What is the Laboratory Centrifuges Market Size?

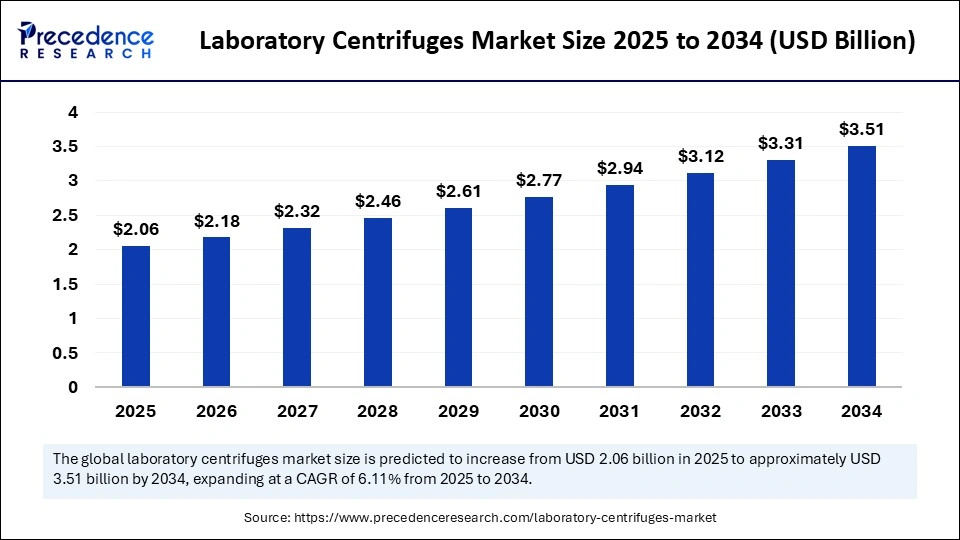

The global laboratory centrifuges market size accounted for USD 2.06 billion in 2025 and is predicted to increase from USD 2.18 billion in 2026 to approximately USD 3.70 billion by 2035, expanding at a CAGR of 6.03% from 2026 to 2035. The market for laboratory centrifuges is driven by increasing demand for advanced sample preparation in clinical diagnostics and biotechnology research.

Market Highlights

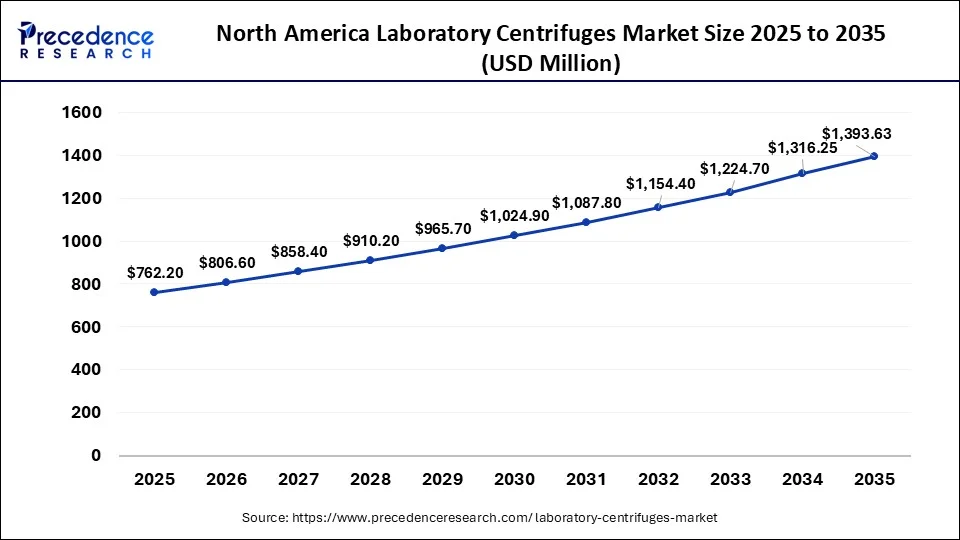

- North America accounted for the largest market share of 37% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

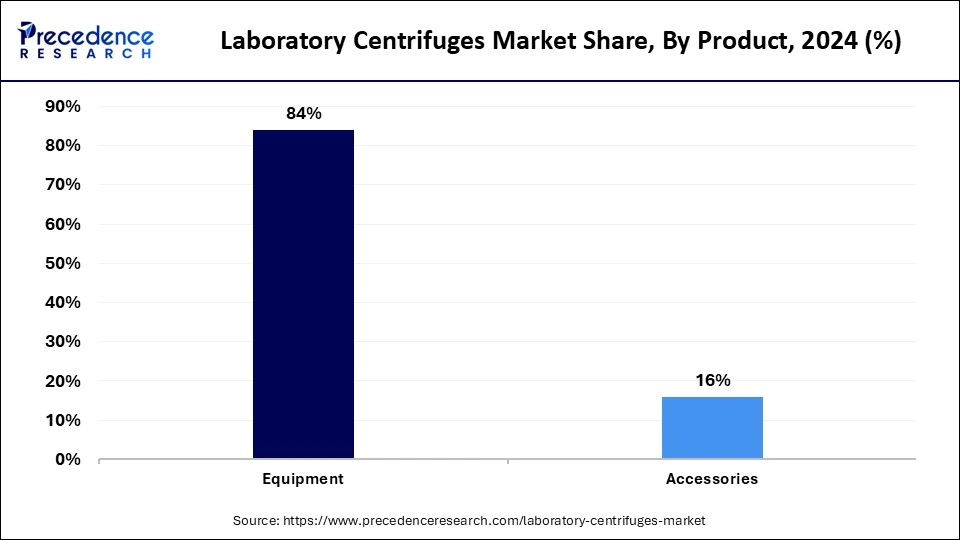

- By product, the equipment segment contributed the highest market share of 84% in 2025.

- By product, the accessories segment is growing at the fastest CAGR from 2026 to 2035.

- By model, the floor-standing centrifuges segment held the major market share of 56% in 2025.

- By model, the benchtop centrifuges segment is growing at a solid CAGR from 2026 to 2035.

- By intended use, the clinical centrifuges segment captured the biggest market share of 47% in 2025.

- By intended use, the preclinical centrifuges segment is growing at a healthy CAGR from 2026 to 2035.

- By application, the microbiology segment generated the highest market share of 38% in 2025.

- By application, the diagnostics segment is expected to grow at a notable CAGR between 2026 to 2035.

Innovating Sample Processing: Technological Evolution in the Laboratory Centrifuges Market

The laboratory centrifuges market has been stable, as more laboratories in healthcare, pharmaceutical, biotechnology, and forensic research are adopting new, improved separation technologies to achieve the desired analytical accuracy. Laboratory centrifuges play a crucial role in liquid separation, the isolation of biological substances, and the preparation of high-quality samples, which are needed for blood analysis, DNA/RNA isolation, microbiology research, and protein purification. With rising diagnostic workloads worldwide due to chronic diseases, infectious epidemics, and personalized medicine, the need for efficient sample preparation tools has increased. Contemporary laboratories are also moving toward an automated, digitalized world, thus necessitating easy-to-use, high-performance centrifugation systems.

Technological upgrades that enhance speed, accuracy, and operational safety are driving significant market expansion. Regulatory monitoring and control, Traceability, reduction of manual errors, and implementation of regulatory standards are being updated with a mix of smart sensors, real-time data analytics, and IoT-based monitoring systems. High-throughput and refrigerated centrifuges are also enabling large-volume processing in biomanufacturing and research. More adoption is occurring due to increased investment in molecular diagnostics, genomics, and cell therapy research, and a growing need for point-of-care diagnostics is driving demand for small, transportable centrifuge models. All these innovations are gaining broader use in clinical lab settings, academic centers, and pharmaceutical discovery environments, increasing the overall market potential for long-term growth.

Key AI Integrations in the Laboratory Centrifuges Market

Artificial Intelligence is transforming the laboratory centrifuges market by enhancing accuracy, efficiency, and predictable monitoring of laboratory activities. AI-powered applications and automated speed and temperature adjustments, depending on the sample type, will reduce manual intervention and improve the quality of the works results. Theintegration of machine learning algorithms supports predictive maintenance, vibration pattern analysis, motor operation, and operational cycles to help prevent failures before they occur and reduce downtime.

The smart sensors and connected dashboards can also be used to provide real-time status on samples, quality control, and compliance through AI-generated data analytics. Moreover, AI helps optimize energy consumption and automate workflows in high-throughput laboratories, allowing for the processing of more samples faster and without a decline in accuracy.

Laboratory Centrifuges Market Outlook

The developments in molecular diagnostics, genomics studies, and biomanufacturing processes, which demand effective separation technology, have facilitated this growth. The growth of healthcare infrastructure and the number of diagnostic tests further boost adoption rates.

North America and Europe are important markets in the laboratory centrifuges sector, owing to the high research investments and the existing laboratory infrastructure. Emerging Asia-Pacific and Latin American economies are growing rapidly due to investments in healthcare, biotech start-ups, and research laboratories.

The main healthcare equipment manufacturers, venture capital funds, and biotechnology-oriented funds are investing in the industry, and the significant contributors are Thermo Fisher Scientific, Eppendorf, Danaher Corporation, and Beckman Coulter. Novo Holdings, SoftBank Vision Fund, and key financial and strategic partners, such as Sequoia Capital, are financing innovation in automated, IoT-enabled centrifuge technologies.

New technologies are prioritizing portable and energy-saving, and AI-based centrifuge designs to meet the needs of decentralized and point-of-care testing. The growing number of grants, incubators, and research partnerships is accelerating the commercialization and innovation processes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.06 Billion |

| Market Size in 2026 | USD 2.18 Billion |

| Market Size by 2035 | USD 3.70 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Model, Intended Use, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Laboratory Centrifuges Market Segment Insights

Product Insights

Equipment: The equipment segment dominates the laboratory centrifuges market, driven by ongoing technological advancements and by industry leaders focus on developing specialized, efficient centrifuge devices. The increased need for precise and reliable sample separation techniques in studies, diagnostics, biotechnology, and pharmaceutical research also promotes growth.

The innovations manufacturers are prioritizing are enhanced performance, automation, safety, and capacity, which are used in labs to process a wider range of samples more accurately. The other key players, such as Thermo Fisher Scientific, Eppendorf, and Beckman Coulter, continue to expand their product portfolios to meet emerging research needs and regulatory requirements, driving overall segment growth.

Accessories: The accessories segment is expected to grow rapidly due to high demand for specialized features that enhance the flexibility and functionality of laboratory centrifuges. All these accessories are rotors, tubes, buckets, adapters, and carriers that enable systems to support various workflows, sample types, and throughput rates in research and clinical diagnostics, as well as in industrial laboratories.

The innovations that emphasize lightweight materials, safety locking, temperature stability, and compatibility with automated platforms make it even more useful. Companies like Hettich Instruments offer a range of centrifuge accessories that help maximize the capacity and functionality of the centrifuges used across many applications.

Model Insights

Floor-Standing Centrifuge: The floor-standing centrifuge segment recorded the highest revenue in 2024, driven by rising demand for high-capacity, high-speed centrifugation in clinical and research laboratories. Such systems are desirable when large volumes of samples are to be processed, a complex workflow is needed, and the task demands higher accuracy, stability, and temperature control.

Rotor engineering, automation, and digital control interfaces have greatly improved performance and operational effectiveness. Investments in biomedical research, bioprocessing, and molecular diagnostics are still being adopted. As laboratories demands for equipment to enable high-throughput analysis and multi-sample processing have increased steadily, floor-standing centrifuges have remained the choice of high-end research institutions and large healthcare centres.

Benchtop Centrifuge: The bench-top centrifuge section will experience the highest growth rate due to increased demand for small, multi-purpose, and energy-efficient lab tools. Advanced benchtop designs have since been developed with digital touch interfaces, programmable settings, or enhanced speed control, and can therefore be used in routine testing and specialized research.

The improvements in the usability of small- and medium-sized labs include innovations such as automated imbalance detection, reduced noise, and improved rotor safety. Its space-saving nature and portability are ideal in clinical diagnosis, biotechnology research, pharmaceutical development, and academic institutions.

Intended Use Insights

Clinical Centrifuge: The clinical centrifuge segment is the market leader in 2024, as it is a significant component of diagnostic procedures in hospitals, pathology laboratories, and clinical research centers. These centrifuges are crucial to the handling of samples (blood and biological), which assist in the diagnosis of a disease, hematology, and biomarker studies. The application grew due to the increasing prevalence of chronic and infectious diseases and the need for high-throughput diagnostics.

The development of molecular testing, point-of-care diagnostics, and precision medicine introduced the need for high-speed, automated systems capable of processing small-volume samples with increased accuracy. The increase in healthcare expenditure and the trend toward modernizing laboratory facilities enhanced market leadership.

Preclinical Centrifuges: The preclinical centrifuges segment will experience high growth driven by rising clinical research projects and expanding sales pipelines in pharmaceutical and biotech development. The increased in investment in drug discovery, biologics, gene therapy, and cell-based research, where specialized sample separation and purification are required, is driving growth. Preclinical centrifuges enable processing of biological materials needed for therapeutic validation, safety testing, and mechanism-of-action studies.

They are also adopted because of the need for advanced, high-speed, controlled-temperature platforms that are reproducible across complex workflows. Ongoing technological innovation and partnerships between research institutions and equipment manufacturers also contribute to the markets continued growth.

General Purpose Centrifuges: A general-purpose centrifuge is one of the most widely used segments, as it is used across a range of applications in the clinical, academic, industrial, and biotechnology markets. Their flexibility and ability to handle diverse samples, including blood components and even cell suspension samples, drive their popularity in day-to-day laboratory operations. These systems facilitate sedimentation, sample clarification, and sample preparation for downstream analysis.

It is also increasing with more research partnerships, expanding lab facilities, and the need to use cheaper technology, thereby driving more adoption. Manufacturers are improving product features to include digital interfaces, variable-speed control, and enhanced rotor safety to accommodate multi-disciplinary laboratory requirements.

Application Insights

Microbiology: The microbiology department recorded the highest revenue in 2024 because it is relevant to the identification and testing of microorganisms in clinical diagnosis, pharmaceutical research, environmental analysis, and food safety analysis. Laboratory centrifuges facilitate the isolation, concentration, and purification of microbial cells, as well as the appropriate identification and quantification in both culture-based and molecular evaluations.

The pressure on demand for high-performance centrifuges has also been increased by growing concerns about antimicrobial resistance, the emergence of new infectious pathogens, and the quality control requirements of biomanufacturing. The segment is expanding because labs are focusing on faster, automated, and more precise microbiological tests to support surveillance of public health and research efforts.

Diagnostics: The diagnostics segment is projected to experience the highest growth rate in the market between 2025 and 2034, as demand for early detection increases, and biomarker testing utilization increases. Laboratory centrifuges will be necessary to separate plasma, serum, and cellular components, enabling proper analysis of clinical samples in hematology, virology, oncology, and immunoassays.

The increase is also facilitated by the development of point-of-care testing, regular screening activities, and upgrades to diagnostic laboratories. Ongoing improvements in automated systems, standard workflows, and integration with digital laboratory systems increase test accuracy and centrifuge throughput, which are essential in clinical diagnostics.

Genomics: The genomics segment is also showing notable growth in the market for laboratory centrifuges, as research institutions and biotechnology companies invest more in DNA, RNA, and protein-based research. Nucleic acids and cell fractionation. Laboratory centrifuges are used in workflows for nucleic acid extraction, cell fractionation, and sample purification, which are needed for sequencing, cell gene expression, and genome editing.

The growing trend toward personalized medicine, targeted therapies, and advanced molecular research is driving the need for high-speed, temperature-controlled centrifuge systems. Their use is further enhanced by greater compatibility with microtubes, culture plates, and next-generation sequencing sample formats. This will lead to more rapid growth of the segment as more organizations in the genomic research field and equipment suppliers work together.

Laboratory Centrifuges Market Regional Insights

The North America laboratory centrifuges market size is estimated at USD 762.20 million in 2025 and is projected to reach approximately USD 1,393.63 million by 2035, with a 6.22% CAGR from 2026 to 2035.

Why Did North America Lead the Global Laboratory Centrifuges Market in 2025?

North America was the most dominant in the global market for laboratory centrifuges due to well-developed healthcare systems, well-established research environments, and the number of laboratory technologies adopted. The region enjoys significant investment in biotechnology, clinical diagnostics, and pharmaceutical production, and therefore requires high-performance centrifuge systems.

Regional supremacy is also enhanced by the presence of large players in the industry, highly regulated markets, and large investments in biotechnological and pharmaceutical research. The expansion package, which focuses on precision medicine, molecular testing, and automation, is enhancing the use of equipment in hospitals, research, and biotech companies. The market presence expected to endure is supported by the ongoing modernization of laboratory facilities and digital transformation initiatives.

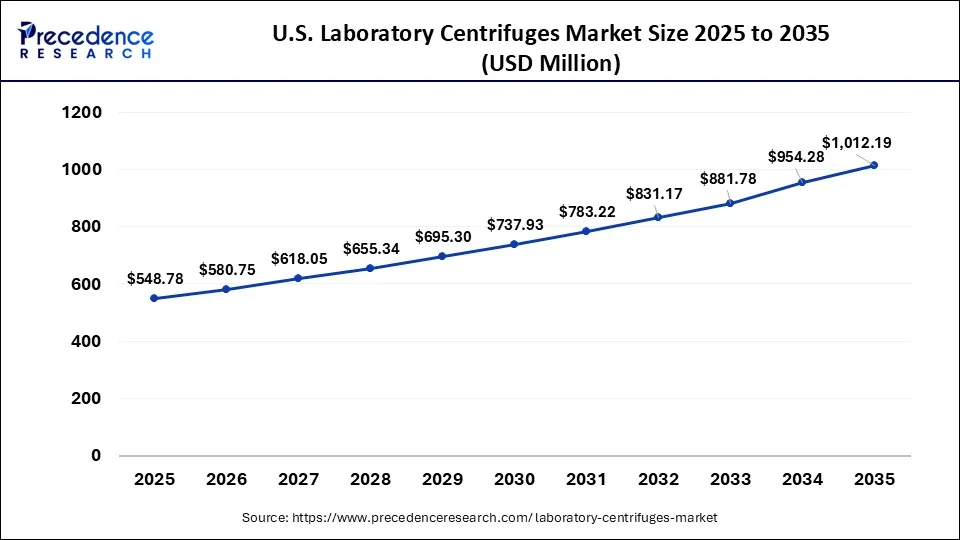

The U.S. laboratory centrifuges market size is calculated at USD 548.78 million in 2025 and is expected to reach nearly USD 1,012.19 million in 2035, accelerating at a strong CAGR of 6.31% between 2026 and 2035.

U.S Laboratory Centrifuges Market Analysis

The United States is the main driver of market growth and has a well-developed research system, diagnostic laboratories, and biotechnology centers. The need to meet the growing demand for advanced centrifuges across the clinical, academic, and industrial sectors is driven by investments in life sciences, genomics, and other public health programs.

The use of automated workflows, high-speed sample processing, and temperature-regulated systems enhances accuracy and efficiency during diagnostic and research applications. Close collaboration among manufacturers, research institutes, and healthcare providers is broadening applications, and advances in precision medicine and biomanufacturing are further expanding the market.

The laboratory centrifuges market in Asia Pacific is also growing rapidly due to expanding healthcare infrastructure, increased pharmaceutical research, and greater government focus on biotechnology and clinical diagnostics. The major manufacturers are also expanding through regionalization, localization, and strategic investments. The use of elaborate centrifuge systems is being boosted by rising demand for molecular tests, infectious disease screening, and individualized medicine. Academic research, clinical trials, and bioprocessing also increase the markets momentum. With the modernization of labs and the building of capacity as the main concerns among emerging economies, the region is a prime target for future market growth.

China Laboratory Centrifuges Market Trends

Chinas laboratory centrifuge market is growing, driven by swift improvements in healthcare infrastructure, rising investments in biotechnology and pharmaceutical research and development, and robust government support for life sciences innovation. The nation is becoming a biopharmaceutical manufacturing center, with genomic studies and clinical trials driving the need for a high-speed, automated, temperature-controlled centrifuge.

Local manufacturers are also becoming more competitive because they are producing low-cost equipment with improved safety, digital interfaces, and the ability to integrate with other state-of-the-art sample workflows. International players are also increasing through joint ventures, research collaborations, and localized production. The increasing attention to disease monitoring, precision medicine, and laboratory innovation continues to drive market growth.

The European laboratory centrifuges market is witnessing sustainable growth driven by increased investment in life sciences, growth in biotechnology research, and interest in early disease diagnostics and individualized treatment. The area is enjoying a robust academic and clinical research base, well-established regulatory guidelines, and increased use of automated laboratory devices.

The performance and efficiency are further enhanced by advances in centrifuge design, including high-throughput capabilities, rotor safety, and built-in data monitoring systems. The growing demand in pharmaceutical manufacturing, genomics, environmental testing, and clinical diagnostics, with financial support for scientific innovation from public and private funds.

UK Laboratory Centrifuges Market Trends

The UK market for laboratory centrifuges is being driven by advances in diagnostic accuracy, biomedical research, and increased investment in genomic medicine and healthcare innovation. The trend towards using more advanced centrifuge technologies in biotech companies, universities, and research institutions is being observed in these facilities, making molecular biology, cell research, and biopharmaceutical production more accessible. Adoption is also enhanced by strong government programs in clinical innovation and healthcare modernization. The market expansion is still being influenced by increasing demand for advanced laboratory infrastructure, especially in the public healthcare laboratories and research clusters.

Latin America's market shows notable growth during the forecast period. It is driven by rising investments in healthcare infrastructure, growing prevalence of chronic diseases, and expanding research activities in the region. The rising adoption of advanced laboratory equipment in biotechnology, clinical diagnostics, and pharmaceutical sectors thus propels market expansion.

Brazil Laboratory Centrifuges Market Trends

Brazil is the major healthcare market in Latin America, spending nearly 9.47% of its GDP on healthcare. The rise in diseases such as cancer, diabetes, and cardiovascular conditions is fueling need for diagnostic equipment. This is due to their compact design, cost-effectiveness, and versatility, benchtop centrifuges are undergoing high demand, mainly in smaller laboratories.

MEA's market shows rapid growth during the forecast period. It is driven by the rapid healthcare modernization, an increasing burden of infectious or chronic disorders, and rising investment in healthcare infrastructure. Government initiatives to modernize healthcare facilities and expand laboratory networks are supporting consistent equipment procurement. Technological advancements, including digital interfaces, energy-efficient designs, and enhanced safety features, are improving usability and reliability.

South Africa Laboratory Centrifuges Market Trends

South Africa's market is experiencing steady expansion, driven by the rising need for diagnostics in the healthcare, biotechnology, and pharmaceutical sectors. Manufacturers are introducing hydrocarbon-cooled, eco-friendly centrifuges with lower global warming potential.

Value Chain Analysis for the Laboratory Centrifuges Market

- R&D: It drives technological innovation, specifically accelerating need for high-speed, automated, and GMP-compliant

systems utilized in biopharma, vaccine production, and even clinical research.

Key Players: Thermo Fisher Scientific, Danaher Corporation, Eppendorf AG, Sartorius AG - Clinical Trials and Regulatory Approvals: It acts as a catalyst for standardization, technological innovation, and increased product demand.

Key Players: QIAGEN N.V., Kubota Corporation, NuAire, Inc., Sigma Laborzentrifugen GmbH - Formulation and Final Dosage Preparation: It is a vital segment in the laboratory centrifuge market, mainly within the pharmaceutical and biotechnology sectors, that provides high-growth opportunities driven by the demand for advanced purification, stability, and quality control.

Key Players: Andreas Hettich GmbH & Co. KG, Sigma Laborzentrifugen GmbH, Sartorius AG

Laboratory Centrifuges Market Companies

A leading German manufacturer of laboratory centrifuges designed for clinical, research, and industrial applications. Hettich is known for durability, precision engineering, and a broad portfolio ranging from microcentrifuges to high-capacity floor models.

Beckman Coulter is a major provider of automated centrifuges, clinical analyzers, and lab automation systems. Their centrifugation technologies support high-throughput clinical labs, bioprocessing, and life science research.

One of the largest global suppliers of laboratory equipment, offering a full range of centrifuges including micro, refrigerated, and high-speed models. Thermo Fisher integrates digital connectivity, advanced rotor technologies, and robust safety systems.

A German manufacturer specializing in compact and mid-sized centrifuges for hospitals, research labs, and industrial testing. Hermle systems are valued for reliability, simplified user interfaces, and long-term performance.

A Japanese manufacturer providing a wide array of laboratory centrifuges for clinical diagnostics, biological research, and material testing. Kubota offers efficient, quiet, and user-friendly designs tailored to routine lab workflows.

Known for its bioprocessing and laboratory technologies, Sartorius offers centrifuges used in cell harvesting, protein purification, and molecular biology. The company focuses on precision, reproducibility, and integration with broader lab systems.

A specialized German producer of high-quality centrifuges, including refrigerated, high-speed, and ultracentrifuge models. Sigma emphasizes performance, energy efficiency, and custom rotor compatibility.

Provides sample preparation and molecular biology kits complemented by centrifuge systems integrated into nucleic acid extraction workflows. QIAGEN supports genomics, diagnostics, and biomarker discovery.

Offers centrifugation solutions integrated within broader analytical and sample-preparation workflows. Agilent focuses on precision instrumentation for chromatography, mass spectrometry, and laboratory automation.

Supplies clinical and diagnostic centrifuges used in blood processing, sample separation, and hospital labs. BDs systems support quality-controlled workflows for immunology and hematology applications.

A global healthcare distributor providing laboratory centrifuges and related consumables to clinical and point-of-care facilities. Cardinal focuses on accessibility, supply chain reliability, and standardized equipment solutions.

Offers laboratory instruments and centrifugation systems utilized in diagnostic and research environments. The company emphasizes affordability and dependable performance for small and mid-sized labs.

A major laboratory equipment manufacturer recognized for microcentrifuges, refrigerated centrifuges, and sample-handling technologies. Eppendorf systems are widely used in molecular biology, biochemistry, and cell research.

Recent Developments

- In July 2024, the Hettich Group entered into a growth cooperation with Bregal Unternehmerkapital to accelerate its international growth. The joint venture aims to leverage Bregals international network to facilitate both organic and inorganic expansion, especially in Asia and the United States(Source: https://www.analytica-world.com)

- In January 2024, Hettich Group purchased Kirsch Medical, a laboratory and healthcare cooling and freezing Solutions Company. The acquisition will expand Hettich portfolio and support new developments in advanced centrifuge technologies.(Source: https://www.analytica-world.com)

- In August 2023, Boekel Scientific also launched a new product line with several centrifuge families for general, STAT, economy, and blood bank use. The line features long-lasting, flexible designs with different capacities and removable rotors to accommodate multiple laboratory processes.(Source: https://www.prnewswire.com)

Laboratory Centrifuges MarketSegments Covered in the Report

By Product

- Equipment

- Accessories

By Model

- Floor-Standing Centrifuges

- Benchtop Centrifuges

By Intended Use

- Clinical Centrifuges

- Preclinical Centrifuges

- General Purpose Centrifuges

By Application

- Microbiology

- Cellomics

- Proteomics

- Diagnostics

- Genomics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting