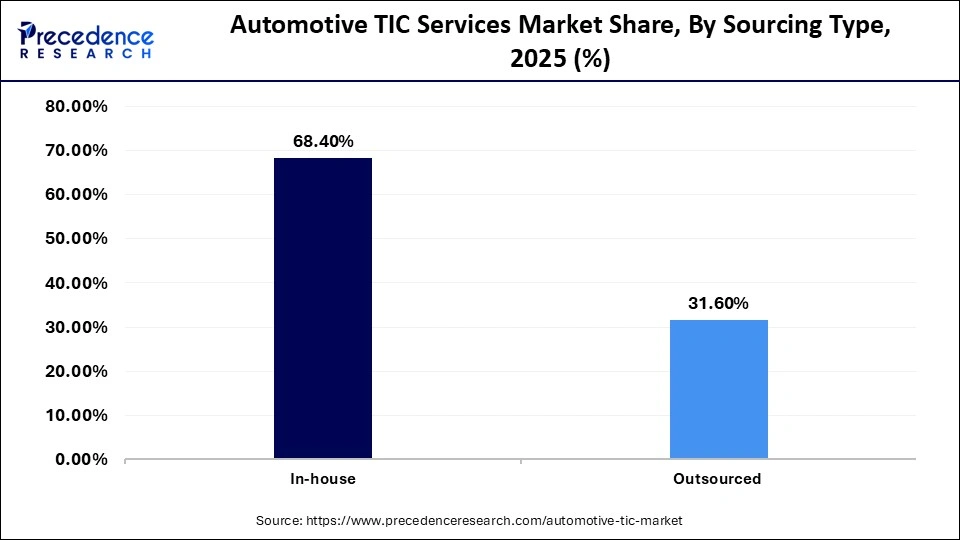

- By sourcing type, the in-house segment captured the biggest market share of 68.4% in 2025.

- By sourcing type, the outsourced segment is poised to grow at a solid CAGR of 3.9% between 2026 and 2035.

- By application, the component & material testing segment accounted for the largest market share of 42.5% in 2025.

- By application, the functional safety & ADAS testing segment is growing at a CAGR of 3.8% between 2026 and 2035.

- By vehicle type, the passenger vehicles segment captured the largest share of 42.5% in 2025.

- By vehicle type, the electric vehicles segment is growing at a 4.0% of CAGR between 2026 and 2035.

- By propulsion type, the internal combustion engine segment held the largest market share of 56.8% in 2025.

- By propulsion type, the battery electric vehicles segment is poised to grow at a CAGR of 3.9% between 2026 and 2035.

- By end user, the OEMs segment held the largest share of 54.3% in 2025.

- By end user, the tier-1 & tier-2 suppliers are set to grow at a 4.0% of CAGR between 2026 and 2035.

Redefining Quality and Compliance: The Automotive TIC Services Market

The automotive testing, inspection, and certification (TIC) services market is an important component in guaranteeing high standards in the regulatory safety, quality, and performance of the vehicles, components, and systems. The services provided by TIC include the all-inclusive testing of materials, parts, and vehicles manufactured as a whole; in-depth inspection in the production and operation process; and certification when complying with both national and international provisions. Such services assist the OEMs, suppliers, and regulatory bodies to ensure high levels of safety, reliability, and performance and to promote emissions regulation as well as environmental sustainability by offering objective verification.

The development of the market is driven by the increased level of regulatory norms, the increase in the level of safety and reliability of the vehicles, and the spread of new automotive technologies, which demand special analysis. Demand for TIC services is abetted by growth in the emerging markets, as well as increasing production of automobiles. The innovations in testing approaches, AI-controlled inspection, and online certification processes are also a chance and contribute to efficiency and decrease the overall cost of operation.

Key AI Integration in the Automotive TIC Services Market

Artificial intelligence is transforming the automotive testing, inspection, and certification services market by significantly improving testing accuracy, operational efficiency, and predictive capabilities. AI-enabled systems enhance inspection precision by reducing human dependency and enabling consistent evaluation across high-volume automotive production environments.

Robotics equipped with computer vision and machine learning algorithms are increasingly used for automated visual inspection of components and assemblies. These systems can identify surface defects, dimensional deviations, material inconsistencies, and micro-level anomalies that are often missed during manual inspections. Continuous learning models improve detection accuracy over time, enabling higher inspection throughput without compromising quality.

AI-driven predictive analytics is another critical advancement, allowing testing and certification providers to identify potential vehicle or component failures before they occur. By analyzing historical test data, sensor outputs, and real-world performance data, AI models help forecast failure risks, improve reliability, and reduce the likelihood of costly recalls. This predictive capability is particularly valuable as vehicles become more software defined and electronically complex.

Automotive TIC Services Market Outlook

- Industry Growth Overview: The automotive TIC services market keeps growing steadily as a result of the growing safety regulations, emission compliance regulations, and the growing use of sophisticated vehicle technologies. The need to ensure quality within the OEMs and suppliers is increasing the market growth constantly on a global level.

- Global Expansion: North America and Europe are the market leaders that have established a regulatory framework and are embracing testing standards, and the Asia-Pacific region is emerging fast due to the growing number of vehicle productions and the enforcement of regulations. The move to emerging economies has opened up new opportunities for TIC service providers to have local testing and certification centers.

- Major Investors: The major investors, including international testing and certification agencies (SGS, Bureau Veritas, TUV SUD, and Intertek, among others), are occupied with modernizing their technology and are spread all over the world. Other aspects that are being funded by venture capital and private equity firms include advanced testing solutions and online certification platforms.

- Startup Ecosystem: AutoTech Labs, CertifyAI, and startup Eyes Automotive Testing are developing AI-based inspection applications and digital certifications. These new firms are concerned with increasing the accuracy of testing, cutting inspection time, and real-time compliance verification of the auto makers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.69 Billion |

| Market Size in 2026 | USD 12.47 Billion |

| Market Size by 2035 | USD 22.21 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.63% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Sourcing Type, Appication, Vehicle Type, Propulsion Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Service Type Insights

Why Did the Testing Segment Hold a 58.4% Share in 2025?

Testing: By 2025, the testing segment held a 58.4% market share in the automotive TIC services market. This visibility is facilitated by the increased complexity of modern cars, including electric power systems, autonomous driving solutions, and connected car systems, which need to be tested in an overall manner, including subsystems and complete cars. The testing services include material characterization, functional performance testing, durability testing, and emissions testing that help OEMs ensure that the product will comply with the high safety and environmental regulation standards. The huge reliance of manufacturers on objective verification and the role of testing in minimizing operational and reputational risks.

Certification: The segment took 4.1% in 2025 and proved to be the most dynamic segment due to certification, vehicles, subsystems, and components being permitted to comply with national and international regulatory frameworks, which enable OEMs and suppliers to access global markets. Implementing the use of digital certification systems and AI-based verification solutions is boosting the speed of a faster approval process, minimizing human error, and decreasing time-to-market. Although testing and certification are not as important to the market share as they are to the testing, the nature of the growing regulatory complexity, cross-border trade, and growing consumer expectations concerning safety and reliability are making certification increasingly important.

Sourcing Type Insights

Why Did the In-House Segment Hold a 68.4% Share in 2025?

In-House: The segment had a 68.4% share as the preference of direct control by the OEMs in the process of testing, inspection, and certification. In-house TIC services allow the manufacturers to reflect quality control during the design and production cycle, allowing them to reveal any errors very fast, to meet the internal requirements, and to comply with the newly emerged safety and regulatory criteria. By keeping services in-house, it assists in protecting proprietary technology and enhances the security of operations and the shortening of the time required to make design changes. Although outsourcing has cost benefits, in-house leadership indicates the strategic orientation of OEMs to control, reliability, and operational efficiency.

Outsourced: The segment is set to be the fastest-growing with an expected CAGR of 3.9% during the forecasted period. OEMs and suppliers are increasingly outsourcing TIC services to gain access to expertise, sophisticated equipment, and scalable test systems without spending a lot of capital. Third-party providers provide a whole range of services, such as component and material testing, emission checks, functional safety tests, and battery tests for electric vehicles. It is also through outsourcing that the companies can control the changing volumes of production, meet the international regulatory standards, and optimize the cost of operations. Outsourced services are becoming more attractive as they are becoming more precise, effective, and fast with the utilization of digital platforms and AI-driven testing solutions.

Application Insights

Why Did Component & Material Testing Lead the Automotive TIC Services Market in 2025?

Component & Material Testing: The segment had the largest share, as it took the largest portion of 42.5% in 2025, as the automotive parts and materials have become more sophisticated and need to be fully tested to ensure safety and functionality, as well as legal requirements. The vehicles are made of sophisticated metals and high-strength composites, plastics, and electronic parts that have to be tested through mechanical, thermal, chemical, and environmental tests. The segment also facilitates the development of technologies such as electric powertrains, lightweight structures, and connected cars that need the accurate assessment of materials and parts.

Functional Safety & ADAS Testing: The segment, is set to be the fastest-growing with a CAGR of 3.8% market share, will increase substantially. The swift implementation of advanced driver-assistance systems (ADAS) and self-driving technology presupposes a specific testing of sensors, computer programs, and the electronic control units to guarantee the safety of the passengers, as well as their reliability and regulatory adherence. Services that are offered in this segment include functional testing and software testing, cybersecurity testing, and performance testing. The incorporation of AI-based simulations, digital twins, and automated testing tools will result in a greater level of accuracy, efficiency, and reproducibility and will reduce the amount of time devoted to validation and minimize the number of human errors.

Vehicle Type Insights

Why Did the Passenger Vehicles Segment Hold a 42.5% Share in 2025?

Passenger Vehicles: The segment took up 42.5% of the automotive TIC services market in 2025, combined with their high volumes of production and the strictness of their regulatory compliance. Passenger vehicle TIC services comprise the testing of emissions, safety inspection of crashes, component endurance testing, and testing of the functional performance. The rising demand of consumers towards safety, comfort, and sophisticated technologies like connectivity, infotainment, and semi-autonomous driving systems has drastically raised the necessity of testing and certification. Furthermore, the introduction of electric and hybrid passenger cars opens the prospects of battery, powertrain, and electronic part testing specialization.

Electric Vehicles: The segment is set to be the fastest-growing with a growth rate of 4.0%. The growth of EV uptake is attributed to the environmental policies, tax subsidies provided by governments, elevated consumer consciousness, and the need to promote sustainable transport worldwide. EV services provided by TIC involve battery testing and safety testing, thermal testing, electric powertrain inspection, and compliance testing of charging systems and electronic devices. Advanced technologies like AI-based simulations, digital twins, and automated testing platforms increase test accuracy, effectiveness, and reproducibility.

Propulsion Type Insights

Why Did the Internal Combustion Engine Lead the Automotive TIC Services Market in 2025?

Internal Combustion Engine: The segment dominated the market, occupying 56.8% in 2025. The ICE vehicles continue to dominate the automotive manufacturing process, despite the emergence of electrification, due to large adoption rates, established supply chains, and production volumes in major regions like North America, Europe, and Asia-Pacific. ICE vehicles have TIC services that involve engine performance, emissions, fuel efficiency, and durability of the parts. Exhaust emissions and safety and reliability regulatory compliance also enhance demand in this segment through testing, inspection, and certification. ICE cars also demand continuous testing with reference to adjusting to the changing environmental standards, performance optimization, and long-term dependability.

Battery Electric Vehicles: The segment is set to be growing at the fastest rate of 3.9%, will increase substantially. The increase in the popularity of EVs throughout the entire planet can be attributed to the constriction of the emissions regulations, the state incentives, the increase in the degree of awareness among consumers, and the rise in the demand for sustainable mobility. Services offered by TIC on BEVs are based on battery safety and performance tests, powertrain and drive system testing, thermal testing, compliance with charging infrastructure, and electronic system testing. The use of advanced tools (AI-based simulations, digital twins, automated testing platforms, etc.) increases accuracy, decreases the time of validation, and ensures that the safety and performance requirements are met as the regulations change.

End-User Insights

Why Did the OEMs Segment Lead the Automotive TIC Services Market in 2025?

OEMs: This sector dominated the market with a market share of 54.3% in the year 2025 due to the importance they have in designing, producing, and controlling the quality of vehicles. To ensure safety, reliability, and regulatory compliance, OEMs incorporate testing, inspection, and certification services as part and parcel of their production and research and development processes. OEM services encompassed in the TIC include emission testing, crash safety, testing of functional performance, component longevity testing, and certification to international standards. The increased focus on product safety, long-term reliability, and expedited time-to-market highlights the dominance of the segment.

Tier-1 & Tier-2 Suppliers: The segment is projected to grow at a significant CAGR over the forecast period, estimated to be 4%. The suppliers are increasingly banking on TIC services to ensure that components are of quality, safe, and compliant with the regulations before delivery to the OEMs. Testing services are material and component testing, emissions testing, functional performance testing, and certification of new technologies such as electrification, ADAS, and advanced electronics. The increased compliance needs on components, the growth of complex automotive systems, and the growth of the global supply chain are driving up the adoption by suppliers.

Regional Insights

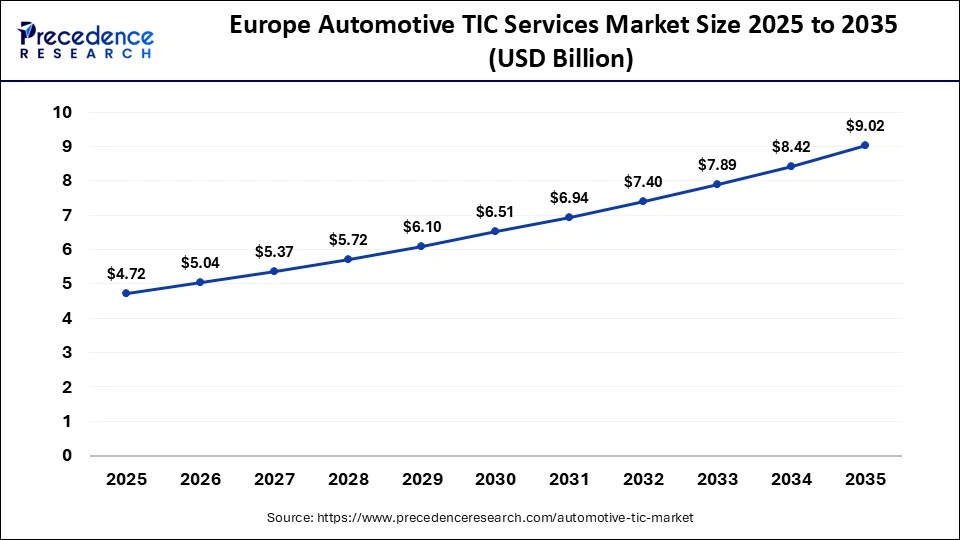

What is the Europe Automotive TIC Services Market Size and Growth Rate?

The Europe automotive TIC services market size has grown strongly in recent years. It will grow from USD 4.72 billion in 2025 to USD 9.02 billion in 2035, expanding at a compound annual growth rate (CAGR) of 6.69% between 2026 and 2035.

Why Did Europe Lead the Global Automotive TIC Services Market in 2025?

In 2025, Europe was the largest market for automotive testing, inspection, and certification services, holding a 40.4% share, supported by advanced technological adoption, a strong automotive manufacturing base, and one of the world's most stringent regulatory environments. The region has a deeply embedded culture of compliance-driven engineering, where vehicle safety, emissions, and performance standards directly translate into sustained demand for comprehensive TIC services.

Countries such as Germany, France, Italy, and the United Kingdom host a dense concentration of global OEMs, Tier-1 suppliers, and specialized component manufacturers. This well-developed automotive ecosystem generates continuous requirements for vehicle type approval, component validation, supplier audits, and lifecycle certification services across both passenger and commercial vehicle segments.

Strict regional safety, emissions, and environmental regulations further reinforce Europe's leadership. Compliance with evolving standards related to vehicle electrification, emissions reduction, functional safety, and cybersecurity necessitates extensive testing and certification throughout the vehicle development and production cycle. High consumer expectations around vehicle quality, reliability, and technological sophistication also push manufacturers to engage third-party TIC providers to validate performance and compliance.

UK Automotive TIC Services Market Analysis

The UK automotive TIC services market is a significant contributor to Europe's market, driven by a strong focus on vehicle safety, emissions compliance, and quality assurance. OEMs, suppliers, and technology companies use the services of TIC providers to verify components and test materials and certify cars to national and international standards. The increase in the application of electric and hybrid vehicles and an array of driver-assistance systems has generated a new requirement in the utilization of particular testing services, including battery testing, functional safety testing, and software testing. Advanced laboratories and online testing software, which may be applicable to undertake AI-assisted simulations and real-time performance analyses and predictive maintenance testing, are present in the UK.

Why is Asia Pacific undergoing the fastest growth in the automotive TIC services market?

The Asia Pacific region is experiencing the most rapid growth in the global automotive testing, inspection, and certification services market, holding a 4.5% market share, driven by accelerated industrialization, expanding vehicle production, and rapid adoption of advanced automotive technologies. The region has emerged as a global manufacturing hub for passenger vehicles, commercial vehicles, and electric vehicles, which significantly increases the need for comprehensive TIC services across the vehicle lifecycle.

Countries such as China, India, Japan, and South Korea are witnessing sustained growth in automotive production capacity and supplier ecosystem depth. The expansion of OEM manufacturing plants and Tier-1 and Tier-2 supplier networks in these markets has strengthened demand for testing, inspection, and certification services related to components, systems, and finished vehicles.

Rising consumer expectations around vehicle safety, build quality, and technological sophistication are further accelerating TIC adoption. Increased penetration of electrified powertrains, advanced driver-assistance systems, and connected vehicle technologies requires specialized testing and validation to ensure functional safety, performance reliability, and system interoperability.

China Automotive TIC Services Market Trends

China is the leading factor in the development of the auto TIC services in the Asia Pacific because the country is increasingly expanding the manufacturing and uptake of modern technologies in the auto industry. Government incentives on electric vehicles, adherence to high-quality regulations, and safety standards put the demand for third-party and in-house TIC services in the background. To enhance efficiency and accuracy, the use of AI-based simulations, digital twins, and testing platforms that are automated becomes more efficient and more accurate. Investment into the research and development of the new smart mobility solutions, as well as expansion of the supply chains, also helps the market expansion in China, aiding it as one of the key factors that influence the Asia Pacific market.

Why Is the North American Automotive TIC Services Market Experiencing Notable Growth?

The North American automotive testing, inspection, and certification services market is recording strong growth, supported by a mature automotive industry, rapid adoption of advanced vehicle technologies, and stringent regulatory requirements related to safety and emissions. The region maintains a highly structured compliance environment, which continues to drive consistent demand for third-party TIC services across the automotive value chain.

Original equipment manufacturers and Tier-1 suppliers in the United States and Canada increasingly rely on TIC providers for emissions testing, crashworthiness validation, material and component testing, and functional safety assessment. This is particularly critical as vehicles integrate more complex electronics, software-defined systems, and advanced driver-assistance technologies that require rigorous validation and certification.

Vehicle electrification, connected mobility, and autonomous driving development are central priorities in North America, further accelerating TIC service consumption. Electric powertrains, battery systems, charging interfaces, and high-voltage components require specialized testing for safety, durability, and regulatory compliance. Similarly, ADAS and autonomous features depend on extensive functional safety, cybersecurity, and performance testing to meet evolving standards.

U.S. Automotive TIC Services Market Trends

The U.S. automotive TIC services market is a decisive engine of general growth of North America, whereby there has been extensive use of advanced technologies and stringent regulatory control. TIC providers are full-service providers who provide testing of emissions and battery and EV system tests, crash testing, durability testing, functional safety and ADAS testing, and regulatory compliance certification. The growing trend of electric vehicles and autonomous driving, as well as connected mobility platforms, needs specific testing solutions to guarantee that reliability, safety, and performance can be maintained. Moreover, the U.S. OEMs and Tier-1 suppliers are heavy investors in in-house and outsourced TIC services as a way of recall reduction, production optimization, and federal and state safety standards.

Why Is the MEA Automotive TIC Services Market Gaining Momentum?

The Middle East and Africa automotive testing, inspection, and certification services market is gaining momentum, driven by expanding automotive manufacturing activity, the development of regional production hubs, and increasing adoption of advanced vehicle technologies. As local assembly operations and component manufacturing scale up, original equipment manufacturers and suppliers are increasingly relying on TIC services to ensure vehicles meet safety, quality, and regulatory requirements before entering domestic and export markets.

Regulatory enforcement is a key growth catalyst. Governments across the Gulf Cooperation Council are implementing stricter emissions, safety, and environmental standards aligned with international benchmarks. These regulations are compelling automakers, importers, and component suppliers to engage accredited TIC providers for emissions testing, homologation, conformity assessment, and ongoing compliance verification.

Market expansion is also supported by the development of automotive research and development facilities, independent testing laboratories, and partnerships with global TIC service providers. These collaborations enhance local testing capabilities and reduce dependence on overseas certification, improving turnaround times and supporting regional automotive ecosystem growth.

UAE Automotive TIC Services Market Trends

The United Arab Emirates automotive testing, inspection, and certification services market is evolving rapidly, supported by regulatory tightening, vehicle electrification, and growing adoption of advanced automotive technologies. Several distinct trends are shaping demand patterns and service innovation in the country.

One key trend is the strengthening of vehicle safety, emissions, and conformity regulations. UAE authorities are increasingly aligning automotive standards with international frameworks, which is driving higher demand for third-party testing and certification across passenger vehicles, commercial fleets, and imported vehicles. Compliance with emissions limits, homologation requirements, and safety validation has become mandatory for market entry, reinforcing the role of accredited TIC providers.

Why Is the Latin American Automotive TIC Services Market Emerging Rapidly?

The Latin American automotive testing, inspection, and certification services market is recording strong growth, driven by rising vehicle production volumes, expansion of regional manufacturing capacity, and increasing adoption of advanced automotive technologies. Countries such as Brazil, Mexico, and Argentina have strengthened their roles as automotive manufacturing hubs, supporting both domestic demand and export-oriented vehicle production. This expansion is directly increasing the need for comprehensive TIC services across the vehicle development and production lifecycle.

Original equipment manufacturers and Tier-1 suppliers in the region are investing more heavily in testing, inspection, and certification services to comply with national and international safety, emissions, and quality standards. As vehicles incorporate more electronics, software-driven functions, and emissions control technologies, regulatory compliance has become more complex, reinforcing the importance of third-party validation and certification.

Market growth is further supported by the expansion of local testing laboratory networks and closer collaboration with global TIC providers. These partnerships are enhancing regional testing capabilities, reducing reliance on overseas certification, and improving turnaround times for homologation and compliance testing. Increasing investment in AI-enabled and digital testing models is also improving testing accuracy, repeatability, and operational efficiency, particularly for electronics-intensive systems and emissions validation.

Brazil Automotive TIC Services Market

The Brazil automotive testing, inspection, and certification services market is expanding steadily, supported by the country's large vehicle production base, diversified automotive manufacturing ecosystem, and strengthening regulatory oversight. Brazil is one of the largest automotive producers in Latin America, with strong passenger vehicle, commercial vehicle, and increasingly electric vehicle manufacturing activity, which sustains continuous demand for TIC services across the vehicle lifecycle.

Growth is driven by rising requirements for compliance with national and international safety, emissions, and quality standards. Brazilian automotive OEMs and Tier-1 suppliers rely heavily on TIC providers for emissions testing, homologation, crash safety validation, material and component testing, and conformity assessment. As regulatory scrutiny increases, particularly around emissions control and environmental impact, certified testing has become a critical prerequisite for both domestic sales and export eligibility.

Top Vendors in Automotive TIC Services Market & Their Offerings

- SGS

- Bureau Veritas

- TUV SUD

- TUV Rheinland

- DEKRA

- Intertek

- Applus+

- DNV

- Eurofins Scientific

- UL Solutions

- ALS Limited

- Mistras Group

- Element Materials Technology

- RINA

- Kiwa

Recent Developments

- In February 2025, SK hynix Inc. announced that it bought TISAX, a global information security certification in the automobile industry, to make its first acquisition in the memory industry. SK hynix has acquired TISAX at all domestic locations in the areas of Icheon, Bundang, and Cheongju and has also been recognized internationally as having the security capability needed by the global automobile industry.(Source: https://finance.yahoo.com)

- In December 2024, SGS purchased Swiss-based cybersecurity and functional safety certification company CertX as part of its effort to increase its capacity to provide digital trust and high assurance certification. This growth improves the internationalization of SGS in sophisticated automotive testing and compliance services.(Source: https://www.sgs.com)

- In December 2023, Continental announced that it would work with Synopsys to develop and validate software features and applications for the Software-Defined Vehicle (SDV). This new partnership will combine the industry-best virtual prototyping products of Synopsys around the virtual Electronic Control Units (vECU) with the Continental Automotive Edge (CAEdge) cloud-based development system.(Source: https://www.continental.com)

Segments Covered in the Report

By Service Type

- Testing

- Inspection

- Certification

By Sourcing Type

- In-house

- Outsourced

By Application

- Component & Material Testing

- Vehicle Inspection

- Homologation & Type Approval

- Emission & Environmental Testing

- Functional Safety & ADAS Testing

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

By Propulsion Type

- Internal Combustion Engine (ICE)

- Hybrid Vehicles

- Battery Electric Vehicles

By End User

- OEMs

- Tier-1 & Tier-2 Suppliers

- Regulatory Authorities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting