What is the Battery Pack Assembly Market Size?

The global battery pack assembly market is witnessing rapid growth as electric vehicles, energy storage systems, and portable electronics drive demand for high-performance battery packs.The market is driven by surge in electric vehicle adoption, renewable energy storage demand, and advancements in battery technologies, enhancing performance and efficiency.

Battery Pack Assembly Market Key Takeaways

- Asia Pacific dominated the global battery pack assembly market with the largest share of 45% in 2024.

- North America is expected to experience the fastest growth during the forecasted years.

- By battery type, the lithium-ion (Li-ion) batteries segment led the market while holding a 70% share in 2024.

- By battery type, the solid-state batteries segment is expected to grow at the fastest rate over the forecast period.

- By application, the electric vehicles (EVs) segment captured a 60% share of the market in 2024.

- By application, the energy storage systems (Ess) segment is expected to grow at a significant rate in the upcoming period.

- By end-user industry, the automotive segment led the market while holding a 55% share in 2024.

- By end-user industry, the renewable energy segment is expected to expand at the highest CAGR between 2025 and 2034.

What is Battery Pack Assembly?

Battery pack assembly is the process of combining individual battery cells into a complete, functional battery pack that can power electronic devices, electric vehicles (EVs), industrial equipment, or energy storage systems. It ensures that the cells work safely and efficiently as a unit, with proper electrical connections, cooling, and control systems in place. The battery pack assembly market has emerged as a central point in the energy and automotive industries, as the global community is mandated to move toward clean energy and more environmentally friendly transportation.

The market focuses on the manufacturing, design, and construction of individual battery cells into fully operational battery packs that are needed to propel the movement of electric vehicles, renewable energy storage systems, consumer electronics, and industrial equipment. As electrification has increased in many fields, battery pack assembly has gained greater prominence, as it ensures energy efficiency, thermal management, safety, and optimal system performance.

Manufacturers are investing in automated assembly, modular designs, improved scalability, durability, and reliability of battery packs, which are produced at a lower cost and with reduced environmental impact. The electric vehicle boom, driven by environmental concerns, government subsidies, and changing consumer preferences, is one of the major factors fueling market growth. Moreover, the growth of renewable energy sources, such as solar and wind, has generated a strong demand for efficient means of energy storage, where battery packs are becoming a key factor in storing surplus energy for later use.

AI Shifts in the Battery Pack Assembly Market

Artificial Intelligence is transforming the battery pack assembly market by making packs more efficient, precise, and scalable. Automation using AI is streamlining all assembly operations, including sorting and welding of cells, thermal regulation, and quality checks. Tesla and LG Energy Solution are among the companies that utilize machine learning algorithms to predict cell behavior, thereby minimizing defects and enhancing battery life. Real-time monitoring and predictive maintenance are also made possible by AI, minimizing downtime and enhancing safety. A combination of AI, robotics, and IoT in smart factories results in the automation of production lines, improved throughput, and lower costs. As demand for high-performance battery packs rises, AI will continue to be a significant driver of innovation and operational excellence in this growing market.

Battery Pack Assembly Market Outlook

- Market Growth Overview: The market is experiencing robust growth as demand for electric vehicles and renewable energy storage increases. To meet global demands, firms like Panasonic, LG Energy Solution, and Samsung SDI have been expanding their operations by focusing on innovation, automation, and efficiency in battery pack manufacturing.

- Global Expansion: North America, Europe, and Asia are experiencing rapid growth in the market due to the high adoption of EVs and clean energy goals. The largest large-scale battery pack manufacturers in China are CATL and BYD, while Tesla is expanding its Gigafactory capacity in the U.S. and Europe to meet global demand for battery packs.

- Major Investors: The energy storage and EV industries have the potential to grow, and, thus, battery production projects, such as Northvolt and Redwood Materials, are being funded by major investors, including BlackRock and Softbank, among others. Investment is driving research activities, factory development, and the implementation of sophisticated assembly line technologies.

- Startup Ecosystem: Startups are performing well, with companies such as Romeo Power, QuantumScape, and Amprius Technologies, which are developing in the fields of battery design, fast charging, and thermal control. With venture capital and a strategic alliance with the OEMs, these startups are working on next-gen battery pack assembly solutions in mobility and grid applications.

What Factors are Boosting the Growth of the Battery Pack Assembly Market?

- Increase in Electric Vehicles Demand: The current trend of the worldwide transition to electric mobility is creating a strong demand for battery packs. EV manufacturers such as Tesla, Ford, and Volkswagen are ramping up EV production, which means that more efficient battery pack assembly is needed to meet the demands for range, performance, and safety.

- Increase in Usage of Renewable Energy: With the growth in the adoption of solar and wind energy, there is a need to have battery packs to store the intermittent energy. Sungrow and Fluence are companies implementing large-scale power storage applications, which increases the demand for advanced and long-life battery pack assemblies.

- Governmental Policies and Incentives: Positive laws, subsidies, and carbon quotas are promoting the manufacture of batteries. Gigafactories in the U.S., EU, and China are being funded by governments, and tax benefits are being provided to companies such as LG Energy Solution and Northvolt, which are increasingly investing in gigafactories.

- Smart Manufacturing/Automation on the Rise: Battery assembly is enhanced by automation and AI, resulting in more efficient, consistent, and cost-effective processes. Robotics and smart systems are being adopted by industry leaders such as Panasonic and BYD to automate and meet the increasing global demand.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

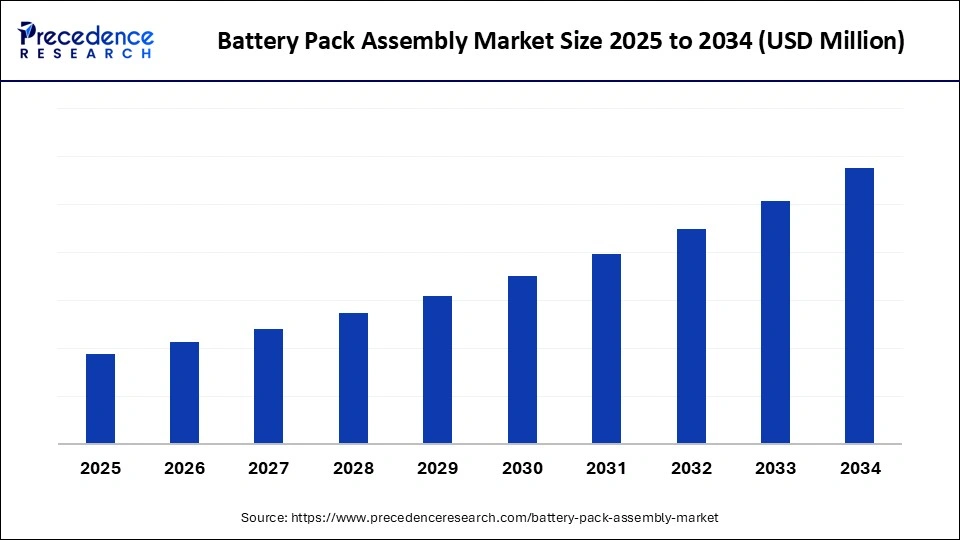

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery Type, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Accelerating Adoption of EVs

The EV craze is viewed as a long-term growth engine in the battery pack assembly market, driven by government incentives, the development of a growing charging network, and ongoing technological innovations. As governments have intensified their crackdown on emissions and promoted clean transportation, EVs have registered a steep increase in demand in major markets, including the U.S., Europe, China, and India. Carmakers that prioritize the production of EVs, such as Tesla, BYD, Volkswagen, and Ford, are demanding high-tech and efficient battery pack assembly. These battery packs are essential to the performance of EVs, which determines their range, charging rate, and the safety of the vehicle.

Additionally, emerging environmental concerns among consumers and increasing fuel costs are driving consumers toward EVs, which further intensifies demand in the market. Battery packs also become more efficient and attractive to use due to the incorporation of fast-charging capabilities, improved energy densities, and AI-based battery management systems.

Restraint

High Manufacturing Costs and Supply Chain Challenges

The battery pack assembly market faces several challenges. The high cost of manufacturing and continuous disruption of the supply chain are major restraining factors. Battery packs also contain sophisticated elements, such as lithium, nickel, cobalt, and graphite, most of which are costly and found in limited quantities in specific parts of the world. This exposes it to price volatility and political instabilities. The assembly process also requires finely engineered, automated, and cleanroom conditions, and therefore necessitates a significant investment in a new plant.

Firms such as Northvolt and Panasonic must invest a significant amount of money in gigafactories, robots, and human resources to remain competitive in production. Additionally, the global semiconductor crisis and logistics bottlenecks have impacted lead times and delivery dates, leading to delays in battery manufacturing. These financial and logistical barriers may hinder the scaling up of startups and smaller manufacturers.

Opportunity

Integration of Advanced Technologies in Battery Pack Assembly

The rising integration of advanced technologies, such as artificial intelligence, machine learning, automation, and digital twin simulations, is a key opportunity in the battery pack assembly market. Tesla, SK On, and LG Energy Solution are among the companies adopting AI to enhance quality control, predictive maintenance, and automated cell alignment, thereby improving speed and precision in the production process.

Moreover, digital twin technology enables the real-time modeling of battery behavior under different conditions, shortening development time and optimizing the design before actual assembly. These technologies will be instrumental in facilitating production at scale as the industry moves to next-gen batteries (e.g., solid-state), offering substantial growth prospects to tech-integrated manufacturers and solution providers in the battery pack assembly ecosystem.

Segment Insights

Battery Type Insights

Why Did the Lithium-ion Batteries Segment Lead the Battery Pack Assembly Market in 2024?

The lithium-ion batteries segment led the market while holding a 70% share in 2024. This is primarily due to their established performance, energy density, cost efficiency, and ubiquity in applications such as electric vehicles, consumer electronics, and renewable energy storage systems. Lithium-ion batteries have a high energy-to-weight ratio, long cycle life, and a comparatively high rate of charging, hence becoming the preferred batteries for most EV manufacturers, such as Tesla, BYD, and Volkswagen.

Additionally, the global lithium-ion cell supply chain is well-established, allowing for mass production and reducing the cost per unit. Continuous advancements in battery management systems, thermal control and regulation, and recycling have also resulted in increased safety and sustainability. Companies such as Panasonic, LG Energy Solution, and CATL have made significant investments in gigafactories, which have strengthened the dominance of lithium-ion batteries.

The solid-state batteries segment is expected to grow at a significant CAGR over the forecast period. In contrast to liquid electrolytes used in lithium-ion batteries, solid-state versions employ solid electrolytes, which are more thermally stable, safer, and have higher energy density. Solid-state batteries have the potential to increase their driving range, shorten charging time, and minimize the occurrence of thermal runaway. Commercialization is being accelerated, although in the developmental and pilot-testing stages, by growing R&D investments by companies such as QuantumScape, Toyota, and Solid Power.

Application Insights

What Made Electric Vehicles (EVs) the Dominant Segment in the Market in 2024?

The electric vehicles (EVs) segment dominated the battery pack assembly market with a 60% share in 2024. This is primarily due to the fact that the world is shifting toward cleaner methods of transportation, largely driven by stringent government regulations on emissions, as well as growing environmental awareness. Large car manufacturers such as Tesla, Volkswagen, BYD, and Ford are rapidly expanding their EV portfolios, as high-capacity battery packs are required for increased efficiency. Additionally, government incentives, subsidies, and investments in charging networks are driving the global adoption of EVs. Consequently, the advanced battery pack assembly demanded by the EV segment has emerged as the key driver of market growth.

The energy storage systems (ESS) segment is expected to grow at the highest CAGR in the upcoming period, driven by the increasing use of renewable energy sources, such as solar and wind. The deployment of ESS by companies such as Fluence, Sungrow, and Tesla Energy is growing around the globe, increasing the need to produce large battery pack assemblies designed specifically to meet grid-scale requirements. The decreasing prices of batteries, the development of lithium-ion and new chemistries, and the increase in investment in smart grids and microgrids also enable this growth. Governments around the world are encouraging the use of renewable energy and infrastructures in energy storage, which enhances the growth of the ESS market. As nations focus on energy security and carbon neutrality, ESS will become an indispensable component, and the assembly of battery packs will become a significant part of the clean energy revolution, emerging as a more popular segment alongside electric vehicles.

End-User Industry Insights

Why Did the Automotive Segment Hold the Largest Share of the Market in 2024?

The automotive segment led the battery pack assembly market while holding a 55% share in 2024, driven by the rising electrification of vehicles. Stricter emission controls, government subsidies, and growing consumer demand for sustainable mobility have compelled electric vehicle manufacturers, including Tesla, Volkswagen, and Ford, to increase their production of electric vehicles. The battery packs are vital to EV performance, including driving range, safety, and charging speed, which has fueled the development of high-quality lithium-ion and new solid-state battery technologies. The battery packs in demand have been given high priority in the automotive industry, as the industry seeks to reduce carbon footprints and meet environmental needs.

The renewable energy segment is expected to grow at a significant CAGR over the forecast period due to the growing use of solar, wind, and other renewable power sources. Several battery pack assemblies are in high demand to serve large-scale battery pack projects worldwide, including those spearheaded by companies in the battery pack assembly sector, such as Fluence, Tesla Energy, and Sungrow. Additionally, falling battery prices, government policies encouraging the adoption of clean energy, and increased investments in smart grid infrastructure are accelerating the implementation of energy storage solutions. As the world shifts toward decarbonization and energy independence, the renewable energy sector is poised to emerge as a key player in the battery pack assembly market.

Region Insights

Why Did Asia Pacific Lead the Global Battery Pack Assembly Market in 2024?

Asia Pacific led the market by capturing the largest share of about 45% in 2024. This is mainly due to the high availability of power resources and raw materials in the area. Government mandates to use renewable energy and electric mobility also contributed to region's market dominance. China, South Korea, and Japan also host some of the world's largest battery makers and automakers, including CATL, LG Energy Solution, Samsung SDI, and Panasonic. Additionally, Asia Pacific is benefiting from an expanding domestic market for electric vehicles, driven by increased urbanization, government subsidies, and stricter emission standards. This combination of manufacturing power, policy support, and market demand has propelled the Asia Pacific to the forefront of the battery pack assembly industry.

China, with the world's largest EV industry, is actively working toward electrification. It has implemented a variety of policies that have boosted the movement of EV buyers, and manufacturers have been required to start producing zero-emission vehicles. The major Chinese battery producers, such as CATL and BYD, are investing billions in their gigafactories and advanced battery technologies, including lithium-ion and solid-state batteries. There are also high reserves of other minerals that are highly required in the production of batteries, such as lithium and cobalt, which have the highest potential to be produced in the country. The faster market growth is being driven by increases in the number of electric vehicles and rising energy storage requirements from residential, commercial, and utility markets.

Why is North America considered the Fastest-Growing Area?

North America is expected to experience the fastest growth in the market throughout the forecast period. The regional market growth is attributed to government programs aimed at reducing carbon emissions and supporting clean energy technologies. Notably, the U.S. government has announced considerable measures, including the Inflation Reduction Act, which provides numerous tax credits and subsidies for the purchase of electric vehicles and battery production. These incentives motivate car manufacturers and battery manufacturers to localize their supply chains, resulting in substantial investments in gigafactories and battery assembly plants. Companies such as Tesla, Ford, and GM are increasing the production of EVs, and battery manufacturers such as SK On, LG Energy Solution, and Panasonic are growing their activities in the region.

The U.S is the major contributor to the market within North America. The country is rapidly emerging as a hub for high-technology battery manufacturing and research, supported by the government and collaboration with the corporate world. Moreover, the development of battery technologies, such as solid-state batteries, and the advancement of battery recycling infrastructure in the region are driving innovation in the region. As the U.S. continues to invest large sums in infrastructure development, clean energy development, and the electrification of transportation.

Country-level Investments & Funding Trends for Battery Pack Assembly Market

- U.S.: The U.S. is experiencing massive investments in the production of battery packs because of government funding programs like the Inflation Reduction Act. Large car manufacturers and battery producers, such as Tesla, GM, and SK On, are establishing gigafactories and R&D centers to expand domestic EV production and reduce reliance on imports, resulting in rapid market growth.

- China: China is a major player in battery pack investments, with leading companies such as CATL and BYD producing more and investing in new-generation batteries. The ambition to remain ahead of the global EV and energy storage industry is backed by robust government support in the form of subsidies and industrial policies.

- South Korea: South Korea is a strategic battery production hub, and both LG Energy Solution and Samsung SDI also work hard to create capacity and technology. To grow its presence in the global market, the country emphasizes solid-state batteries and production which are sustainable production.

- Germany: Germany is emerging as a powerhouse in battery production, and Volkswagen, BASF are investing in gigafactories and recycling. The government finances EV adoption and battery R&D, which will accelerate the process of replacing conventional mobility and energy storage systems in the region with clean solutions.

Recent Developments

- In August 2024, Amara Raja Energy & Mobility opened its Battery Pack Assembly Plant and laid the foundation stone for a Customer Qualification Plant at its Giga Corridor in Divitipalli, Mahbubnagar district. The plant should have the capacity to support 5GWh of battery packs and 16GWh of cell production.

(Source: https://www.amararaja.com) - In August 2024, Samsung SDI announced its breakthrough solid-state battery technology, boasting an energy density of 500 Wh/kg, nearly twice the industry average. The high-voltage battery packs are already being tested by larger EV OEMs for potential integration in the future.(Source: https://www.amararaja.com)

- In September 2023, Amprius Technologies announced that its high-energy-density lithium-ion cells, built on its Silicon Anode Platform, have been integrated into advanced battery packs by Tenergy. The joint venture represents a significant step towards providing a next-generation battery solution to the rechargeable power market.(Source: https://amprius.com)

Top Vendors in the Battery Pack Assembly Market & Their Offerings

- Tesla, Inc.: Tesla is a leader in EVs with the development of high-performance battery packs, combined with its battery management and thermal systems, to achieve maximum efficiency and potential range.

- LG Energy Solution: LG Energy Solution is one of the largest lithium-ion battery manufacturers in the world, which provides high-tech battery packs for EVs and energy storage systems around the world.

- Panasonic Corporation: Panasonic is one of the major lithium-ion cells and battery pack assemblies, and Tesla partnered with Panasonic to drive its EVs.

- BYD Company Ltd.: BYD focuses on battery pack manufacturing for electric vehicles and renewable energy storage, delivering cost-effective solutions through vertical integration.

- Samsung SDI Co., Ltd.: Samsung SDI focuses on developing automotive and industrial high-energy density battery packs, as well as state-of-the-art solid-state technology.

Battery Pack Assembly Market Companies

- CATL (Contemporary Amperex Technology Co. Limited)

- SK Innovation Co., Ltd.

- AESC (Automotive Energy Supply Corporation)

- Guoxuan Technology Co., Ltd.

- CALB Group Co., Ltd.

Segments Covered in the Report

By Battery Type

- Lithium-Ion (Li-ion) Batteries

- Lithium Iron Phosphate (LiFePOâ‚„) Batteries

- Nickel Manganese Cobalt (NMC) Batteries

- Solid-State Batteries

- Others (e.g., Sodium-Ion, Zinc-Air)

By Application

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Consumer Electronics

- Industrial Equipment

- Others (e.g., Off-Highway Vehicles, Aerospace)

By End-User Industry

- Automotive

- Renewable Energy

- Consumer Electronics Manufacturing

- Industrial Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting