What is the Pharmaceutical Blister Packaging Market Size?

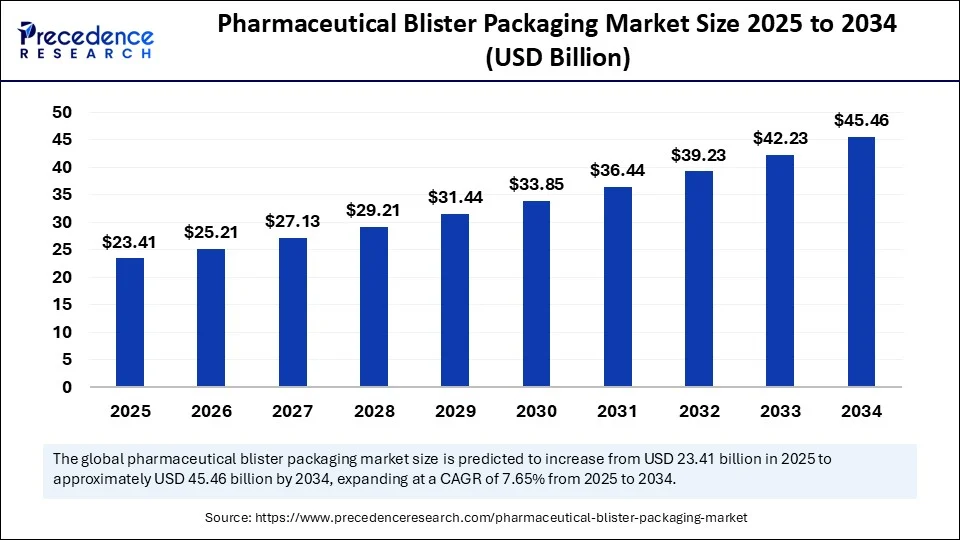

The global pharmaceutical blister packaging market size is accounted at USD 23.41 billion in 2025 and predicted to increase from USD 25.21 billion in 2026 to approximately USD 45.46 billion by 2034, expanding at a CAGR of 7.65% from 2025 to 2034. Growth in e-pharmacies and demand for tamper-evident packaging solutions, innovation in cold form foil technology for improved drug protection, and generic drug manufacturing expansion are driving the growth of the pharmaceutical blister packaging market.

Market Highlights

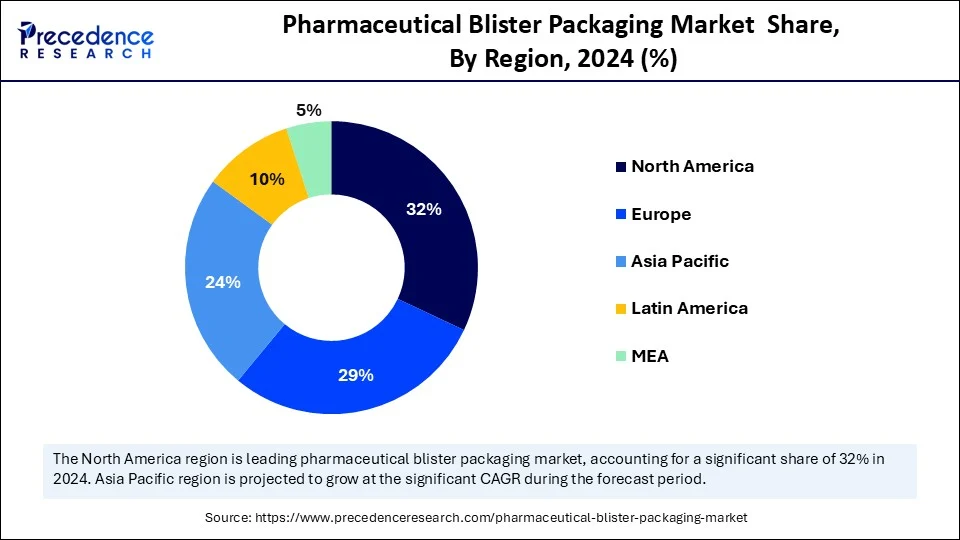

- North America dominated the global pharmaceutical blister packaging market with the largest market share of 32% in 2024.

- Asia Pacific is seen to grow at the fastest CAGR of 8.90% during the forecast period.

- By blister type, the thermoformed blister segment captured the biggest market share of 65% in 2024.

- By blister type, the paper-based blisters segment is expected to grow fastest CAGR of 12.50% during the forecast period.

- By material composition, the plastic-based films segment contributed the highest market share of 55% in 2024.

- By material composition, the multi-layer laminates segment is projected to experience the highest growth rate of 10.80% between 2025 and 2034.

- By drug form (application area), the solid oral dosage form segment held the largest share of 72% in 2024.

- By drug form (application area), the transdermal patches (unit-dose) segment is set to experience the fastest CAGR of 9.60% from 2025 to 2034.

- By technology used, the thermoforming segment generated the major market share of 58% in 2024.

- By technology used, the anti-counterfeit segment is anticipated to grow with the highest CAGR of 11.30% during the years studied.

- By functionality, the standard blister packaging segment held the maximum market share of 60% in 2024.

- By functionality, the environmentally sustainable packs segment is anticipated to grow with the highest CAGR of 13.40% during the years studied.

- By packaging format, the multi-cavity/strip packs segment accounted for the remarkable market share of 50% in 2024.

- By packaging format, the blister wallets and cards segment is predicted to witness significant growth of 9.20% in the market over the forecast period.

- By distribution channel (for DTC or B2B customized packs), the direct-to-pharma segment held the largest market share of 70% in 2024.

- By distribution channel (for DTC or B2B customized packs), the online pharmacies segment is predicted to witness significant growth of 14.10% over the forecast period.

- By end-user, the pharma manufacturers segment contributed the highest market share of 68% in 2024.

- By end-user, the clinical trial supply providers segment is expected to grow fastest CAGR of 10.50% during the forecast period.

- By region, North America generated the highest market share of 32% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR of 8.90% during the forecast period.

How Is Artificial Intelligence (AI) Transforming the Pharmaceutical Blister Packaging Market?

Artificial intelligence (AI) improves packaging processes for blister packs and vials, automating quality control inspections. Real-time monitoring through AI maintains reliable, consistent, and effective production, ensuring higher quality. AI can play an important role in packaging manufacturing quality control. It can scan packaging products at many stages of the manufacturing process and detect defects at a micro-level that can be invisible to the human eye, whereas traditional quality checks are labor-intensive and can miss subtle defects.

AI techniques can analyze large-scale biomedical data to identify existing drugs that may have therapeutic potential for different diseases. By repurposing approved drugs for new indications, AI accelerates the drug discovery process and reduces costs. AI helps in packaging design, including in-text effects, turns initial sketches into packaging designs, generates design ideas from text prompts, simulation testing, refines and perfects designs, creates prompts, and creates a brand kit.

Blister Packaging: Ensuring Safety, Compliance, and Patient Convenience

Pharmaceutical blister packaging is a form of tamper-evident packaging where an individual pushes individually sealed tablets through the foil to take the medication. This form of packaging can also help the individual recall if the previous dose was taken. A blister pack is any of many types of pre-formed plastic packaging used for small consumer goods, foods, and pharmaceuticals. Blister packs are generally used as unit-dose packaging for pharmaceutical tablets, capsules, or lozenges. It can provide barrier protection for shelf-life needs and a degree of tamper resistance.

Blister packs can protect from environmental factors; they safeguard drugs from air, moisture, and contamination. Each blister corresponds to a single dose, making it easier for patients to track their medication intake. Blister packaging production will be far more intelligent, flexible, and automated in the future.

What Factors Are Fueling the Rapid Expansion of the Pharmaceutical Blister Packaging Market?

- Growth in e-pharmacies: The growth of the e-pharmacies includes ease of additional information, prescription verification, reduced medication errors, privacy & confidentiality, money savings, and time savings. E-pharmacy is a business model that deals with the preparation and sale of prescription and non-prescription drugs, as in traditional pharmacies. The online pharmacy is a pharmacy that sells medicines on the internet and delivers them to customers. It is very easy to order prescription drugs through an E-pharmacy. In addition, the cost is much cheaper than travelling to a traditional pharmacy.

- Generic drug manufacturing expansion: The advantages of generic medicines include diverse availability, encouragement of market competition, widened access to healthcare, equivalent effectiveness, and cost-effectiveness. With numerous manufacturers producing generic drugs, patients and healthcare providers may have many options for a particular medication, ensuring a consistent supply. Generic drug availability fosters competition in the pharmaceutical industry, leading to reduced prices for both generic and brand-name drugs.

Market Outlook

- Industry Growth Offerings- The pharmaceutical blister packaging industry is growing due to rising demand for tamper-evident, unit-dose packaging, patient adherence solutions, and sustainable materials. Advancements in automation, smart packaging, and eco-friendly films further drive market expansion globally.

- Global Expansion- Global expansion of pharmaceutical blister packaging is driven by increasing pharmaceutical production, rising demand for patient-centric and tamper-evident packaging, and adoption of automated, sustainable, and smart packaging solutions across emerging and developed markets worldwide.

- Startup ecosystem- The startup ecosystem for pharmaceutical blister packaging is growing, focusing on innovative solutions like automated, smart, and eco-friendly packaging. Emerging companies aim to enhance patient adherence, ensure safety, and provide sustainable, high-efficiency blister packaging technologies globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.41 Billion |

| Market Size in 2026 | USD 25.21 Billion |

| Market Size by 2034 | USD 45.46 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Blister Type, Material Composition, Drug Form, Technology Used, Functionality, Packaging Format, Distribution Channel, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Innovation in cold-form foil technology

Innovation in cold-form foil technology helps improve drug protection. It offers protection against light, moisture, and oxygen, thereby ensuring the medication's integrity and stability. Innovations in blister packaging materials for pharmaceutical products are making it eco-friendlier and more efficient than ever. The cold-forming blister packaging technique uses thin sheets of laminate film containing aluminium. To create blister packs with cold forming, the blister machine generally uses a stamp to force the sheets into a form, allowing the aluminum-based film to stretch and retain the mold shape after the stamp is removed.

Restraint

Complexities in blister packaging

Complexities in blister packaging may include poor barrier against moisture ingress and oxygen ingress. In the case of blister packaging, the PVC sheet does not contain any plasticizer and is sometimes referred to as Rigid PVC or RPVC. Normally, blister packaging is formed using durable and long-lasting materials. But sometimes, the packaging breaks after the sealing, bringing about product damage, contamination, and customer dissatisfaction. Breakage may be due to poor-quality plastic polymers and backing materials.

Opportunity

Increasing investment in research and development (R&D)

Research and development (R&D) can help our ideas or business become more attractive to investors and other companies looking to expand. Investing in R&D allows us to broaden our product or service offer, reducing reliance on a single product. This diversification can help us to adapt quickly to market changes and stay competitive even in tough economic times. The benefits of increased investment include tax benefits, a better option than savings accounts, growth potential, market performance, combining passion with financial growth, diversifying portfolio, planning for retirement, providing regular income, and growing our wealth.

Segment Insights

Blister Type Insights

The thermoformed blister segment dominated the pharmaceutical blister packaging market with the largest market share of approximately 65% in 2024. Thermoforming benefits include customization for industry-specific needs, industry versatility, versatility in parts, focus on sustainability, product durability, creating lightweight products, a wide range of material options, reduced lead times across industries, design flexibility, and thermoforming is cost-effective.

The paper-based blisters segment is expected to grow fastest rate of 12.50% in the market during the forecast period of 2025 to 2034. Using paper-based blister packs benefits the environment and improves branding. It also enhances packaging productivity. This makes it easier for consumers to know how much medication to take at one time. Another advantage of blister packaging is convenience. Blister packs are generally lighter, smaller, and less unwieldy than a typical pill bottle. Consequently, they are easy to store and easy to transport.

Material Composition Insights

The plastic-based films segment peaked with the largest share of 55% in the market in 2024. Plastic used in blister packaging is comprised of PET (polyethylene terephthalate) or PVC (polyvinyl chloride) plastic packaging. The rugged material used for blister packs makes them ideal for a wide range of applications like pharmaceuticals, electronic equipment, or toy products.

The multi-layer laminates segment is projected to experience the highest growth rate of 10.80% in the pharmaceutical blister packaging market between 2025 and 2034. Multi-layer laminates in blister packs are flexible films that prevent water, oxygen, light, and other elements from entering or exiting a product's packaging. Multi-layer laminates engineered for high moisture and oxygen barrier performance.

Drug Form (Application Area) Insights

The solid oral dosage form segment held the largest share of 72% in 2024. Among the many packaging solutions available, blister packaging has emerged as the gold standard for solid oral dosage forms, accounting for over 70% of unit dose packaging in developed markets. Blister packaging consists of a thermoformed plastic cavity sealed with an aluminum foil or paper cover.

The transdermal patches (unit-dose) segment is set to experience the fastest rate of 9.60% in the pharmaceutical blister packaging market growth from 2025 to 2034. As compared to traditional dosage forms, transdermal patches offer key benefits, including steady, controlled medication release with fewer side effects and more consistent effects. A non-invasive, pain-free option for those who have trouble with pills or injections. Easy to use and discreet, making them ideal for many patients.

Technology Used Insights

The thermoforming segment held the largest share of the market at around 58% in 2024. Thermoforming stands out for its remarkable cost-effectiveness in many ways. It boasts low tooling costs, making it accessible to businesses of all sizes. In addition, thermoforming is highly material-efficient, reducing waste and contributing to sustainability.

The anti-counterfeit segment is anticipated to grow with the highest CAGR of 11.30% in the market during the studied years. Anti-counterfeit technology's main goal is to ensure that only genuine products reach the market. It helps businesses to track their goods, prove authenticity, and stop fake items from spreading.

Functionality Insights

The standard blister packaging segment held the largest share of the market at around 60% in 2024. The standard blister packaging benefits include cost-effectiveness, brand-visibility & marketing, extended shelf life, security, temper evidence, improved consumer convenience, and improved product protection. This makes it easy to consumers to know how much medication to take at one time.

The environmentally sustainable packs segment is anticipated to grow with the highest CAGR of 13.40% in the market during the studied years. Environmentally friendly blister packaging solutions addresses the concerns by reducing waste, lowering carbon emissions, and promoting recyclability.

Packaging Format Insights

The multi-cavity/strip packs segment registered its dominance over the pharmaceutical blister packaging market with a share of 50% in 2024. Multi-cavity blanking allows companies to produce more parts at one time. Inferior equipment can generate burrs and cracks along the edges of the blank. Multi-cavity molding is a process that allows multiple identical parts to be produced in a single cycle, reducing costs, waste, and time.

The blister wallets and cards segment is predicted to witness significant growth of 9.20% in the market over the forecast period. Blister wallets are excellent at protecting medications from environmental factors like light, air, and moisture. Each dose is securely encased in its own blister, minimizing exposure to conditions that can degrade the medication before it is used.

Distribution Channel (for DTC or B2B customized packs) Insights

The direct-to-pharma segment led the market with a share of 70% in 2024. Direct to the pharma distribution channel, manufacturers can transact directly with pharmacies to connect with the final consumer. It refers to the marketing and advertising of pharmaceutical products directly to consumers as patients, as opposed to specifically targeting health professionals.

The online pharmacies segment is predicted to witness significant growth of 14.10% the market over the forecast period. An online pharmacy platform is an effective model that helps to reach more customers, helps in better inventory management, offers better purchasing margins, competitive and reduced prices for medicines, and offers options for generic medicines.

End-user Insights

The pharma manufacturers segment enjoyed a prominent position in the market share of 68% in 2024. The benefits of pharma manufacturers include selective supplier partnerships, reduced costs, reduced risk, quality control, product range, on-time delivery, investment, inventory management, increased efficiency, healthcare advancement, established brand & reputation, cost-effective production, broadening product line, market expansion opportunities, cost savings, focus on core competencies, faster market entry, advanced technology & expertise, scalability & flexibility, and regulatory compliance.

The clinical trial supply providers segment is expected to grow fastest rate of 10.50% in the market during the forecast period of 2025 to 2034. Well-designed and well-performed clinical trials provide benefits while allowing us to help others by contributing to knowledge about new treatments or procedures.

Regional Insights

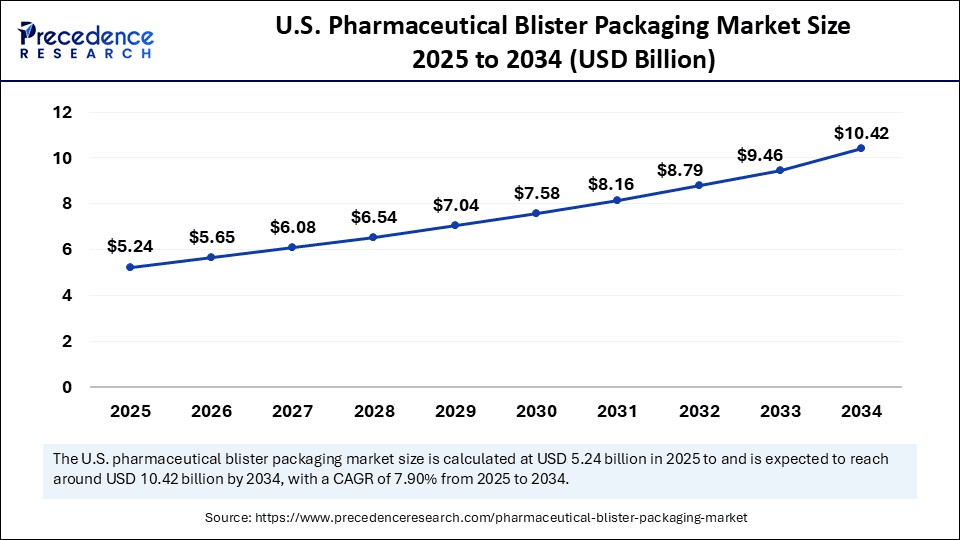

U.S. Pharmaceutical Blister Packaging Market Size and Growth 2025 to 2034

The U.S. pharmaceutical blister packaging market size is exhibited at USD 5.24 billion in 2025 and is projected to be worth around USD 10.42 billion by 2034, growing at a CAGR of 7.90% from 2025 to 2034.

Why is the U.S. Pharmaceutical Packaging Market Expanding Rapidly?

The U.S. market is expanding due to rising demand for tamper-evident and unit-dose packaging, increased adoption by e-pharmacies, and growth in generic drug production. Innovations in cold form foil technology enhance drug protection, while regulatory emphasis on patient safety and adherence, coupled with the rising prevalence of chronic diseases, further drive market growth across hospitals, retail pharmacies, and home healthcare segments.

North America's Booming Blister Packaging Market: Key Growth Factors

North America held a significant share of 32% in the pharmaceutical blister packaging market in 2024. High demand for tamper-evident packaging solutions, growth in e-pharmacies, innovation in cold form foil technology for improved drug protection, expansion of generic drug manufacturing, and rising prevalence of chronic diseases contribute to the growth of the pharmaceutical blister packaging market in the North American region.

What's Behind Asia Pacific's Surge in Pharmaceutical Blister Packaging?

Asia Pacific is anticipated to grow at the fastest rate of CAGR 8.90% in the market during the forecast period. The integration of IoT, automation, and digitalization leads to reducing costs and streamlining operations, suitable governmental policies, a shift towards high performance and sustainable solutions, and rapid technological innovation contributing to the growth of the pharmaceutical blister packaging market.

What's Driving the Growth of China's Blister Packaging Market?

The China market is expanding due to increasing pharmaceutical production, growing demand for safe and tamper-evident packaging, and rising adoption of automated and digitalized manufacturing processes. Supportive government policies, focus on sustainable and high-performance solutions, and rapid technological advancements are driving market growth. Additionally, the increasing prevalence of chronic diseases and the expansion of retail and e-pharmacy channels further boost the adoption of blister packaging in China.

Why is Europe Seeing a Surge in Pharmaceutical Blister Packaging?

The European market is growing due to the rising focus on patient-centric packaging solutions that improve adherence and dosage tracking. Innovations in eco-friendly materials, lightweight designs, and integration of serialization and anti-counterfeiting technologies are boosting adoption. Additionally, increasing investments by pharmaceutical companies in advanced packaging machinery and the expansion of generic and specialty drug production support steady market growth across Europe.

What's Fueling the Expansion of the UK Blister Packaging Market?

The UK market is increasing due to growing demand for secure, tamper-evident, and unit-dose packaging that ensures patient safety and adherence. Adoption of smart and automated packaging solutions, focus on sustainability, and rising production of generic and specialty drugs drive market growth. Additionally, regulatory support, technological advancements in packaging machinery, and increasing chronic disease prevalence contribute to the steady expansion of the UK blister packaging market.

Value Chain Analysis

- R&D

R&D in pharmaceutical blister packaging is improving product protection and patient safety.

Innovations include advanced materials, smart packaging technology, and flexible manufacturing processes.

Key players: Amcor, Uflex, West Pharmaceutical Services, Gerresheimer, and Schott AG. - Packaging and Serialization

Pharmaceutical blister packaging uses serialization to assign unique codes for tracking each product.

Packaging must comply with regulatory standards and provide adequate protection for the medicine.

Key players: Amcor, Uflex, West Pharmaceutical Services, Gerresheimer, and Schott AG. - Distribution to Hospitals, Pharmacies

Pharmaceutical blister packaging is distributed to hospitals and pharmacies through a secure, regulated supply chain.

The process involves manufacturers, wholesalers, and specialized logistics for healthcare facilities.

This multi-step system ensures product integrity, safety, and traceability from production to the end user.

Key players: Amcor, West Pharmaceutical Services, Uflex, Gerresheimer

Key players in Pharmaceutical Blister Packaging Market and Their Offerings

- VinylPlus: Produces sustainable PVC-based blister films through recycling initiatives for eco-friendly pharmaceutical packaging.

- Sonoco: Offers rigid thermoformed blister packs designed for safe and durable pharmaceutical applications.

- Romaco: Supplies high-speed, sustainable blister packaging machines with PET mono-material options.

- Rohrer: Provides custom heat-sealed blister cards, including eco-friendly, all-paper alternatives for pharmaceuticals.

Recent Developments

- In October 2024, a first-of-its-kind in the healthcare industry, polyethylene terephthalate (PET) blister packaging on its renowned brand, Aleve, was launched by Bayer in collaboration with pharma packaging specialist, Liveo Research, this innovative solution reduces the carbon footprint of this packaging by 38% and marks a stride in environmental stewardship by eliminating the use of polyvinyl chloride (PVC).(Source: https://www.bayer.com)

- In October 2024, a new office and showcases blister packaging solutions at Chakan MIDC Phase II in Pune, Maharashtra, were inaugurated by Uhlmann India. This event marked a significant step in the company's growth and commitment to Indian operations. (Source: https://www.expresspharma.in)

Segment Covered in the Market

By Blister Type

- Thermoformed Blisters

- Cold-formed Blisters (CFF)

- Paper-based Blisters

By Material Composition

- Plastic-based Films

- Aluminum Foils

- Multilayer Laminates

By Drug Form

- Solid Oral Dosage Forms

- Powders and Granules

- Lozenges

- Sublingual and Buccal Tablets

- Transdermal Batches (unit-dose)

- Effervescent Tablets (in specialized barrier blisters)

By Technology Used

- Thermoforming

- Cold-forming

- Heat-sealing (Flat platen or rotary)

- Ultrasonic or RF Sealing (rare, niche)

- Laser Coding & Perforation

- Vision-based Inspection (inline QA)

- Anti-counterfeit Integration

By Functionality

- Standard Blister Packaging

- Child-resistant and Senior-friendly packs

- Tamper-evident Blisters

- Environmentally Sustainable Packs

- Others

By Packaging Format

- Single Blister Packaging

- Multi-Cavity/Strip Packs

- Unit Dose Blisters

- Blister Wallets and Cards

By Distribution Channel (for DTC or B2B customized packs)

- Direct-to-Pharma

- Through Contract Packaging Organizations (CPOs)

- Private Label Brands

- Online Pharmacies (for home-delivered patient-centric packs)

By End-user

- Pharma Manufacturers

- Clinical Trial Supply Providers

- Hospitals & Clinics (In-house Packaging Units)

- Retail Pharmacies (Privacy Label/DTC Blister Units)

- Government Tender Agencies

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content