What is the In-Dash Navigation System Market Size?

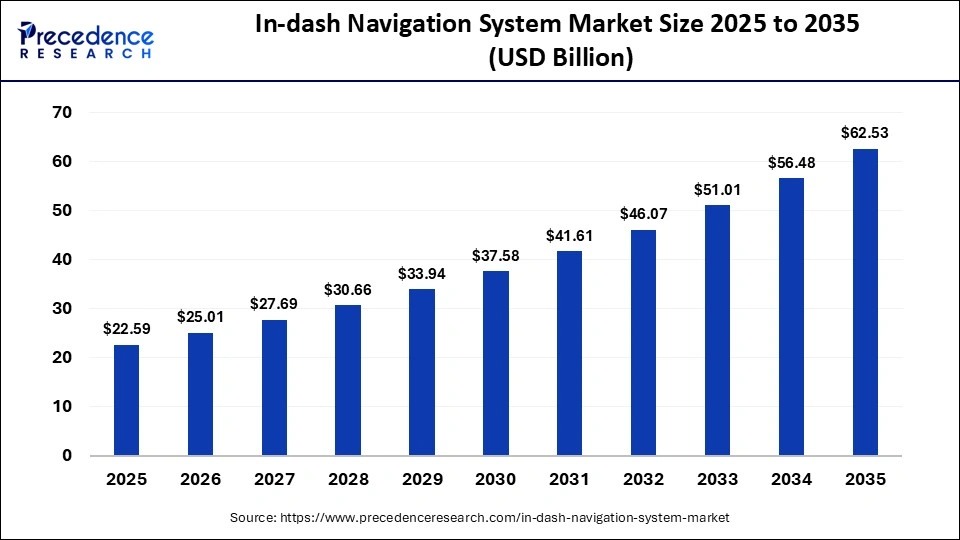

The global in-dash navigation system market size accounted for USD 22.59 billion in 2025 and is predicted to increase from USD 25.01 billion in 2026 to approximately USD 62.53 billion by 2035, expanding at a CAGR of 10.72% from 2026 to 2035. The market for in-dash navigation systems is driven by growing adoption of connected vehicles and integrated infotainment systems.

Market Highlights

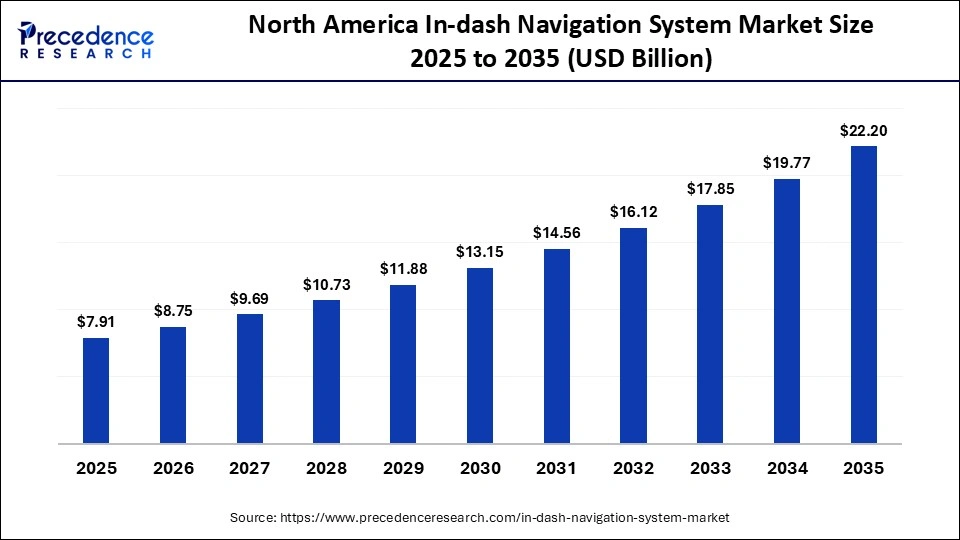

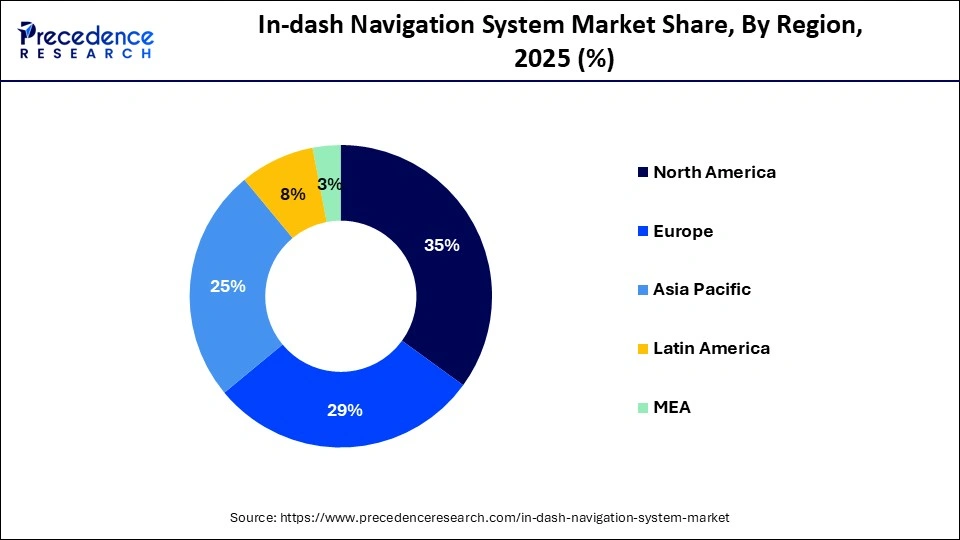

- North America dominated the market, holding the largest market share of 35% in 2025.

- The Asia Pacific is expected to grow at a strong CAGR of 15.50% between 2026 and 2035.

- By system type, the built-in / OEM in-dash navigation systems segment held the major market share of 60% in 2025.

- By system type, the integrated infotainment navigation systems segment is expected to grow at a strong CAGR of 13.60% between 2026 and 2035.

- By vehicle type, the passenger car treatment settings segment accounted for the highest market share of 55% in 2025.

- By vehicle type, the electric vehicles segment is growing at a remarkable CAGR of 15% between 2026 and 2035.

- By technology, the map-based GPS navigation segment captured the highest market share of 48% in 2025.

- By technology, the real-time connected & AI-assisted navigation segment is expected to grow at a healthy CAGR of 16% between 2026 and 2035.

- By display type, the touchscreen displays segment contributed the biggest market share of 70% in the market during 2025.

- By display type, the heads-up display integrated navigation is set to grow at a solid share of 18% CAGR between 2026 and 2035.

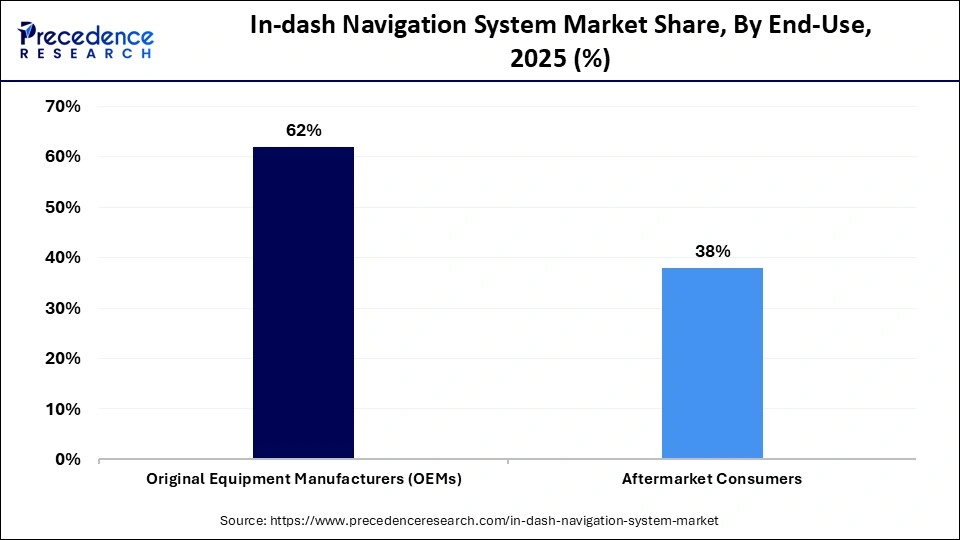

- By end-use, the OEM segment held the major market share of 62% of the market in 2025.

- By end-use, the aftermarket integration segment is expanding at a notable 14% CAGR between 2026 and 2035.

Navigating the Future of Mobility: Innovation Shaping the In-Dash Navigation System Market

The global in-dash navigation systems market includes embedded navigation systems that are built into passenger cars, light commercial vehicles, heavy commercial vehicles, and specialty cars. The fundamental features of these systems include GPS-based positioning to follow the route, real-time traffic, lane-level navigation, points of interest, and voice-assisted directions. With the increasing softwareization of vehicles, in-dash navigation systems are increasingly becoming the focus of connected mobility and smart driving.

The development of the market is facilitated by increasing consumer demand for real-time, precise, and user-friendly navigation and by the rapid spread of smart car and autonomous vehicle technologies. With the growing number of vehicles being manufactured globally, particularly the electric and semi-autonomous vehicles, the adoption of sophisticated navigation systems is currently accelerating. Increased safety standards, rising traffic and congestion in cities, and the need to design hands-free and voice-recognition driving systems are also contributing to the growth of the markets.

Key AI Integration in the In-Dash Navigation System Market

Artificial intelligence will enhance real-time analysis of optimal routes, road conditions, traffic trends, weather, and driver tendencies to enable predictive and dynamic navigation. AI-powered voice assistant applications improve natural language processing, so one can type the destination without touching the screen, and it can decide what to do based on context and provide real-time machine learning to improve map accuracy and route options.

Artificial intelligence in electric vehicles enables efficient real-time navigation that accounts for battery capacity, charging station availability, and driving habits. With vehicles shifting to software defined and self-driving systems, AI-based in-dash navigation systems are becoming more than simple guidance systems; they are intelligent mobility management systems.

In-Dash Navigation System Market Outlook

- Industry Growth Overview: The market is experiencing growth, as more is being integrated through the use of navigation, infotainment, ADAS, and connected vehicle platforms. The need for real-time traffic intelligence and in-vehicle user experience is on the rise, which reinforces adoption.

- Global Expansion: growth is increasing in North America, Europe, and the Asia Pacific due to the high levels of vehicle manufacturing and connected cars that have penetrated quickly. The rising markets are also picking up as automakers standardize in-dash navigation in mid-range vehicles.

- Major Investors: The major investments include the automotive OEMs and technology suppliers like Bosch, Continental, Denso, Harman, Panasonic, and TomTom. The focus of such companies is on the software-defined navigation, artificial intelligence routing, and cloud connectivity.

- Startup Ecosystem: Mapbox, HERE Technologies mobility projects, and Telenav projects are startups that are revolutionizing the navigation system through the use of AI maps and real-time data analytics. EV-oriented routing and HD map autonomous driving are also being developed by newcomers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.59 Billion |

| Market Size in 2026 | USD 25.01 Billion |

| Market Size by 2035 | USD 62.53 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Type, Vehicle Type, Technology, Display Type, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

System Type Insights

Why Did the Built-in/OEM In-dash Navigation Systems Segment Hold a 60% Share in 2025?

Built-in/OEM In-dash Navigation Systems: In 2025, this segment commanded an approximately 60% market share because these systems are fully embedded in automotive hardware and software. OEM-installed navigation systems are preferred by car manufacturers for their seamless integration with infotainment systems, ADAS, sensors, and vehicle control units, delivering higher levels of accuracy, reliability, and safety. These systems are equipped with advanced features such as lane-level directions, route anticipation, voice response, and real-time traffic warnings, which make driving easier and less distracting. Also, original equipment manufacturer (OEM)- produced solutions have several advantages,, such as long-term technical support and software updates delivered via the Internet, enabling continuous performance improvements.

Integrated Infotainment Navigation Systems: The segment was expected to grow at a CAGR of 13.60% over the forecast period. These systems are both navigational and entertainment, coupled with connectivity, mirroring smartphone and vehicle controls in a single interface, delivering a smooth experience. Automakers are using infotainment-based navigation platforms to deliver customized services, cloud-based services, and subscription models. The development of AI-powered voice assistants, real-time data connectivity, and software-defined vehicle designs has further reinforced this segment. With manufacturers still diversifying their advanced infotainment systems across mid-range and premium cars, integrated infotainment navigation is likely to spread rapidly worldwide.

Vehicle Type Insights

Why Did the Passenger Cars Segment Hold a 55% Share in 2025?

Passenger Cars: This segment led the in-dash navigation system market in 2025, with an approximate share of 55%, as it ranks highest in vehicle production volume, and consumers increasingly expect in-dash navigation systems. In-dash navigation is increasingly becoming an important tool for car users, helping with commuting and long-distance travel, as well as navigating through congested cities. The increase in traffic congestion and intricate road system has increased the demand for real-time traffic updates, optimum routes, and lane guidance. In-dash navigation systems are also becoming standardized across a wide range of passenger vehicles, from mid-range models, to ensure that automakers compete with each other and meet consumers' expectations for connected cars. The increasing integration of voice control, smartphone connectivity, and infotainment systems supports further adoption.

Electric Vehicles (EVs): This segment is estimated to grow the fastest over the forecast period, with an approximately 15% CAGR, owing to its use of smart, energy-efficient routing methods. EV navigation systems will be set to include battery range, charging station coverage, and traffic conditions, as well as driving behavior, to help eliminate range anxiety. Automakers are keen to ensure that navigation platforms integrate with battery management and energy optimization systems to improve vehicle efficiency. This demand has further increased with the rapid rise in EV adoption, driven by government incentives and expanding charging infrastructure. With the global progress in electrification, electric mobility-specific navigation systems are becoming necessary.

Technology Insights

Why Did Map-Based GPS Navigation Lead the In-Dash Navigation System Market in 2025?

Map-Based GPS Navigation: This segment dominated the market for in-dash navigation systems in 2025, accounting for approximately 48% share, driven by its reliability and widespread acceptance. These systems provide proper turn-by-turn guidance, offline features, and reliable operation under various driving conditions. The map-based navigation also remains a powerful technology that automakers use as a base and integrate comfortably with vehicle displays, control units, and infotainment systems. The development of satellite positioning, computerized cartography, and localization applications has enhanced responsiveness and accuracy. Customers will continue to use the map interfaces they are familiar with, as increasing personalization accentuates them, driving further adoption.

Real-Time Connected Navigation & AI-Assisted Navigation: The real-time connected and AI-assisted navigation segments are expected to grow at exponential rates in the coming years, with a 16% CAGR during the forecast period. This is because such systems expertly leverage live traffic information, cloud networks, and artificial intelligence to enable adaptive and predictive routing. AI algorithms use driving habits, weather conditions, and historical data to improve navigation accuracy and personalization. When combined with ADAS, it enables proactive safety notifications, adaptive rerouting, and traffic-intelligent navigation. As vehicles move toward autonomous and software-defined architectures, AI-assisted navigation is becoming a fundamental intelligent mobility capability, poised to grow robustly in the future.

Display Type Insights

Why did the Touchscreen Displays Segment Hold a 70% Share in the in-dash navigation system market during 2025?

Touchscreen Displays: This segment accounted for a significant share, representing 70% of the in-dash navigation system market in 2025. Touch screens enable drivers to interact with maps, traffic information, and infotainment services through easy-to-use, visual interfaces. Manufacturers are becoming fond of giant, high-resolution touchscreens that facilitate multifunctional digital dials with navigation, media, climate, and vehicle settings. The development of capacitive touch technology, anti-glare features, and haptic feedback has increased usability and reduced driver distraction. Touchscreen systems are also voice-controlled and gesture-controlled, enhancing safety and ease of use. They support a smooth software update and interface customization aligned with the increased use of connected and software-defined vehicles.

Heads-Up Display (HUD) Integrated Navigation: The heads-up display integrated navigation segment, set to grow at an 18% CAGR between 2026 and 2035, is driven by its comfort and safety features. HUD navigation systems direct the driver's crucial routes directly into the driver's field of view and reduce the need to look outside the road. This improves user situational awareness, allowing for safer driving, particularly in tricky traffic scenarios. The performance of HUD has been significantly enhanced by augmented reality, display brightness, and projection accuracy. HUD systems are being used to provide immersive navigation experiences in premium and electric vehicles, which are the most widely adopted, as production costs decrease and automakers pay greater attention to driver safety and comfort.

End-Use Insights

Why Did the OEM Segment Lead the In-Dash Navigation System Market in 2025?

Original Equipment Manufacturers (OEMs): The OEM segment led the market, holding approximately 62% share in 2025, due to integration, with consumers preferring the factory-installed system. OEM navigation systems are designed to be vehicle-specific, ensuring high reliability, cybersecurity, and performance. Car manufacturers are adding more navigation and infotainment features, along with ADAS, to provide a unified, safe driving experience. The OEM solutions are also in line with regulatory and quality standards, which strengthen the consumer trust. Also, OEM systems benefit from hardware-software integration and the reliability guaranteed by the warranty; manufacturers and end users alike highly favor them.

Aftermarket Consumers: The aftermarket integration segment is expected to experience a high 14% CAGR during the forecast period. Consumers are demanding affordable ways to retrofit older cars with modern navigation systems that include real-time traffic information, smartphone connectivity, and high-tech displays. Plug-and-play systems have been improved and made more compatible with vehicles, making the installation process less complex. Growth is also being supported by the expansion of e-commerce platforms and increased access to advanced aftermarket infotainment units, as the vehicle ownership lifecycle lengthens and drivers increasingly prefer digital convenience without necessarily buying new cars.

Region Insights

How Big is the North America In-Dash Navigation System Market Size?

The North America in-dash navigation systems market size is estimated at USD 7.91 billion in 2025 and is projected to reach approximately USD 22.20 billion by 2035, with a 10.87% CAGR from 2026 to 2035.

Why Did North America Lead the Global In-Dash Navigation System Market in 2025?

In 2025, North America was the largest market for in-dash navigation systems, accounting for a 35% share. The region benefits from a mature automotive ecosystem, strong digital infrastructure, a large vehicle parc, and high consumer acceptance of advanced in-car technologies. Automakers in the U.S. and Canada increasingly offer in-dash navigation as a standard or bundled feature, particularly in mid-range and premium vehicles.

In-dash navigation systems in North America are commonly integrated with advanced driver assistance systems, infotainment platforms, and telematics modules to enhance driving safety, route optimization, and user experience. Growing demand for real-time traffic updates, over-the-air software updates, and seamless smartphone integration through platforms such as Apple CarPlay and Android Auto is further strengthening adoption. These capabilities are driving deeper penetration of in-dash navigation systems across both passenger vehicles and commercial fleets in the region.

What is the Size of the U.S. In-Dash Navigation System Market?

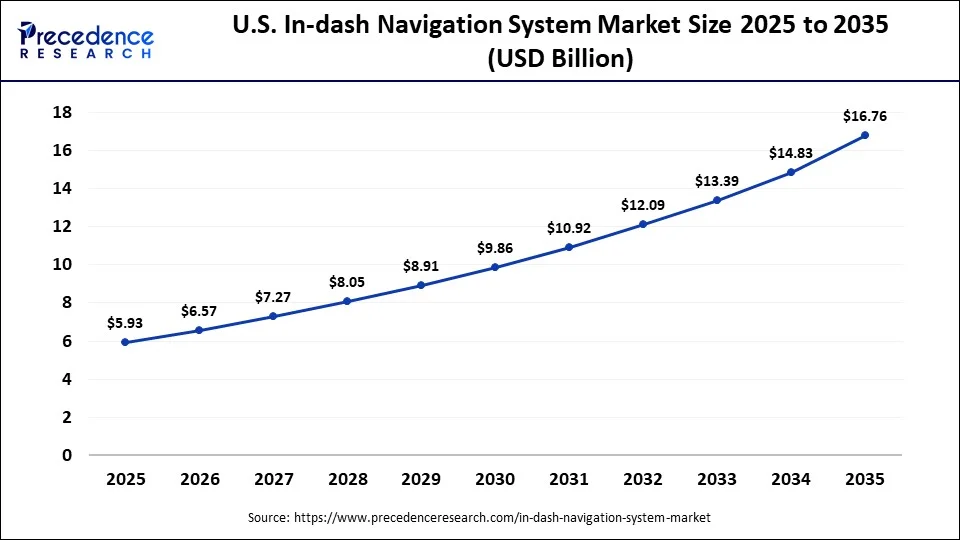

The U.S. in-dash navigation systems market size is calculated at USD 5.93 billion in 2025 and is expected to reach nearly USD 16.76 billion in 2035, accelerating at a strong CAGR of 10.95% between 2026 and 2035.

U.S In-Dash Navigation System Market Analysis

Strong consumer demand for a driving experience decked out with the latest technology is driving the U.S. in-dash navigation system market. Voice-controlled navigation, live traffic information, predictive navigation, and flawless smartphone connectivity are increasingly becoming the norm. The highly competitive automobile industry, and the luxury and electric car markets in particular, encourage manufacturers to distinguish their products by offering more advanced in-dash navigation and infotainment systems. Moreover, high-speed connectivity and robust software innovation capabilities are widely available, enabling continuous upgrades, personalized services, and cloud-based navigation, thereby maintaining market growth in the U.S.

Why is Asia Pacific undergoing the Fastest Growth in the In-dash Navigation System Market?

Asia Pacific is experiencing the fastest growth globally in the in-dash navigation system market, accounting for an estimated 15.50% share, driven by rapid urbanization, a growing middle-class population, and rising vehicle ownership across the region. The increasing use of passenger vehicles, particularly in developing economies such as China, India, and Southeast Asian countries, is driving strong demand for built-in navigation systems that improve route efficiency and reduce travel time in highly congested urban environments.

The region's high automotive production volumes, combined with rising investment in electric and autonomous vehicles, are accelerating the adoption of advanced navigation technologies. Automakers are increasingly integrating navigation systems with vehicle connectivity, driver-assistance features, and energy-management functions, especially in electric vehicles. In response to consumer demand for affordable vehicles with advanced digital features, manufacturers are standardizing in-dash navigation systems across mid-range models, which continues to drive rapid market expansion across the Asia Pacific.

China In-Dash Navigation System Market Trends

The China in-dash navigation system market is growing because the nation is the world's largest automotive market and a global hub for electric vehicles. Local car manufacturers are rapidly integrating hi-tech navigation systems with AI, voice recognition, and connected-car systems to meet the needs of tech-savvy consumers. City congestion is increasing, and this is why citizens are increasingly relying on real-time traffic data and smart route applications. In addition, the current government support for smart transport, autonomous driving, and the EV market is driving the growth of navigation technologies.

Why Is the European In-dash Navigation System Market Experiencing Notable Growth?

The European in-dash navigation system market is experiencing strong growth, supported by the presence of leading automotive manufacturers and widespread availability of advanced vehicle technologies. Consumers across Europe show a strong preference for premium, connected, and safety-focused vehicle features, driving demand for sophisticated navigation platforms integrated directly into the vehicle cockpit. Automakers are increasingly embedding navigation systems into unified digital dashboards to enhance usability and driver experience.

Adoption is further strengthened by tight integration between navigation systems and advanced driver assistance systems, as well as EV-specific routing features that optimize range, charging stops, and energy consumption. Europe's stringent vehicle safety standards and emphasis on emissions reduction reinforce the need for accurate, reliable navigation data. In addition, the region's focus on smart mobility initiatives, frequent cross-border travel, and dense transportation networks makes intelligent, real-time navigation systems a functional necessity rather than an optional feature.

UK In-Dash Navigation System Market Trends

The UK in-dash navigation systems market is growing gradually, supported by rising adoption of connected and electric cars. There is growing customer demand for easily accessible navigation systems with real-time traffic information and voice-recognition capabilities. The city's traffic issues and the growing focus on effective route planning also underscore the need for advanced in-dash solutions. The navigation platforms are also helping UK automakers achieve sustainability goals, including EV range optimization and charging station mapping. In the UK, navigation systems are increasingly integrated with telematics and vehicle connectivity platforms to support congestion-aware routing and compliance with low-emission zones in major cities such as London and Birmingham. Adoption is further supported by fleet operators and shared mobility services that rely on in-dash navigation for route efficiency, fuel savings, and emissions monitoring.

Why Is the Middle East and Africa In-dash Navigation System Market Gaining Momentum?

The Middle East and Africa in-dash navigation system market is gaining momentum, supported by ongoing development of automotive infrastructure and rising adoption of connected vehicles across key economies. Rapid urbanization, the large-scale expansion of road networks, and growing passenger-vehicle sales, particularly across GCC countries, are driving demand for factory-installed navigation systems. Higher disposable incomes and increased sales of premium sedans and luxury SUVs further support adoption of advanced in-dash navigation technologies.

Growth is also reinforced by expansion of tourism, logistics, and commercial transportation, where operators rely on real-time navigation, traffic updates, and route optimization to improve efficiency and service reliability. In parallel, government-led smart city and intelligent transportation system initiatives across the region are encouraging integration of digital mobility solutions into vehicles. These programs are strengthening demand for accurate, connected, and locally optimized in-dash navigation systems across the Middle East and Africa.

Why Is the Latin American In-dash Navigation System Market Emerging Rapidly?

Latin America is emerging as a promising market for in-dash navigation systems, supported by expanding vehicle manufacturing and growing interest in connected car technologies. Rapid urban population growth, increasing traffic congestion, and longer commuting times are pushing drivers to seek advanced navigation systems that provide real-time traffic updates and route optimization. These factors are making built-in navigation increasingly relevant for daily mobility in major metropolitan areas.

Automakers are responding by integrating in-dash navigation systems into mid-range vehicle models, rather than limiting them to premium segments, to reach a broader consumer base. Improvements in digital infrastructure and widespread smartphone adoption are also facilitating smoother integration between vehicle navigation platforms and mobile applications. In parallel, government investments in road modernization and smart mobility initiatives are supporting wider adoption of connected and intelligent navigation systems across Latin American markets.

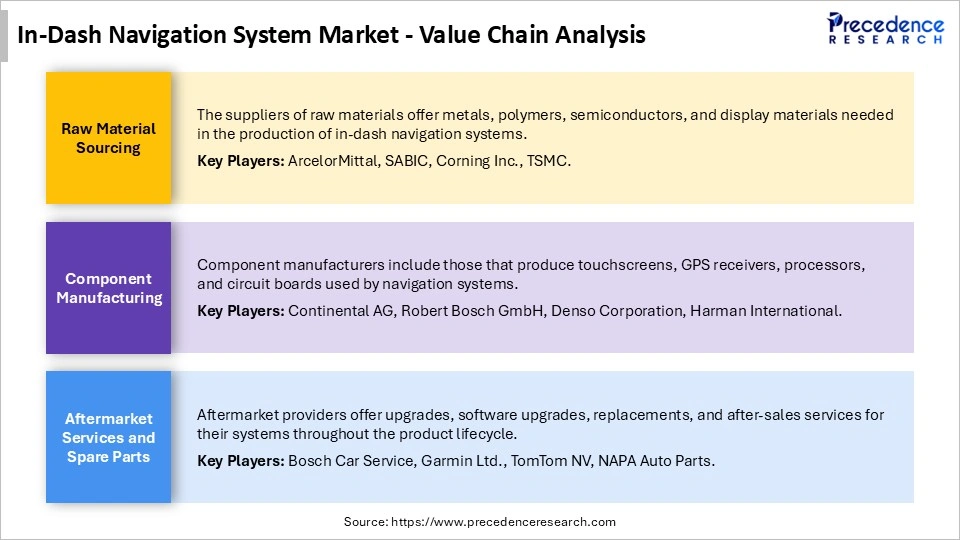

In-Dash Navigation System Market Vlaue Chain

Top Vendors in the In-Dash Navigation System Market & Their Offerings

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Harman International

- Alpine Electronics, Inc.

- Pioneer Corporation

- Garmin Ltd.

- TomTom NV

- Clarion Co. Ltd.

- JVCKENWOOD Corporation

Recent Developments

- In February 2023, Mappls, the biggest provider of digital maps in India, introduced a new series of cars and two-wheelers, Mappls Gadgets, such as GPS trackers, dash cameras, smart helmet-kits, and in-dash navigation systems. The in-dash is integrated into the vehicle's dashboard and includes steering wheel controls, a rear-seat media display, and rear-view AHD cameras, making the car more convenient and safe to drive.(Source: https://telecom.economictimes.indiatimes.com)

Segments Covered in the Report

By System Type

- Built-in/OEM In-dash Navigation Systems

- Aftermarket In-dash Navigation Systems

- Integrated Infotainment Navigation Systems

By Vehicle Type

- Passenger Cars

- Compact/Subcompact

- Mid-Size/Sedan

- SUV & Crossovers

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- Two-Wheelers (motorcycles with navigation)

By Technology

- Standalone Navigation Units

- Map-Based GPS Navigation

- Real-Time Connected Navigation (with OTA traffic & updates)

- AI-Assisted Navigation (voice/semantic route prediction)

- AR Navigation (augmented reality overlays)

By Display Type

- Touchscreen Displays

- Standard Resolution

- High Resolution/HD Displays

- Voice-Only Navigation Interfaces

- Heads-Up Display Integrated Navigation

By End-Use

- Original Equipment Manufacturers

- Aftermarket Consumers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting