What is the Expandable Microspheres Market Size?

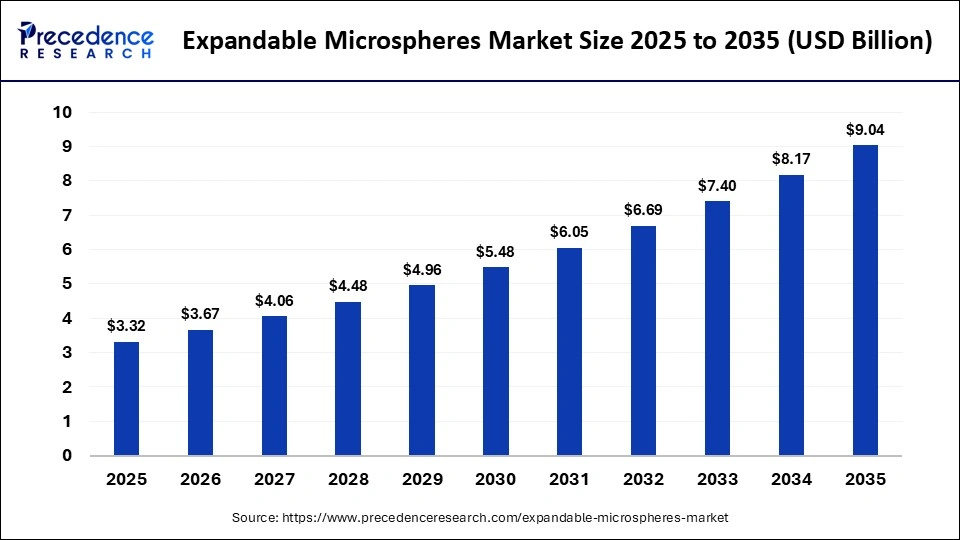

The global expandable microspheres market size accounted for USD 3.32 billion in 2025 and is predicted to increase from USD 3.67 billion in 2026 to approximately USD 9.04 billion by 2035, expanding at a CAGR of 10.53% from 2026 to 2035. The market growth is attributed to rising demand for lightweight, energy-efficient, and high-performance materials across automotive, construction, and packaging industries.

Market Highlights

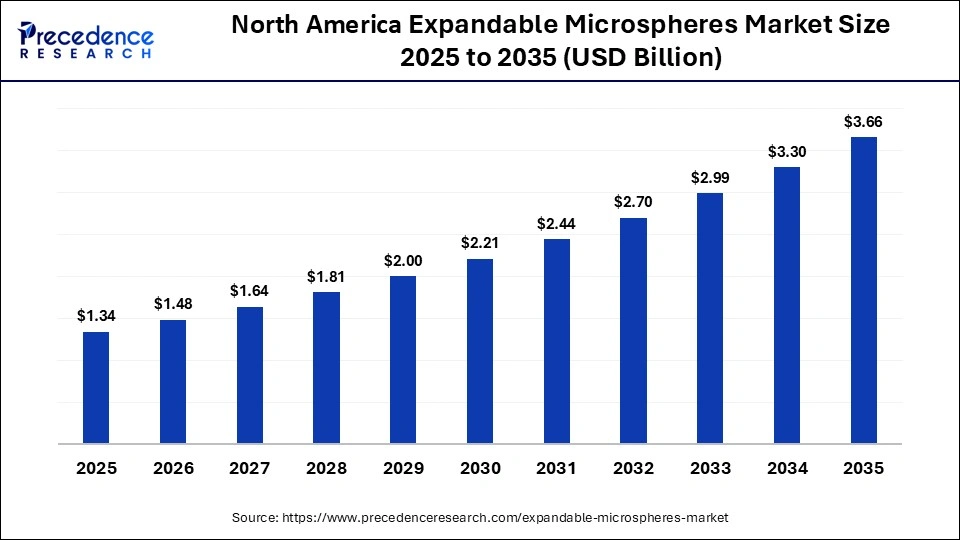

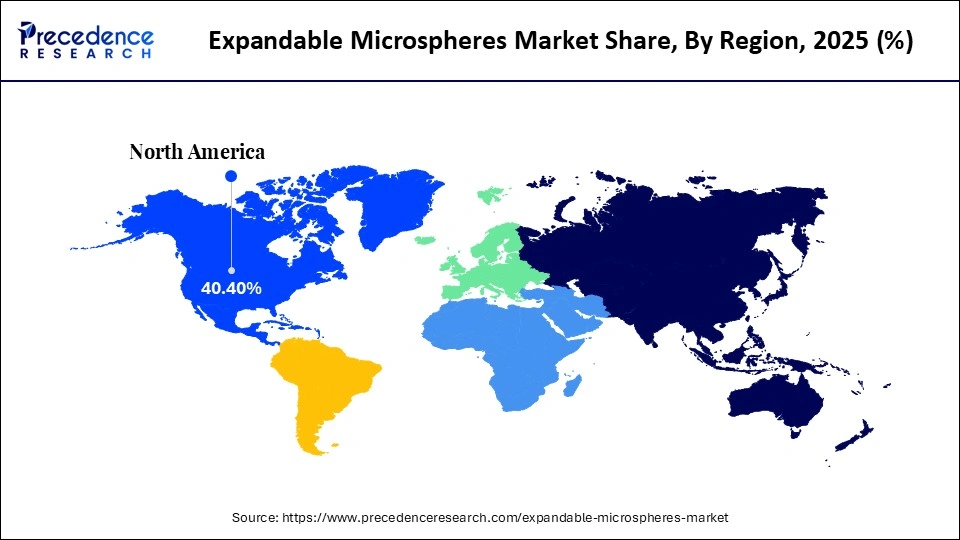

- North America held a dominant global market in 2025, accounting for an estimated 40.4% market share.

- The Asia Pacific is expected to grow at a solid CAGR of 10% between 2026 and 2035.

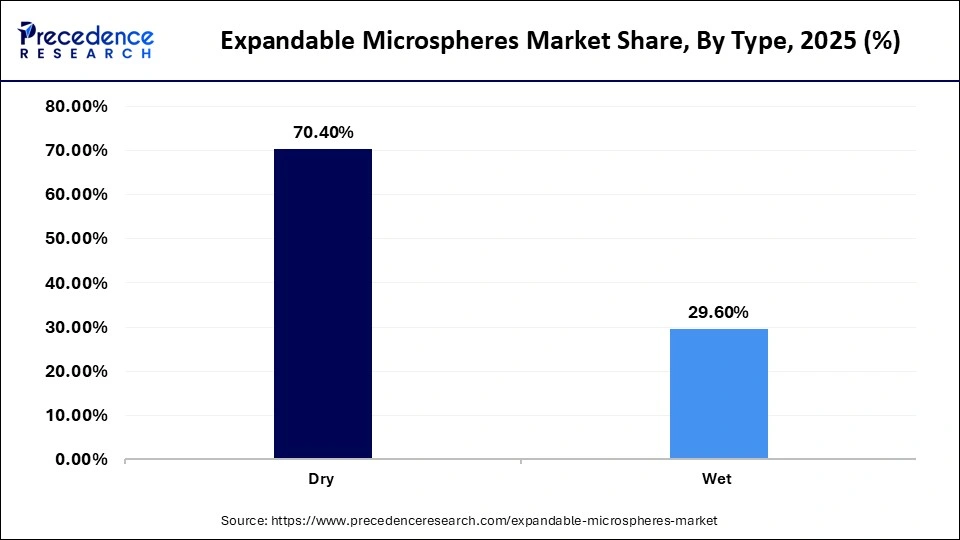

- By type, the dry segment accounted for a considerable market share of 70.4% in 2025.

- By type, the wet segment is poised to grow at a solid CAGR of 8.6% between 2026 and 2035.

- By polymer type, the polyacrylic ester (PAE) segment led the market, which held a market share of 52.5% in 2025.

- By polymer type, the polyvinyl acetate segment is expanding at a strong CAGR of 8.8% between 2026 and 2035.

- By application/end use, the automotive segment contributed the highest market share of 38.6% in 2025.

- By application/end use, the sports & leisure segment is poised to grow at a solid CAGR of 8.9% from 2026 to 2035.

- By end-user industry, the paints & coatings segment captured the biggest market share of 43.4% in 2025.

- By end-user, the plastics segment is expected to expand at a healthy CAGR of 9% from 2026 to 2035.

Expandable Microspheres Market Overview

Expandable microspheres are microscopic polymer spheres that expand when heated, increasing their volume up to 60-80 times. This creates millions of tiny closed air cells that reduce density and improve insulation and mechanical performance, making them ideal for lightweight composites, coatings, and plastics. Vehicle and material lightweighting are still one of the major drivers of growth in these technologies, with research by the U.S.

Department of Energy, indicating that a 10% decrease in vehicle weight can yield a 6-8% boost in fuel economy and that substituting heavy parts with new lightweight materials is the key to achieving energy and emissions targets by 2025 and beyond. The government and industry efforts put an emphasis on material efficiency in the reduction of emissions. The OECD analysis shows that lightweighting has a significant part to play in the emission reduction in the clean energy case of passenger vehicles. Furthermore, the growing adoption of expandable microspheres across transportation, construction, and consumer materials is projected to accelerate market growth.

Impact of Artificial Intelligence on the Expandable Microspheres Market

The concept of artificial intelligence is transforming the expandable microspheres market by improving production efficiency and accelerating material innovation within tightly controlled manufacturing environments. AI-driven predictive analytics are increasingly used to regulate critical parameters such as particle size distribution, shell thickness uniformity, and expansion ratios during polymerization and encapsulation. By modeling the interaction between temperature, pressure, monomer composition, and blowing agents, these systems enable manufacturers to achieve consistent batch quality while reducing raw material waste and off-spec production.

AI-controlled monitoring and process control systems are being deployed across production lines to detect deviations in real time during microsphere synthesis and thermal expansion stages. These systems use sensor data and machine learning models to identify anomalies related to reaction kinetics, shell integrity, or expansion behavior, allowing immediate corrective action without halting operations. This reduces downtime, shortens production cycles, and improves overall equipment efficiency, particularly in high-volume applications such as automotive lightweighting, construction materials, and specialty coatings, where consistency and cost control are critical.

Expandable Microspheres Market Growth Factors

- Rising Demand for Lightweight Composites: Growing adoption of hollow microsphere-based composites is boosting material efficiency in automotive and aerospace applications.

- Advancements in Thermal Insulation Technologies: Driving improved energy savings, expandable microspheres are fuelling innovations in construction and industrial insulation.

- Expansion of Eco-Friendly Coatings: Rising regulatory pressure is propelling the use of microsphere-enhanced low-VOC paints and coatings globally.

- Integration in Consumer Packaging: Growing emphasis on lightweight, durable, and sustainable packaging is boosting microsphere incorporation in plastics and laminates.

- Innovations in Polymer Formulations: Continuous R&D in polymer-microsphere compatibility is driving enhanced performance in adhesives, sealants, and composites.

Expandable Microspheres Market Insights Shaping the Future of Lightweight Materials

- In 2025, broader tariff frameworks affecting chemical intermediate imports, including duties of 10-50% and up to 245% on certain specialty precursors in markets like the U.S., increased the cost base for polymer and acrylate intermediates that are essential to expandable microsphere manufacture.

- Acrylic acid shipments exceeded 1 million kg with a trade value near USD 15.6 million in 2024, underscoring reliance on traded polymer intermediates.

- In automotive components such as interior plastics, EPDM seals, and rubber weather strips, the addition of expandable microspheres at low use levels, typically 1-2% by weight, has been shown to reduce part density by approximately 15-40% compared to equivalent parts made with conventional solid fillers, directly lowering vehicle component mass while maintaining mechanical performance.

- The worldwide vehicle fleet exceeded 1.5 billion vehicles in circulation during 2024, with annual production remaining above 90 million units, sustaining large-scale demand for lightweight materials across interior plastics, sealants, coatings, and underbody components where expandable microspheres are applied.

- Global electric vehicle stock crossed 40 million units in 2024, increasing by more than 35% year-on-year, with EVs accounting for approximately 18-20% of new passenger vehicle sales in 2025, intensifying OEM focus on material lightweighting to maximize driving range.

- Worldwide construction activity exceeded USD 13 trillion in annual output in 2024, driven by infrastructure renewal, housing demand, and urban expansion across Asia, the Middle East, and emerging economies, increasing demand for lightweight, material-efficient construction additives.

- The global urban population surpassed 4.6 billion people in 2024, with the United Nations projecting continued urban housing expansion, indirectly accelerating consumption of lightweight plasters, insulation coatings, and sealants where expandable microspheres are increasingly used.

- Multiple patent applications specifically concerning heat-expandable microspheres and thermoplastic shell formulations were filed in 2024 and published in 2025, including innovations in expansion behavior and barrier properties targeted at lightweight filler applications.

Expandable Microspheres Market Outlook

- Industry Growth Overview: Rising demand for lightweight, high-performance materials is driving strong momentum across industries that prioritize material efficiency and functional enhancement. Microspheres with expansive properties assist in reducing weight, surface smoothing, and thermal protection in automobiles, building products, packaging, shoes, and consumer products. Manufacturers are progressively utilizing these materials to achieve the performance goal and maximize the consumption of materials and the processing efficiency.

- Sustainability Trends: Sustainability priorities strongly influence product development strategies across the expandable microspheres landscape. Producers are paying more attention to the minimization of the use of raw materials through the possibility of lightweight design, which leads to a lower consumption of resources. The use of water-based products and low-emission manufacturing solutions is becoming more popular, as regulators and customers focus on fewer volatile emissions and less hazardous manufacturing conditions. Innovation in polymer shell design and choice of blowing agent is also encouraged by environmental compliance.

- Global Expansion: Global manufacturing expansion supports the steady geographic diversification of expandable microsphere production and consumption. Capacity investments are still being drawn to the Asia-Pacific because of good growth in the production of automotive and footwear and growth in infrastructure. The governments of the regions promote the use of advanced materials in the case of industrial modernization programs, enhancing the local supply chains. The major manufacturers are developing regional presence and technical service hubs strategically to serve the customers and increase their supply protection.

- Major Investors: The worldwide production of microspheres enhances the consistency of geographical diversification in the manufacture and consumption of the expandable type of microsphere. The activity in investment demonstrates the trust in the long-term demand due to the lightweighting issues, sustainability-driven material replacement, and high-end surface engineering tendencies. Intellectual property positions and application-specific product portfolios are reinforced with the help of portfolio optimization and targeted acquisitions. Furthermore, the processes of capital deployment are more favorable to process optimization and application development as opposed to commoditized volume growth, which strengthens the industry segmentation in the advanced material markets.

- Startup Ecosystem: The startup ecosystem surrounding expandable microspheres emphasizes formulation science, specialty coatings, and advanced polymer engineering. The venture capital interest fosters material innovation in the early stages and pilot-scale production. Further cooperation between startups, academic research facilities, and more advanced chemical manufacturers facilitates commercialization channels. This ecosystem continues to provide the market with specialized solutions to the emerging performance, sustainability, and regulatory needs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.32 Billion |

| Market Size in 2026 | USD 3.67 Billion |

| Market Size by 2035 | USD 9.04 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Polymer Type, Application/End Use, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did Dry Expandable Microspheres Dominate the Market in 2024?

Dry segment dominated the expandable microspheres market in 2025, accounting for an estimated 70.4% market share, as their lightweight structure significantly reduced material usage in construction and automotive components. Thermal stability improved insulation performance, packaging performance, and performance of composite materials. Dry microspheres were popular in industries for bulk processing and in large-scale formulation of materials. Inclusion in coating and gluing enhanced the performance of products and decreased operational expenses. Furthermore, the current trend of regulatory focus on lightweight and energy-efficient materials fosters the further use of dry microspheres.

The wet segment is expected to grow at the fastest rate in the coming years, accounting for 8.6% CAGR, owing to the superior dispersion in liquid formulations. They are easily incorporated into paints, adhesives, coatings, and specialty polymers. High-level shells of polymer enhance thermal insulation, compressive strength, and quality of surface finish. Additionally, the wet microspheres are gaining popularity in the emerging markets because of their versatility and convenience.

Polymer Type Insights

Why Are Polyacrylic Ester Microspheres Dominating Polymer Type Demand?

Polyacrylic ester (PAE) segments held the largest revenue share in the expandable microspheres market in 2025, holding a market share of about 52.5%, as they have outstanding thermal and mechanical stability. These microspheres swell linearly in the presence of heat, keeping shell integrity and constant particle size. This guarantees the dependability of any coating, adhesive, and lightweight composite. Many industrial industries, such as automotive, construction, and packaging, are turning to the use of PAE microspheres to lower the weight of materials without affecting their durability. These are also very popular in high-performance environments for customization to suit different applications due to their compatibility with various resin systems. Furthermore, the development of shell design is still aimed at expansion control, which is expected to bolster the market leadership of PAE in the coming years.

Polyvinyl acetate (PVA) segment is expected to grow at the fastest CAGR in the coming years, accounting for 8.8% CAGR, owing to its excellent dispersion and adhesion properties in water-based formulations. PVA microspheres are easy to incorporate into coats, adhesives, and laminates that provide a superior surface texture and bonding performance. Moreover, the new uses in biodegradable polymers, functional coatings, and specialty adhesives are expected to further boost PVA.

Application/End Use Insights

Why Is Automotive The Dominant Application In The Expandable Microspheres Market?

The automotive segment dominated the expandable microspheres market in 2025, accounting for an estimated 38.6% market share. Due to the intense focus on lightweighting and fuel efficiency measures. The automobile manufacturing growth is projected to have a slight year-on-year growth to about 89.6 million light vehicles sold around the world in 2025. This favors the introduction of material advancement in manufacturing. Manufacturers incorporate expandable microspheres into interior panels, door trims, and bumpers. This minimizes the mass of the parts without compromising their strength and stiffness when loading. OEM engineers are taking advantage of closed-cell microsphere composite to enhance thermal insulation of cabin components at the expense of comfort and energy performance. Furthermore, the Trends of electrification also insist on the use of lightweight materials, thus creating an upward pressure on demand for density-reducing additive solutions, including expandable microspheres.

Sports & leisure segment is expected to grow at the fastest rate in the coming years, accounting for an 8.9% CAGR of the expandable microspheres market, propelled by robust consumer demand for high-performance, lightweight products. The industry data concerning sportswear markets reveals that the world sports equipment and apparel industries are still growing in the coming years. The number of people involved in organized and recreational activities increases in North America and the Asia Pacific, thus favouring the high-level material technologies in sports equipment. Moreover, the continued R&D focus on lightweighting, material resilience, and enhanced user comfort is projected to sustain rapid growth in this segment.

End-User Industry Insights

Why Are Paints & Coatings the Dominant End-User Industry?

Paints & Coatings segment held the largest revenue share in the expandable microspheres market in 2025, holding a market share of about 43.4%, driven by their need for texture control, insulation, and reduced density. Microspheres enhance the smoothness of the surface and sag resistance in architectural and industrial finishes. Polymer science research reveals that integration of closed-cell microspheres reduces thermal conductivity while enhancing abrasion resistance in high-performance coatings. Expandable microspheres are becoming more specified when used by paint formulators to reduce volatile organic compounds without affecting their rheological performance. Moreover, the growth in infrastructure renovation and protective coatings for steel and concrete is expected to sustain heavy usage of microsphere-enhanced coating systems.

Plastic segment is expected to grow at the fastest CAGR in the coming years, accounting for 9% CAGR, owing to the demand for lightweight, high-performance polymer parts in various industries. Microspheres decrease part density and increase dimensional stability of complex molded thermoplastics and are useful in automotive and industrial applications. Additionally, there are emerging interests in using microsphere-modified plastics in housing medical devices and consumer products, in which the weight-versus-strength ratio is critically important.

Regional Insights

How Big is the North America Expandable Microspheres Market Size?

The North America expandable microspheres market size is estimated at USD 1.34 billion in 2025 and is projected to reach approximately USD 3.66 billion by 2035, with a 10.57% CAGR from 2026 to 2035.

Why Is North America the Dominant Region in the Expandable Microspheres Market Demand?

North America led the expandable microspheres market in 2025, capturing an estimated 40.4% market share, driven by strong adoption across automotive coatings, specialty composites, and industrial applications where weight reduction and thermal insulation are critical performance requirements. In the automotive sector, expandable microspheres are increasingly used in interior and exterior coatings, sealants, and molded components to reduce material density while maintaining surface quality and mechanical integrity. Similar demand patterns are visible in industrial formulations and specialty composites, where manufacturers prioritize lightweight structures, improved insulation, and controlled surface textures to meet performance and efficiency targets.

The region's strong manufacturing foundation further supports widespread application of expandable microspheres in construction materials and textured finishes. North America benefits from close collaboration between material producers, downstream manufacturers, and academic research institutions, enabling continuous improvement in microsphere chemistry, expansion behavior, and compatibility with different matrices. Investments in advanced materials research at both industry and university laboratories are supporting development of next-generation microspheres with improved expansion control, durability, and processing stability, reinforcing adoption across coatings, construction products, and high-performance industrial materials.

What is the Size of the U.S. Expandable Microspheres Market?

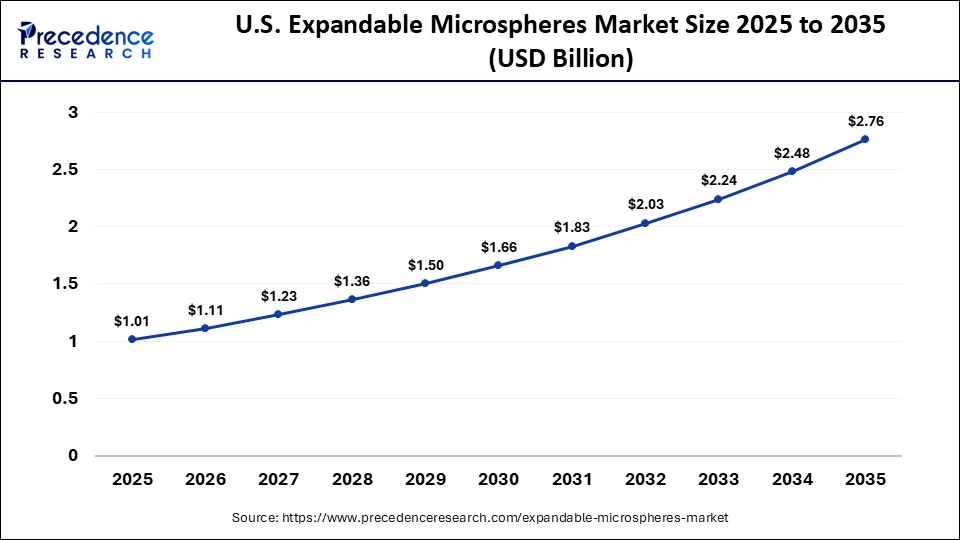

The U.S. expandable microspheres market size is calculated at USD 1.01 billion in 2025 and is expected to reach nearly USD 2.76 billion in 2035, accelerating at a strong CAGR of 10.58% between 2026 and 2035.

U.S. Leads North America in Expandable Microsphere Adoption

The U.S. is a major player in the market due to robust industrial and automotive demand. The use of expandable microspheres that enhance energy efficiency and emissions reduction is increasing, with manufacturers adding expandable microspheres to lightweight composites, insulation, and interior vehicle parts. Microsphere-based thermal protection and vibration-damping coatings are also being applied in aerospace and defense assemblies. The supply chains developed in North America and the mature polymer production infrastructure further strengthen market leadership. Federal sustainability and materials-efficiency initiatives in the United States are accelerating qualification of microsphere-enabled formulations for lightweighting and insulation across regulated sectors. In parallel, close coupling between OEMs and specialty polymer suppliers is shortening validation cycles for new grades tailored to automotive, aerospace, and industrial specifications.

What Is Driving Asia Pacific as the Fastest Growing Regional Expandable Microspheres Market?

Asia Pacific is anticipated to grow at the fastest rate in the expandable microspheres market during the forecast period, accounting for 10% CAGR, driven by rapid industrialization and the expansion of automotive, electronics, and construction sectors. Large-scale polymer production centers in China and India are accelerating adoption of hollow particle additives in lightweight composites, insulation panels, sealants, and coatings, where cost efficiency and material performance optimization are critical. In automotive manufacturing, microspheres are increasingly incorporated into interior components, underbody coatings, and structural fillers to achieve weight reduction and improved thermal and acoustic performance.

Capacity expansions and targeted investments in R&D during 2025 strengthened Asia Pacific's role in materials innovation, particularly in developing multifunctional composites that combine lightweighting, insulation, and surface texture control. Regional manufacturers and research institutions are focusing on tailoring microsphere grades for compatibility with local polymer systems and high-volume processing conditions used in construction materials and electronics encapsulation. This ongoing integration of expandable microspheres into advanced composite formulations is being driven by production-scale requirements and application-specific performance needs rather than experimental adoption.

China Drives Rapid Growth in Asia-Pacific Expandable Microspheres Market

China is leading the charge in the Asia Pacific market, owing to the rapid expansion of its manufacturing industry and strong downstream demand. Microspheres with controlled expansion properties are widely used in lightweight panels, insulation systems, and textured coatings across automotive and construction applications. Local chemical firms have invested in large-scale production lines for polyacrylic ester and polyvinyl acetate microspheres to meet rising domestic consumption.

Government-backed industrial upgrading programs in China are encouraging adoption of advanced lightweight fillers to improve material efficiency in high-volume manufacturing. At the same time, closer collaboration between domestic polymer producers and construction material manufacturers is accelerating qualification of microspheres for standardized building and automotive formulations.

How Is Europe Notably Growing as a Key Market for Expandable Microspheres?

The Europe region is expected to hold a notable revenue share in the expandable microspheres market, driven by stringent environmental standards and widespread adoption of sustainable material solutions. Regulatory pressure across the European Union is encouraging manufacturers to reduce material intensity, improve insulation performance, and lower lifecycle emissions, which has increased the use of hollow polymer fillers in coatings, construction materials, and industrial formulations. According to manufacturing data published by Eurostat, production of advanced materials has been rising steadily, with particularly strong gains observed in Germany, France, and the United Kingdom, where materials innovation is closely tied to sustainability targets.

Within the region, chemical formulators are increasingly incorporating expandable microspheres to enhance thermal insulation, reduce density, and improve surface durability in coatings and composite systems. These materials are being tailored for applications such as weather-resistant architectural coatings, lightweight construction panels, and specialty industrial finishes that must perform under variable climatic conditions. Collaboration between chemical manufacturers and research institutes across Europe is supporting application-specific optimization of microsphere chemistry, including control over expansion temperature, particle size distribution, and compatibility with local resin systems used in regionally regulated markets.

Germany Strengthens Europe's Demand for Advanced Microsphere Solutions

Germany leads the expandable microspheres market in Europe, driven primarily by strong demand from automotive manufacturing and specialty coating applications. German manufacturers have optimized the use of expandable microspheres in thermoplastic composites to achieve weight reduction, improved thermal insulation, and enhanced surface texture in industrial components and infrastructure-related materials. In automotive applications, microspheres are increasingly incorporated into interior parts, underbody coatings, and structural fillers to support lightweighting objectives while maintaining mechanical performance and surface quality. Growth is further supported by increasing use of microspheres in renewable energy materials, particularly in lightweight composite structures used for wind turbine components and auxiliary systems.

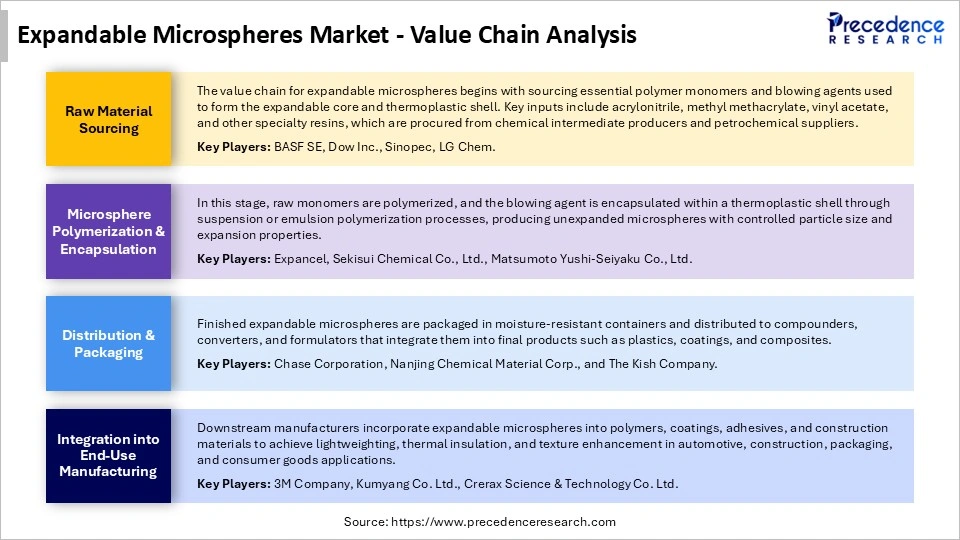

Expandable Microspheres Market Value Chain

Expandable Microspheres Market Companies

- 3M Company

- AkzoNobel N.V.

- Bublon GmbH

- Chase Corporation

- Chinasinno Chemical Co. Ltd.

- Crerax Science & Technology Co. Ltd.

- Dennert Poraver GmbH

- Kumyang Co. Ltd.

- Kureha Corporation

- Matsumoto Yushi-Seiyaku Co., Ltd.

- Nanjing Chemical Material Corp.

- Nouryon/Expancel

- Sekisui Chemical Co., Ltd.

- The Kish Company

- Trelleborg AB

Recent Developments

- In April 2025, Nouryon unveiled Expancel WB microspheres at the 2024 Chinaplas exhibition in Shanghai, China, marking an innovation in expandable microspheres for white shoe sole applications in the clothing and apparel industry. The launch responds to growing consumer demand for white shoe soles, enabling manufacturers to enhance performance and comfort without compromise.(Source: https://www.nouryon.com)

- In April 2025, Terumo Europe N.V. introduced BioPearlTM microspheres, the first resorbable drug-eluting microspheres. This advancement strengthens TACE therapeutic options by combining proven drug-eluting microsphere technology with the benefits of a resorbable agent, reflecting the company's commitment to innovation in minimally invasive treatments.(Source: https://www.terumo-europe.com)

- In September 2025, Varian, a Siemens Healthineers company, announced that its Embozene microspheres received CE Marking for Genicular Artery Embolisation (GAE) to treat knee osteoarthritis. This regulatory milestone positions Embozene as the first embolic agent specifically approved for GAE, supporting targeted inflammation control and pain relief in affected patients.(Source: https://www.varian.com)

Segments Covered in the Report

By Type

- Dry

- Wet

By Polymer Type

- Polyacrylic Ester (PAE)

- Polyvinyl Acetate (PVA)

- Vinyl Acetate Ethylene (VAE)

By Application/End Use

- Automotive

- Construction

- Consumer Goods

- Sports & Leisure

- Others (Packaging, Textile)

By End-User Industry

- Paints & Coatings

- Plastics

- Rubber

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting