What is Urban Air Mobility Market Size?

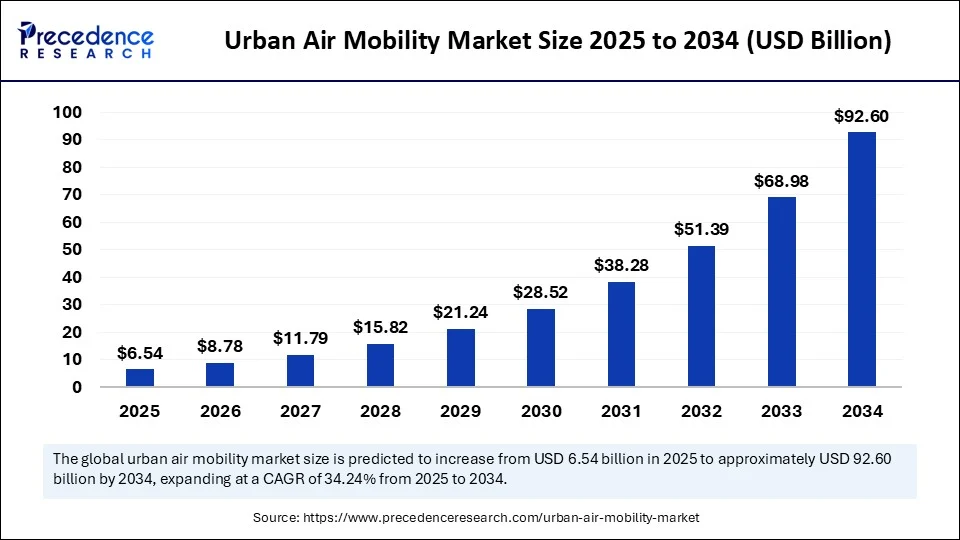

The global urban air mobility market size accounted for USD 6.54 billion in 2025 and is predicted to increase from USD 8.78 billion in 2026 to approximately USD 92.60 billion by 2034, expanding at a CAGR of 34.24% from 2025 to 2034. The urban air mobility market is experiencing rapid growth, with its size expected to significantly increase over the next decade. This emerging sector is poised to transform transportation in cities worldwide.

Market Highlights

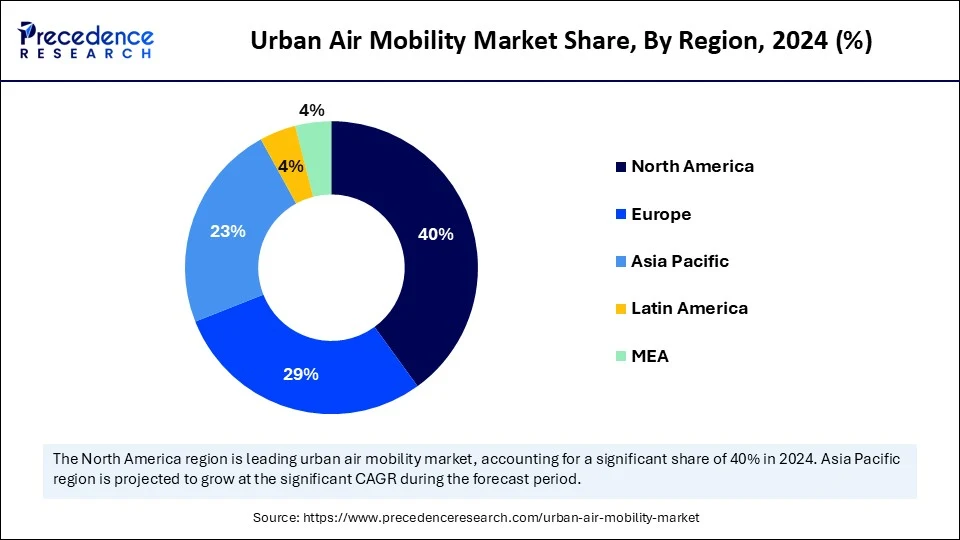

- North America dominated the urban air mobility market with the largest market share of 40% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By vehicle type, the air taxes segment held the biggest market share in 2024.

- By vehicle type, the passenger drones segment is expected to grow at the fastest CAGR during the forecast period.

- By operation mode type, the piloted segment accounted for a considerable share in 2024.

- By operation mode type, the fully autonomous segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By propulsion type, the electric segment contributed the highest market share in 2024.

- By propulsion type, the hydrogen fuel cell segment is expected to experience the fastest growth CAGR from 2025 to 2034.

- By range type, the intracity segment generated the major market share in 2024.

- By range type, the intercity is are fastest growing during the forecast period.

- By end-use application, the ride-sharing / air taxis segment led the market in 2024.

- By end-use application type, the air ambulance & emergency services segment is projected to expand rapidly in the coming years.

- By infrastructure type, the vertiports segment captured the largest market share in 2024.

- By infrastructure type, the charging station segment is projected to expand rapidly in the coming years.

- By component type, the mobile device unlock segment generated the major market share in 2024.

- By component type, the software segment is projected to expand rapidly in the coming years.

Reimagining Cities: How UAM is Transforming Urban Life?

Artificial intelligence is playing a central role in the evolution of urban air mobility by enhancing safety, efficiency, and scalability. AI-powered navigation systems enabled autonomous or semi-automatic eVolt aircraft to operate seamlessly in dense airspaces. Predictive analytics optimize flight paths, reduce energy consumption, and minimize delays, ensuring reliable operations. AI also supports real-time air traffic management by integrating vast amounts of data. Key vehicle types, such as air taxis and passenger drones, are expected to dominate and expand rapidly in the coming years. With a focus on sustainability, electric and hydrogen propulsion systems are gaining traction, appealing to the global push for carbon reduction. Additionally, artificial intelligence is enhancing safety and efficiency, enabling smoother operations in crowded airspaces through advanced navigation and real-time traffic management.

- In August 2025, CEAT integrated artificial intelligence into its factory infrastructure, utilizing computer vision for automated tire inspection and implementing predictive maintenance to minimize downtime. Additionally, CEAT is developing in-house AI and agentic AI tools to provide real-time engineering insights and actionable analytics on the shop floor, thereby enabling teams to operate with increased speed and accuracy, according to Roy.

Market Overview

The Urban Air Mobility (UAM) Market refers to the ecosystem of aircraft, infrastructure, digital systems, and services designed to provide efficient, safe, and sustainable air transportation within urban and peri-urban areas. UAM integrates electric vertical take-off and landing (eVTOL) aircraft, autonomous flight technologies, vertiport infrastructure, and digital air traffic management to reduce congestion, enhance connectivity, and offer on-demand air taxi, logistics, and emergency response solutions. It is a convergence of aviation, automotive, and digital mobility industries aimed at creating an aerial mobility network in cities.

The Urban Air Mobility (UAM) market is experiencing significant growth due to several key factors. First, increasing urbanization is leading to heightened congestion in cities, prompting the need for more efficient transportation solutions. Additionally, advancements in technology, particularly in electric vertical take-off and landing (eVTOL) aircraft and autonomous systems, are facilitating the development of safer and more reliable aerial transportation options. The growing focus on sustainable transportation alternatives is also driving interest in electric and hydrogen propulsion systems, which align with global carbon reduction goals. Furthermore, substantial investments from both private and public sectors are fueling innovation and infrastructure development in the UAM space. As cities strive to enhance connectivity and streamline their transportation networks, the UAM market is poised for rapid growth over the next decade.

Market Key Trends

- Expansion of electric vertical take-off and landing aircraft programs.

- Growing partnerships between aerospace companies and tech firms.

- Increasing focus on sustainable, zero-emission aerial transport.

- Emergence of vertiport networks and supporting digital infrastructure.

- Integrating UAM into broader smart city planning initiatives.

Market Outlook

- Industry Growth Overview: The urban air mobility market is growing, driven by the growing urban congestion, development in electric and autonomous technology, increasing demand for rapid travel, and noteworthy investments. The development of essential infrastructure, like skyports, vertiports, and charging stations.

- Global Expansion: The urban air mobility market is experiencing global expansion, as a novel aviation technology that uses highly automated, electric vertical takeoff and landing (eVTOL) aircraft for transport in cities. North America is dominant in the market due to growing urban populations, increasing traffic congestion, and technological development.

- Major investors: Major investors in the Urban Air Mobility (UAM) industry include large aerospace companies such as Toyota, Airbus, and Boeing, as well as specialized UAM companies such as Joby Aviation and EHang.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.54 Billion |

| Market Size in 2026 | USD 8.78 Billion |

| Market Size by 2034 | USD 92.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 34.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Operation Mode, Propulsion Type, Range, End-Use Application, Infrastructure, Component, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Congestion, Rising Need for the Sky

A primary driver for the urban air mobility industry is the increasing congestion in urban centers worldwide. Rapid urbanization and vehicle ownership have led to gridlock roads, extended commuting hours, and rising levels of pollution. Urban air mobility providers a futuristic solution by shifting transport into the sky, offering faster, cleaner, and more efficient alternatives to ground transport into the sky, offering faster, cleaner, and more efficient alternatives to ground transport. Governments and municipalities are supporting the market as part of their smart city initiatives, aimed at enhancing mobility and sustainability. At the same time, the adoption of electric propulsion technologies makes it an environmentally favorable option. The convergence of public support, technological innovation, and investor interest is fueling the momentum for its adoption. In many ways, congestion itself has become the catalyst for aerial mobility innovation.

- In September 2025, the at-home services platform Urban Company was honored with the prestigious Startup of the Year 2025 award for establishing a groundbreaking business that has not only scaled successfully but also achieved profitability and expanded beyond India, all while ensuring high levels of customer satisfaction. The jury selected Urban Company from an impressive pool of nominees after thoroughly discussing the strengths of the founding teams and the challenges they are tackling.

Restraints

Regulations, Risks, and Readiness

Despite its promise, the market faces significant restraints. Regulatory challenges around air traffic management, passenger safety, and noise control are major hurdles. Public acceptance remains a concern, as many consumers are cautious about autonomous aerial vehicles. The high initial costs of developing eVOLT aircraft, infrastructure, and certification processes also limit early-stage scalability. Additionally, energy storage technologies, such as batteries, still face limitations in terms of endurance and payload capacity. Concerns about cybersecurity in AI-driven and connected systems add another layer of complexity. Until these challenges are addressed, the widespread deployment of these challenges will progress gradually rather than rapidly.

Opportunity

Flying Beyond Boundaries

The urban air mobility sector presents immense opportunities that extend far beyond passenger transport. Logistics and cargo delivery using urban air mobility platforms are gaining traction, especially for time-sensitive goods such as medical supplies or e-commerce shipments. There is also potential in the emergency services, including air ambulances and disaster relief operations, where speed is critical. The tourism and luxury travel markets offer another avenue for creating opportunities for entire ecosystems, ranging from vertiport construction and maintenance to digital booking platforms. Emerging economies with rapid urban growth represent untapped potential for deployment. Overall, the scope of the market is expanding, and early adopters are poised to gain a significant advantage in this transformative market.

- In August 2025, GMR Airports Ltd has greenlit initiatives to secure up to rupees 5,000 crore using a combination of financial instruments, including equity shares, non-convertible debentures (NCDs), warrants, and foreign currency convertible bonds (FCCBs). The capital will be raised in phases, based on the business's needs and prevailing market conditions.

Segment Insights

Vehicle Type Insights

Why Air Taxis Are Dominating the Urban Air Mobility Market?

Air taxis continue to dominate the urban air mobility sector, promising to redefine short-distance travel in metropolitan areas. Their ability to reduce road congestion while providing quick, point-to-point connectivity has positioned them as a dominant choice. Early investments from established aerospace companies and startups alike are helping to accelerate the commercialization of air taxis. With regulatory authorities beginning to frame policies, the deployment of air taxis is moving closer to reality. Their integration into smart city ecosystems also makes them highly attractive for governments and urban planners. Overall, air taxes are expected to remain the backbone of urban aerial transport in the foreseeable future.

In addition, the growing interest of private players and ride-hailing companies is accelerating the adoption of air taxis. The segment benefits from high passenger demand for premium, time-saving travel solutions in urban areas with dense populations. Partnerships with infrastructure developers for vertiports further strengthen their dominance. Moreover, air taxis are well-suited for both intercity and intracity connectivity, enhancing their versatility. The scalability potential of air taxis makes them attractive to investors, ensuring a steady pipeline of technological advancements. This dominance is reinforced by strong public-private collaborations, which drive their market leadership.

Passenger drones are witnessing rapid growth, nonetheless attracting attention for their futuristic appeal and efficiency. Unlike traditional air taxis, they are smaller, autonomous, and designed for single or dual passengers. Their compact size makes them suitable for shorter commutes within congested city centers. Growing advancements in AI, automation, and lightweight materials are enabling their rapid development. With strong backing from drone technology companies, they are evolving as a practical alternative to urban transportation. Increasing public acceptance of drones is also contributing to their fast-paced growth.

Furthermore, the relatively lower operational cost of passenger drones compared to larger air taxis is making them attractive for wider adoption. Startups and technology companies are pioneering pilot projects that showcase their feasibility. Passenger drones also hold promise for personalized travel, appealing to urban professionals seeking flexible mobility options. Their scalability potential for both commercial and private use further boosts the segment. As governments explore drone-friendly regulations, passenger drones are expected to experience exponential growth. This trajectory highlights their potential to reshape personal mobility in urban landscapes.

Operation Mode Insights

Why Is the Piloted Segment Leading the Urban Air Mobility Market?

Piloted continues to lead the urban air mobility sector, ensuring greater passenger confidence and regulatory compliance. Having a trained pilot on board provides a sense of security for first-time users and those who are skeptical. Piloted air vehicles are also easier to integrate into existing aviation frameworks since they mirror conventional aircraft operations. Many companies are starting with potential models as an entry point before transitioning to full automation. This hybrid approach strikes a balance between innovation and safety during early adoption phases. As a result, piloted systems remain the preferred operational mode in initial commercialization stages.

Additionally, pilots provide adaptability in complex or unpredictable urban environments where automated systems may still face limitations. The piloted mode also follows regulatory authorities to assess air mobility safety in a real-world scenario. Insurance companies and investors find comfort in the added human oversight, further supporting their adoption. Moreover, having pilots on board ensures compliance with aviation protocols during emergencies. This builds credibility for the industry and encourages customer trust. Consequently, piloted vehicles will likely dominate until automation achieves full-scale maturity.

Fully autonomous systems are witnessing rapid growth due to their efficiency and scalability. Automation eliminates the need for human pilots, significantly reducing operational costs. Artificial intelligence, sensor fusion, and advanced navigation systems are enabling precise, autonomous operations. Fully automated air vehicles promise seamless urban travel with minimal human intervention. Their potential to integrate with smart traffic management systems makes them ideal for large-scale deployment. As urban mobility evolves, full automation is expected to unlock higher adoption rates.

Moreover, the absence of pilots enables more compact designs, thereby optimizing passenger capacity and reducing costs. Startups are pioneering autonomous prototypes that are undergoing rigorous trials. Fully automated vehicles also align with long-term visions of smart, interconnected cities. Their scalability across diverse use cases, from passenger mobility to logistics, enhances their attractiveness. Increasing regulatory discussions on unmanned aerial mobility further support this trajectory. Hence, automation is expected to outpace piloted systems in growth, shaping the future of the industry.

Propulsion Insights

Why Are Electric Vehicles Dominating the Urban Air Mobility Market?

The electric vehicles segment continues to dominate the urban air mobility sector, owing to its environmental benefits and technological readiness. Battery-powered systems offer lower emissions, reduced noise, and cost efficiency. The advancements in battery density and charging technology are enhancing flight ranges and reliability. Electric propulsion also aligns with global sustainability goals, attracting government support and subsidies. Many manufacturers are prioritizing electric models for near-term deployment. Consequently, electric propulsion remains the dominant force in current urban air mobility development.

Furthermore, electric propulsion benefits from widespread public acceptance as a clean energy solution. Its compatibility with urban infrastructure makes integration easier and more cost-effective. Electric systems are also relatively simpler to maintain, lowering overall operational costs. Companies are increasingly investing in battery innovation to extend flight duration and capacity. Collaborations between aviation firms and energy providers further accelerate adoption. This synergy ensures electric propulsion remains the most commercially viable solution in the near term.

The hydrogen fuel cell segment is witnessing rapid growth due to their potential for extended range and higher efficiency. Unlike batteries, hydrogen systems enable longer flights with shorter refueling times. Their scalability makes them suitable for both passenger and cargo applications. Hydrogen propulsion also offers significant environmental advantages, producing only water vapor as a byproduct. The increasing global push for hydrogen economies further accelerates interest in this technology. As a result, hydrogen fuel cells are poised for exponential growth.

Additionally, hydrogen-powered air vehicles offer strategic benefits for intercity connectivity, particularly when extended ranges are required. Major aerospace companies are already testing hydrogen-based prototypes, signaling industry confidence. Governments are also investing in hydrogen infrastructure, making it more accessible for mobility solutions. The durability and lightweight potential of hydrogen cells further enhance performance in aerial vehicles. These advantages make hydrogen an attractive alternative to traditional battery systems. With sustained innovation, hydrogen fuel cell propulsion may eventually rival electric dominance.

Range Insights

Why Are Intracity Ranges the Most Popular Segment in the Urban Air Mobility Market?

The intracity segment is the most popular in the urban air mobility sector, is becoming increasingly essential for urban environments as cities grapple with rising congestion and demand for efficient transportation solutions. This segment focuses on short-range flights that connect various points within a city, significantly reducing travel times and alleviating congestion on the ground. The integration of electric vertical take-off and landing (eVTOL) aircraft offers a sustainable and rapid alternative to conventional road transportation. With a focus on convenience, intracity services like air taxis are gaining popularity, appealing to both commuters and tourists. Infrastructure such as vertiports and charging stations is being developed to support this growing demand. As urban populations continue to swell, intracity solutions are positioned to dominate the air mobility market over the next decade.

Intercity air mobility is emerging as a significant segment within the broader urban air mobility market, focusing on connecting cities that are a substantial distance apart. This segment addresses the need for faster travel between urban centers, reducing the journey times that traditional methods require. With advancements in aircraft technology, including longer-range eVTOLs and hydrogen fuel cell systems, intercity services are poised for rapid growth. The introduction of air logistics and passenger transport options will cater to both business and leisure travelers, enhancing connectivity across regions. Additionally, partnerships between urban air mobility companies and public transportation systems are likely to further streamline intercity travel. As infrastructure continues to develop, intercity air mobility is set to become a dominant force in the evolution of transportation.

End-Use Application Insights

Which End-Use Application Leads the Urban Air Mobility Sector?

Ride-sharing / air taxis led the urban air mobility market in 2024. The integration of air taxis into ride-hailing platforms offers commuters a premium travel alternative. Established mobility players are investing in aerial fleets to expand their service offerings. Urban congestion and rising demand for fast commuting further drive adoption. The synergy between air mobility and existing ride-sharing infrastructure ensures scalability. As a result, ride-sharing dominates the market in terms of early adoption.

Air ambulance & emergency services are emerging as a significant segment within the broader urban air mobility market, due to their life-saving potential. Urban congestion often delays ground-based emergency response, making aerial solutions critical. Compact, automated crafts can quickly transport patients, organs, or medical supplies. Governments and healthcare providers are increasingly investing in this segment. The high value of time in emergencies amplifies its importance. Thus, this segment is projected to expand rapidly.

Infrastructure Insights

Why Do Vertiports Make Up the Largest Share of the Urban Air Mobility Market?

Vertiports made up the largest share of the urban air mobility sector in 2024, owing to these specialized hubs providing takeoff, landing, and passenger handling facilities. Major cities are already exploring locations for vertiport construction. Public-private partnerships are driving investments into this infrastructure. Vertiports also serve as visible symbols of the adoption of aerial transport. Consequently, they dominate the infrastructure ecosystem.

Charging stations are emerging as a significant segment within the broader urban air mobility market, due to rising adoption of electric air vehicles. As battery technology advances, the need for widespread charging networks intensifies. Urban planners are beginning to integrate charging points into smart grid systems. Mobility operators are investing heavily in fast-charging solutions. These developments ensure rapid scaling of the charging infrastructure. As a result, charging stations are witnessing exponential growth.

Regional Insights

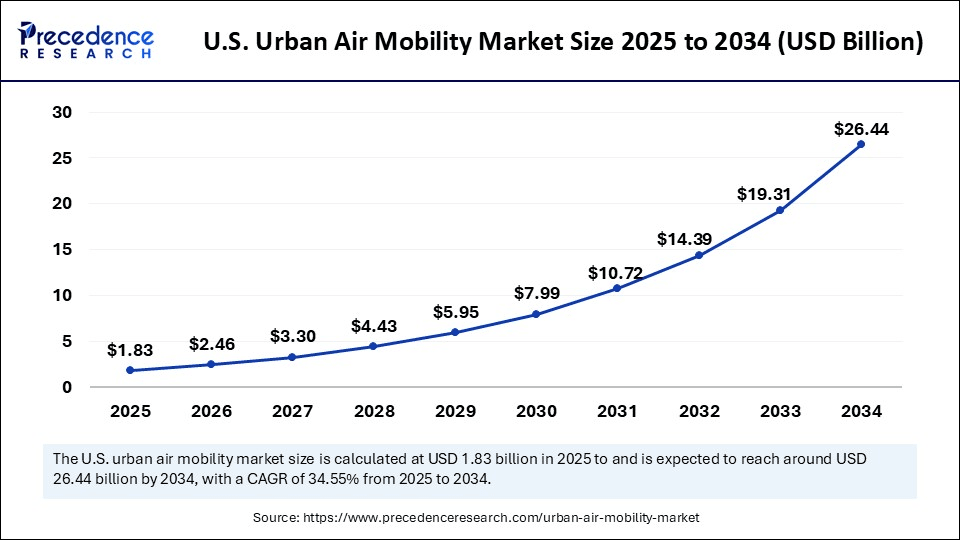

U.S. Urban Air Mobility Market Size and Growth 2025 to 2034

The U.S. urban air mobility market size is exhibited at USD 1.83 billion in 2025 and is projected to be worth around USD 26.44 billion by 2034, growing at a CAGR of 34.55% from 2025 to 2034.

U.S.: Robust Aviation Infrastructure

In the U.S., significant spending is made by private organizations and venture capitalists in UAM technology, infrastructure such as vertiports, and pilot programs. The U.S. has leading organizations and research institutions that are increasing innovation in eVTOL aircraft, battery technology, and air traffic control technology.

Is North America Leading the Urban Air Mobility Market?

North America dominated the global market in 2024, supported by strong investments from aerospace giants, tech firms, and venture capital. The U.S. is at the forefront with multiple pilot projects, regulatory initiatives, and collaborations between private players and government agencies. The Federal Aviation Administration is working toward creating a framework that balances safety with innovation. Urban centers such as Los Angeles, Dallas, and New York are exploring the early adoption of urban air mobility services. The strong presence of electricity in these kinds of services. The strong presence of electric aircraft manufacturers and AI-driven technology developers further accelerates regional growth. Additionally, public-private partnerships in research and demonstration projects have positioned North America as a global leader in advancements.

- In August 2025, Joby Aviation, a developer of electric air taxis, agreed to acquire Blade Air Mobility's helicopter rideshare business for up to $125 million. Joby will take over the Blade brand, along with the company's passenger operations, which span both the United States and Europe. Rob Wiesenthal, the founder and CEO of Blade, will remain in place to manage the business, which will operate as a wholly owned subsidiary of Joby. The transaction does not encompass Blade's medical division, responsible for organ transportation, which will continue to operate as a separate entity.(Source: https://techcrunch.com)

How Is Asia Pacific Rising High on Demand and Innovation?

Asia Pacific is the fastest-growing region in the urban air mobility sector, driven by its rapid urbanization and increasing demand for innovative mobility solutions. Megacities such as Tokyo, Seoul, Singapore, and Shanghai are facing acute congestion challenges, creating fertile ground for aerial transport. Governments in the region are actively supporting the development of the industry through policy initiatives, infrastructure planning, and partnerships with global aerospace leaders. The region also benefits from a strong base of manufacturing and technological innovation, particularly in electric propulsion and AI integration. Growing investments from both local and international players are expected to accelerate deployment. With its combination of demand, government support, and technological capabilities, the Asia Pacific is emerging as the next powerhouse for market adoption.

- In August 2025, India marked a major milestone in its green energy transition, with 56.75 lakh electric vehicles registered across the country as of February 2025. This achievement reflects the nation's growing commitment to sustainable mobility and reduced dependence on fossil fuels. The steady rise in EV adoption is being driven by government incentives, advancements in charging infrastructure, and increasing consumer awareness about eco-friendly alternatives. Industry experts view this milestone as a critical step toward achieving India's ambitious climate goals and strengthening its position in the global clean energy landscape.

China: Growing demand for sustainable solutions

In China, the growing and immense volume of ground traffic in major cities creates an increasing requirement for substitute, rapid transportation such as UAM for short-distance travel and logistics. There is a growing push in the area to accept sustainable and green energy services to combat air pollution and carbon emissions from traditional transport, making battery-driven UAM vehicles an attractive choice.

Europe: Presence of proactive regulation

Europe is significantly increasing in the market as a result of integrating proactive government policies, strong partnerships between among public and private sectors, and an emphasis on integrating UAM into existing transportation networks. The European Union's government framework, through bodies such as the European Union Aviation Safety Agency (EASA), drives the growth of the market.

UK: Technological Advancements

The UK government offers noteworthy support through funding for R&D and infrastructure advancement, making it an attractive home for UAM players. The UK is taking a leadership role in building the essential infrastructure, represented by the world's first UAM airport, Urban Port Air-One, in Coventry. The UK is aggressively advancing a government framework to provide the safe and responsible integration of UAM into the existing transportation network.

Value Chain Analysis – Urban Air Mobility Market

- Raw Material

The significant raw materials for the urban air mobility (UAM) market include carbon fiber and other composites, along with traditional aerospace metals such as titanium, aluminum, and steel.

Key Players: Volocopter and EHang - Chemical Synthesis and Processing

Chemical synthesis and processing are important to making developed materials for lightweight structures, high-performance battery systems, and ensuring operational maintenance and safety.

Key Players: Joby Aviation and Lilium - Compound Formulation and Blending:

It includes the creation and combination of progressive materials, specifically carbon fiber composites and adhesives, to build lightweight, efficient, and strong aircraft.

Key Players: Boeing and Hyundai

Top Vendors in the Urban Air Mobility Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Joby Aviation |

California |

Innovative eVTOL design |

Joby Aviation is ramping up eVTOL aircraft production at its pilot manufacturing facility in Marina, California. |

|

Archer Aviation |

California |

Infrastructure development |

Archer Aviation announced an agreement to supply Anduril Industries and EDGE Group with Archer's dual-use electric powertrain technology to speed up the development and scaled production of Anduril's recently unveiled Omen Autonomous Air Vehicle system. |

|

Lilium GmbH |

Germany |

Proprietary technology |

In January 2025, Lilium announced an asset purchase agreement with Mobile Uplift Corporation, a newly formed company. |

|

Volocopter GmbH |

Germany |

Patent cutting-edge technology |

Volocopter GmbH still expects to begin commercial operations with its electric flying taxis. |

|

EHang Holdings |

China |

Pilotless or autonomous focus |

In October 2025, EHang launched the AAM Sandbox Initiative in Thailand in partnership with the Civil Aviation Authority of Thailand and local partners. |

Urban Air Mobility Market Companies

- Joby Aviation

- Archer Aviation

- Lilium GmbH

- Volocopter GmbH

- EHang Holdings

- Vertical Aerospace

- Hyundai Motor Group (Supernal)

- Boeing (Wisk Aero)

- Airbus SE

- Embraer (Eve Air Mobility)

- Bell Textron Inc.

- Beta Technologies

- Pipistrel (Textron eAviation)

- Kitty Hawk (Heaviside project)

- SkyDrive Inc.

- Autoflight

- Ascendance Flight Technologies

- Jaunt Air Mobility

- Electra Aero

- XTI Aircraft

Recent Development

- In September 2025, On-demand services have evolved far beyond just taxi-hailing and food delivery apps; they've transformed into innovative, always-on solutions that are reshaping our daily lives! Imagine having immediate access to telemedicine or getting a reliable handyman right when you need them. This is the new standard that users expect! However, achieving this seamless experience globally requires more than just user-friendly interfaces; it hinges on robust infrastructure that brings computing power closer to each user. The thrilling future of on-demand services is poised at the intersection of mobile technology and software development. With cutting-edge advancements like edge computing, modular data centers, and AI at the edge, the landscape of service delivery is being revolutionized.(Source: https://www.livemint.com)

Segments Covered in this Report

By Vehicle Type

- Air Taxis

- Passenger Drones

- Cargo Air Vehicle

- Delivery Drones

- Personal Air Vehicles

- Others

By Operation Mode

- Piloted

- Remotely Operated

- fully autonomous

By Propulsion Type

- electric (Battery-Electric)

- Hybrid-Electric

- hydrogen fuel cell

- Others

By Range

- Intracity (≤50 km)

- Intercity (50–200 km)

- Long Range (>200 km)

By End-Use Application

- Ride-sharing / air taxis

- Air ambulance & emergency services

- Logistics & Cargo Delivery

- Private / Corporate Travel

- Military & Defense

- Others

By Infrastructure

- Vertiports

- Charging stations

- Air Traffic Control Systems (UTM/ATM Integration)

- Maintenance, Repair & Overhaul (MRO) Facilities

- Others

By Component

- Aircraft (Airframe, Avionics, Propellers, Motors)

- Infrastructure (Physical & Digital)

- Software (AI, Fleet Management, Flight Control, Air Traffic Integration)

- Services (Operational, Leasing, Maintenance, Training)

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting