What is the Personalized Testing and Supplements Market Size?

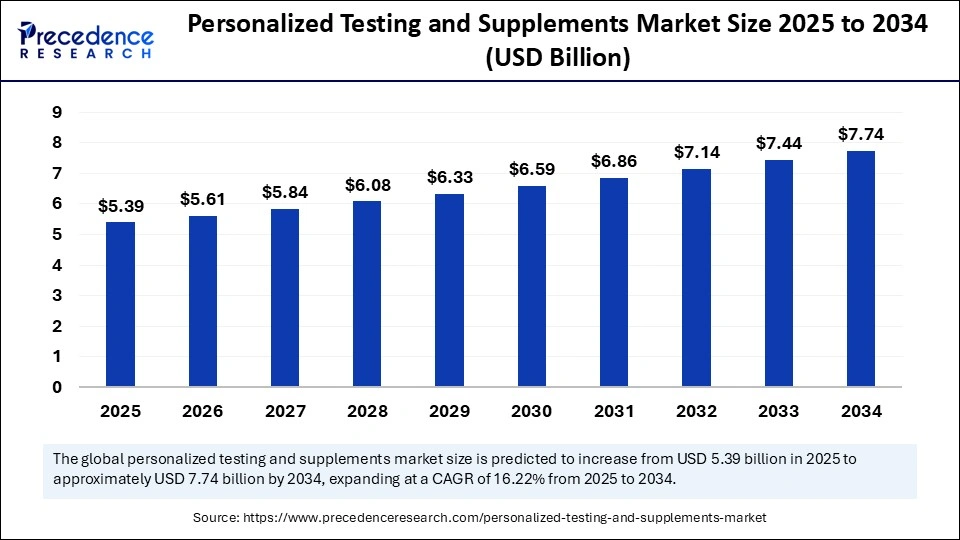

The global personalized testing and supplements market size is calculated at USD 5.39 billion in 2025 and is predicted to increase from USD 5.61 billion in 2026 to approximately USD 7.74 billion by 2034, expanding at a CAGR of 16.22% from 2025 to 2034. The market growth is attributed to increasing consumer demand for personalized health solutions and wellness analytics services.

Market Highlights

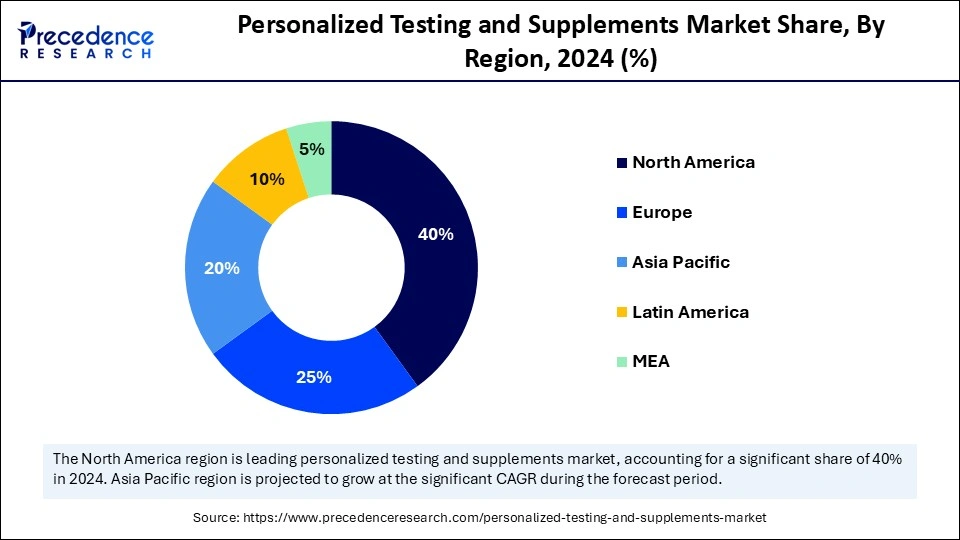

- The North America segment held a dominant presence in the market in 2024, accounting for an estimated 40% market share.

- The Asia Pacific segment is expected to grow at the fastest CAGR of in the market during the 20% from 2025 to 2034.

- By product type, the nutrition supplements segment accounted for a considerable share of 65% in 2024.

- By product type, the personalized testing segment is expanding at a strong CAGR from 2025 to 2034.

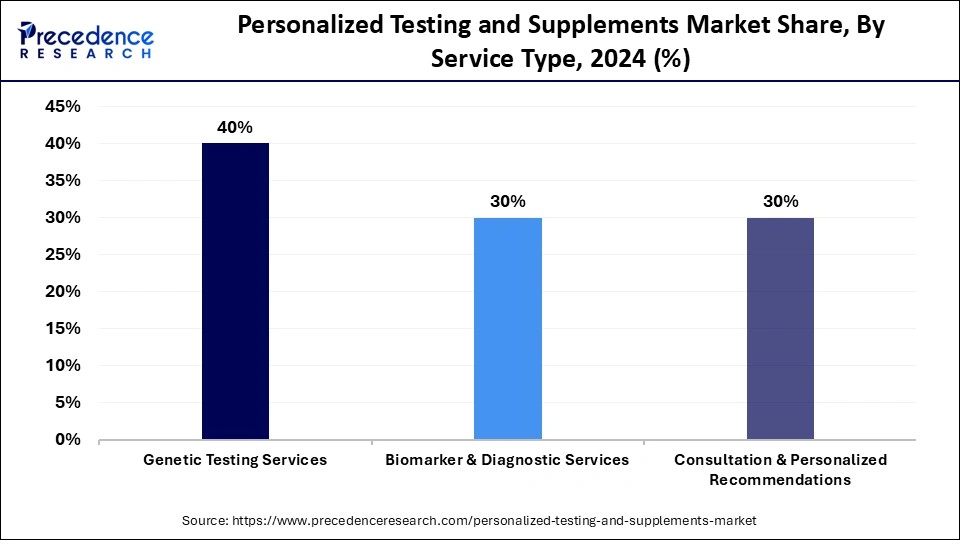

- By service type, the genetic testing services segment led the market, accounting for an estimated 40% market share in 2024.

- By service type, the consultation & personalized recommendations segment is expanding at a solid CAGR from 2025 to 2034.

- By delivery format, the oral supplements segment contributed the biggest market share of 55% in 2024.

- By delivery format, the functional foods & beverages segment is anticipated to grow with the highest CAGR between 2025 and 2034.

- By application, the general wellness segment dominated the market, accounting for an estimated 50% market share in 2024.

- By application, the sports and wellness segment is projected to grow at a notable CAGR from 2025 to 2034.

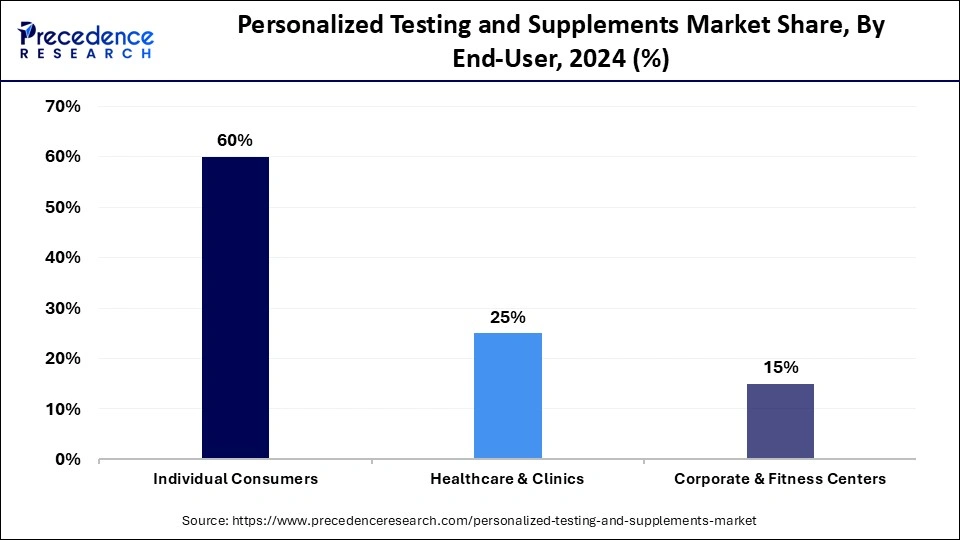

- By end-user, the individual consumers segment held the major market share of 60% in 2024.

- By end-user, the healthcare & clinics segment is expected to grow at a strong CAGR from 2025 to 2034.

Market Overview

Increasing consumer health consciousness and preventative-care orientations as more consumers demand nutrition and testing solutions that are specific to their biology and not the one-size-fits-all supplements. The technological basis of this is genetic sequencing, microbiome studies, metabolic biomarker studies, and artificial intelligence-driven algorithms.

That combines these data with lifestyle data to provide personalized testing data and supplement suggestions. NIH is committing US$170 million to the NIH Nutrition for Precision Health program to recruit 10,000 participants and create algorithms to predict personal responses to food and dietary habits using AI and microbiome technology. Furthermore, the fastening nature of wearable biosensors, mobile health apps, and AI analytics to provide real-time dietary or supplement feedback further facilitates the personalized testing market.

Impact of Artificial Intelligence on the Personalized Testing & Supplements Market

Artificial intelligence (AI) is transforming genetic, metabolic, and lifestyle data into practical health-sensitive information. Firms are combining AI-based analytics with testing systems to decipher DNA sequences, microbiome compositions, and biomarker concentrations with greater accuracy than before. Furthermore, the nutritionists and health-technology companies can use this technology to create an individualized type of supplement targeted at addressing a particular deficiency.

Personalized Testing and Supplements Market Growth Factors

- Rising Consumer Awareness of Preventive Health: Growing public understanding of nutrition�genomics links is fuelling demand for DNA-based testing and customized supplement solutions.

- Expanding Integration of AI and Data Analytics: Advancements in artificial intelligence are driving more precise health assessments and boosting the adoption of data-driven personalization platforms.

- Growing Influence of Digital Health Ecosystems: The increasing use of mobile health apps and connected wearables is propelling continuous monitoring and individualized supplement recommendations.

- Surging Investment in Nutrigenomics Research: Rising funding from public health agencies and private investors is fuelling breakthroughs in genotype-based nutrition science.

Global Insights & Metrics Driving the Personalized Health Revolution

- In 2022, the United States accounted for over $465 million in revenue from DTC genetic testing, covering ancestry and health risk assessments. The U.S. leads in lab infrastructure and consumer trust in genomics. This revenue demonstrates strong market penetration and adoption among health-conscious populations.

- As of November 2023, there were approximately 197,779 genetic tests available globally, with over 129,000 tests offered in the United States alone. This reflects the rapid expansion of genetic testing services worldwide

- A study in 2023 revealed that 289 laboratories provided information on tests offered, with 138 (47.8%) offering only panel testing throughout their enrollment. This highlights the scale and specialization of clinical laboratories in genetic testing

- As of 2023, there are over 10,250 genetic counselors in more than 45 countries, indicating a growing workforce to support the increasing demand for genetic testing services

- The EU has established the In Vitro Diagnostic Regulation (IVDR), which came into effect in May 2022. This regulation requires that all in vitro diagnostic devices, including genetic tests, undergo a conformity assessment and be CE marked before being placed on the market

- In 2025, genetic testing services will be regulated by the Indian Council of Medical Research (ICMR). The ICMR has issued guidelines for genetic testing, emphasizing the need for informed consent and the involvement of qualified healthcare professionals in the testing process

- A study published in 2023 reported that, as of November 2022, there were 129,624 genetic tests available in the United States and 197,779 globally.

- In 2024, global health app downloads reached 388 million, reflecting growing consumer adoption of digital health tools. Consumers increasingly use apps to track genetic test results, supplements, and personalized health insights. This growth is driven by the proliferation of smartphones and wearable devices.

- In 2023, users spent a total of $377 million on healthcare apps, a 19% increase from the previous year. This spending includes subscriptions, premium features, and integration with personalized supplement services. The rise in app monetization indicates strong consumer willingness to invest in digital health solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.39 Billion |

| Market Size in 2026 | USD 5.61 Billion |

| Market Size by 2034 | USD 7.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Service Type, Delivery Format, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Personalized Testing & Supplements Market � Regulatory Landscape

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | FDA (Food & Drug Administration), FTC (Federal Trade Commission), CMS (Centers for Medicare & Medicaid Services) |

Dietary Supplement Health and Education Act (DSHEA) FDA 21 CFR Part 11 (for electronic records) CLIA (Clinical Laboratory Improvement Amendments) |

Safety and labeling of supplements Lab quality standards Consumer protection and advertising claims | DTC genetic tests are regulated variably; only a few have FDA clearance for health claims. FTC ensures marketing claims are not misleading. |

| European Union | EFSA (European Food Safety Authority), National Health Authorities | EU Nutrition & Health Claims Regulation (Regulation EC 1924/2006) Novel Food Regulation (EU 2015/2283) IVDR (In Vitro Diagnostic Regulation 2017/746) | Safety and efficacy of supplements Lab diagnostics standards Claims substantiation | IVDR requires CE marking of diagnostic devices; health claims must be scientifically validated. |

| United Kingdom | MHRA (Medicines and Healthcare products Regulatory Agency), FSA (Food Standards Agency) | Human Medicines Regulations 2012 Food Supplements Regulations 2003 | Safety and quality of supplements Lab testing standards | After Brexit, the UK maintains separate post-market surveillance. DTC genetic tests are regulated under medical device laws if used for health diagnosis. |

| Canada | Health Canada | Food and Drugs Act Natural Health Products Regulations (NHPR) | Safety, efficacy, and labeling of supplements Lab certification | Supplements require product licensing; DTC tests must comply if intended for health claims. |

| Australia | TGA (Therapeutic Goods Administration), FSANZ (Food Standards Australia New Zealand) | Therapeutic Goods Act 1989-Australia New Zealand Food Standards Code | Safety, labeling, and registration of supplements Quality of diagnostic tests | Supplements sold with health claims must be registered with the TGA. DTC genetic tests sold online face compliance challenges. |

| India | FSSAI (Food Safety and Standards Authority of India), ICMR (Indian Council of Medical Research) | Food Safety and Standards (Health Supplements, Nutraceuticals, Food for Special Dietary Use, Functional Food) Regulations, 2016 - ICMR Guidelines for Genetic Testing | Licensing and labeling of supplements Lab and genetic test standards Consumer protection | Personalized supplements must comply with FSSAI licensing. Genetic tests require qualified supervision, informed consent, and lab accreditation. |

| Japan | MHLW (Ministry of Health, Labor and Welfare), PMDA (Pharmaceuticals and Medical Devices Agency) | Health Promotion Act - Pharmaceuticals and Medical Devices Act (PMD Act) | Approval of functional foods and supplements Clinical and lab standards for genetic testing | Personalized supplements may fall under �Food with Functional Claims.� DTC genetic tests require regulatory oversight if used for diagnosis. |

Personalized Testing and Supplements MarketSegment Insights

The nutrition supplements segment dominated the personalized testing & supplements market in 2024 that holding a market share of about 65%, as consumers are becoming aware of preventive healthcare and personalized wellness. Customers are progressively demanding special vitamins, minerals, and functional supplements to help curb nutrient shortages and the health risks associated with lifestyle. Furthermore, the growing focus on scientifically proven and data-driven nutrition solutions is further fuelling the segment. The individualized testing kits segment is expected to grow at the fastest rate from 2025 to 2034, accounting for 35% market share, owing to the innovative technologies in the field of genomics, biomarker analysis, and AI-driven diagnostics. Other companies, including Viome and 23andMe, stated that they experienced substantial growth in the number of tests, which indicates high consumer confidence and interest.

The genetic testing services segment dominated the personalized testing & supplements market in 2024, accounting for an estimated 40% market share, due to the growing popularity of personalized health solutions among consumers. Such services allow people to understand their genetic predispositions to tailor their nutrition and wellness plans. The next-generation sequencing (NGS) technologies have been integrated to allow genetic tests to be more accurate and affordable to the general public. Companies such as 23andMe and AncestryDNA have diversified their products to include health-related genetic tests to the growth of the segment. The consultation and personalized recommendations segment is expected to grow at the fastest CAGR between 2025 and 2034, accounting for 30% of market share. Owing to the rise of the need to personalize health counseling and the incorporation of genetic information into personal health and wellness programs. Additionally, with the emergence of telehealth systems, the scope of consultation has increased, and people can now obtain individual advice remotely.

The oral supplement segment held the largest revenue share in the personalized testing and supplements market in 2024, which held a market share of about 55%, due to the high level of individual dosing, the possibility of easy incorporation into daily routines, and the feasibility of use with the individualized nutrition plan. Furthermore, the increased awareness of preventive health, coupled with the strong clinical validation response, is expected to sustain the superiority of oral supplements in the foreseeable future. The functional foods and beverages segment is expanding at a notable CAGR between 2025 and 2034, accounting for 20% market share, owing to the growing consumer preference for ready-to-drink beverages and foods that support health. Additionally, the bioactive ingredient fortification and taste-masking technologies are improving the functionality and attractiveness of functional foods, thus further boosting the segment.

The general wellness segment held the largest revenue share in the personalized testing & supplements market in 2024, accounting for an estimated 50% market share, due to the increasing success of preventive health and holistic well-being perceptions in the world. In 2023, the NIH and the ASN emphasize that individual interventions enhance the intake of micronutrients and metabolic fitness. Moreover, the segment is expected to remain dominant as the desire of people for validated and science-based wellness solutions grows. The sports and fitness segment is expected to grow at the fastest CAGR from 2025 to 2034, accounting for 20% of market share, owing to the growing interest in performance optimization, recovery aid, and general physical health in the case of athletes and fitness enthusiasts. In 2024, InsideTracker, DNAfit, and Viome were among the companies that used AI and data collected by wearable devices. They provide real-time advice and individualized diets, guided by genetic, metabolic, and biomarker testing. Additionally, with the increase in technology and data analytics, there is a high chance of the Sports and Fitness segment gaining momentum quickly, owing to the need to propose performance-driven, science-based nutritional solutions.

The individual consumers segment held the largest revenue share in the personalized testing & supplements market in 2024 that holding a market share of about 25%, due to the growing consumer interest in preventive health and individual wellness solutions and services. Furthermore, since the increased popularity of personalized nutrition has only begun, the leading role in the market is likely to be occupied by individual consumers. The healthcare and clinics segment is expected to grow at the fastest CAGR from 2025 to 2034, holding a market share of about 25%, owing to the rising trend of personalized medicine and the introduction of nutrigenomics into clinical practice. Additionally, the individualized supplements based on the genomic composition of a person, their lifestyle, and health issues provide a more specific method of treatment and prevention.Product Type Insight

Service Type Insights

Delivery Format Insights

Application Insights

End-User Insights

Personalized Testing and Supplements MarketRegional Insights

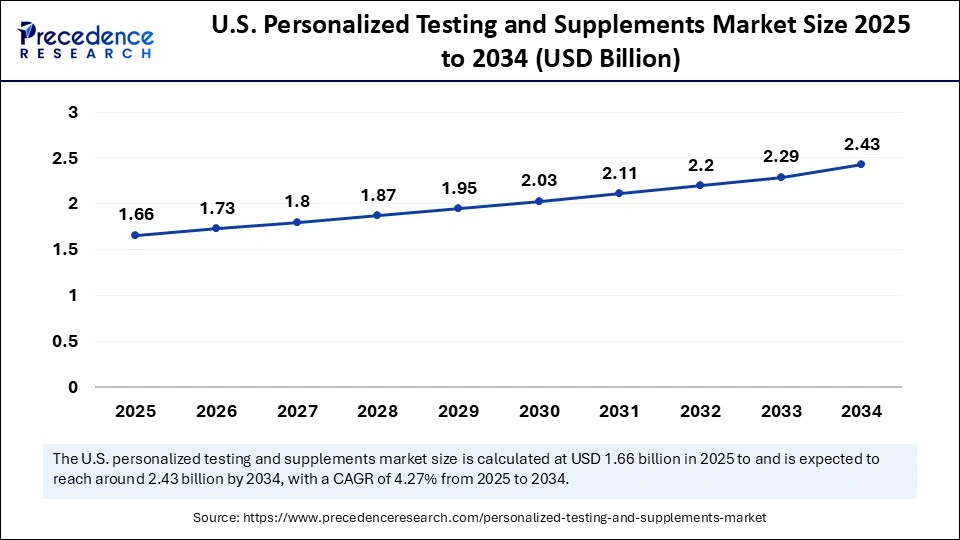

The U.S. personalized testing and supplements market size is evaluated at USD 1.66 billion in 2025 and is projected to be worth around USD 2.43 billion by 2034, growing at a CAGR of 4.27% from 2025 to 2034. How Did North America Become the Leading Region in Personalized Testing & Supplements Adoption? North America led the personalized testing and supplements market, capturing the largest revenue share in 2024accounting for an estimated 40% market share, due to the popularity of preventive health care and the popularity of online health systems among the population. Research has shown that more than 26 million adults in the U.S. have used at-home genetic testing kits to make nutritional and supplement choices. United States: Powerhouse of Personalized Wellness in 2024 In 2024, the United States was a pioneer in the personalized testing and adoption of supplements in North America, indicating a great emphasis on preventative health and wellness among consumers. Furthermore, the U.S. dominant status in the market is likely to be supported by the high disposable incomes, technological literacy, and favorable policy frameworks.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, accounting for 20% of market share, owing to the increase in health consciousness, urbanization, and the widening digital penetration. Further penetration of smartphones and access to e-commerce technologies contribute to the application of the tailored wellness solution contributes to the sustainable development of the market in the Asia Pacific region. China: Rapidly Rising Hub for Personalized Nutrition in 2024 The increasing health awareness and growing middle classes in 2024 see China turn into the fastest-growing market in the Asia Pacific region as far as personalized testing and supplements are concerned. There were around 3.2 million Chinese consumers in 2022 who had adopted at-home genetic and biomarker testing kits, which means that there is a high demand for personalized nutrition solutions. The personalized testing and supplements market in China is predicted to experience long-term growth due to increasing digitalization and health-aware millennials, governmental involvement.

Germany became the most dynamic market in Europe in 2024, regarding personalized testing and supplements. This indicates that consumers are becoming more interested in preventative health and wellness. The extensive healthcare system, high disposable incomes, and technologically aware population in Germany are likely to continue the pace of personalized testing and supplements uptake in the rest of Europe.

The Middle East and Africa region is expected to hold a notable revenue share of the market, as growing awareness among consumers of preventive health and high-quality research in nutrigenomics. The increase in interest in the preventive healthcare programs by both the private and the government is another factor that promotes market growth.

Personalized Testing and Supplements Market Value Chain

The foundation of personalized health services lies in the collection of biological data, including saliva, blood, or other biomarker samples, which are analyzed to determine individual health profiles. Key Players: 23andMe, AncestryDNA, MyHeritage, Color Genomics

Collected samples are processed in certified laboratories using advanced genomic sequencing, metabolomic profiling, and biochemical assays to generate actionable health insights. Key Players: Invitae, Helix, Fulgent Genetics, Gene by Gene

Raw lab data is translated into personalized health and nutrition recommendations using AI algorithms, machine learning, and expert analysis. Key Players: Nutrigenomix, Viome, InsideTracker, DNAfit

Based on interpreted data, customized nutraceuticals or dietary supplements are formulated to match individual needs for vitamins, minerals, probiotics, and other nutrients. Key Players: Care/of, Persona Nutrition, Baze, Rootine

Personalized supplements are packaged into daily or weekly doses, often with app-based tracking, subscription services, or home delivery options. Key Players: Care/of, Persona Nutrition, Rootine, Baze

Mobile application, dashboards, and wearable integration allow consumers to track progress, adjust recommendations, and receive updated health insights in real-time. Key Players: InsideTracker, Viome, Nutrigenomix

Personalized Testing and Supplements Market Companies

A global leader in life science research tools, Bio-Rad offers gel documentation systems that include imaging, analysis, and documentation solutions for electrophoresis gels, supporting both research and clinical applications.

Thermo Fisher provides advanced gel documentation systems integrated with high-resolution imaging, data analysis software, and workflow automation to enhance molecular biology research efficiency.

GE Healthcare supplies gel imaging and documentation solutions with proprietary imaging technologies, enabling researchers to capture, analyze, and store gel electrophoresis data reliably.

Azure Biosystems develops user-friendly gel documentation systems designed for sensitive imaging, offering both UV and visible light detection for DNA, RNA, and protein gels.

Vilber offers compact and versatile gel documentation systems that combine imaging, quantitative analysis, and intuitive software, catering to academic and industrial laboratories.

UVP provides gel imaging solutions that include high-performance UV and blue-light systems, designed for nucleic acid and protein detection with robust imaging software.

Analytik Jena manufactures gel documentation and imaging systems optimized for precise electrophoresis analysis, including fluorescence and chemiluminescence detection.

Top Vendors in Gel Documentation Systems Market & Their Offerings

- Viome Life Sciences: Viome is a leader in AI-driven microbiome and gene expression testing, offering personalized nutrition and supplement recommendations based on individual biological data. Its proprietary metatranscriptomic sequencing technology analyzes gut and oral microbiome activity to create custom supplement formulations under its Precision Supplements line. Viome's strong research partnerships and focus on preventive health position it as a top innovator in precision wellness.

- DSM Nutritional Products AG: A global leader in nutritional ingredients and life sciences, DSM combines bioscience expertise and data-driven innovation to develop personalized supplement solutions. The company's portfolio includes vitamins, lipids, probiotics, and specialty nutrients, supported by digital tools and diagnostics for individualized nutrition. DSM's merger with Firmenich to form DSM-Firmenich further strengthens its position in holistic health and wellness personalization.

- Thorne HealthTech: Thorne offers personalized health testing and supplement solutions, integrating biomarker and genetic insights through its proprietary Thorne Health Intelligence platform. The company's product range includes personalized vitamins, performance supplements, and at-home diagnostic kits. Thorne's collaboration with Mayo Clinic and its focus on clinical validation make it a trusted brand in precision nutrition.

- Pharmavite LLC: Parent company of the well-known Nature Made brand, Pharmavite has entered the personalized nutrition space through data-driven supplement offerings and digital health integrations. The company leverages its strong manufacturing base and research expertise to deliver customized vitamin and nutrient packs, aligning with evolving consumer demand for tailored wellness.

- Baze: Baze provides personalized micronutrient solutions through at-home blood testing and algorithm-based supplement recommendations. Its model combines nutrient deficiency analysis with individualized supplement delivery. Baze emphasizes clinical accuracy and adaptive nutrition, catering to health-conscious consumers seeking measurable results.

- GNC Holdings, Inc.: A global retailer of health and wellness products, GNC has pivoted toward personalization through DNA- and lifestyle-based supplement plans. Its partnerships and tech integrations enable data-backed product recommendations, complementing its wide retail presence and established brand trust.

- The Vitamin Shoppe: The Vitamin Shoppe has integrated personalized wellness into its retail and digital strategy through customized supplement regimens, DNA testing partnerships, and subscription models. The company's omnichannel presence allows it to blend e-commerce personalization tools with expert in-store consultations.

- Nestle Health Science: Nestl� Health Science leads the personalized nutrition and medical nutrition sector through brands like Persona Nutrition, Garden of Life, and Vital Proteins. The company leverages genetic and lifestyle data to tailor supplement and meal solutions, reflecting its strategic expansion into precision health. Its deep R&D capabilities and acquisitions have positioned it as a global powerhouse in personalized wellness.

- Vitaminpacks, Inc.: Acquired by Nestl� Health Science, Persona Nutrition provides AI-powered, questionnaire-based personalized vitamin packs delivered via subscription. Its platform evaluates health goals, medications, and dietary habits to generate custom supplement regimens. Persona's technology-driven model exemplifies scalable personalization in the supplements industry.

- myDNA: myDNA offers genetic testing-based nutrition and fitness plans, translating DNA insights into actionable supplement and dietary recommendations. The company's direct-to-consumer platform integrates nutrigenomics and digital coaching, empowering users to make informed wellness choices.

- LifeNome: LifeNome provides AI-based genomic analysis for personalized nutrition, wellness, and skincare. Its Epitrace� platform analyzes hundreds of genetic markers to recommend supplements and health strategies. The company also partners with health brands to enable embedded personalization technology.

- Everlywell: Everlywell specializes in at-home diagnostic testing, including metabolic and micronutrient tests that guide supplement and diet plans. Through its digital health platform, the company connects users to lab-based insights for personalized nutrition, positioning itself as a key enabler of data-driven wellness.

- Nutrisystem: Nutrisystem integrates personalized meal and supplement plans with metabolic and lifestyle data, offering solutions for weight management and metabolic health. Its transition toward digital personalization and adaptive diet programs enhances its competitiveness in the health optimization market.

- Nutrigenomix Inc.: A pioneer in genetic testing for personalized nutrition, Nutrigenomix provides evidence-based DNA tests that guide diet and supplement recommendations. Its platform is used by healthcare professionals and dietitians globally to enable clinical-grade personalized nutrition advice.

- Orig3n: Orig3n offers DNA-based wellness and nutrition tests that help consumers understand their genetic predispositions related to metabolism, vitamins, and exercise response. Its consumer-friendly kits and genetic insights apps make it accessible for entry-level personalization.

- Anatolia Nutrition: An emerging player focused on nutrigenetic supplements and metabolic testing, Anatolia Nutrition combines biomarker analysis with regionally tailored nutrition plans, targeting the Middle Eastern and European personalized wellness markets.

- Nutritional Growth Solutions: Focused on pediatric growth and development, Nutritional Growth Solutions offers personalized nutritional supplements designed using clinical research and child growth data. The company bridges clinical nutrition and personalization, addressing a niche market segment.

- Nutritional Genomics: Nutritional Genomics develops genomic and metabolomic-based diagnostic tools that enable supplement manufacturers and clinics to deliver customized nutrition interventions. Its research-driven approach integrates molecular biology and AI analytics for data-backed personalization.

Recent Developments

- In April 2025, India's Sova Health, recognized for custom-based probiotics and personalized gut-balancing solutions, launched its Gut Microbiome Test (GMT) and Food Intolerance Test (FIT) in April 2025. Leveraging India's largest proprietary gut microbiome database with over 35,000 sequenced samples, the tests measure gut bacteria, SCFA levels, and key metabolic markers with high precision. These diagnostic tools aim to identify root causes of metabolism, immune, and mental health conditions, enabling targeted interventions.

- In September 2025, Maastricht University spin-off InnerBuddies introduced its Gut Health Operating System (GHOS) dashboard in September 2025. The platform combines advanced analytics, personalized nutrition algorithms, and microbiome science into an integrated solution, setting a new global standard for gut health management.

- In October 2025, Ultrahuman expanded its preventive healthcare offerings in October 2025 with Vision Cloud and Blood Vision Essentials. Vision Cloud allows users to upload historical medical test results and receive instant insights and long-term health trends, positioning the platform as the world's first free universal health report interpreter.

- In September 2025, Nutrafol announced its first multi-year sports partnership with Major League Baseball in September 2025, becoming the Official Hair Growth Partner. The collaboration, starting with the 2025 Postseason and extending into the 2026 season, focuses on fan engagement and promoting hair health both on and off the field.

(Source: https://www.businesswire.com)

(Source: https://insider.fitt.co)

(Source: https://pharmabiz.com)

(Source: https://www.bioniq.com)

(Source: https://corporate.oriflame.com)

(Source: https://www.businesswire.com)

(Source: https://www.cbs42.com)

(Source: https://www.digitalhealthnews.com)

(Source: https://www.nsf.org)

Personalized Testing and Supplements MarketSegments Covered in the Report

By Product Type

By Service Type

By Delivery Format

By Application

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting