What is Service Provider Network Infrastructure Market Size?

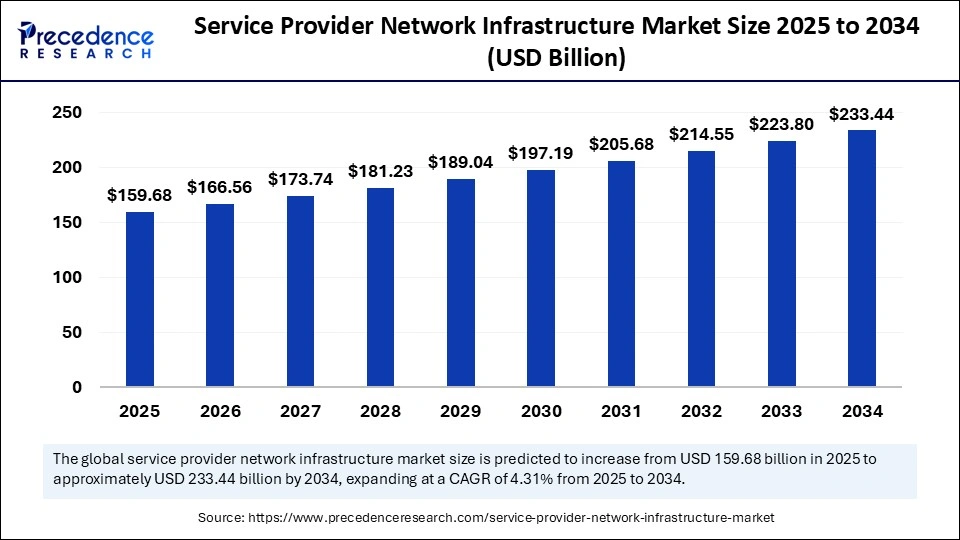

The global service provider network infrastructure market size accounted for USD 159.68 billion in 2025 and is predicted to increase from USD 166.56 billion in 2026 to approximately USD 233.44 billion by 2034, expanding at a CAGR of 4.31% from 2025 to 2034. The market growth is attributed to the rising demand for high-speed connectivity, driven by 5G deployments, cloud adoption, and the proliferation of IoT and data-intensive applications.

Market Highlights

- North America dominated the service provider network infrastructure market with the largest revenue share in 2024.

- Asia Pacific is expected to grow at a notable CAGR between 2025 and 2034.

- By technology, the broadband access & optical transport segment held the major revenue share in 2024.

- By technology, the wireless packet core segment is projected to grow at a CAGR in the coming years.

- By enterprise size, the large enterprise segment contributed the biggest revenue share in 2024.

- By enterprise size, the SMEs segment is projected to expand at a significant CAGR during the forecast period.

- By industry, the banking, financial services, & insurance segment dominated the market with the highest revenue share in 2024.

- By industry, the healthcare segment is expected to grow at a significant rate over the projected period.

Market Overview

The service provider network infrastructure is flourishing due to higher demand for dependable and fast connections for new technologies and applications. It consists of the important equipment and the software needed to supply internet, voice, and data service, such as routers, switches, fiber-optic cables, and software-defined networking. The expansion of online gadgets and the number of internet-hungry applications users enjoy, including video streaming, gaming, and cloud services, further contribute to market expansion. In 2025, GSMA found that mobile network operators make up 85% of investments in mobile internet infrastructure, highlighting their main role in addressing the rising need. Increased use of 5G is one of the reasons why the market for service provider network infrastructure is growing faster. Furthermore, the increasing data traffic facilitates the market's growth.

Impact of Artificial Intelligence on the Service Provider Network Infrastructure Market

Artificial Intelligence is making service provider network infrastructure intelligent and adaptable. Network managers use AI tools to boost performance, spot network issues early, and solve issues ahead of time. Service providers rely on AI tools to analyze all the data on their networks and quickly adjust bandwidth, spot unusual events, and predict when equipment might fail. Moreover, AI plays a key role in intent-based networking, helping networks learn and adjust themselves as needed using desired business settings. AI-powered automation enables service providers to manage and optimize network operations.

Growth Factors

- Rising Adoption of AI-Powered Network Management: AI-driven automation is boosting real-time monitoring and predictive maintenance across telecom networks.

- Expanding Edge Computing Deployments: Edge infrastructure is fuelling demand for localized data processing, improving latency-sensitive applications.

- Growing Emphasis on Network Resilience: Enterprises are driving investments in robust failover systems to ensure service continuity amid rising cyber threats.

- Boosting Demand for SD-WAN Solutions: Increased reliance on remote and hybrid work models is driving SD-WAN implementation for flexible and secure connectivity.

- Surge in IoT Device Connectivity: Rapid growth of connected devices is fuelling the need for scalable, high-capacity network infrastructure.

- Propelling Shift Toward Cloud-Native Architectures: Telecom operators are transitioning to cloud-native cores, enhancing agility and reducing time-to-market.

- Driving Focus on Private 5G Networks: Industrial sectors are boosting private 5G adoption to enable ultra-reliable, low-latency communications for mission-critical operations.

Market Outlook: Strategic Perspectives from the Service Provider Network Infrastructure Market

- Market Context: The increasing internet traffic of 23% year-on-year in 2022, is increasing the demand for infrastructure in the service provider networks and is operational pressure to increase areas, capacity and resilience.

- Global Growth: China's reach passed 4.04 million 5G base-stations by August 2024 - representing a rapid region of growth (China is nearing 32.1% of the total number of all mobile base-stations).

- Research & Development: Governments and standards organizations are expressing advocacy for open disaggregated (i.e. Open RAN) network architecture enabling flexibility and multi-vendor solutions, this was published more formally by the UK Government.

- Technology Stack Modernisation, in preparation for lower latency and greater scalability operator is moving to software defined networking (SDN), edge computing and virtualization which is now moving into hyperdrive.

- Public Policy and Supply Chain, with governments working with telecom infrastructure supply-chain diversification goals reducing vendor lock and improving resilience in a number of strategic geographies.

- Sustainability and Operational Efficiency, the rapid expansion of the network infrastructure is now beginning to produce greater energy use and carbon-efficiency operational challenges which necessitate energy-efficient network design is now into hyper drive.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 159.68 Billion |

| Market Size in 2026 | USD 166.56 Billion |

| Market Size by 2034 | USD 233.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.31% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Industry, Enterprise Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is Increased Demand for High-Speed Connectivity Drives Infrastructure Upgrades?

The increased demand for high-speed connectivity is expected to drive substantial infrastructure upgrades. Greater demand for high-speed internet prompts upgrades of existing networks. This demand is exemplified due to the proliferation of applications like video streaming, online gaming, and cloud computing. The increasing numbers of people are shifting toward remote working models, boosting the need for cloud computing. This creates the need for networks with high bandwidth and low latency. Moreover, businesses are increasingly adopting digital and 5G technologies, boosting the demand for high-speed connectivity. According to GSMA Intelligence, 5G connections are expected to represent over half (51%) of mobile connections by 2029, rising to 56% by the end of the decade, making 5G the dominant connectivity technology.

Restraint:

Stringent Regulatory and Spectrum Allocation Challenges

Stringent regulatory and spectrum allocation challenges are anticipated to hinder the growth of the service provider network infrastructure market. Enforcement of policies related to spectrum, privacy of data, and network infrastructure locations create challenges in the market. This deters service providers from building their network infrastructures. There are not enough high-frequency bands for 5G in some regions. The telecom industry is subject to stringent regulations, which vary across regions and impact infrastructure deployment and operation.

Opportunity

How is High Demand for Edge Computing Creating New Opportunities in the Market?

High demand for edge computing is expected to create immense opportunities for the players competing in the service provider network infrastructure market. The growth of edge computing, which brings processing closer to the data source, requires distributed network infrastructure. Operators use MEC technology to handle data near users, which makes their services more responsive. The architecture is used for developing autonomous vehicles, augmented reality, and remote control of industrial machines. Major different industries were planning to spend more on edge computing in the coming year, with most looking to boost their budgets. The Industry Specification Group (ISG) MEC from ETSI Multi-access Edge Computing completed Phase 3 activities and has moved on to Phase 4 in 2024, concentrating on new topics to progress MEC standards. Furthermore, this growing availability of edge computing technology creates further demand for advanced network infrastructure solutions.

Segment Insights

Technology Insights

The broadband access & optical transport segment dominated the service provider network infrastructure market with the largest share in 2024. This is mainly due to the increased demand for efficient and powerful ways to connect devices. Many service companies increased the usage of fiber optics technologies, including DWDM and PON to improve data transmission over long distances. In the year 2024, the ITU noted that there was a rapid increase in fiber-optic networks, mainly in Asia-Pacific and Europe, reflecting the rising demand for broadband adoption. Funding from the government for digital transformation operators and increased replacement of old copper systems with fiber networks further bolstered the segment's growth. Experts from Dell'Oro Group said there was a significant rise in investment in broadband setup in developing countries in 2024, helping more people gain access to high-speed internet. Furthermore, since more businesses and consumers are using applications that require high bandwidth, it further facilitates segment growth.

The wireless packet core segment is projected to grow at a significant CAGR in the coming years, as it is central to ensuring that 5G and newer networks work properly. In 2024, MWC GSMA stated that 261 operators from 101 countries already provided 5G coverage worldwide.

This showed a growth in the need for cloud-based and adaptable telecom solutions. Additionally, the use of MEC, together with the wireless packet core, minimizes latency for timely applications, making it an important part of network growth. All these advancements contribute to the fast growth of the segment.

Enterprise Size Insights

The large enterprises segment held the largest share of the service provider network infrastructure market in 2024. This is mainly due to their increased spending on advanced, secure, and scalable network systems for their international operations. Gartner noted in 2024 that large organizations were focusing on using both multi-cloud solutions and edge computing to speed up data work and lessen latency. Companies are looking to network function virtualization (NFV) and automation to both increase performance and decrease expenses. Furthermore, finance, healthcare, and manufacturing sectors spend more on private 5G networks and network slicing, further propelling the need for service provider network infrastructure.

The SMEs segment is projected to expand at a significant CAGR during the forecast period. This is mainly due to their rapid shift toward digital services and greater use of the cloud. Companies with fewer than 500 employees spend much on network systems that are flexible and help save money to support remote staff, improve security, and raise operational efficiency. Moreover, the digital inclusion efforts globally greatly increased SMEs in developing regions being able to benefit from broadband, thus further fuelling the market growth.

Industry Insights

The banking, financial services, & insurance segment dominated the service provider network infrastructure market in 2024. This is mainly due to the rising digitalization and strong demand for highly secured, low-latency networks within financial institutions. With more uses of blockchain, AI-driven fraud protection, and cloud services, the sector wanted a larger and more reliable infrastructure to support complex tasks. The harsh rules on data privacy and cyber security encouraged businesses in financial services to upgrade both their core and edge network capabilities. GSMA reports that enhanced mobile banking and digital paymentsystems in emerging countries helped spur higher infrastructure investments last year.

The healthcare segment is expected to grow at a significant rate over the projected period, as a high number of people use digital health options and telemedicine. The healthcare industry spent a lot on dependable, safe, and fast network systems to use EHR, remote monitoring solutions, and work with real-time analytics. According to the International Telecommunication Union in 2024, meeting the tough requirements of telehealth and regulations in healthcare meant that facilities expanded their use of broadband and fiber-optic networks. Digital healthcare transformation plans by the government made it possible to build critical infrastructure in cities and remote areas faster. Additionally, the rising need for data security and privacy led to a surge in investments in advanced network infrastructure for healthcare.

Regional Insights

North America dominated the service provider network infrastructure market in 2024. This is mainly due to advancements in network virtualization and edge computing. The widespread use of 5G technologies further bolstered the growth of the market in the region. North America's mature telecommunications industry relies on cloud frameworks and automation to boost efficiency and lower costs. Due to strict laws and major spending on cyber tools, enterprises have updated their network setups quickly.

Since North America is home to many hyperscale data centers and technology companies, it saw an increase in demand for advanced optical transport and broadband access. In 2024, ETSI stated that North American operators were the first to implement network slicing and SDN, which is important for supporting all kinds of services. Moreover, the light reading highlighted that deployments of edge computing have increased in support of applications that need fast responses in healthcare and finance, which is boosting the infrastructure market.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to increasing digital economies and high spending on telecom infrastructure. Deploying fiber-optic networks and distributing 5G has become important for China, India, Japan, and South Korea to meet the needs of their fast-rising internet users. According to the GSMA, in 2024, Asia Pacific saw the highest growth in 5G subscriptions due to strong help from government support and attractive regulations. A large number of population and firms are turning to digital technologies, and infrastructure projects in the region continue to advance. The increased need for low-latency apps and speedy broadband encouraged cooperation between providers and technology companies to scale and secure their networks. Furthermore, the government's efforts to help rural areas gain access to broadband have increased the potential number of customers is further fuelling the market in this region.

In Europe, the Digital Networks Act is proposed to align telecom regulation across member states, promote fibre/5G deployment, and create uniform spectrum regulations, interconnection frameworks etc.

Europe held a considerable share of the service provider network infrastructure market in 2024 and is expected to grow at a steady growth rate in the coming years. This is mainly due to the rising 5G deployments, strict regulations for open access, and increased investment in digital advancement. In Germany, the UK, and France, major telecom companies added equipment to support the need for more bandwidth among both consumers and businesses. According to ETSI, in 2024, Europe achieved major progress in setting up 5G SA networks, helping improve latency and network slicing. IDC reported in 2024 that telecom operators in Europe placed greater emphasis on using energy-efficient and software-defined infrastructure to meet the continent's green ICT aims and sustainability objectives. Additionally, due to increased dangers and political unrest, European service providers have strengthened their important network infrastructure. Based on GSMA's findings, Europe led with a large portion of the world's Internet of Things device connections in 2024, requiring industries to focus on strong, low-delay connectivity.

Germany's market is supported by steady investments in broadband ramp-ups, densification of 5G networks, and fiber-to-the-home (FttH) implementations. Strong regulatory focus on digital transformation in Germany and increased enterprise demand for cloud-connectivity drive a favorable market for upgrading infrastructure and expanding digital ecosystem integration. Service providers continue their focus on network virtualization and deploying secure, energy-efficient architectures.

The U.S. telecom market is being driven by large-scale 5G rollouts, fiber expansion, and growing demand for networks with sufficient capacity to support cloud-based applications, edge computing, and streaming services. Service providers are increasingly embracing software-defined networking and open networking, benefiting from improved scalability, reduced latency, and enhanced performance of national connectivity.

Government Innovation on Network Infrastructure: China State-Cloud to India People Connectivity

Governments are taking an active role in reshaping the backbone of service-provider networks. China's Ministry of Industry and Information Technology is partnered with state companies in July 2025, (China Mobile, China Unicom, and China Telecom) to create a national cloud-reseller network, a direct monetization of the excess capacity from data-centre overbuild.

China is continuing its rapid expansion of advanced telecommunications infrastructure with aggressive deployments of 5G and extensive fiber networks and stimulus for digital initiatives from the state. Rapid growth of Internet of Things (IoT) ecosystems and cloud platforms generates demand for networks with high capacity and scalable architectures. Service providers optimize their efforts in automation, high-bandwidth capacity, and integration of expressed national digital ecosystems.

The Universal Service Obligation Fund in India (now called Digital Bharat Nidhi) is financing fibre rollout via BharatNet and subsidizing 4G expansion in rural India.

And, supported by leased-line connectivity, public cloud initiatives like MeghRaj and digital public-goods platforms like UPI and National Health Stack, are fostering enterprise adoption and bridging the digital divide.

Service Provider Network Infrastructure Market Companies

- Alcatel–Lucent S.A.

- Aruba Networks Inc.

- Avaya Inc.

- Bluecoat Systems In.

- Brocade Communications Systems Inc.

- Ericsson Inc.

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc

- Nokia Siemens Networks

- ZTE Corporation

Latest Announcement by Industry Leader

- In April 2025, Nokia and Bharti Airtel are strengthening their partnership through the deployment of Nokia's Packet Core appliance-based and Fixed Wireless Access solutions to enhance network performance for Airtel's expanding 4G/5G user base. This solution will facilitate the seamless integration of 4G and 5G technologies on a unified server infrastructure. Nokia's FWA will deliver increased capacity for home broadband and mission-critical enterprise services. Airtel plans to leverage Nokia's automation framework to enable zero-touch service deployment and efficient core network lifecycle management, improving service delivery speed and reducing operational expenses. “Nokia and Airtel have a long-standing partnership and we are pleased to bolster its 5G SA readiness,” stated Raghav Sahgal, President of Cloud and Network Services at Nokia. “Airtel's use of Nokia's Packet Core to build greater network agility and reliability demonstrates how we are both helping customers solve problems and furthering Nokia's leadership position in the Core space in India and around the world.”

Recent Developments

- In October 2024, At India Mobile Congress 2024 (IMC24), Vodafone Idea (Vi), India's third-largest mobile operator, confirmed it will commercially launch 5G services by March 2025, intensifying market competition and driving new digital infrastructure investments. Unlike its rivals, Vi delayed 5G entry by nearly two years. In contrast, Reliance Jio and Bharti Airtel rolled out 5G in late 2022, committing billions to nationwide coverage. Jio currently serves around 148 million 5G users, while Airtel caters to over 90 million. Despite rapid deployment, monetizing 5G remains challenging due to India's low average revenue per user (ARPU), as highlighted in recent coverage of Airtel's efforts to tap the consumer segment for 5G profitability.

- In February 2025, Bharti Airtel is preparing to launch satellite communication services in India, pending final spectrum allocation, according to Vice Chairman Rajan Bharti Mittal. Two earth stations—one each in Gujarat and Tamil Nadu—are already built and ready. Once the necessary regulatory approvals are granted, service rollout will commence domestically. Bharti Enterprises has launched 635 satellites to date and currently provides satellite services across multiple international markets. Mittal emphasized the company's readiness to rapidly scale services within India as soon as it receives the required spectrum permissions.

- In April 2025, Bharat Sanchar Nigam Limited (BSNL) has started testing its 5G infrastructure across several Indian state capitals such as Jaipur, Lucknow, Chandigarh, Bhopal, Kolkata, Patna, Hyderabad, and Chennai. These test deployments leverage upgraded 4G towers as part of BSNL's broader project to roll out 100,000 4G sites nationwide. Officials confirmed that full commercial 5G services are expected to launch within three months. Network testing has already commenced in multiple telecom circles where BSNL holds strong market presence. In addition to testing, BSNL is expanding its footprint by installing Base Transceiver Stations (BTS) in urban hubs including Kanpur, Pune, Vijayawada, Coimbatore, and Kollam, enhancing mobile coverage and connectivity.

Segments Covered in the Report

By Technology

- Broadband Access & Optical Transport

- Carrier IP Telephony

- Microwave transmission & Mobile Backhaul

- Routers & Switches

- Wireless Packet Core

By Industry

- Banking, Financial Services, & Insurance

- Government & Defense

- Healthcare

- Information Technology & Telecommunications

- Manufacturing

- Retail and eCommerce

- Others

By Enterprise Size

- Large Enterprises

- SMEs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting