What is the Network Monitoring Market Size?

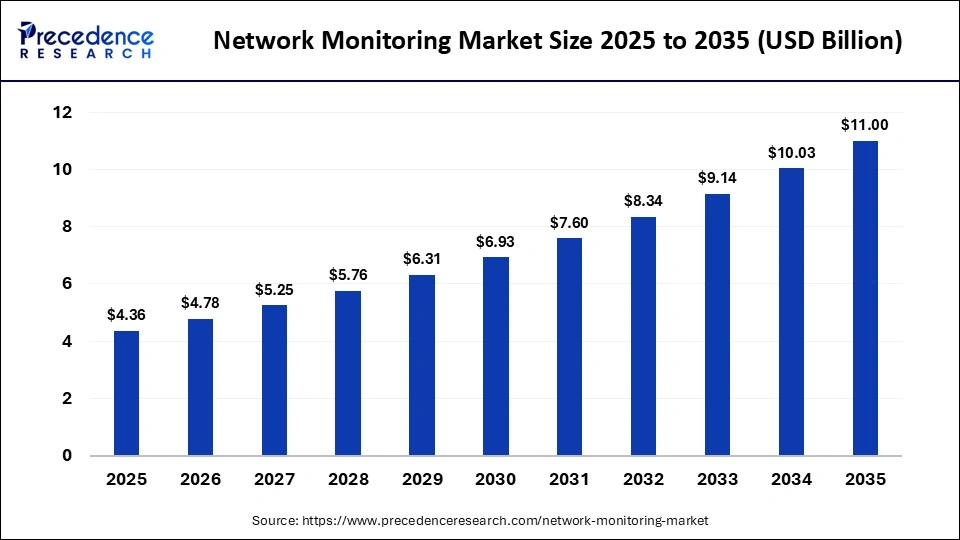

The global network monitoring market size was calculated at USD 4.36 billion in 2025 and is predicted to increase from USD 4.78 billion in 2026 to approximately USD 11.00 billion by 2035, expanding at a CAGR of 9.70% from 2026 to 2035. This market is growing due to the rapid expansion of cloud computing, rising network complexity, and the increasing need for real-time visibility to ensure performance, security, and uptime.

Market Highlights

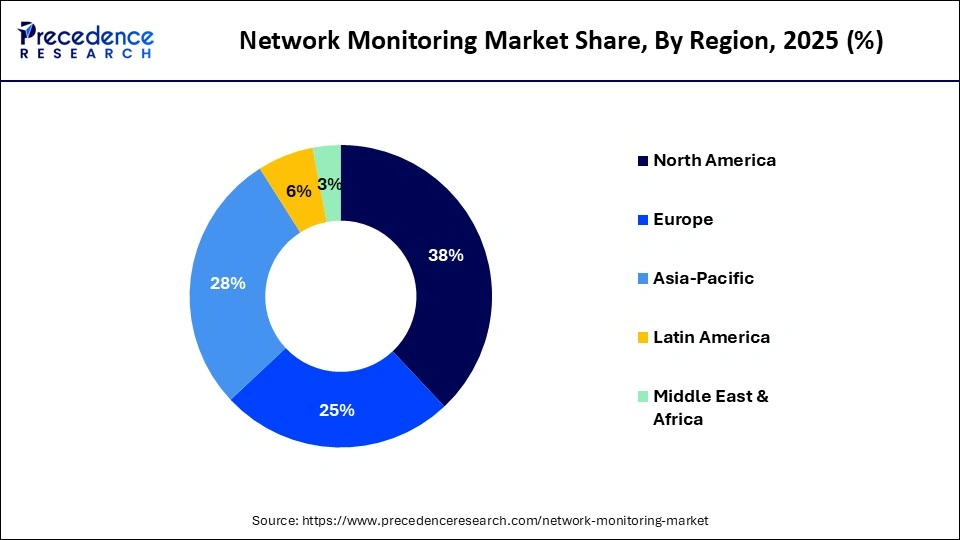

- North America dominated the network monitoring market with a major market share of 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

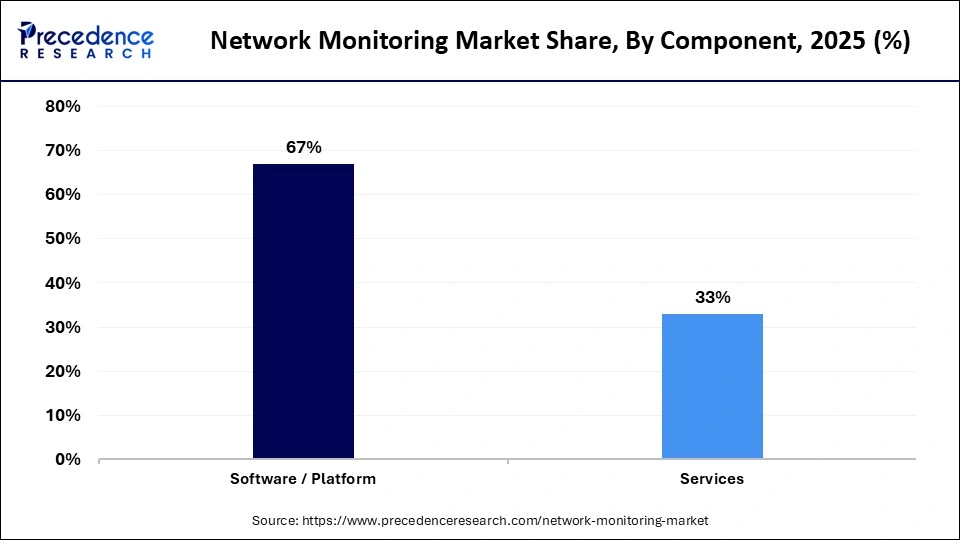

- By component, the software/platform segment held the biggest market share of approximately 67% in 2025.

- By component, the services segment is expected to expand at the fastest CAGR between 2026 and 2035.

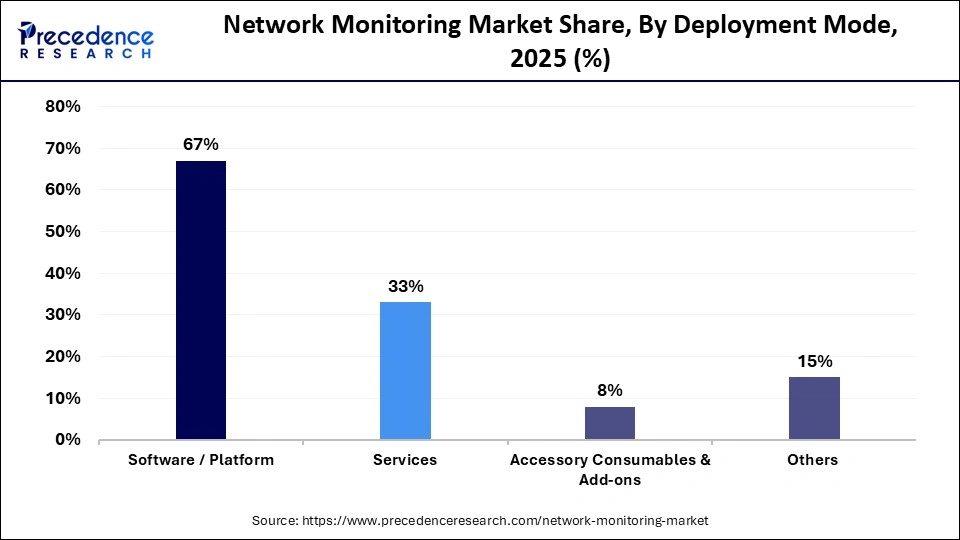

- By deployment mode, the cloud-based (SaaS) segment contributed the highest market share of approximately 59% in 2025.

- By deployment mode, the hybrid segment is expected to grow at a robust CAGR between 2026 and 2035.

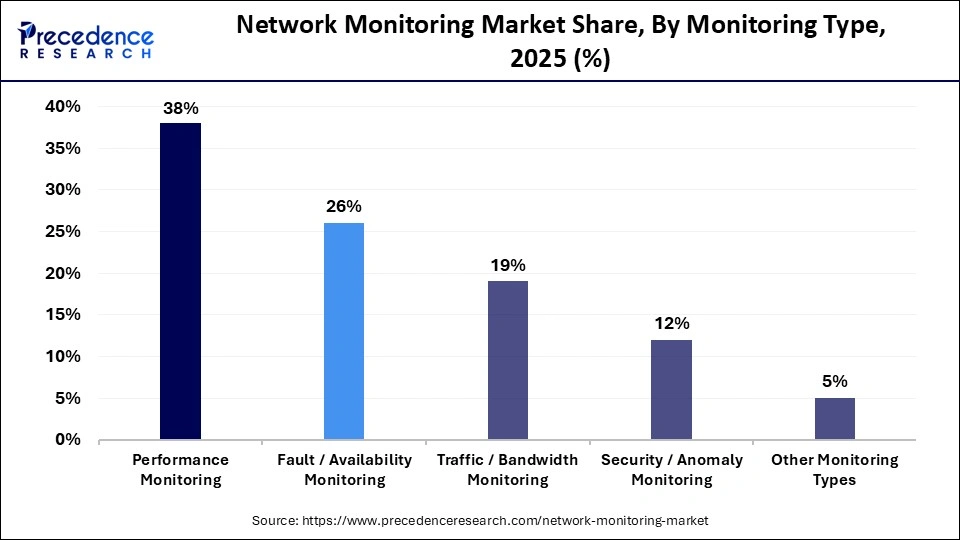

- By monitoring type, the performance monitoring segment held a major market share of approximately 38% in 2025.

- By monitoring type, the security/anomaly monitoring segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By end user industry, the IT & telecom segment generated the biggest market share of approximately 23% in 2025.

- By end user industry, the healthcare & life sciences segment is expected to expand at the fastest CAGR between 2026 and 2035.

What Drives the Growth of the Network Monitoring Market?

The network monitoring market is witnessing steady growth as businesses depend more on intricate IT systems for cloud-based settings and remote work arrangements that necessitate ongoing performance monitoring. The global network monitoring market includes software and services that continuously observe, analyze, and report on network performance, health, traffic, security events, and availability across enterprise, data center, cloud, and hybrid environments. Network monitoring solutions provide real-time alerting, performance analytics, fault detection, bandwidth utilization insights, root-cause diagnostics, and SLA compliance metrics.

Businesses are adopting sophisticated monitoring solutions that provide real-time visibility, predictive analytics, and quicker issue resolutions due to growing concerns about network outstate cybersecurity risks, and service quality. Furthermore, the rising use of IoT devices, software-defined networking (SDN), and managed IT services in sectors like IT & telecom, BFSI, healthcare, and manufacturing is driving the market.

How Is Artificial Intelligence Transforming the Network Monitoring Market?

Artificial intelligence is significantly changing the network monitoring industry. Artificial intelligence plays a critical role in enabling automated root cause analysis, real-time anomaly detection, and predictive analytics. AI-powered solutions assist businesses in anticipating possible network problems, minimizing downtime, and enhancing performance in intricate hybrid cloud and multi-vendor settings. AI-based network monitoring systems are increasing operational efficiency and meeting the increasing need for scalable, intelligent, and self-healing network infrastructure by reducing manual intervention and improving decision-making accuracy.

Major Market Trends

- Growing adoption of AI and machine learning based monitoring for predictive insights and automated issue detection.

- Rising demand for cloud-based and hybrid network monitoring solutions due to increasing cloud migration.

- Increasing focus on network security integration, combining performance monitoring with threat detection.

- Expansion of IoT, 5G, and edge computing is driving the need for real-time high-speed network visibility.

- Shift toward unified observability platforms for monitoring multi-cloud and distributed networks.

- Higher adoption of automated and self-healing networks to reduce downtime and operational costs.

- Growing emphasis on end-user experience monitoring to directly link network performance with business outcomes.

Future Growth Outlook

- Increasing adoption of AI-driven and predictive monitoring tools is expected to boost the demand for advanced analytics and automation providers.

- Rapid growth of cloud, hybrid, and multi-cloud infrastructures opens the door for scalable, cloud native monitoring solutions.

- Expansion of 5G networks and edge computing presents opportunities for real-time, low-latency network monitoring platforms.

- Rising focus on cybersecurity and compliance enables integration of network monitoring with security and risk management solutions.

- Growing use of IoT devices across industries drives demand for specialized monitoring of large, distributed networks.

- Increasing adoption of managed network monitoring services among SMEs offers growth potential for service providers.

- Demand for user experience and application performance monitoring creates opportunities to link network insights with business performance.

How Are Government Initiatives Driving the Network Monitoring Market?

The expansion of the network monitoring market is being greatly impacted by government initiatives aimed at bolstering digital infrastructure, cybersecurity, and data protection. The need for ongoing network performance and security monitoring is growing because of public sector investments in smart cities, e-governance platforms, broadband expansion, and 5G deployment. To guarantee dependability compliance and real-time threat detection, government agencies and businesses are also being encouraged to adopt sophisticated network monitoring solutions by tighter laws about data privacy, critical infrastructure protection, and national cybersecurity frameworks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.36 Billion |

| Market Size in 2026 | USD 4.78 Billion |

| Market Size by 2035 | USD 11.00 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.70% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, Monitoring Type, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

What made software/platform the dominant segment in the network monitoring market?

The software/platform segment dominated the market with the largest share of 67% in 2025, as businesses increasingly use automated alert systems, real-time analytics, and centralized dashboards more frequently to manage intricate network infrastructures. These platforms are crucial for large-scale and mission-critical network operations because they allow for proactive issue detection, performance optimization, and smooth integration with cloud IoT and enterprise IT environments.

The services segment is expected to grow at the fastest rate in the coming years, driven by rising demand for managed network monitoring, consulting, and support services. To lower operating costs and guarantee constant network uptime, many businesses lacking internal expertise are increasingly contracting out monitoring, maintenance, and optimization tasks to specialized service providers.

Deployment Mode Insights

Why did the cloud-based (SaaS) segment dominate the network monitoring market?

The cloud-based (SaaS) segment dominated the market, holding a 59% share in 2025, due to its ease of access, remote scalability, and lower upfront costs. SaaS-based network monitoring solutions provide real-time visibility across distributed networks, enable rapid deployment, and reduce dependence on on-premise infrastructure, making them highly favored by organizations. For businesses, automatic updates and flexible pricing models enhance long-term cost efficiency, while seamless integration with digital transformation initiatives and cloud-native applications further drives adoption.

The hybrid segment is expected to grow at the fastest CAGR in the market, as businesses combine cloud-based monitoring tools with on-premises systems in search of flexibility. Large businesses are regulated industries that find this model appealing because it allows for gradual cloud migration while preserving control over sensitive data. Additionally, hybrid deployments facilitate improved business continuity and disaster recovery planning. As organizations modernize, the demand for hybrid monitoring solutions continues to rise steadily.

Monitoring Type Insights

How does the performance monitoring segment dominate the network monitoring market?

The performance monitoring segment dominated the market while holding a 38% share in 2025, as businesses place a high value on network dependability, speed, and uptime. IT teams can now maintain service quality and fulfill service level agreements by using continuous performance monitoring to detect latency, bandwidth problems, and system bottlenecks. It plays a critical role in optimizing application performance and end-user experience. Predictive maintenance capabilities are further improved by the increasing use of performance analytics tools.

The security/anomaly monitoring segment is expected to expand at the fastest CAGR over the forecast period, driven by an increase in the frequency of network breaches and cyberthreats. To identify anomalous traffic patterns, stop intrusions, and guarantee network security in real time, advanced monitoring tools utilizing AI and machine learning are being used more. As businesses concentrate on zero-trust architecture, security anomaly detection is becoming more popular. Strong growth of this segment is also supported by growing data protection regulations.

End-User Industry Insights

What made IT & telecom the dominant segment in the network monitoring market?

The IT & telecom segment dominated the market with a 23% share in 2025 due to its extensive network operations and strong need for continuous connectivity. To control data traffic, guarantee network dependability, and support cutting-edge technologies like edge computing and 5G, this industry needs constant monitoring. For real-time fault detection, sophisticated monitoring tools are necessary due to high network complexity. Strong demand from this segment is maintained by ongoing infrastructure expansion.

The healthcare & life sciences segment is expected to grow at the fastest rate in the upcoming period, as network complexity is driven by electronic health records, linked medical devices, and digital health platforms. Data security system availability and adherence to healthcare regulations all depend on dependable network monitoring. Demand is also increased by the growing use of telemedicine and remote patient monitoring. Monitoring systems are essential because network outages in healthcare settings can affect patient safety.

Regional Insights

How Big is the North America Network Monitoring Market Size?

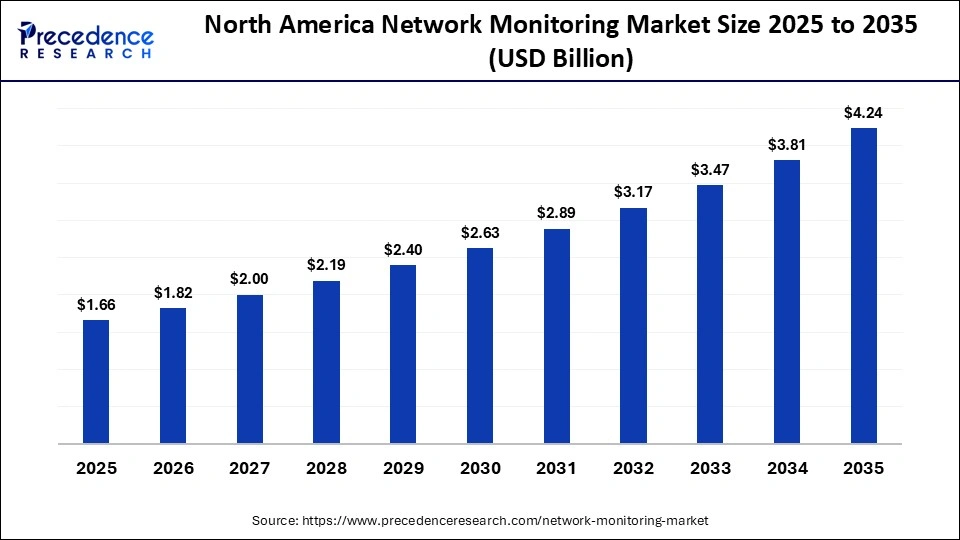

The North America network monitoring market size is estimated at USD 1.66 billion in 2025 and is projected to reach approximately USD 4.24 billion by 2035, with a 9.83% CAGR from 2026 to 2035.

What made North America the dominant region in the network monitoring market?

North America registered dominance in the network monitoring market by holding a major share of 38% in 2025. This dominance is supported by early adoption of cloud computing, cybersecurity, and sophisticated IT infrastructure. The region's leadership is further reinforced by the presence of significant technology providers and high enterprise network management expenditures. Innovation is accelerated by a strong emphasis on automation and AI-based monitoring tools. Sustained market dominance is also supported by the extensive deployment of data centers in the 5G network.

What is the Size of the U.S. Network Monitoring Market?

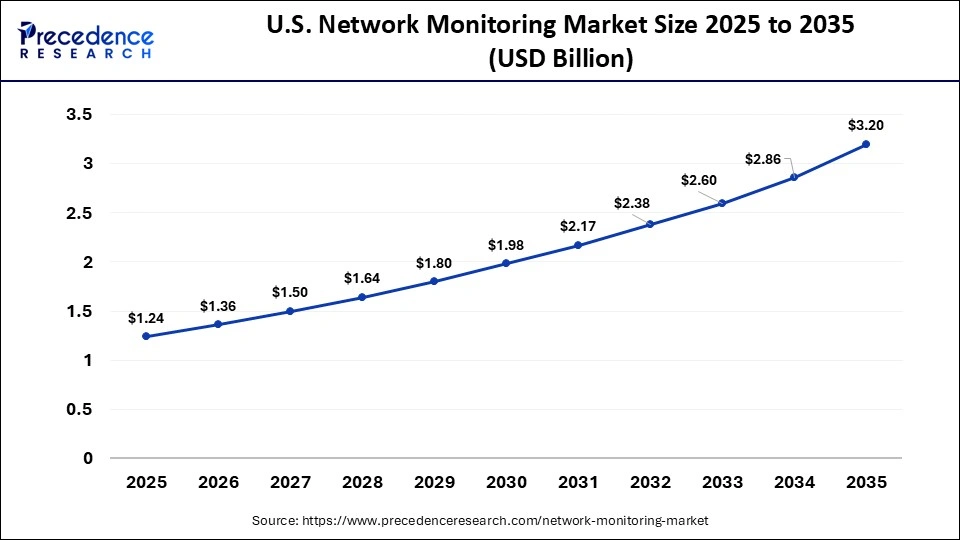

The U.S. network monitoring market size is calculated at USD 1.24 billion in 2025 and is expected to reach nearly USD 3.20 billion in 2035, accelerating at a strong CAGR of 9.94% between 2026 and 2035.

U.S. Network Monitoring Market Trends

The market in the U.S. is growing, driven by a strong emphasis on cybersecurity, high cloud adoption, and sophisticated IT infrastructure. To guarantee uptime and data security, businesses in a variety of industries, including IT and telecom, BFSI, healthcare, and government, significantly depend on real-time network visibility. The need for sophisticated monitoring solutions is further increased by the extensive deployment of 5G data centers and hybrid cloud environments. Furthermore, early adoption of automated and AI-driven monitoring tools promotes long-term market expansion in the U.S.

What makes Asia Pacific the fastest-growing region in the market?

Asia Pacific is expected to grow at the fastest rate in the market throughout the forecast period, fueled by rapid digital transformation, expanding telecom networks, and increased cloud adoption across emerging economies. The region's need for sophisticated network monitoring solutions is growing due to increased investments in data centers, smart cities, and 5G infrastructure. Government-led digital projects and growing enterprise digitization both aid in market growth. The growing number of internet users also increases network complexity, driving monitoring needs.

India Network Monitoring Market Trends

India is leading the market within Asia Pacific, backed by growing telecom networks, quickening digitalization, and rising cloud adoption among businesses. Growth in industries like fintech, e-commerce, e-healthcare, and IT services has greatly increased network complexity, which has raised demand for security and performance monitoring systems. Increased adoption is also a result of government-led projects for smart cities and digital infrastructure. Furthermore, India's market opportunities are being strengthened by the country's increasing internet user base and data traffic volumes.

Who are the Major Players in the Global Network Monitoring Market?

The major players in the network monitoring market include Cisco Systems, Inc., SolarWinds Worldwide, LLC, Broadcom Inc., IBM Corporation, Microsoft Corporation, Datadog, Inc., Dynatrace, Inc., NETSCOUT Systems, Inc., Paessler AG (PRTG), ManageEngine, Juniper Networks, Inc., LogicMonitor, Inc., ExtraHop Networks, Inc., Riverbed Technology LLC, Nagios Enterprises, LLC, Auvik Networks Inc., Splunk Inc., Keysight Technologies, Inc., and Palo Alto Networks Inc.

Recent Developments

- In January 2026, Dynatrace launched a new platform category that fuses deterministic and agentic AI to enable reliable autonomous operations and closed-loop remediation. The system utilizes specialized Intelligence Agents to automate complex IT workflows while operating within defined security guardrails, as detailed by Dynatrace.(Source: https://www.dynatrace.com)

- In January 2026, SolarWinds unveiled a major evolution of its Web Help Desk platform, featuring a completely modernized user interface and a transition to a contemporary language framework. The update is built on a "Secure by Design" architecture to eliminate legacy vulnerabilities while improving scalability for network operations teams(Source: https://www.solarwinds.com)

- In January 2026, Broadcom announced the general availability of DX NetOps 25.4.4. This update offers enhancements for network observability and fault management, including modernized root cause analysis and event correlation for multi-vendor operations. The release also indicates the end-of-service for the older 24.3.x versions. (Source: https://community.broadcom.com)

- In August 2025, Riverbed announced the launch of new AI-driven intelligent network observability solutions. These solutions include the Riverbed IQ Essentials bundle and the next-generation xx90 appliance family, which offers up to three times higher performance for packet and flow capture. The new tools provide automated insights and proactive remediation to help IT teams resolve network issues in real-time before they affect business operations.(Source: https://finance.yahoo.com)

Segments Covered in the Report

By Component

- Software/Platform

- Network performance monitoring

- Fault/A nominal detection engines

- Traffic analytics dashboards

- Services

- Implementation & integration

- Managed network monitoring services

- Training & support

By Deployment Mode

- Cloud-based (SaaS)

- On-premise

- Hybrid

By Monitoring Type

- Performance Monitoring

- Fault/Availability Monitoring

- Traffic/Bandwidth Monitoring

- Security/Anomaly Monitoring

- Other Monitoring Types

By End-User Industry

- IT & Telecom

- BFSI

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

- Government & Public Sector

- Energy & Utilities

- Other Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting