What is the In Vivo Cell Reprogramming Market Size?

The global in vivo cell reprogramming market is witnessing significant growth as researchers explore in-body cellular conversion for tissue repair and organ regeneration.The market for in vivo cell reprogramming represents a rapidly evolving field focused on the transformative potential of reprogramming cells within living organisms. This innovative approach is poised to have a significant impact on therapeutic developments and regenerative medicine, reflecting the growing interest and advancements in the life sciences sector. As research progresses, the market is expected to expand, offering new solutions and opportunities in the healthcare sector.

In Vivo Cell Reprogramming Market Key Takeaways

- North America dominated the market, holding the largest market share in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component, the therapeutics / reprogramming agents segment held the largest market share in 2024.

- By component, the delivery systems/device segment, specifically non-viral delivery systems (LNPs, exosomes), is expected to grow at a remarkable CAGR between 2025 and 2034.

- By reprogramming approach/technology, the direct lineage reprogramming segments held the largest market share in 2024.

- By reprogramming approach/technology, the partial reprogramming and mRNA/protein transient approaches segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By cell/source type, the fibroblast functional parenchymal cells segment held the largest share in the in vivo cell reprogramming market in 2024.

- By cell/source type, glial neuronal and pancreatic exocrine beta cell conversions grow at a remarkable CAGR between 2025 and 2034.

- By target tissue type, the cardiac and neurological segments held the largest market share in 2024.

- By target tissue type, pancreas (β-cell regeneration) and retina are expected to grow at a remarkable CAGR between 2025 and 2034.

- By indication/disease area type, the cardiovascular & neurological indications segment held the largest market share in 2024.

- By indication/disease area type, metabolic (Type 1 diabetes) and liver fibrosis indications are projected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user type, the biotech & pharmaceutical companies segment held the largest market share in 2024.

- By end-user type, hospitals & specialty clinics are adopting point-of-care delivery for localized therapies. Grow at a remarkable CAGR between 2025 and 2034.

What is the In Vivo Cell Reprogramming Market?

In vivo cell reprogramming is the process of converting one somatic cell type into another directly inside the body without ex-vivo manipulation, using genetic, epigenetic, chemical, or physical interventions to restore tissue function, regenerate damaged organs, or treat disease. This market covers the tools, delivery systems, therapeutic approaches, target indications, and end-users involved in translating in-body reprogramming into clinical products.

Market growth in the in vivo cell reprogramming market is being driven by increasing clinical interest in regenerative therapies that convert resident cells into functional phenotypes within the native tissue environment. This nascent field promises to obviate the need for ex vivo cell manipulation, thereby reducing procedural complexity, immunogenic risk, and the cost of goods, while enabling localized tissue repair. Applications range from cardiac regeneration after myocardial infarction to neuronal reprogramming for neurodegenerative disorders, as well as in situ induction of pancreatic β-cells for diabetes treatment. Scientific advances in safe delivery vectors, transient expression systems, and epigenetic modulators are expanding translational feasibility. Regulatory pathways remain exacting, requiring robust evidence of specificity, durability, and absence of tumorigenicity, which shapes investment and timelines. Consequently, the market evolves as a careful interplay of scientific promise, clinical validation, and regulatory stewardship.

In Vivo Cell Reprogramming Market Outlook

- Industry Growth Overview: Industry expansion is driven by convergent advances: more precise gene-editing and epigenetic tools, improved viral and non-viral delivery vehicles, and a deeper understanding of in situ cellular plasticity. Biotech firms and incumbent pharma are building translational hubs, leveraging CRO partnerships for GLP toxicology and GMP vector manufacture. Investment is bifurcated; early-stage R&D receives venture capital, while late-stage development attracts strategic alliances and corporate venture arms seeking access to a platform. Contract manufacturing organizations are scaling capacity for viral vectors and nucleic-acid therapeutics, recognizing future demand spikes. The resulting ecosystem supports a pipeline-rich environment, albeit one that requires patient capital and iterative clinical validation. Industry growth will therefore be progressive, punctuated by milestone-driven valuation inflection points.

- Sustainability Trends: In the in vivo cell reprogramming market, sustainability emphasizes manufacturing efficiency, reducing cold-chain burdens, and minimizing biological waste associated with vector production. Firms are exploring single-use bioreactor systems, greener upstream chemistries for nucleic acids, and energy-efficient cryostorage solutions. There is also emphasis on designing therapeutics that reduce lifetime healthcare resource consumption by achieving durable, perhaps curative, outcomes. Ethical and social sustainability, equitable access, and responsible clinical deployment are increasingly integral to development strategies. Supply-chain resilience, particularly for critical raw materials such as plasmid DNA and viral capsid reagents, is becoming a top procurement priority. Thus, sustainability here spans environmental, economic, and social dimensions.

- Major Investors: Capital formation comes from a mix of specialised life-sciences venture funds, strategic corporate investors within big pharma, and patient capital from family offices interested in transformative medicine. Public translational grants and philanthropy continue to underwrite high-risk, high-reward early science, particularly in academic spinouts. Larger biopharmaceutical firms often secure minority stakes to gain privileged access to platform technologies. Infrastructure investors are beginning to back GMP vector-manufacturing facilities as long-duration, annuity-like assets. Overall, investors display a balanced appetite, optimistic about paradigm shifts but cautious about regulatory and safety runways.

- Startup Economy: The startup landscape is effervescent: agile companies are specialising in delivery modalities, AAV capsid engineering, LNPs, polymeric nanoparticles, transcription-factor cocktails, and inducible-expression systems to limit off-target reprogramming. Many spin out from academic laboratories, retaining deep IP and close clinician collaborations for translational testing. Startups often partner with CMOs and platform providers to de-risk scale-up challenges. While clinical validation is capital- and time-intensive, successful proof-of-concept results substantially elevate valuation and M&A interest. The ecosystem is therefore characterized by high scientific creativity, significant capital demands, and strategic alignment with larger industrial partners.

Key Technological Shift in the In Vivo Cell Reprogramming Market

The pivotal technological inflection is the maturation of precise, transient in vivo expression systems that deliver reprogramming cues without permanent genomic insertion. Advances in engineered viral capsids with tissue tropism, lipid-nanoparticle formulations tailored for targeted uptake, and RNA-based transient expression modalities reduce the risks of genomic integration and improve safety profiles. Concurrently, inducible genetic circuits and small-molecule epigenetic modulators enable temporal control over cell-fate transitions. Enhanced in situ imaging and single-cell omics now permit real-time assessment of lineage conversion and off-target phenotypes. These tools together convert in vivo reprogramming from a conceptual novelty into a controllable therapeutic strategy. As a result, the market is shifting toward clinically pragmatic platforms that prioritise reversibility, specificity, and manufacturability.

Top Products in the In Vivo Cell Reprogramming Market

| Product Category | Key Description / Examples | Core Benefits | Primary Applications |

| Gene Delivery Vectors (Viral & Non-Viral) | ncludes adeno-associated virus (AAV), lentivirus, and lipid nanoparticles delivering reprogramming factors directly to target tissues. | Enables precise in vivo delivery of reprogramming genes (e.g., Yamanaka factors); high transfection efficiency. | Regenerative therapies for cardiac, neural, hepatic, and muscular diseases. |

| mRNA-based Reprogramming Systems | Synthetic or modified mRNA formulations encoding transcription factors for transient gene expression. | Non-integrative, safer approach avoiding genomic insertion; allows repeat dosing. | Tissue regeneration, wound healing, and neurodegenerative disease therapy. |

| CRISPR-based Gene Activation Systems | CRISPRa platforms using dCas9 fused with activator domains to upregulate endogenous genes for cell fate conversion. | Enables precise control over gene activation without DNA cleavage. | In vivo reprogramming for neuroregeneration, diabetes, and muscle repair. |

| Epigenetic Modulators | Small molecules or peptides that modulate chromatin remodeling to induce cell reprogramming. | Enhances reprogramming efficiency and stability; enables partial reprogramming for rejuvenation. | Anti-aging, fibrosis reversal, tissue regeneration. |

| Transcription Factor Delivery Platforms | Protein- or RNA-based systems delivering key reprogramming factors (e.g., Oct4, Sox2, Klf4, c-Myc). | Direct control over transcription factor levels; avoids permanent genetic modification. | Regeneration of cardiomyocytes, neurons, hepatocytes, and beta cells. |

| Cell-free Reprogramming Reagents | Extracellular vesicles (EVs), exosomes, or reprogramming protein complexes are applied directly to damaged tissues. | Low immunogenicity, avoids viral vectors, enables tissue-specific targeting. | In vivo regenerative therapies, especially for cardiac and neural tissue repair. |

| Small Molecule Cocktails for Reprogramming | Combinations of chemical compounds that mimic transcription factors and induce lineage reprogramming. | Low-cost, scalable, and controllable; avoids genetic manipulation. | Liver, retina, and muscle regeneration; anti-aging interventions. |

| AI-Driven Reprogramming Platforms | Machine learning models predicting optimal factor combinations and delivery methods. | Accelerates discovery of reprogramming cocktails and improves reproducibility. | Drug discovery, regenerative medicine R&D, and precision reprogramming design. |

| Tissue-Specific Reprogramming Kits | Ready-to-use reagent kits designed to induce reprogramming in specific tissues (e.g., neural, hepatic). | Standardized formulations for reproducible in vivo experiments. | Academic and clinical R&D in regenerative and gene therapy research. |

| Rejuvenation & Partial Reprogramming Therapies | Gene therapy-based interventions applying partial reprogramming for cellular age reversal. | Restores youthful gene expression without altering cell identity. | Longevity research, age-related degeneration, and tissue rejuvenation. |

Market Key Trends

- Movement from permanent genome modification toward transient modulation of cell identity.

- Growing emphasis on non-viral and hybrid delivery platforms to enhance safety and repeat dosing.

- Increasing collaboration between material scientists and molecular biologists to refine localised delivery.

- Regulatory focus on long-term surveillance and validated biomarkers of successful reprogramming.

- Convergence of cell reprogramming with bioelectronic and scaffold technologies for tissue engineering.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

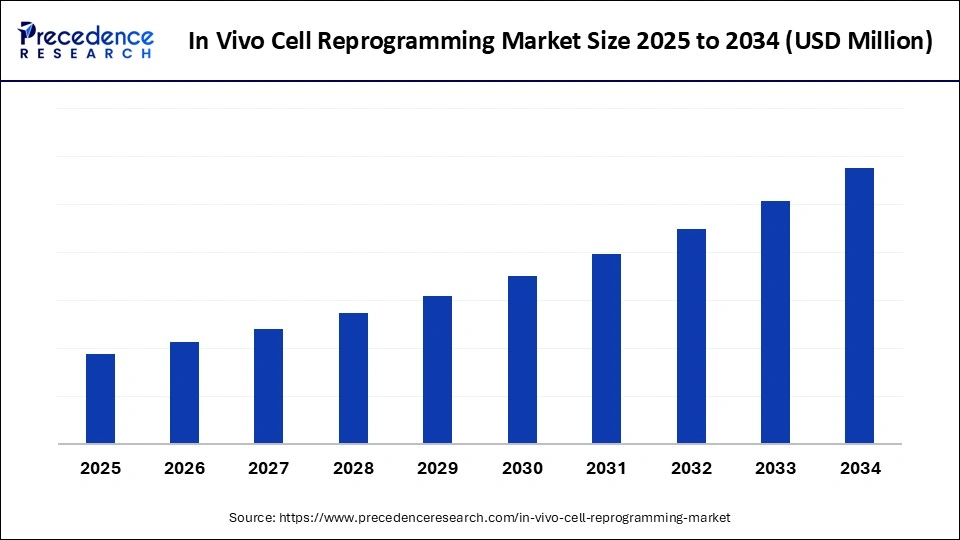

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Reprogramming Approach / Technology, Cell / Source Type, Target Tissue / Organ, Indication / Disease Area, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

From Replacement to Repair

A central driver in the in vivo cell reprogramming market is the paradigm shift from organ or cell replacement to in situ repair, enabling the body to regenerate lost function by coaxing resident cells to adopt therapeutic phenotypes. This approach promises to reduce reliance on donor tissues, immunosuppression, and complex ex vivo cell therapies, thereby simplifying clinical pathways. For indications where tissue architecture remains partially intact, reprogramming can restore function more naturally and with lower procedural complexity. Payers and health systems prize durable outcomes that lower lifetime costs, an economic incentive that aligns with the scientific impetus. The potential to address large, unmet markets heart failure, spinal cord injury, and diabetes, magnifies commercial appeal. Consequently, clinical viability is the fulcrum upon which investment and adoption hinge.

Restraint

Safety and Specificity: The Non-Negotiables

A major restraint is the demanding safety bar: ensuring lineage specificity, avoiding aberrant proliferation, and mitigating immunogenicity are non-negotiable for clinical and regulatory acceptance. Off-target reprogramming or incomplete conversion risks the development of dysplasia or tumorigenesis, necessitating thorough preclinical evaluation to ensure safety. Delivery inefficiencies, particularly for deep tissues or privileged sites like the CNS, complicate dose control and repeat administration strategies. Long-term surveillance requirements inflate clinical program costs and extend timelines to market. Furthermore, heterogeneous patient biology means that responses may vary, complicating endpoint selection and trial design. Thus, while potential is vast, safety imperatives constrain rapid commercialization.

Opportunity

Phantomization and Indication Hubs

The most promising opportunity lies in platform technologies that can be modularly adapted across multiple indications, tissue-tropic delivery vehicles, universally applicable transcriptional modulators, and regulated-expression cassettes that limit exposure. Companies that commercialize such platforms can license them to therapeutic developers, generating recurring revenue and expanding their market reach. Indication hubs starting with cardiac, retinal, and dermal regeneration offer more tractable clinical paths with clear functional endpoints. Integration with diagnostics and imaging enables patient stratification and real-world outcome tracking, enhancing reimbursement narratives. Ancillary opportunities include GMP vector manufacturing, companion diagnostics, and long-term surveillance services. Phantomization thus converts technical novelty into scalable commercial architecture.

Segment Insights

Component Insights

Why Therapeutics / Reprogramming Agents are Dominating the In Vivo Cell Reprogramming Market?

Therapeutics and reprogramming agents are dominating the in vivo cell reprogramming market, driven by their pivotal role in driving innovation and clinical applications. These agents, which include genetic, epigenetic, and chemical compounds, enable the direct conversion of somatic cells within the body, facilitating tissue regeneration and repair. Key developments in this area focus on enhancing the effectiveness and safety of these agents, with a particular emphasis on minimizing potential risks, such as immunogenic responses. The growing demand for regenerative therapies has led to increased investment in research aimed at optimizing delivery systems for these therapeutics. Additionally, advancements in understanding cellular plasticity are unlocking new possibilities for treating complex diseases, including neurodegenerative conditions and diabetes. As clinical validation progresses, the market for these reprogramming agents is expected to expand significantly, providing new avenues for personalized medicine and improved patient outcomes.

A surge in collaborative research efforts between academic institutions and biotechnology companies underpins the market's growth. This collaboration fosters innovation and expedites the translation of scientific discoveries into clinically viable treatments. Moreover, as societal awareness regarding regenerative medicine and its potential benefits increases, patient demand for advanced therapeutic options continues to rise. Investment in educational initiatives is also crucial, ensuring that healthcare professionals are well-informed about novel techniques and their applications. Additionally, advancements in imaging and diagnostic technologies complement the development of reprogramming therapies, enabling more accurate assessment and monitoring of treatment effects. Overall, the synergy between technological advancements and regulatory support is likely to propel the market towards unprecedented growth, with promising implications for patient care and healthcare outcomes.

The non-viral delivery systems (LNPs, exosomes) and base/prime editors. It is the fastest-growing segment in the in vivo cell reprogramming market, thanks to virtual boundaries in non-viral vehicles such as lipid nanoparticles and exosomes, as well as base or prime editors that edit the genome with surgical precision. Their rise stems from a dual impetus: the craving for safety and the desire for reversibility. Freed from the risks of genomic integration, these systems offer transient solutions with precision, thereby alleviating regulatory concerns. The ability to target specific tissues through lipid chemistry or vesicular tropism expands their therapeutic geography. As these technologies attain manufacturability and reproducibility, they are poised to eclipse earlier paradigms in speed and scope. In essence, non-viral vectors and next-gen editors represent the elegant evolution of molecular control.

Reprogramming Approach / Technology Insights

Is the In Vivo Cell Reprogramming Market Witnessing the Age of Direct Lineage Reprogramming?

Direct lineage reprogramming is dominating the in vivo cell reprogramming market, with a validated mechanism in the therapeutic canon. Exemplifying precision without regression to pluripotency. By directly converting one somatic cell type into another fibroblast to neuron, myocyte, or hepatocyte, it bypasses embryonic intermediates and mitigates oncogenic risks. This method preserves tissue architecture and engenders functional integration more readily than pluripotent detours. Clinicians appreciate its pragmatic ethos, which targets transformation without cellular chaos. Its success in early preclinical models, particularly in cardiac and neuronal repair, underscores its translational viability. Hence, direct reprogramming remains the sovereign technique, harmonizing safety with functional restitution.

The partial reprogramming and mRNA/protein transient approach is the fastest-growing market segment for in vivo cell reprogramming. These methodologies harness the ability to induce a reversible and flexible state in cells, enabling them to adopt desired traits without fully reverting to a pluripotent state. This approach minimizes the risk of tumorigenicity often associated with complete reprogramming, making it a safer alternative for therapeutic applications. Moreover, mRNA and protein-based strategies offer rapid, transient effects, enabling precise control over reprogramming processes. As research advances, these techniques are being explored for a range of applications, from cardiac repair to neurodegeneration, further driving their market growth. The increasing focus on developing efficient and safe regenerative therapies positions partial reprogramming and mRNA/protein transient approaches at the forefront of innovation in the life sciences sector.

Cell / Source Type Insights

Why Are Fibroblast Functional Parenchymal Cells Dominating the In Vivo Cell Reprogramming Market?

The fibroblast, a functional parenchymal cell, dominates the in vivo cell reprogramming market due to its abundance, accessibility, and proliferative capacity, making it an ideal candidate for reprogramming into functional parenchymal cells across organs. In cardiac and hepatic tissues, they provide a readily available cellular reservoir for regenerative interventions. Researchers exploit their epigenetic malleability to sculpt new functional identities within the damaged milieu. The strategy also mitigates immune rejection since reprogramming occurs autologously in situ. Consequently, fibroblast conversion epitomizes the particular genius of turning biological commonplace into clinical gold.

The neuronal and pancreatic exocrine beta cell conversions approach is the fastest-growing in the market in in vivo cell reprogramming. However, the swiftest ascendance belongs to conversions addressing dire unmet needs, specifically from neuronal and pancreatic exocrine to insulin-secreting beta cells. These transformations strike at the heart of neurodegeneration and diabetes, a disease long deemed intractable. The scientific rationale is compelling: reprogram resident, non-functional cells into the very elements lost to pathology. Preclinical studies have demonstrated that glial cells can be coaxed to replenish damaged neurons, while pancreatic exocrine cells can assume the role of insulin producers. Such feats promise not symptom management but biological restitution. Thus, these conversions herald a renaissance in curative medicine, rather than merely palliation.

Target Tissue / Organ Insights

Why Are Cardiac and Neurological Dominating the In Vivo Cell Reprogramming Market?

The cardiac and neurological are dominating the in vivo cell reprogramming market. Cardiac and neurological health are crucial aspects of overall well-being, as they significantly impact an individual's quality of life. Advances in medical research have led to innovative treatments for cardiac conditions, such as heart attacks and heart failure, with a focus on restoring heart function and improving patient outcomes.

Similarly, neurological disorders like Alzheimer's disease and Parkinson's disease present significant challenges, prompting ongoing research into potential therapies that can halt or reverse neurodegeneration. New techniques in regenerative medicine, including in vivo cell reprogramming, are being explored to effectively regenerate damaged cardiac and neural tissues. The integration of personalized medicine approaches aims to tailor treatments for individuals based on their unique genetic and environmental factors. Both fields continue to evolve, promising hope and improved therapies for millions affected by cardiac and neurological diseases.

Meanwhile, pancreatic regeneration and retinal reprogramming are emerging as the next vanguards of progress. The allure lies in the clarity of outcome: measurable insulin restoration and tangible vision improvement. Both fields benefit from well-defined endpoints that are amenable to regulatory and clinical validation. Advances in targeted delivery and tissue-specific promoters have invigorated feasibility. Startups and major biotechs alike are redirecting capital toward these frontiers, drawn by scalable patient populations and clear therapeutic wins. As a result, the pancreas and retina now glimmer as the field's fastest brightening constellations.

Indication / Disease Area Insights

Why Are Cardiovascular & Neurological Indications Dominating the In Vivo Cell Reprogramming Market?

The cardiovascular & neurological indications dominating the in vivo cell reprogramming industry, due to advancements in cell reprogramming, hold promise for transformative therapies. In cardiovascular applications, in vivo reprogramming can enable the conversion of resident cardiac cells into functional cardiomyocytes, potentially aiding recovery after myocardial infarction. This approach not only enhances tissue regeneration but also aims to restore normal heart function without the complexities associated with cell transplantation.

On the neurological front, reprogramming techniques offer exciting prospects for addressing neurodegenerative diseases, such as Parkinson's and Alzheimer's. By converting local glial cells into neurons or enhancing neuronal plasticity, these therapies may improve cognitive function and overall quality of life for individuals affected by the condition. As research continues to uncover the nuances of cellular behavior in both cardiovascular and neurological contexts, innovative treatments may emerge that address these pressing health challenges more effectively.

The metabolic (Type 1 diabetes) and liver fibrosis indications approach is the fastest-growing in the in vivo cell reprogramming market; their appeal lies in the accessibility of tissues, regenerative tractability, and quantifiable endpoints. Pancreatic B-cell induction offers a convenient alternative to glucose management, while hepatic reprogramming addresses fibrotic scarring directly. Investors view these arenas as clinically practical and commercially ripe. As delivery technologies mature, in situ reprogramming could redefine the care of chronic metabolic conditions. Hence, these indications may soon metamorphose from peripheral pursuits to principal priorities.

End-User Insights

Why Are Biotech & Pharmaceutical Companies (R&D Investment) Dominating the In Vivo Cell Reprogramming Market?

The biotech & pharmaceutical companies (R&D investment) dominating the in vivo cell reprogramming market, driven by marshal intellectual, infrastructural, and regulatory expertise to advance reprogramming therapies. These entities orchestrate multi-disciplinary alliances, vector engineering, clinical design, and GMP manufacturing to navigate the translational maze. Their R&D expenditures, often exceeding tens of millions of dollars per candidate, reflect a long-term conviction in the promise of cellular rejuvenation. Strategic acquisitions of academic spinouts and platform firms amplify pipeline breadth. Furthermore, intellectual property portfolios and data exclusivity strengthen their position. In sum, corporate custodianship of innovation ensures that ambition remains tethered to scalability and compliance.

Hospitals and specialty clinics adopting point-of-care delivery for localized therapies are the fastest-growing segment in the in vivo cell reprogramming market, which is evolving into hubs of localized, point-of-care delivery. These institutions are no longer passive endpoints of innovation but active participants in therapeutic execution. Equipped with gene-delivery infrastructure and imaging diagnostics, they administer localized reprogramming with clinical precision. Physicians, who were once consumers of innovation, are now becoming implementers of next-generation regenerative practices. The clinical embrace of direct in vivo intervention signals a decentralization of biotechnologys power. Thus, hospitals may become the sanctuaries of regenerative transformation, where science finally meets the patient at the bedside.

Regional Insights

Why Is North America Leading the In Vivo Cell Reprogramming Market?

North America dominates the in vivo cell reprogramming market, driven by robust translational ecosystems that combine academic ingenuity, deep-pocketed venture capital, and a dense clinical trial infrastructure. The United States provides an integrated pathway from discovery to first-in-human studies, with CROs and CMOs capable of supporting IND-enabling workstreams. Clinical networks and specialist centres for cardiology, neurology, and ophthalmology facilitate recruitment and endpoint validation. Moreover, regulatory dialogue and established frameworks for gene-therapy oversight, while stringent, are sufficiently mature to guide iterative development. The presence of large biopharma players willing to form strategic alliances accelerates commercialisation prospects. In consequence, North America remains the market's fulcrum for both innovation and early adoption.

Why Is Asia Pacific the Fastest Growing in the In Vivo Cell Reprogramming Market?

The Asia Pacific is the fastest-growing region in the in vivo cell reprogramming market, driven by expanding biotech investments, growing clinical research capacity, and supportive industrial policies in several nations. The region's large patient populations and rising clinical infrastructure create compelling testbeds for scalable regenerative therapies. Governments and regional consortiums are increasingly funding translational hubs and GMP manufacturing facilities to attract biotech innovation. Local companies and academic spinouts are beginning to specialise in delivery technologies and indication-specific programs, often in partnership with Western licensors. Cost advantages in manufacturing and an expanding CMO base accelerate capacity building for vector and nanoparticle production. Taken together, these dynamics render the Asia Pacific a rapidly ascending complement to Western innovation.

Bio-Compatible Semiconductor Lasers Market Value Chain Analysis

- Raw Material Sources: Primary inputs include plasmid DNA, synthetic mRNA, purified capsid components, lipid excipients for nanoparticles, and high-quality enzymes for GMP production. Supply-chain resilience for these biologics-critical reagents is essential, given single-source vulnerabilities that can bottleneck clinical programs.

- Technology Used: Core technologies comprise AAV and engineered viral vectors, lipid-nanoparticle delivery systems, transient RNA expression platforms, inducible genetic circuits, and small-molecule epigenetic modulators that facilitate lineage conversion. Complementary tools include single-cell transcriptomics, in vivo imaging, and biomaterial scaffolds to support tissue integration.

- Investment by Investors: Investors favour platform companies demonstrating tissue targeting, transient-expression control, and manufacturability at scale; they also back CMOs and analytics firms that de-risk clinical pathways. Strategic biopharma partnerships are common, providing both capital and commercialization channels.

Top In Vivo Cell Reprogramming Market Companies

- CRISPR Therapeutics: A global leader in CRISPR-Cas9 gene editing, CRISPR Therapeutics develops transformative therapies for genetic blood disorders, oncology, and regenerative medicine. Its lead program, exa-cel (developed in collaboration with Vertex Pharmaceuticals), targets sickle cell disease and beta-thalassemia, marking one of the first CRISPR-based therapies to reach the regulatory approval stage.

- Intellia Therapeutics: Intellia is advancing both in vivo and ex vivo CRISPR-Cas9 therapies, with a strong focus on liver and blood-related genetic disorders. The company achieved a milestone with the first-ever systemic CRISPR gene editing in humans, demonstrating durable clinical efficacy.

- Editas Medicine: Editas develops next-generation CRISPR therapies aimed at ocular and rare genetic diseases. Its flagship program, EDIT-101, targets Leber congenital amaurosis 10 (LCA10), a leading cause of childhood blindness, highlighting its focus on precision medicine.

- Beam Therapeutics: Beam is pioneering base editing, a more precise gene editing technology that modifies individual DNA bases without cutting the double helix. Its programs focus on rare blood disorders, liver diseases, and cancer, with growing partnerships across the biopharma sector.

- Sana Biotechnology: Sana develops engineered cell and gene therapies that enable cell replacement and immune evasion for regenerative and genetic medicine. The company's in vivo and ex vivo cell engineering platforms aim to repair or replace damaged tissues across multiple therapeutic areas, including neurology and oncology.

Other Companies in the Market for In Vivo Cell Reprogramming

- Sangamo Therapeutics

- LyGenesis

- Rejuvenate Bio

- uniQure

- Voyager Therapeutics

- BlueRock Therapeutics

- Spark Therapeutics

Recent Developments

- In March 2025, AstraZeneca is strengthening its cell therapy capabilities by agreeing to invest up to $1 billion in a biotechnology startup that develops treatments for in-body cell reprogramming. The British pharmaceutical company will acquire EsoBiotech, a Belgian startup, for an initial cash payment of $425 million. Additionally, EsoBiotech's investors, including Invivo Partners and UCB Ventures, may receive up to $575 million in further payments contingent upon the achievement of specific development and regulatory milestones, as stated by AstraZeneca.(Source:https://www.biopharmadive.com)

- In September 2025, Roche reached an agreement to acquire the U.S. biotech company 89bio for as much as $3.5 billion, entering the competition to develop new treatments for liver diseases that align with the growing focus on weight-loss medications.(Source: https://economictimes.indiatimes.com)

Segment Covered in the Report

By Component

- Therapeutics / Reprogramming Agents

- Gene therapies (TF overexpression, mRNA, miRNA)

- Genome editing tools (CRISPR/Cas, base editors, prime editors)

- Small molecules & chemical cocktails

- Protein/transcription factor (TF) delivery (recombinant proteins, cell-penetrating peptides)

- Epigenetic modulators (HDAC inhibitors, DNMT inhibitors)

- Delivery Systems / Devices

- Viral vectors (AAV, lentivirus, adenovirus)

- Non-viral delivery (lipid nanoparticles, polymeric nanoparticles, exosomes)

- Physical delivery devices (electroporation, ultrasound-mediated delivery, microneedles, implantable pumps)

- Supportive Tools & Diagnostics

- In vivo imaging & tracking (molecular imaging, reporter systems)

- Biomarkers & companion diagnostics

- Cell-specific targeting ligands/antibody conjugates

By Reprogramming Approach / Technology

- Direct lineage reprogramming / transdifferentiation (e.g., fibroblast → cardiomyocyte)

- In vivo partial reprogramming (transient expression of Yamanaka factors to restore function/ageing reversal)

- In vivo transgene replacement + reprogramming (gene replacement combined with cell identity shift)

- Cell fate conversion via epigenetic remodeling (small molecules / epigenetic drugs)

- In vivo delivery of mRNA / protein TFs (transient reprogramming)

- Genome editing–mediated reprogramming (knock-in/out regulatory nodes to enforce new cell fate)

By Cell / Source Type

- Fibroblasts

- Endothelial cells / vascular cells

- Epithelial cells (skin, lung epithelium)

- Glial cells/astrocytes

- Cardiac fibroblasts/cardiomyocytes

- Pancreatic exocrine cells/alpha cells → beta cells

- Hepatocytes / hepatic stellate cells

- Skeletal muscle cells

By Target Tissue / Organ

- Cardiac (heart repair/cardiomyocyte generation)

- Neurological (brain, spinal cord — neuron regeneration)

- Pancreas (β-cell regeneration for diabetes)

- Liver (hepatocyte regeneration/fibrosis reversal)

- Lung (alveolar epithelial repair)

- Skin & wound healing

- Retina & ocular tissues

- Musculoskeletal (skeletal muscle, cartilage)

By Indication / Disease Area

- Cardiovascular diseases (MI, heart failure)

- Neurological disorders (Parkinson's, spinal cord injury, stroke)

- Metabolic disease (Type 1 diabetes)

- Liver disease & fibrosis

- Ophthalmic diseases (retinal dystrophies)

- Wound healing & dermatology

- Musculoskeletal disorders (OA, muscle loss)

- Oncology (reprogramming tumor microenvironment / immune reprogramming)

By End-User

- Hospitals & specialty clinics (cardiac centers, neurocenters)

- Biotech & pharmaceutical companies (product development)

- Academic & research institutes (R&D)

- Contract development & manufacturing organizations (CDMOs) for vectors/biologics

- Diagnostics & companion diagnostics providers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting