Pressure Guidewires Market Size and Forecast 2025 to 2034

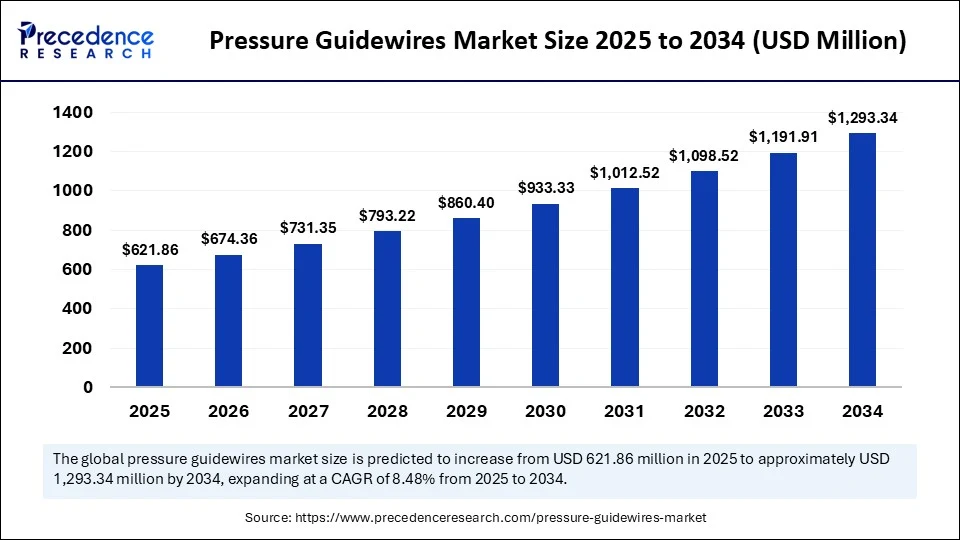

The global pressure guidewires market size accounted for USD 573.48 million in 2024 and is predicted to increase from USD 621.86 million in 2025 to approximately USD 1,293.34 million by 2034, expanding at a CAGR of 8.48% from 2025 to 2034. It plays a crucial role in industries where safe and precise operations are essential, such as oil and gas, chemical processing, pharmaceuticals, and manufacturing.

Pressure Guidewires Market Key Takeaways

- In terms of revenue, the global pressure guidewires market was valued at USD 573.48 million in 2024.

- It is projected to reach USD 1,293.34 million by 2034.

- The market is expected to grow at a CAGR of 8.48% from 2025 to 2034.

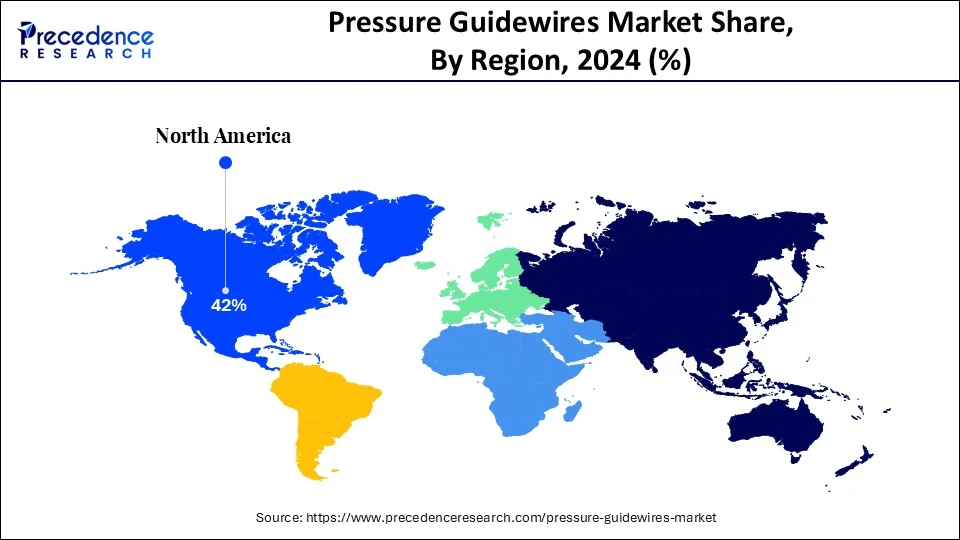

- North America dominated the chemical subsea and offshore services market with the largest market share of 41% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the pressure-only guidewires segment held the biggest market share of 60% in 2024.

- By product type, the pressure + flow guidewires segment is expected to grow at the fastest CAGR during the forecast period.

- By lesion type, the complex lesions segment led the market in 2024.

- By lesion type, the simple lesions segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By technology, the solid-state pressure sensors segments captured the highest market share of 60% in 2024.

- By technology, the fiber optic sensors segment will grow at the highest CAGR during the period.

- By end use, the hospitals segment generated the major market share of 50% in 2024.

- By end use, the cardiac catheterization laboratories segment is projected to expand rapidly in the coming years.

- By distribution channel, the direct sales segment captured a significant market share in 2024.

- By distribution channel, the online medical platforms segment is predicted to witness significant growth over the forecast period.

How Is AI Transforming the Pressure Guidewires Market?

Artificial Intelligence (AI) is significantly enhancing the application and enforcement of pressure guidewires across industries. AI-powered predictive maintenance tools analyze real-time pressure data to identify risks before failures occur. This allows companies to not only comply with guidewires but also optimize operational efficiency. Machine learning algorithms are being used to refine safety models and improve compliance accuracy. AI-driven digital twins simulate pressure systems, enabling engineers to test compliance under different scenarios. Moreover, artificial intelligence helps automate auditing and documentation processes, reducing human error and regulatory delays. As a result, AI is making pressure guidewires more adaptive, proactive, and cost-effective in their implementation, leading to expansion of the pressure guidewires market.

U.S. Pressure Guidewires Market Size and Growth 2025 to 2034

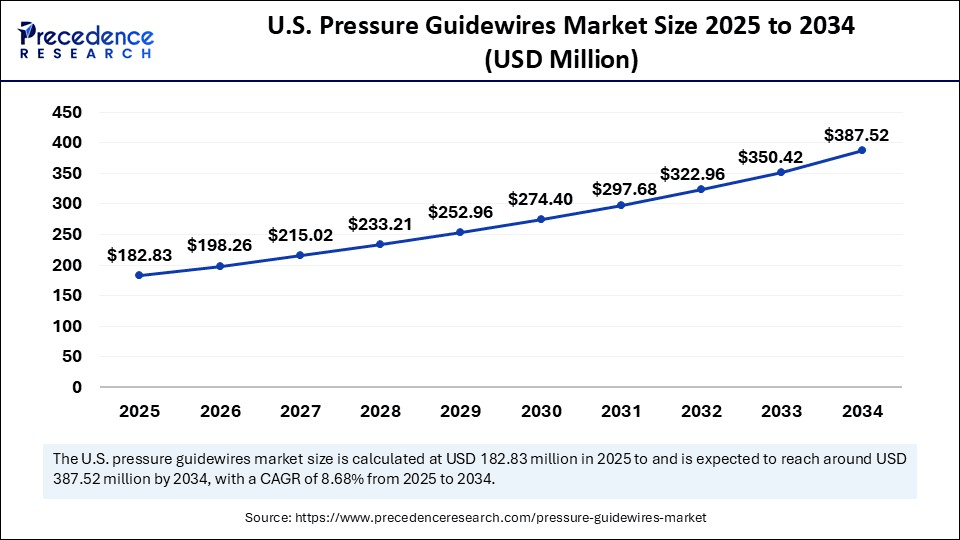

The U.S. pressure guidewires market size was evaluated at USD 168.60 million in 2024 and is projected to be worth around USD 387.52 million by 2034, growing at a CAGR of 8.68% from 2025 to 2034.

Why is North America Leading the Pressure Guidewires Market?

North America dominated the global market in 2024, supported by technological advancements and high adoption of minimally invasive procedures. Hospitals and cardiac centers actively implement cutting-edge guidewire solutions for improved diagnostic accuracy. Favorable reimbursement policies and a strong presence of leading medical device companies support rapid market growth. Continuous research and clinical trials contribute to product innovation and enhanced procedural efficiency. Physicians' preference for advanced tools and patient demand for high-quality care further boost market expansion. The convergence of innovation, infrastructure, and patient-centric care models positions North America for dominance.

Is Asia Pacific the Fastest-Growing Market?

Asia Pacific is the fastest-growing region in the pressure guidewires market sector, due to the increasing prevalence of cardiovascular diseases and expanding healthcare infrastructure. Countries like China, Japan, and India are witnessing significant investments in advanced cardiac care facilities. Growing government initiatives to improve cardiac healthcare access have also accelerated adoption. Rising disposable incomes and increasing health awareness among patients contribute to higher demand. Leading medical device manufacturers are strategically focusing on this region to expand their presence. This combination of disease prevalence, infrastructure development, and rising awareness continues to reinforce Asia Pacific as the fastest-growing region.

Market Overview

The pressure guidewires market caters to the demand of a crucial component used in advanced intravascular devices, which have wide applications in interventional cardiology to measure fractional flow reserve (FFR), coronary flow reserve (CFR), and other physiological parameters. These instruments are pivotal in the evaluation of the functional significance of coronary artery stenosis. Unlike traditional angiography, pressure guidewires provide real-time hemodynamic data, enabling precise diagnosis and treatment planning for percutaneous coronary interventions (PCI). These guidewires integrate miniature pressure sensors and, at times, Doppler flow technology, aiding in improved clinical outcomes, reduced stent overuse, and evidence-based decision-making. They are widely utilized in hospitals, catheterization labs, and specialty cardiac centres. Increasing prevalence of cardiovascular diseases, emphasis on minimally invasive procedures, and guideline-driven adoption of FFR assessments support market expansion.Innovations such as wireless pressure guidewires, improved lesion crossing capability, and hybrid pressure-flow measurement systems are further shaping growth, especially in North America, Europe, and the Asia Pacific.

The pressure guidewires industry has been witnessing steady growth, driven by stricter safety regulations and the rising demand for high-performance equipment across industries. Manufacturers and operators increasingly rely on standardized protocols to reduce risks associated with pressure failures, leaks, or system breakdowns. Digital pressure monitoring, smart sensors, and automated safety systems are reshaping how guidewires are applied in real time. Industries such as energy, petrochemicals, and pharmaceuticals remain the key adopters of these standards. Moreover, the growing adoption of renewable energy and hydrogen fuel systems is expanding the applications of pressure regulations. Overall, the market is evolving from static compliance frameworks to more dynamic, technology-enabled safety solutions.

Market Key Trends

- Integration of IoT-enabled pressure monitoring systems.

- Shift from reactive to predictive safety protocols.

- Adoption of cloud-based platforms for regulatory compliance.

- Growing focus on hydrogen and renewable energy safety standards.

- Standardization efforts across international regulatory bodies.

- Use of digital twins to model and validate pressure systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,293.34 Million |

| Market Size in 2025 | USD 621.86 Million |

| Market Size in 2024 | USD 573.48 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.48% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Lesion Type, End Use, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Precision Diagnostics Fueling Growth

The pressure guidewires market is driven by the growing demand for accurate and minimally invasive cardiovascular diagnostics. Clinicians increasingly rely on pressure guidewires to assess coronary artery lesions and optimize treatment strategies. The rising prevalence of cardiovascular diseases worldwide has accelerated the adoption in hospitals and specialized cardiac centers. Technological advancements in guidewire design, including improved flexibility and real-time pressure measurement, further support market growth. Additionally, physicians' preference for reliable and reproducible diagnostic tools enhances market penetration. Increasing awareness among patients and healthcare providers about the benefits of precision-guided interventions continues to fuel demand.

Restraint

High Costs and procedural complexity

Despite its growth potential, the pressure guidewires market faces restraints due to the high cost of pressure guidewires and related equipment. The complexity of using these devices requires skilled personnel, which can limit adoption in smaller hospitals or clinics. Reimbursement challenges in certain regions may discourage healthcare providers from investing in advanced guidewire technologies. Additionally, the need for regular calibration and maintenance can increase operational expenses. Limited awareness among some healthcare practitioners about procedural advantages can further hinder uptake. These factors collectively slow the widespread adoption of pressure guidewires in certain markets.

Opportunity

Expanding Access and Technological Innovation

The pressure guidewires market presents significant opportunities through the integration of advanced imaging and digital health technologies. Emerging markets in certain regions offer high growth potential due to expanding healthcare infrastructure and increasing cardiac disease awareness. Innovation in wireless and sensor-enabled guidewires opens avenues for more efficient procedures and remote monitoring capabilities. Collaborations between medical device companies and healthcare providers are creating customized solutions tailored to specific patient populations. Rising investments in research and development for next-generation guidewires provide long-term growth prospects. The convergence of high-tech advanced tools and pressure measurement tools also promises enhanced procedural efficiency and better clinical outcomes.

Product Type Insights

Why Are the Pressure-Only Guidewires Dominating the Pressure Guidewires Market?

The pressure-only guidewires have become a dominant force in the pressure guidewires market industry, owing to these devices being simpler to use and cost-effective, making them the preferred option in hospitals worldwide. Physicians rely on them for routine decision-making in interventions, especially for patients with stable coronary artery disease. Their ease of integration into existing workflows further strengthens their market dominance. Moreover, pressure-only systems provide rapid results, reducing producers' time and improving patient throughput. This reliability makes them the gold standard across both developed and emerging healthcare systems.

Their dominance is also supported by strong clinical evidence validating their effectiveness in guiding treatment strategies. Hospitals continue to invest heavily in pressure-only systems due to their compatibility with existing catheterization lab infrastructure. Compared to more advanced options, they present fewer training barriers for clinicians, which speeds adoption. Patients also benefit from reduced costs, as these systems do not require expensive complementary technologies. With the rising demand for evidence-based medicine, pressure-only guidewires will likely sustain their leadership. This is the cornerstone of the pressure guidewires market.

The pressure + flow guidewires are the fastest-growing in the pressure guidewires market space, driven by the combination of pressure and flow management to deliver a clearer picture of lesion severity. Their ability to improve diagnostic precision helps clinicians tailor interventions more efficiently. The growing shift toward precision medicine is driving demand for these advanced systems. Although costlier than pressure-only devices, this clinical value justifies the investment for many institutions. Their rising use in complex cardiovascular cases highlights their market momentum.

Advancements in sensor technology are making pressure flow guidewires more accurate and user-friendly. Increased adoption is particularly seen in advanced cardiac centers that handle high-risk patients. Training initiatives and physician awareness of cardiac centers that handle high patients. Training initiatives and physicians' awareness programs are further expanding their clinical uptake. As reimbursement policies evolve, financial barriers to adoption are expected to ease. This combination of precision and growing accessibility positions them for rapid expansion. Over time, they may close the gap with pressure-only guidewires by market share.

Technology Insights

Which Technology Dominated the Pressure Guidewires Market?

The solid-state pressure sensors have become a dominant force in the pressure guidewires market, stemming from superior accuracy and minimal signal drift. They offer a practical alternative for hospitals in emerging economies with budget constraints. Growing improvements in their design are narrowing the performance gap with fiber optic sensors. Manufacturers are also focusing on integrating them into compact devices for routine applications. These factors are contributing to their accelerating adoption rate.

The growth of solid-state technology is also supported by its scalability in large-volume production. As demand for affordable pressure monitoring solutions rises, solid-state sensors provide a strong fit. Their improved accuracy is making them suitable even for complex lesion assessments. Moreover, they require less specialized training for clinicians, further supporting uptake. Strategic collaborations among manufacturers are helping expand their global reach. This positions solid-state sensors as a disruptive force in the market.

The fiber optic pressure sensors are the fastest-growing in the pressure guidewires market space, in view of their appeal lies in being cost-effective and relatively easy to manufacture. They are particularly valued in complex producers where precise readings are critical. Their reliability has established them as the benchmark in pressure monitoring systems. Additionally, their compatibility with advanced imaging and diagnostics systems enhances their appeal. Physicians trust fiber optic technology because it consistently delivers reproducible results. This trust has translated into widespread adoption in leading hospitals worldwide.

The high growth of fiber optic sensors is also linked to their durability and reduced calibration needs. They are less prone to electromagnetic interference, which improves safety in sensitive producers. Despite being costlier than solid-state alternatives, their clinical performance justifies their price. Ongoing product innovations continue to enhance their sensibility and miniaturization. These advancements ensure they remain the preferred choice in high-end characterization labs. Overall, fiber optic sensors will likely retain their leadership in the foreseeable future.

Lesion Type Insights

Why Are Complex Lesions the Dominant Ones in the Pressure Guidewires Market?

The complex lesions have become a dominant force in the pressure guidewires market, due to their higher clinical need for accurate physiological assessment. These cases often involve multi-vessel disease, bifurcation lesions, or clarification, requiring advanced pressure measurement. Physicians rely heavily on pressure monitoring is highest in these challenging scenarios. As a result, hospitals prioritize investment in advanced systems for complex lesion management. Their clinical significance ensures they remain the largest segment.

Clinical trials have repeatedly demonstrated the importance of pressure assessment in improving outcomes for complex lesions. There is a reduction in the risk of unnecessary stenting and adverse events. Hospitals also see these systems as essential in reducing long-term costs associated with complications. The integration of pressure assessment into standard protocols for complex lesions further reinforces their dominance. Moreover, reimbursement structures often support their use in such high-risk cases. These combined factors guarantee their continued leadership in the market.

The following are the fastest-growing in the pressure guidewires market space, referring to its traditionally, physicians managed simple cases without advanced pressure assessment. However, rising emphasis on evidence-based medicine is changing this approach. Pressure monitoring in simple lesions helps avoid overtreatment, especially unnecessary stenting. This not only improves patient outcomes but also reduces healthcare costs. Consequently, adoption is increasing across general hospitals and mid-sized centres.

The affordability of new sensor technologies is also making pressure assessment viable in simple lesion cases. Training programs are encouraging physicians to incorporate these tools into everyday practice. Patients benefit from more personalized treatment strategies, further driving acceptance. As awareness spreads, the use of pressure guidewires is becoming standard practice even outside complex procedures. Reimbursement expansion is also supporting adoption in lower-risk scenarios. This positions the simple lesion segment for strong growth in the coming years.

End Use Insights

Who Leads As the End User in the Pressure Guidewires Market?

Hospitals are the leading segment in the pressure guidewires market; they remain the primary setting for cardiovascular interventions requiring pressure monitoring. Hospitals often house specialized cardiac units equipped with advanced catheterization labs, as they are the bulk service providers for cardiovascular treatments. Their access to resources and skilled professionals supports large-scale adoption of pressure guidewires. Moreover, hospitals handle both emergency and elective cases, increasing the frequency of use. Their central role in healthcare delivery ensures their dominance in this market.

Hospitals also benefit from partnerships with medical device manufacturers for technology upgrades. They are often the first to adopt innovations such as fibre optic and hybrid guidewires. Regulatory compliance requirements also drive hospitals to prioritize safety tools like pressure guidewires. Large hospitals especially serve as training hubs, promoting widespread clinical adoption. With strong financial capacity, hospitals are better positioned to invest in high-end systems. This makes them the anchor customer base for the industry.

The cardiac catheterization laboratories are the fastest-growing in the market for pressure guidewires, driven by increasingly independent general hospitals, focusing on interventional cardiology. Their rapid growth is fueled by the rising demand for minimally invasive procedures. They are well-equipped to adopt advanced pressure guidewires tailored to specific interventions. Moreover, catheterization labs often serve high-risk patients, necessitating precise monitoring tools. Their niche expertise accelerates the uptake of cutting-edge technologies.

The growth of catheterization labs is also driven by the decentralization of healthcare delivery. Many regions are investing in standalone labs to improve access to advanced cardiac care and even leading research in the space. Reimbursement models support their specialized procedures, encouraging wider adoption of pressure guidewires. These labs also play a critical role in clinical research and technology validation. With their agility, they can adopt new devices faster than traditional hospitals. As cardiovascular disease burdens rise globally, catheterization labs will emerge as key growth drivers.

Distribution Channel Insights

Why Are Direct Sales the Dominant Segment in the Pressure Guidewires Market?

The direct sales have become a dominant force in the pressure guidewires market. This channel allows companies to provide personalized service, training, and after-sales support. Direct engagement also ensures faster adoption of new technologies by clinicians. Large hospitals prefer direct procurement for its reliability and access to technical expertise. Direct sales further facilitate bulk purchasing agreements, strengthening vendor-client partnerships. As a result, they remain the preferred distribution model for most manufacturers.

The dominance of direct sales is also reinforced by the complex nature of pressure monitoring systems. Hospitals require training and maintenance support, which manufacturers can best deliver directly. Moreover, direct sales provide greater control over pricing and brand positioning. Many companies also use this channel to gather clinical feedback to improve their products. Strategic alliances with hospitals through direct sales build long-term trust and loyalty. Consequently, direct sales will continue to anchor market growth.

The online medical platforms are the fastest-growing in the pressure guidewires market space due to rising digital adoption in healthcare procurement. Hospitals and clinics increasingly value the convenience and transparency of online purchasing. These platforms offer broader product access, especially in regions underserved by direct sales networks. Competitive pricing and digital catalogs also make online channels attractive for smaller facilities. The COVID-19 pandemic accelerated the trend, highlighting the efficiency of remote procurement. This momentum continues as digital health ecosystems expand.

The growth of online platforms is also fueled by their integration with supply chain analytics and inventory management systems. Buyers benefit from real-time tracking, streamlined documentation, and faster delivery. Manufacturers are partnering with online distributors to reach new markets more efficiently. In emerging economies, online platforms reduce barriers for hospitals with limited access to sales representatives. Enhanced cybersecurity and regulatory compliance features are boosting confidence in digital procurement. These factors collectively ensure strong growth for online medical channels.

Pressure Guidewires Market Companies

- Abbott Laboratories

- Boston Scientific Corporation

- Philips Volcano

- Terumo Corporation

- Opsens Inc.

- Acist Medical Systems (Bracco Group)

- Merit Medical Systems

- Cardiovascular Systems, Inc. (CSI)

- Asahi Intecc Co., Ltd.

- Biotronik SE & Co. KG

- Medtronic plc

- B. Braun Melsungen AG

- Nipro Corporation

- Lepu Medical Technology

- Nihon Kohden Corporation

- MicroPort Scientific Corporation

- Hexacath

- Teleflex Incorporated

- Shimadzu Corporation

- iVascular S.L.U.

Recent Developments

- In June 2025, MedHub-AI, an Israel-based startup specializing in AI-powered cardiovascular diagnostics, received approval from Japan's Pharmaceuticals and Medical Devices Agency (PMDA) for AutocathFFR. This innovative software solution uses AI to evaluate coronary physiology non-invasively, calculating fractional flow reserve values from standard X-ray coronary angiograms without requiring guidewires or vasodilatory agents. AutocathFFR provides fast and reproducible results, supporting interventional cardiologists in the cath lab. Meanwhile, the trend of online medical procurement continues to grow, driven by the efficiency and convenience highlighted during the COVID-19 pandemic. Digital health ecosystems are expanding, and online platforms are integrating with supply chain analytics and inventory management systems, enabling real-time tracking, streamlined documentation, and faster delivery.

(Source: https://www.biospectrumasia.com) - In June 2025, MedHub-AI, a global provider of AI-powered cardiovascular diagnostics, announced that Japan's Pharmaceuticals and Medical Devices Agency (PMDA) had granted approval for AutocathFFR, its non-invasive, AI-driven software designed to assess coronary physiology.

(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Product Type

- Pressure-Only Guidewires

- Pressure + Flow Guidewires (Hybrid)

- Wireless Pressure Guidewires

- Others

By Technology

- Fiber Optic Pressure Sensors

- Solid-State Pressure Sensors

- Others

By Lesion Type

- Complex Lesions

- Simple Lesions

- Others

By End Use

- Hospitals

- Cardiac Catheterization Laboratories

- Specialty Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Distribution Channel

- Direct Sales (Institutional Procurement)

- Third-Party Distributors

- Online Medical Platforms

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting