What is Flash Chromatography Market Size?

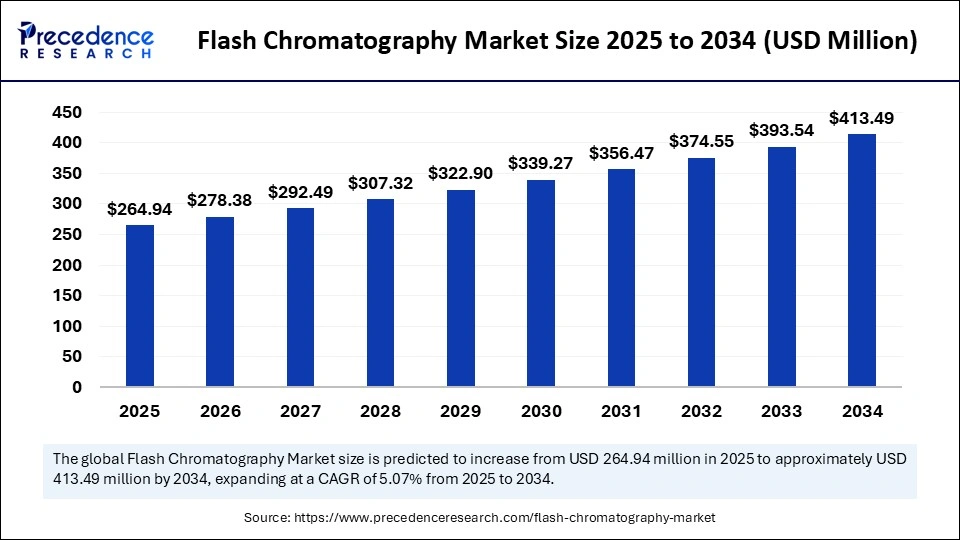

The global flash chromatography market size was calculated at USD 264.94 million in 2025 and is predicted to increase from USD 278.38 million in 2026 to approximately USD 413.49 million by 2034, expanding at a CAGR of 5.07% from 2025 to 2034. The market stands as a cornerstone of modern separation science, enabling swift and efficient purification of chemical mixtures in laboratories worldwide.

Market Highlights

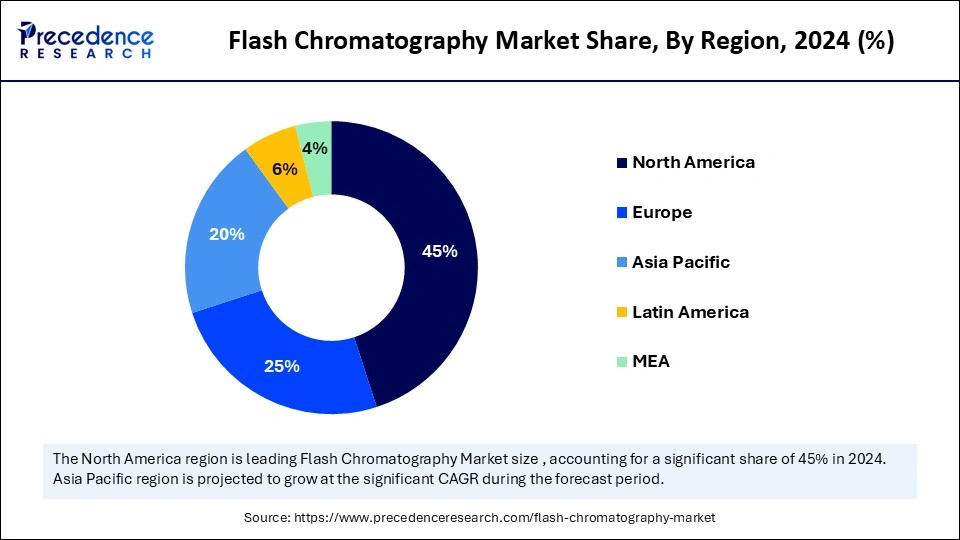

- By region, North America dominated the market, holding the largest market share of 45% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

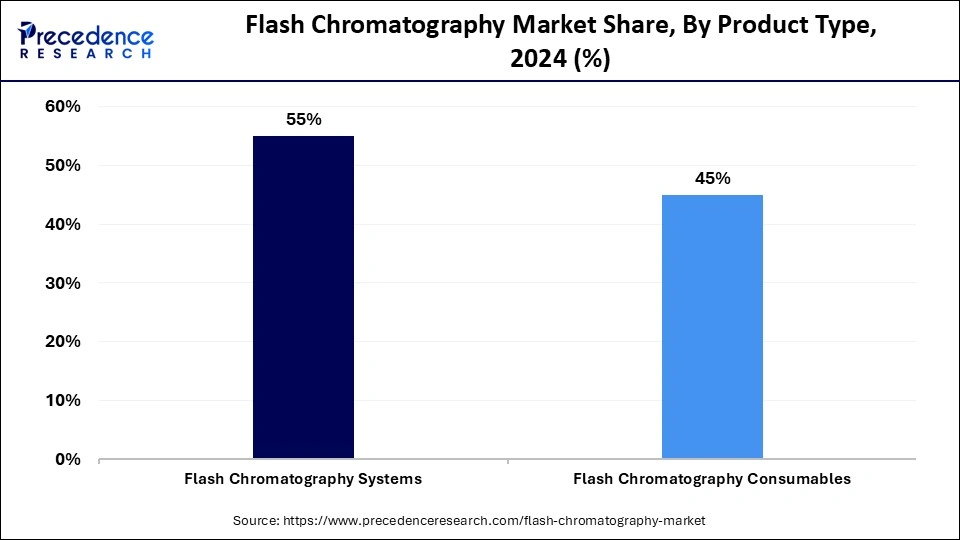

- By product type, the flash chromatography systems segment held the largest market share of 55% in 2024.

- By product type, flash chromatography consumables is growing at a strong CAGR between 2025 and 2034.

- By applications, the pharmaceuticals segment held the largest market share of 50% in 2024.

- By applications, biotechnology devices segments is growing at a notable CAGR between 2025 and 2034 in the flash chromatography market.

- By end-user, the pharmaceutical companies segment held the largest market share of 50% in 2024.

- By end-user, biotechnology companies segment is poised to grow at the fastest CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 264.94 Million

- Market Size in 2026: USD 278.38 Million

- Forecasted Market Size by 2034: USD 413.49 Million

- CAGR (2025-2034): 5.07%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Flash Chromatography Market?

Flash chromatography is a rapid, preparative liquid chromatography technique used to separate and purify chemical compounds. Unlike traditional gravity-fed column chromatography, flash chromatography utilizes compressed gas or a pump to push solvent through a column, providing faster flow rates and more efficient separations. This method employs smaller silica gel particles and higher pressure (typically between 50–200 psi) to accelerate the separation process. Flash chromatography is widely used in various applications, including pharmaceutical research and development, biochemistry, natural product isolation, and analytical chemistry.

The growth in the flash chromatography sector has been nothing short of meteoric, driven by the relentless pursuit of purity and efficiency in compound isolation. The technology's evolution from manual setups to automated, software-guided instruments has transformed bench chemistry into a high-throughput, reproducible process. With applications spanning pharmaceuticals, natural product extraction, and polymer research, the market continues to expand across scientific domains. Additionally, the rise of contract research organizations (CROs) and small biotech firms has amplified demand for scalable purification systems. Miniaturization and modular system design have further democratized access to advanced chromatography. In essence, the market reflects a marriage between precision engineering and chemical artistry, propelling laboratories into a new era of speed and sophistication.

Flash Chromatography Market: Market Outlook

- Industry Growth Overview: The industry's expansion is orchestrated by the convergence of automation, miniaturization, and eco-efficient solvent use. Academic institutions, research labs, and industrial entities are adopting flash systems to accelerate synthesis-to-purity workflows. Manufacturers are increasingly focusing on compact, user-friendly systems with high reproducibility. Moreover, rising collaborations between analytical equipment makers and life science innovators are accelerating technological diffusion. The flourishing of biosimilars and peptide therapeutics has particularly bolstered the chromatography domain.

- Sustainability Trends: Sustainability has transcended rhetoric to become a measurable target in chromatography operations. Solvent recycling systems, low-toxicity eluents, and reduced solvent consumption modules are redefining the ecological footprint of purification labs. Green chemistry integration within flash chromatography workflows underscores a growing awareness of environmental stewardship. Companies are developing biodegradable stationary phases and energy-efficient systems to minimize waste and carbon emissions. This paradigm shift signals the market's alignment with global sustainability mandates.

- Major Investors: Global analytical technology giants, along with venture-backed instrumentation startups, are pouring investments into refining flash chromatography systems. The focus is on automation, smart interfaces, and AI-enabled predictive analysis tools. Private equity firms are recognizing the profitability in this niche, funding innovations that enhance throughput and reproducibility. These investments are not merely financial injections but strategic collaborations designed to fuel long-term technological transformation.

- Startup Economy: A vibrant startup ecosystem surrounds the flash chromatography sector, with young innovators reimagining purification through compact, cloud-connected devices. These enterprises are breaking barriers with cost-effective, customizable systems catering to academic and industrial chemists alike. Their agility allows rapid prototyping and adaptation to user feedback, an attribute often elusive to larger corporations. The convergence of chemical engineering, data science, and sustainable design defines this new entrepreneurial spirit

Key Technological Advancements in the Flash Chromatography Market

Automation, digital control, and Artificial Intelligence-powered analytics constitute the most profound technological metamorphosis in flash chromatography. Systems now possess the intelligence to self-adjust flow rates, predict fraction purity, and reduce solvent use autonomously. The infusion of real-time monitoring and smart sensors ensures reproducibility across laboratories. This shift marks a transition from operator-dependent purification to algorithm-driven precision, setting new benchmarks in analytical efficiency.

Market Key Trends in Flash Chromatography Market

- Integration of AI and data analytics for predictive purification outcomes

- Growth in portable and modular flash systems for on-field and decentralized labs

- Rising demand for eco-friendly solvents and recyclable cartridges

- Expanding applications in peptide synthesis, polymer chemistry, and nutraceuticals

- Enhanced workflow automation through touch-screen and cloud-based interfaces

Flash Chromatography Market Value Chain Analysis

- Raw Material Sources: Key raw materials such as silica gel, bonded phases, and organic solvents are primarily derived from chemical manufacturers specializing in analytical-grade purity. The stability and quality of these materials directly influence the system's efficiency and reproducibility.

- Technology Used: Flash chromatography employs differential adsorption principles coupled with gradient elution. Modern systems integrate UV, ELSD, and MS detectors for real-time purity assessment, alongside microprocessor-controlled pumps for precise solvent flow.

- Investment by Investors: Investors are channeling funds into automation, digital user interfaces, and AI-integrated chromatography modules. The focus lies on reducing purification time, improving reproducibility, and enhancing data connectivity across global research facilities.

- AI Advancements: Artificial Intelligence is revolutionizing flash chromatography through predictive modeling and automated decision-making. Algorithms now anticipate optimal solvent gradients and adjust system parameters dynamically, ushering in a new era of intelligent purification.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 264.94 Million |

| Market Size in 2026 | USD 278.38 Million |

| Market Size by 2034 | USD 413.49 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application,Service Model,End-user Industry,Deployment Model, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product type Insights

Why Are Flash Chromatography Systems Dominating the Flash Chromatography Market?

Flash chromatography dominates the market, holding a 55% share and serving as the technological nucleus of modern purification operations. These systems, equipped with automated gradient control, intelligent detectors, and user-friendly software, epitomize precision and productivity. Their dominance stems from the rising need for reproducibility, speed, and scalability in laboratory workflows. Pharmaceutical and academic institutions alike prioritize these instruments for their ability to deliver high-quality separations within compressed timelines. The integration of digital analytics and intuitive touch interfaces has transformed them into indispensable laboratory companions. Ultimately, they embody the confluence of chemistry, computing, and convenience, an alliance driving the industry's efficiency paradigm.

The growing sophistication of system design continues to redefine purification standards globally. Manufacturers are investing heavily in modular, portable, and AI-integrated systems that optimize solvent use and minimize human intervention. The evolution from manual columns to fully automated instruments has democratized access to high-end purification tools. Their versatility, supporting both small-scale synthesis and large preparative separations, further cements their leadership position. Moreover, systems that facilitate real-time data monitoring and error prediction have made quality control more proactive than reactive. Thus, flash chromatography systems not only dominate by market share but also by innovation and impact.

Flash chromatography consumables are the fastest-growing segment in the flash chromatography market, holding a 45% share. Columns, cartridges, stationary phases, and solvents are the recurring components that sustain continuous operations. With increasing experimentation volumes and a rising emphasis on precision, demand for high-quality consumables has surged. The trend towards customized column chemistries tailored for specific compounds further amplifies this growth. Laboratories now seek consumables that offer higher capacity, durability, and solvent compatibility, reinforcing their indispensable role in analytical and preparative workflows.

The consumables segment thrives on innovation, sustainability, and accessibility. Manufacturers are focusing on eco-friendly cartridge materials and recyclable components to align with green laboratory initiatives. Shorter run times and improved separation efficiencies have prompted greater replacement frequency, fuelling consistent market expansion. As laboratories diversify their analytical capabilities, specialized stationary phases such as silica, alumina, and polymer-based media are gaining traction. Additionally, the availability of affordable yet high-performance consumables has lowered entry barriers for smaller research institutions. This dynamic evolution ensures that consumables remain the pulse of the flash chromatography ecosystem.

Application Insights

Why Are Pharmaceuticals Dominating the Flash Chromatography Market?

The pharmaceuticals dominate the flash chromatography market, holding a 55% share. The technique's ability to purify complex mixtures rapidly and reproducibly makes it an essential tool in drug discovery and development. From synthesis to quality control, flash chromatography ensures that every compound meets stringent purity benchmarks. The rising demand for novel APIs, generic formulations, and biosimilars further intensifies its use across research pipelines. Automation and real-time detection technologies enable seamless integration into pharmaceutical laboratories, driving workflow efficiency and regulatory compliance.

Pharma's dependence on this technology extends across discovery, process development, and scale-up operations. High-throughput systems facilitate the simultaneous purification of multiple intermediates, which is crucial for accelerating R&D timelines. The growing shift towards small molecule innovation and peptide-based drugs enhances the need for adaptable purification systems. Furthermore, the industry's emphasis on data integrity and reproducibility has made automated flash chromatography a trusted standard. The marriage of precision and productivity ensures that pharmaceuticals will continue to anchor the market's revenue foundation for years ahead.

Biotechnology is the fastest-growing sector in the flash chromatography market, holding a 20% share. As the biotech industry pivots toward advanced biomolecules, peptides, and natural extracts, purification becomes a critical bottleneck. Flash chromatography offers a swift and efficient solution, supporting high-purity isolations for biologically derived compounds. The technology's adaptability to both organic and aqueous systems makes it ideal for biotechnological research. Increasing collaborations between biopharma startups and research institutes amplify this adoption, reflecting a clear shift toward flexible, scalable purification technologies.

The rising prominence of synthetic biology, proteomics, and metabolomics research accelerates the sector's growth. Biotech firms are leveraging automated flash systems to enhance reproducibility and reduce purification turnaround times. Portable and compact units now enable benchtop operations even in smaller labs, democratizing access to advanced purification. The ability to handle complex biomolecule separations with minimal denaturation marks a significant leap in technology's capability. Additionally, the convergence of AI-based prediction tools is optimizing purification parameters for biotech workflows. As the frontier of life sciences expands, biotechnology will remain the market's most promising growth catalyst.

End-User Insights

Why Are Pharmaceutical Companies Dominating the Flash Chromatography Market?

The pharmaceutical companies dominate the flash chromatography market, holding a 50% share, due to their reliance on its unrivaled capacity to streamline purification in drug synthesis and validation stages. The technology ensures consistency, speed, and compliance with global quality standards, attributes vital to pharmaceutical innovation. Large enterprises invest heavily in high-throughput systems that integrate automation and data management, ensuring flawless reproducibility. The emphasis on process optimization and rapid screening further reinforces its centrality in pharmaceutical research and manufacturing.

The dominance of this segment is further enhanced by regulatory mandates demanding stringent impurity profiling. As companies pursue accelerated drug development cycles, flash chromatography becomes a critical enabler for achieving time-bound objectives. Many pharmaceutical giants are upgrading to smart chromatography systems capable of predictive maintenance and solvent efficiency optimization. The incorporation of digital analytics allows seamless tracking and validation of purification data. With the global expansion of generics and biosimilars, these systems play a pivotal role in ensuring cost efficiency and quality assurance. Hence, pharmaceutical companies remain both the largest consumers and technological drivers of the market.

The biotechnology companies are the fastest growing in the flash chromatography market, holding the share of 20%, due to their research intensity and focus on complex biological compounds necessitate reliable, adaptive purification platforms. The rise of therapeutic peptides, enzymes, and natural biomolecules has expanded the role of flash chromatography in biotech labs. Compact, automated systems with real-time detection empower researchers to handle intricate separations with minimal manual intervention. The adaptability of flash systems to diverse solvents and compound classes enhances operational versatility in biotechnology R&D.

This growth is further accelerated by the proliferation of biotech startups and research collaborations across academic and private sectors. These organizations value affordability, ease of use, and data integration—all hallmarks of modern flash chromatography. Advances in microfluidic technology and gradient optimization have further improved efficiency for delicate biomolecule purification. Moreover, biotech companies increasingly utilize cloud-connected systems for data sharing and remote monitoring—an innovation perfectly aligned with their agile research culture. As biotechnology continues to redefine healthcare frontiers, flash chromatography stands poised as its most dependable ally in the pursuit of molecular precision.

Regional Insights

U.S. Flash Chromatography Market Size and Growth 2025 to 2034

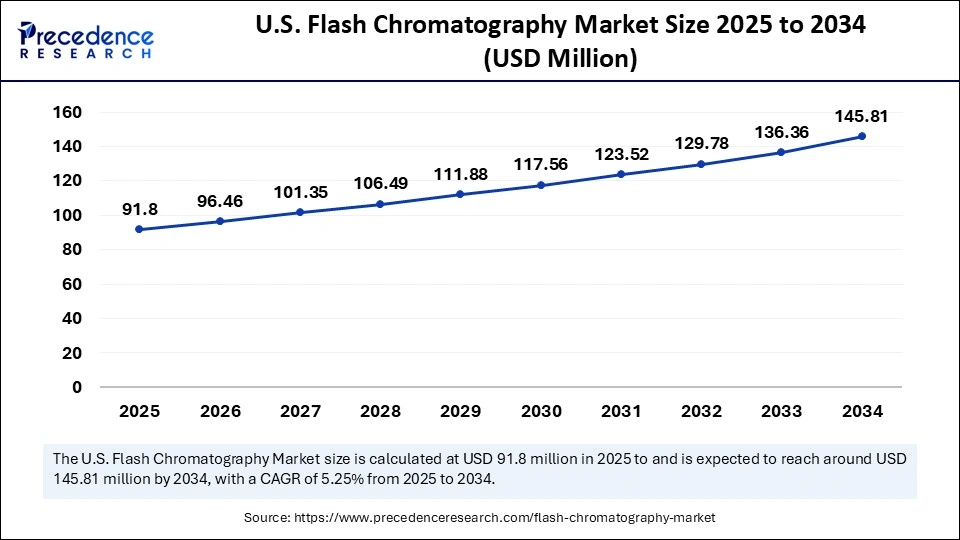

The U.S. flash chromatography market size was exhibited at USD 91.8 million in 2025 and is projected to be worth around USD 145.81 million by 2034, growing at a CAGR of 5.25% from 2025 to 2034.

Why Does North America Lead the Flash Chromatography Market?

North America held a dominant share in the flash chromatography market, holding 45%, owing to its robust pharmaceutical and biotechnology landscape. The region houses the highest concentration of R&D facilities, CROs, and instrument manufacturers. The U.S., in particular, spearheads innovation with a culture of early technology adoption and academic-industrial collaboration. Government funding and venture capital inflows further accelerate market evolution. Stringent regulatory norms also necessitate high-purity standards, amplifying demand for advanced purification technologies. The integration of AI, automation, and sustainable solvents defines the region's modern research ethos.

Can the U.S. be the Innovation Outpace Regulation?

The U.S. continues to dominate due to a flourishing biopharmaceutical sector and the presence of major chromatography solution providers. Its universities and biotech hubs drive the continuous refinement of purification workflows. Federal initiatives supporting analytical instrumentation innovation sustain the region's global leadership. The convergence of automation, sustainability, and AI ensures the nation remains the epicenter of chromatographic advancement.

Does Asia Pacific Horizon Define the Future of Separation Science?

Asia Pacific is the fastest-growing region in the flash chromatography market, holding a 20% share, driven by a surge in pharmaceutical manufacturing and research investments. Nations such as China, India, and South Korea are rapidly modernizing their laboratory infrastructures. Growing contract manufacturing and drug discovery activities necessitate efficient purification systems. The cost advantage in production and labor fuels the large-scale deployment of flash chromatography instruments. Academic institutions are also embracing these systems for curriculum and research integration, expanding the regional market footprint.

Can Innovation and Affordability Coexist in India?

India's flash chromatography landscape thrives on its synthesis-driven pharmaceutical and biotech sectors. The proliferation of small-scale research firms and generics manufacturers stimulates consistent demand. Local manufacturing of consumables and columns reduces costs, democratizing access to purification technology. With the government's focus on R&D innovation and startup incentives, India is poised to become a pivotal hub for chromatography advancement in Asia.

Is European Tradition Meeting Technological Transcendence?

Europe is notably growing in the flash chromatography market, holding a share of 25%, blending its deep scientific heritage with modern innovation. The continent's regulatory focus on product quality and environmental safety enhances chromatography adoption. Germany, Switzerland, and the U.K. lead in instrument manufacturing and sustainable solvent use. European firms are emphasizing solvent recovery systems and green chemistry integration. Collaborations between academia and industry foster continuous methodological evolution, ensuring Europe's steady ascent in this sector.

Will Germany, the well-known engineering excellence, continue to define Europe's Edge?

Germany's reputation for precision engineering finds perfect resonance in flash chromatography innovation. Its well-established pharmaceutical and chemical industries prioritize reliability and accuracy in purification. The nation's research programs in analytical sciences and green technologies further bolster adoption. With sustainable materials and automation at the forefront, Germany continues to symbolize Europe's technological prowess in the chromatography landscape.

Top Flash Chromatography Market Companies

- Biotage AB: Biotage is a global leader in automated flash chromatography and purification systems, offering scalable, high-throughput solutions for synthetic and natural product chemistry. Its flagship systems, such as Isolera™ and Selekt, combine intuitive software, smart gradient optimization, and environmental sustainability, serving pharmaceutical, biotech, and academic R&D sectors.

- Teledyne Isco: Teledyne Isco revolutionized the market with its CombiFlash line, setting benchmarks in automation, reproducibility, and sample purity. The company's focus on high-efficiency solvent management, intuitive touchscreen interfaces, and wide detection capabilities makes it a preferred choice for organic synthesis and purification workflows.

- Agilent Technologies: Agilent provides integrated purification and flash chromatography solutions designed to streamline compound isolation and purification processes. By combining precision flow control, scalable platforms, and software-driven automation, Agilent enhances productivity in drug discovery and analytical chemistry labs

- Waters Corporation:Waters brings decades of expertise in liquid chromatography and purification technologies, offering seamless integration between analytical LC and preparative flash systems. Its purification platforms feature high-resolution separations and robust scalability, addressing the needs of pharmaceutical, food, and environmental laboratories.

- Thermo Fisher Scientific: Thermo Fisher delivers high-performance flash chromatography systems supported by an extensive range of columns, media, and purification consumables. The company's modular and customizable systems enable reliable compound isolation, reduced solvent use, and superior reproducibility, aligning with its focus on analytical excellence and sustainability.

Other Companies in the Market

- Waters Corporation: Specializes in chromatography and purification technologies, offering robust systems that bridge analytical and preparative workflows for pharmaceutical and life science applications.

- Shimadzu Corporation: Offers comprehensive chromatography solutions, including automated flash and preparative systems, focused on efficiency, reproducibility, and scalability in compound isolation.

- BÜCHI Labortechnik AG: Produces reliable and user-friendly flash chromatography instruments, recognized for seamless integration with rotary evaporation and purification workflows in R&D labs.

- Grace Davison Discovery Sciences: Offers silica-based purification media and flash chromatography columns, serving academic and industrial chemical research sectors globally.

- Gilson Inc.: Manufactures automated purification and liquid handling systems, combining flash chromatography with fraction collection and sample tracking capabilities.

- Axel Semrau GmbH & Co. KG:Specializes in custom chromatography automation solutions, integrating flash purification into analytical workflows for chemical and pharmaceutical applications.

- VWR International LLC: Distributes a wide range of flash chromatography consumables, instruments, and accessories, catering to research, quality control, and analytical laboratories worldwide.

- Altmann Analytik GmbH & Co. KG: Supplies chromatography consumables and media, offering flexible and high-quality solutions for preparative and analytical purification needs.

- MZ-Analysentechnik GmbH: Focuses on chromatography columns, stationary phases, and flash purification media, providing specialized solutions for laboratory and industrial applications.

- dichrom GmbH:A European distributor offering flash chromatography systems and consumables, emphasizing cost-effective and reliable purification technologies.

- Orochem Technologies Inc.: Develops innovative flash chromatography media and cartridges, with a focus on high-capacity and high-efficiency separation technologies.

- Santai Science: Known for its SepaBean™ Flash Chromatography Systems, Santai Science provides advanced AI-assisted purification systems optimized for academic and industrial R&D.

- Restek Corporation: Supplies chromatography consumables, columns, and sample prep tools, ensuring high reproducibility and performance across flash and preparative workflows.

- Phenomenex Inc.:Offers high-quality purification media and flash chromatography cartridges, leveraging proprietary silica technologies for superior separation performance.

- Sartorius AG: Provides lab-scale purification systems and filtration solutions, integrating chromatography-based purification into bioprocessing and pharmaceutical workflows.

- MilliporeSigma:A leading provider of flash chromatography consumables, resins, and purification solutions, supporting chemical synthesis, life science, and analytical laboratories.

Recent Developments

- In October 2025, Gujarat University received a grant of â‚ą10 crore under the Pradhan Mantri Uchchatar Shiksha Abhiyan (PM-Usha) to enhance its research infrastructure. The funding will be used to acquire advanced scientific instruments for various science departments, empowering students and faculty to carry out cutting-edge research within the university premises. (Source: https://timesofindia.indiatimes.com)

- In October 2025, Following the deaths of 23 children in Madhya Pradesh including 20 from Chhindwara after consuming Coldrif cough syrup contaminated with the toxic chemical diethylene glycol (DEG), the Drugs Controller General of India (DCGI) on Friday mandated compulsory testing for both diethylene glycol (DEG) and ethylene glycol (EG) in all raw materials and finished pharmaceutical products.

Segments Covered in the Report

By Product type

- Flash chromatography systems

- Automated Systems

- Semi-Automated Systems

- flash chromatography consumables

- Columns

- Solvents & Reagents

- Accessories

By Application

- Pharmaceuticals

- Drug Discovery

- Drug Purification

- biotechnology

- Protein Purification

- Peptide Isolation

- Academic & Research Institutes

- Food & Environmental Testing

By End-User

- pharmaceutical companies

- biotechnology companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content