What is the Biochemical Reagents Market Size?

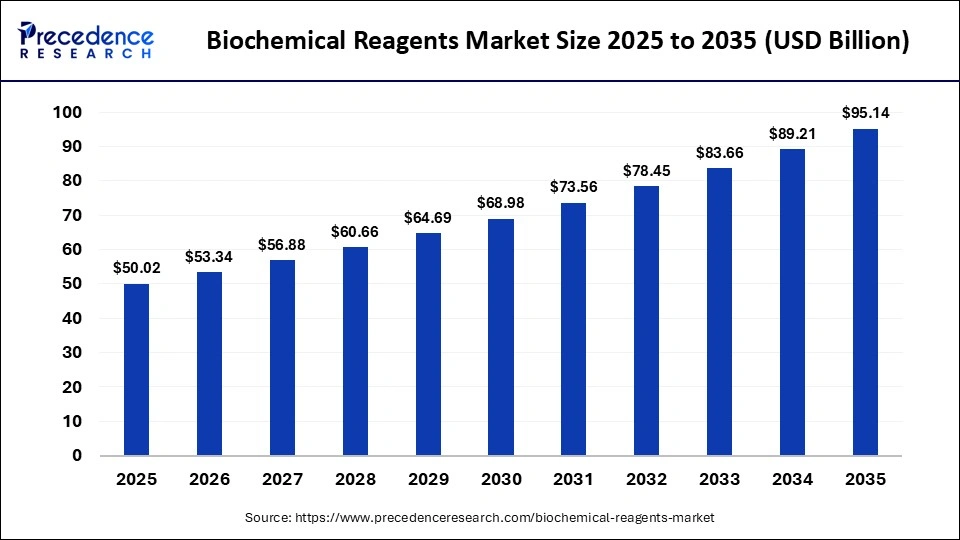

The global biochemical reagents market size accounted for USD 50.02 billion in 2025 and is predicted to increase from USD 53.34 billion in 2026 to approximately USD 95.14 billion by 2035, expanding at a CAGR of 6.64% from 2026 to 2035. The market for biochemical reagents is driven by expanding life science research, rising diagnostic testing, biopharmaceutical development, and increasing adoption of advanced laboratory technologies worldwide.

Market Highlights

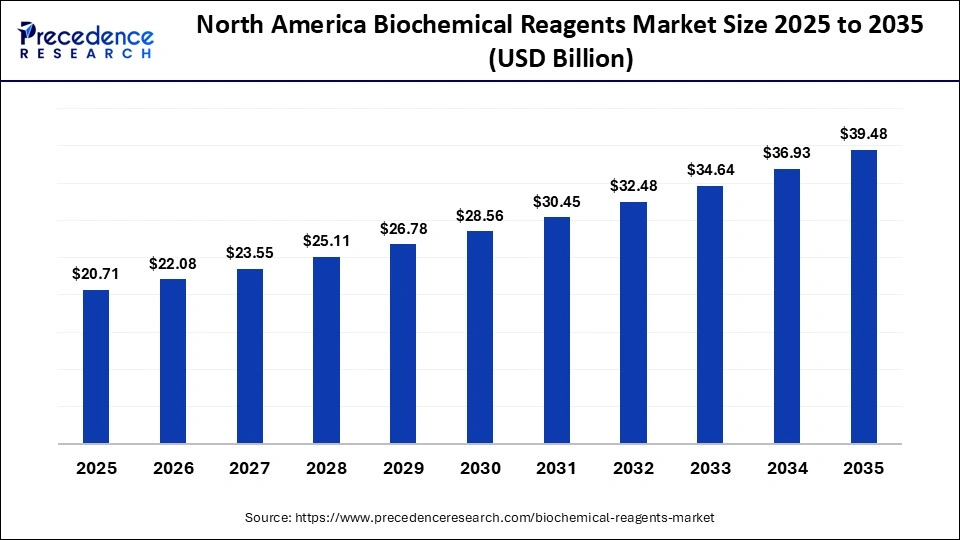

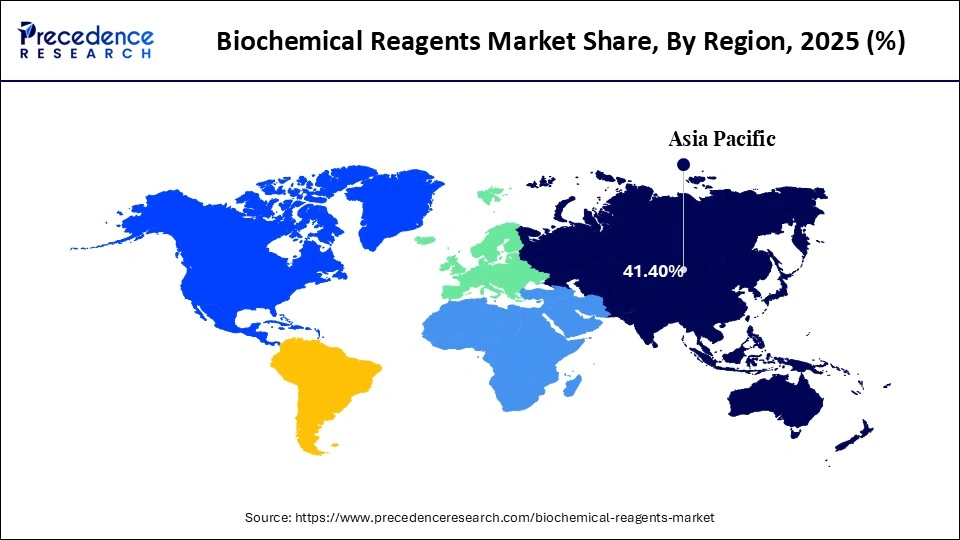

- North America led the biochemical reagents market with 41.40% share in 2025.

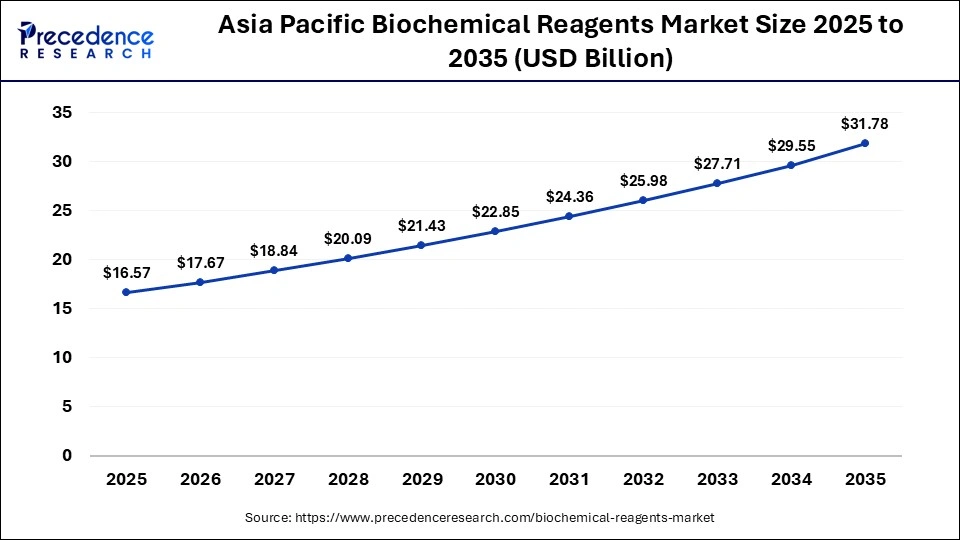

- The Asia Pacific is expected to grow the fastest CAGR of 8.5% between 2026 and 2035.

- By product type, the kits and assay reagents segment contributed the highest market share of 26.80% in 2025.

- By product type, the nucleic acids & oligonucleotides segment is growing at a strong CAGR of 9.1% between 2026 and 2035.

- By application, the research and development segment held the major market share of 34.50% in 2025.

- By application, the drug discovery and development segment is expected to expand at the fastest CAGR of 8.6% from 2026 to 2035.

- By technique, the PCR & qPCR segment captured the highest market share of 28.90 in 2025.

- By technique, the flow cytometry segment is expected to grow at a healthy CAGR of 8.4% between 2026 and 2035.

- By end user, the pharmaceutical and biotechnology companies segment dominated the biochemical reagents market with 38.20% market share in 2025.

- By end user, the contract research organizations (CRO) segment is poised to grow at the fastest CAGR between 2026 and 2035.

- By distribution channel, the direct sales segment dominated with 46.70% market share in 2025.

- By distribution channel, the online sales platform segment is expected to expand at the highest CAGR of 9.3% between 2026 and 2035.

What is Driving Life Science Development through Biochemical Research?

Biochemical reagents are specific chemical compounds that are used to stimulate or test a biological process. They enable scientists to quantitatively assess biological activity using a variety of methods and instrumentation, including molecular biology, proteomics, genomics, clinical diagnostics, and biotechnology.

The growth of biochemical reagents is driving science, the rapidly increasing use of diagnostic testing, and the development of biopharmaceuticals. As precision medicine gains popularity, the demand for highly specific, highly reproducible, and reliable reagents continues to grow. Academic funding, contract research organizations (CROs), and laboratory automation all contribute to the continued success of the biochemical reagents market. The focus of biochemical has changed toward sensitivity, batch-to-batch consistency, and compatibility with new analytical instruments. Regulatory requirements for quality control standards and validation will guide supplier selection. The companies that traditionally produce biochemical research materials will be the beneficiaries of this shift.

How is Artificial Intelligence Currently Transforming Biochemical Reagents?

Artificial intelligence is revolutionising biochemical reagents at a rapid pace through automating the high-throughput assay design process, enhancing reagent formulations, and facilitating quicker QC workflows from bench-to-bench. More recently, large players in the field have been incorporating agentic AI (AI-driven data analysis) and pipeline AI to facilitate the process of experiment planning and validation, as well as streamline the experimental processes generally; further, digital labs are helping to standardise metadata so that reagent data can be made ready for AI.

However, life science organisations continue to caution about what they call a scientific content crisis that undermines the accuracy of AI-derived results unless the quality and traceability of their data continue to improve. Many of the major players in the market continue to invest in developing AI-enabled applications and in improving regulatory compliance with their automation systems to improve traceability, minimise errors caused by human intervention, and accelerate reagent development in both research and diagnostic uses.

Biochemical Reagents Market Outlook

- Market Overview: Biological assays or biochemical reagents have become essential testing tools to detect or measure biological samples from patients. In addition, these reagents support global health systems and help monitor diseases.

- Expansion of Global Markets: As research facilities and diagnostic services continue to grow throughout the world, the number of assays and reagents used for research in genomics, proteomics, and within the field of clinical laboratory medicine is increasing.

- Increase in Healthcare Demand Globally: With the burden of both chronic and infectious diseases increasing globally, there is a growing demand for the use of biochemical tests. Therefore, reagents are crucial to provide reliable and accurate diagnostic results and for public health monitoring.

- Technological Advances: Emerging technologies such as automated assays, improved sensitivity of platforms, and increased shelf life of reagents will increase laboratory efficiency and spur adoption due to the complexity associated with the workflows involved in many laboratories.

- Regulatory and Quality Pressures: Stringent regulatory requirements and quality control measures have put pressure on biochemical reagent manufacturers to comply with these requirements, resulting in increased costs of manufacturing and approval by the FDA for their products.

- R&D Investments: Government and academic institutions are providing increased funding for research and development of new drug therapies and scientific innovations. This provides manufacturers with long-term stability and continued demand for their products across the industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 50.02 Billion |

| Market Size in 2026 | USD 53.34 Billion |

| Market Size by 2035 | USD 95.14 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, Technique, End-user, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why Do Kits and Assay Reagents Drive Most of the Demand for Biochemical Reagents?

Kits & Assay Reagents: The segment dominates the global biochemical reagents market with a 26.8% share, owing to their ability to produce reproducible, standardised test results; they enable technicians to perform tests using the same equipment regardless of manufacturer. The use of kits is widespread across all types of biological research (academic and clinical) and across industries that produce biochemical products. Kits are available to users who wish to conduct diagnostic tests, molecular biology research, and quality assurance.

Nucleic Acids & Oligonucleotides: The segment will be the fastest-growing with a 9.1% CAGR during the forecast period, driven by growth in genomic research, the advent of gene-editing technology, and the growing use of Synthetic Biology in developing products for everyday use. Kits and Oligonucleotide reagents have been used in the growing field of Personalized Medicine and advanced therapies. This will continue to increase usage in both research and clinical laboratories through 2024.

Application Insights

What's Driving Research and Development to Dominate the market for biochemical reagents?

Research & Development: The segment continues to dominate the market in 2025 with a 34.5% share, as it remains a high priority for investment across the life sciences, molecular biology, and biomedical research sectors. Because of their continual need for reagents for experimentation, confirmation, and the creation of new technologies, academic institutions, government laboratories, and private research institutions represent on-going demand for reagents with very high consumption levels in exploratory and hypothesis-driven research.

Drug Discovery & Development: The segment is the fastest-growing in the market, with an 8.6% CAGR, driven by increased pharmaceutical innovation and biopharmaceuticals. Advanced screening assays, biomarker validation, and pre-clinical testing will all utilize approximately 100% of all reagents used in Biopharmaceutical Development. There is growing demand for targeted therapies and precision medicine driven by the increasing use of molecular and biochemical evaluations across the product development pipeline.

Technique Insights

Why PCR and qPCR Techniques Dominated the Market in 2025?

PCR & qPCR: The segment has the largest share of 28.9%, due to their robust sensitivity, reliability, ease of use, and versatility for molecular analysis. PCR and qPCR are used for pathogen detection, gene expression analysis, and gene therapy validation. In clinical research, diagnostics, and regulatory testing, these techniques are used regularly; therefore, they have a strong track record and continue to expand their application base, resulting in high reagent usage.

Flow Cytometry: The segment is a rapidly growing field, with an expected CAGR of 8.4%, driven by increased adoption across oncology (immunotherapy) and other research areas using these techniques. Flow cytometry's ability to offer high-throughput, multiparametric cell analysis is the driving force behind its use and increases demand for specialty biochemical reagents. In addition, as immunotherapy and cell characterization continue to expand and evolve in both research and clinical settings, the number of laboratories using flow cytometry will increase.

End User Insights

Why Are Pharmaceutical & Biotechnology Companies the Dominant End Users of Reagent Demand?

Pharmaceutical & Biotechnology Companies: The segment held the largest share of 38.2%, due to their comprehensive engagement in drug discovery and development. These companies use chemical reagents across a broad range of applications at all stages of the drug discovery, drug regulation, and drug manufacturing processes. Additionally, due to the increased demands placed on them by regulatory agencies, pharmaceutical and biotech companies can maintain steady demand for reagents across all phases of product development.

Contract Research Organizations (CROs): The segment is the fastest-growing end-user segment for biochemicals, with an 8.9% CAGR, reflecting the growing trend of outsourcing research and clinical testing services to these organizations. Pharmaceutical companies have begun using CROs to reduce overall development costs and timelines by relocating the production of reagents used in drug development to CRO laboratories. The expansion of CRO capabilities in molecular diagnostics and advanced analytics will drive further demand for biochemical reagents in this segment.

Distribution Channel Insights

What Makes Direct Sales the Most Favourable Distribution Channel in the Biochemical Reagents Market?

Direct Sales: The segment dominated the distribution landscape with a 46.7% share, driven by its ability to develop robust supplier-customer relationships, provide technical support, and enable bulk procurement. For example, many pharmaceutical companies or large research institutions prefer direct sourcing over other distribution methods to maintain product consistency, ensure regulatory compliance, and create a custom supply agreement. Additionally, the direct sales channel relies on long-term contracts and reliable logistics, further reinforcing direct sales as the main distribution method for biochemical reagents.

Online Sales Platforms: This distribution channel segment is the fastest-growing in the market for biochemical reagents, with a 9.3% growth rate, driven by the digital procurement process, which has increased the number of buyers and improved logistics. Small laboratories and academic users are increasingly buying online due to the convenience of reviewing multiple products at once and receiving their orders quickly. The continued and expanding presence of e-commerce and supplier digitalization continues to improve accessibility and drive growth in this distribution channel.

Regional Insights

How Big is the North America Biochemical Reagents Market Size?

The North America biochemical reagents market size is estimated at USD 20.71 billion in 2025 and is projected to reach approximately USD 39.48 billion by 2035, with a 6.66% CAGR from 2026 to 2035.

Why is North America Dominating the Biochemical Reagents Market?

North America has become a leading region for biochemical reagents, with a 41.4% share, due to its mature, integrated life sciences ecosystem comprising advanced research, translational medicine, and large-scale commercialization. The continuous support of government funding in biomedical research, the concentration of pharmaceutical/biotech businesses, and the growing use of molecular diagnostics have combined to equip this region to be a dominant force in the supply of biochemical reagents. Superior collaboration between academia, hospitals, and industry has accelerated all aspects of reagents; from validating using, and getting them into everyday usage in genomics, proteomics, and cell-based research, as well as providing a stable and predictable demand for a variety of high-purity and application-specific types of reagents, and thus, promoting and enhancing innovation in this region.

What is the Size of the U.S. Biochemical Reagents Market?

The U.S. biochemical reagents market size is calculated at USD 16.57 billion in 2025 and is expected to reach nearly USD 31.78 billion in 2035, accelerating at a strong CAGR of 6.73% between 2026 and 2035.

U.S. Biochemical Reagents Market Trends

The U.S. remains the leader in North America, partly due to federal funding for biomedical research, the significant number of clinical trials currently underway, and the availability of domestic manufacturing to produce the wide variety of advanced and custom biochemical reagents used in both research and diagnostics. Federal agencies such as the National Institutes of Health and the Biomedical Advanced Research and Development Authority provide sustained funding that supports early-stage research, translational studies, and large-scale clinical programs across oncology, infectious diseases, and rare disorders.

- In December 2025, Infinity Chem introduced its U.S.-manufactured peptide platform from Scottsdale, Arizona, enhancing supply chain transparency, traceability, and quality for research labs by integrating peptide synthesis, purification, conditioning, and analytics.

Why is the Asia Pacific Experiencing the Fastest Growth in the Biochemical Reagents Market?

Asia Pacific is set to see the fastest growth, with an 8.5% CAGR, driven by the growing capabilities of life-science research and its increasing reliance on molecular diagnostics, and supported by government-sponsored biotechnology programs and research infrastructure, which will continue to make the region the fastest-growing. Most nations in the Asia-Pacific region have improved their laboratory infrastructure. Therefore Improving the use of reagents in laboratories. The emphasis on producing biological products such as vaccines and diagnostic kits onshore has resulted in increased demand for reliable enzymes, buffers, antibodies, and cell culture reagents. Cost-effective manufacturing capabilities, along with a skilled workforce, provide opportunities for high-volume production of reagents, making the Asia Pacific an excellent choice for both routine and advanced biochemical research.

India Biochemical Reagents Market Trends

India's expanding pharmaceutical manufacturing base and biotech research ecosystem, in conjunction with a strong focus on affordable diagnostics and vaccines, provide India with a very important position within the global biochemical reagents market. Increased governmental support for life science research, an increase in the number of clinical trials conducted in India, and a large pool of highly qualified scientists have led to continued demand for biochemical reagents across clinical, industry, and academic laboratories in India.

- In February 2024, LordsMed launched a set of 10 biochemistry reagents in India, expanding its laboratory solutions and offering versatile diagnostic tools for clinical testing workflows across healthcare facilities.

Why is Europe Entering a New Era of Biochemical Reagents Market?

Key drivers behind the rising demand for biochemical reagents in Europe include a strong public research environment that supports advanced research and development, as well as sustained funding for translational research, genomics, and biologics programs across academic institutions, hospitals, and the biomanufacturing sector. European Union framework programs and national funding bodies play a central role in financing laboratory research, clinical translation, and biologics scale-up, thereby creating consistent demand for high-quality, specialized reagents. Growing adoption of precision medicine approaches and advanced diagnostic practices across oncology, rare diseases, and infectious disease management is increasing the use of assay-specific and custom biochemical reagents throughout European research and clinical laboratories.

In countries such as Germany, France, and the United Kingdom, large academic medical centers and publicly funded research institutes are expanding genomics and molecular diagnostics programs, driving routine demand for enzymes, antibodies, buffers, and molecular biology reagents. Additionally, Europe's growing biologics and cell and gene therapy manufacturing base is increasing the need for GMP-grade reagents used in process development, quality control, and clinical production workflows.

Germany Biochemical Reagents Market Trends

Germany is the leading market in Europe due to its well-established biopharmaceutical manufacturing base, strong academic–industry collaboration, and sustained public and private investment in research. The country hosts a dense network of research universities, applied science institutes, and biomanufacturing facilities that jointly drive demand for advanced biochemical reagents across discovery, development, and production stages.

In July 2024, Merck KGaA launched a new biomarker detection reagent designed to identify a broad range of disease biomarkers with high sensitivity and specificity, reflecting ongoing innovation within Germany's life sciences supply ecosystem. Germany's continued focus on molecular biology techniques, translational diagnostics, and laboratory standardization supports steady demand for specialized, high-quality biochemical reagents across both research laboratories and clinical diagnostic settings.

Why is the Middle East & Africa region accelerating the use of Biochemical Reagents Market?

The region of the Middle East and Africa (MEA) has been experiencing a growing demand for Biochemical Reagents due to the continued development of health care system infrastructure, the development of biotech centres, and the application of life sciences in research across these countries. As a result, fostering laboratory upgrades, vaccine development, and increased clinical research has also created a need for greater use of analytical and molecular reagents in the region. The African landscape is also gaining ground with continued investments in strengthening local public health laboratories; creating agricultural biotechnology programmes; and fostering local disease surveillance systems, which, unfortunately, will lead to an increased number of baseline reagents being matched to their current use in the labs.

South Africa Biochemical Reagents Market Trends

South Africa is Leading the MEA in their Biochemical Reagent Market, followed closely by other Regional Neighbours; this is mostly because South Africa has an Established Research Ecosystem, the Presence of Quality Universities and National Laboratories, and there continues to be a Significant Investment in the areas of Biomedical Research; Infectious Disease Monitoring; as well as Local Manufacturing Capabilities, which all establishes a Consistent Need for Biochemical Reagents and positions South Africa as a Regional Point of Reference for Innovation within the Laboratory Setting.

Why is Latin America Emerging in the Biochemical Reagents Market?

Latin America is emerging as a key player in the biochemical reagents market due to rising investment in public healthcare systems, the expansion of clinical research activity, and the growing adoption of molecular diagnostics across major economies such as Brazil, Mexico, and Argentina. Governments and public health agencies in the region are strengthening laboratory infrastructure to support infectious disease surveillance, oncology diagnostics, and chronic disease monitoring, which directly increases demand for enzymes, antibodies, buffers, and assay reagents used in routine and advanced testing. The region's disease burden profile, including endemic infectious diseases alongside rising cancer and metabolic disorders, is pushing laboratories to adopt more sensitive and specific biochemical testing workflows.

The market is further supported by increasing participation of Latin American hospitals and research institutes in international clinical trials and translational research programs, particularly in Brazil and Mexico. Academic medical centers and public research institutes are expanding their genomics, immunology, and molecular biology research capabilities, driving sustained demand for research-grade and diagnostic reagents. In parallel, gradual strengthening of regulatory frameworks and quality standards for diagnostics and biopharmaceutical production is encouraging laboratories and manufacturers to shift toward higher-quality, validated biochemical reagents rather than basic or improvised alternatives.

Brazil Biochemical Reagents Market Trends

Brazil represents the largest and most mature biochemical reagents market in Latin America, supported by its extensive public healthcare system, large diagnostic testing volume, and established biomedical research ecosystem. Institutions such as federal universities, public research organizations, and national reference laboratories conduct large-scale research and diagnostic programs that require a consistent supply of molecular biology reagents, immunoassay components, and clinical chemistry inputs. Brazil's Unified Health System drives high-volume testing for infectious diseases, maternal health, and chronic conditions, sustaining baseline demand for biochemical reagents across public laboratories.

In addition, Brazil's growing involvement in vaccine research, biologics development, and clinical trials is increasing demand for specialized and GMP-aligned biochemical reagents used in assay development, quality control, and validation workflows. The expansion of molecular diagnostics, including PCR-based and immunodiagnostic testing in both public and private laboratories, is further shaping market demand toward higher-sensitivity reagents. Ongoing investments in laboratory modernization and domestic biomanufacturing capabilities continue to strengthen Brazil's role as a regional hub for biochemical reagent consumption and applied life sciences research.

Biochemical Reagents Market Value Chain

- R&D and Raw Material Procurement

Chemicals, Enzymes, and Biopolymers were identified and procured, and suppliers were engaged to collaborate with R&D scientists to create a custom reagent for laboratory use.

Key Players: Merck (Sigma-Aldrich), Thermo Fisher Scientific, New England Biolabs, Agilent Technologies, Takara Bio

- Production & Formulation

Manufacturers produce, formulate, and stabilize reagents to meet Good Manufacturing Practice (GMP) standards for quality control, consistent batches, optimal shelf life, and safe handling before use.

Key Players: Merck, Cytiva (GE Healthcare Life Sciences), Sartorius, Lonza, Catalent (CMO Services).

- QC and Validation Testing

Companies ensure that product testing and development are in accordance with International Standards Organization (ISO) and Food and Drug Administration (FDA) standards, as well as other regulatory authorities. Product testing helps to ensure that manufacturers produce lots of products that are reproducibly reliable and can be verified as produced by an accredited laboratory.

Key Players: Eurofins, SGS, Intertek, Charles River Laboratories, Thermo Fisher Scientific.

- Distribution Logistics

Global distribution networks, including warehouse space, cold chain, and inventory management, will enable reagents to be delivered on time and shipped in accordance with all applicable federal and state regulations for the safe transport of temperature-sensitive reagents in specialized packaging.

Key Players: Fisher Scientific (Thermo Fisher), Avantor (VWR), DHL Life Sciences, UPS Healthcare, FedEx Custom Critical.

- Marketing, Sales, and Customer Support

Businesses invest heavily in Marketing, Sales, and Customer Support to facilitate the entry of their offerings into Academia, Diagnostics, and other Industries. The majority of companies provide technical training to customers on Assays and how to use Reagents.

Key Players: Thermo Fisher Scientific, Merck, Bio-Rad, Agilent Technologies, Promega.

Top Key Players in the Biochemical Reagents Market and Their Offerings

- Thermo Fisher Scientific

- QIAGEN

- New England Biolabs

- Illumina, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories F.

- Hoffmann-La Roche Ltd.

- Merck KGaA

- Promega Corp.

- Takara Bio, Inc.

- LGC Ltd.

- Toyobo Co. Ltd.

Recent Developments

- In December 2025, Veritiv launched TempSafe PalletShield, the industry's first curbside-recyclable, fibre-based cold chain pallet shipper designed for biopharma logistics, offering over five days of validated thermal performance and enhanced sustainability.(Source: https://finance.yahoo.com)

- In December 2025, FUJIFILM India expanded its in-vitro diagnostics portfolio with the FW500 Clinical Chemistry Analyzer, combining precision and speed to support mid-sized labs with up to 200 tests/hour and advanced reagent integration.(Source: https://www.digitalhealthnews.com)

- In December 2025, Sino Biological received the 2025 Supplier Performance Recognition Award from Scientist.com for excellence in responsiveness, marketplace activity, and customer satisfaction, highlighting its contribution to global drug discovery research services.(Source: https://www.news-medical.net)

Segments Covered in the Report

By Product Type

- Enzymes

- Antibodies

- Proteins & Peptides

- Nucleic Acids & Oligonucleotides

- Buffers, Salts & Solutions

- Dyes & Stains

- Kits & Assay Reagents

By Application

- Research & Development

- Clinical Diagnostics

- Drug Discovery & Development

- Biotechnology Production

- Academic & Government Research

By Technique

- PCR & qPCR

- ELISA

- Chromatography

- Flow Cytometry

- Immunoassays

- Cell Culture

By End-user

- Pharmaceutical & Biotechnology Companies

- Clinical & Diagnostic Laboratories

- Academic & Research Institutes

- Contract Research Organizations (CROs)

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Online Sales Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting