Chemical Foaming Agent (CFA) Market Size and Forecast 2025 to 2034

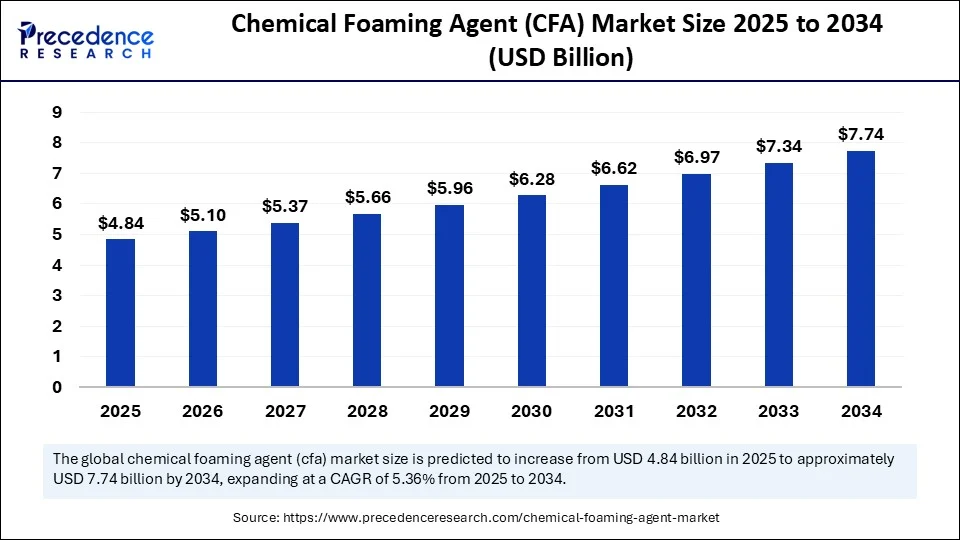

The global chemical foaming agent (CFA) market size accounted for USD 4.59 billion in 2024 and is predicted to increase from USD 4.84 billion in 2025 to approximately USD 7.74 billion by 2034, expanding at a CAGR of 5.36% from 2025 to 2034.The market is driven by the rising demand for lightweight materials in the automotive, construction, and packaging industries, along with increasing use of chemical foaming agents to enhance product strength, insulation, and cost efficiency.

Chemical Foaming Agent (CFA) MarketKey Takeaways

- In terms of revenue, the global chemical foaming agent (CFA) market was valued at USD 4.59 billion in 2024.

- It is projected to reach USD 7.74 billion by 2034.

- The market is expected to grow at a CAGR of 5.36% from 2025 to 2034.

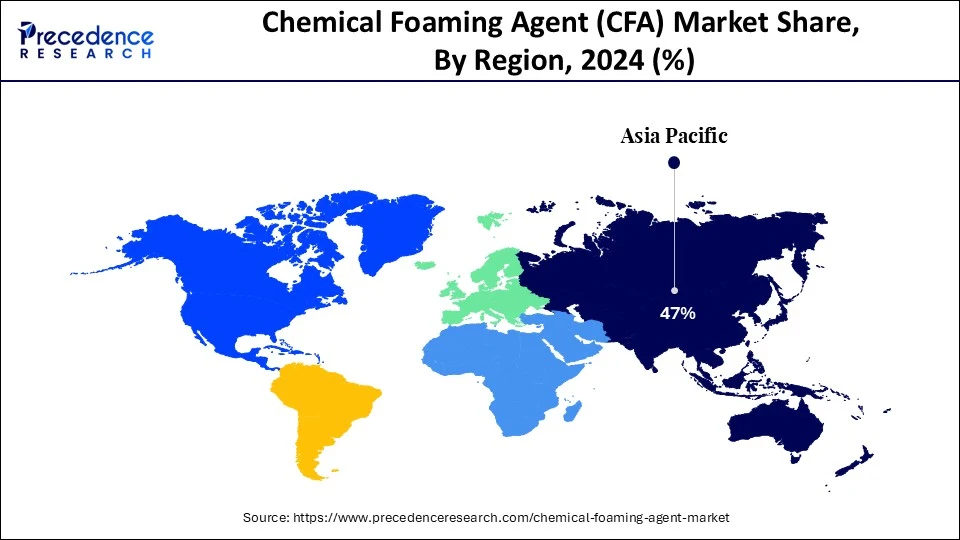

- Asia Pacific dominated the global market with the largest market share of 47% in 2024.

- The Middle East and Africa is anticipated to witness the fastest growth during the forecasted years.

- By product type, the endothermic segment led the market in 2024.

- By product type, the hybrid/blended foaming agents segment is anticipated to show considerable growth in the market over the forecast period.

- By form, the powder segment captured the highest market share of 48% in 2024.

- By form, the microencapsulated forms segment is anticipated to show considerable growth in the market over the forecast period.

- By material compatibility, the thermoplastics segment led the market and will grow rapidly in the coming years.

- By decomposition temperature, the medium temperature (150–200 °C) segment held a 45% share in 2024.

- By decomposition temperature, the low temperature (<150 °C) segment is anticipated to show considerable growth in the forecast period.

- By application, the automotive and transportation segment dominated the global market in 2024.

- By application, the building and construction segment is anticipated to show considerable growth in the market over the forecast period.

- By end-use industry, the automotive segment accounted for the highest market share of 38% in 2024.

- By end-use industry, the construction segment is anticipated to show considerable growth in the market over the forecast period.

How Is AI Integration Transforming the Chemical Foaming Agent (CFA) Market?

The smart connectivity in the chemical foaming agent (CFA) market is reshaping the efficacy and capability of manufacturing innovation and quality production. Precisely monitoring long-term production parameters such as temperature, pressure, and ratios of chemicals to maintain the foam density and cellular structure will be achievable with the aid of Artificial Intelligence-powered solutions. AI will help transition towards more environment-friendly foaming agents by helping to identify the most suitable bio-based compounds and by reducing the carbon footprint.

Asia Pacific Chemical Foaming Agent (CFA) Market Size and Growth 2025 to 2034

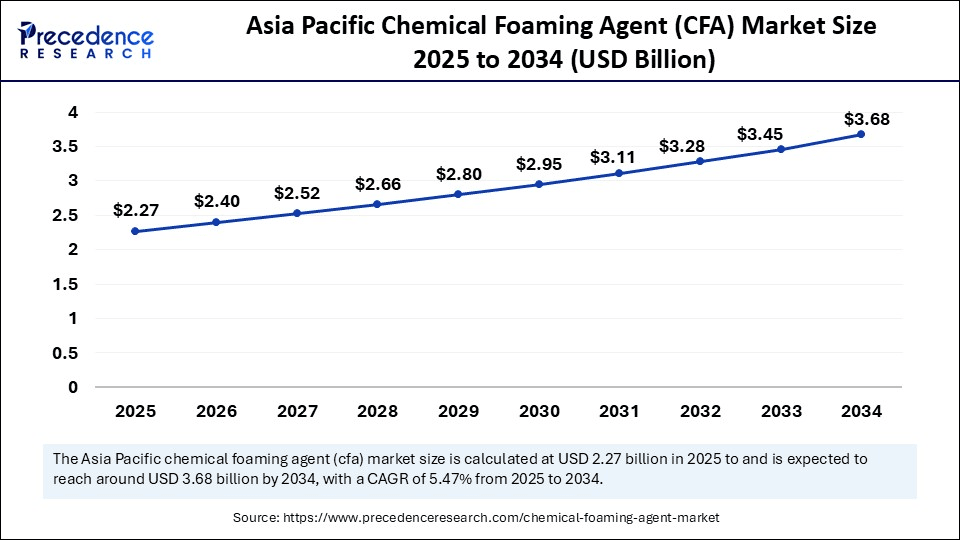

The Asia Pacific chemical foaming agent (CFA) market size was exhibited at USD 2.16 billion in 2024 and is projected to be worth around USD 3.68 billion by 2034, growing at a CAGR of 5.47% from 2025 to 2034.

Why Did Asia Pacific Dominate the Global Chemical Foaming Agent (CFA) Market in 2024?

Asia Pacific led the global market with the highest share of 47% in 2024, due to rapid industrialization, urbanization, and strong industry growth in various sectors, including the automotive industry, the construction industry, and the packaging industry. Use of foaming agents in light automotive components, energy-efficient building materials, and other protective packaging concepts is becoming acceptable in countries such as India, Japan, and South Korea. The continued demand for foaming agents in the construction sector is also being driven by their use in construction work on developing infrastructure, besides the investments of the governments in the long-term planning of cities and towns.

China plays a major role in the chemical foaming agent (CFA) market in the Asia Pacific, as it is a large producer and consumer. The country has a well-developed foundation of polymer manufacturing, a cheap labor force, and a very long supply chain, making the country a significant contributor to the supply of foaming agents. The fast development of the Chinese car industry, especially the segment of electric vehicles, is escalating the consumption of lightweight foamed plastics to enhance efficiency and performance. In addition, the booming e-commerce industry and the growth in disposable revenues in China are increasing the demand in the packaging industry, which largely depends on foamed products in terms of protecting products.

Middle East and Africa

The Middle East and Africa are estimated to grow at the fastest CAGR during the forecast period, fuelled by continuous industrialization, major infrastructure works, and increasing demand for sustainable building materials. Developing the construction industry, including residential, commercial, industrial, etc., of the region is driving the lightweight concrete, insulation boards, and roofing materials using foaming agents. An upsurge in attention to environmentally friendly solutions in buildings is justified by governmental regulations (through green building programs) that can help to minimize energy use and carbon footprint. Also, there is an increase in the packaging industry supported by the growth in retail and e-commerce activities in the region, which further boosts demand.

The high speed of delivering construction projects such as luxury residential, business premises, sports, and tourist-related projects necessitates in the UAE a critical demand for light, durable, and efficient thermal materials, contributing to the increased application of chemical foaming agents. The current industrial diversification and infrastructure buildout in Saudi Arabia by Vision 2030 is increasing the construction speed of smart cities in Saudi Arabia, which will need higher-level energy-saving architecture materials. This opens up prospects in eco-friendly foaming agents for insulation, prefabrication of buildings, and high-performance food packaging. In these countries, however, government-sponsored sustainability initiatives and an increase in environmental conservation awareness are driving such a transition to bio-based and low-emission foaming agents.

What Are the Key Trends Driving the North America Chemical Foaming Agent (CFA) Market?

The North American chemical foaming agent (CFA) market is expected to account for a substantial share in 2024. This is enabled by the advanced manufacturing capacity, strict environmental standards, and the high demand in the automotive, construction, and packaging industries. The increase in the demand for eco-friendly and low-emission foaming agents is also due to environmental policies in both the U.S and Canada, as consumers demand sustainable materials. The well-established R&D facilities and relevant cooperation between the industry players and academic institutions result in the creation of new and advanced foam formulations customized according to the applications.

The U.S. automotive industry is also finding application in foamed plastics as a replacement for interior seats and structural parts to improve performance and reduce weight, particularly in electric cars, where energy consumption is essential. Residential and commercial construction are booming businesses in the U.S., and builders are turning to foamed insulation material to achieve high energy efficiency ratings and green building certifications. Moreover, the increasing e-commerce field is stimulating the need for protective foamed packaging. Regulatory structure, on the impact on the environment, is promoting the conversion of bio-based and recyclable foaming agents.

Market Overview

The chemical foaming agent (CFA) market refers to the industry focused on materials that release gases through chemical reactions or thermal decomposition, creating a cellular structure within substrates such as plastics, rubber, and other polymers. These agents are used to reduce material density, improve thermal and acoustic insulation, enhance cushioning, and optimize weight-to-strength ratios. CFAs are classified into exothermic and endothermic types based on reaction heat release, and they find applications in industries such as automotive, construction, packaging, footwear, and furniture manufacturing. The market is driven by demand for lightweight materials, cost-efficient manufacturing, and enhanced product performance across diverse end-use sectors.

The demand for lightweight materials in the automotive, construction, and packaging industries is increasing, thus propelling the chemical foaming agent (CFA) market. Such agents are used to lighten products, insulate better, and decrease the cost of materials without the loss of structural integrity. Automotive usage in foamed plastics is on the rise, and its aim is to improve fuel consumption and decrease emissions, which is in line with the sustainability objectives in the global community. Improvement in technology towards making environmentally friendly and non-toxic foaming agents also stimulates their adaptation, which meets strict environmental requirements, and consumers are becoming increasingly brand-conscious individuals interested in sustainable products.

What Factors Are Fueling the Rapid Expansion of the Chemical Foaming Agent (CFA) Market?

- Rising Demand for Light Materials: In the automotive and construction sectors, companies are increasingly making use of lightweight materials in the drive to save on transportation costs and gas emissions. Such chemical foaming agents play a critical part in the production of foamed plastics, lightweight concretes, and insulation that meet current performance and sustainability requirements.

- Increase in the Construction and Infrastructure Projects:There is an increase in demand for such attributes as light-weight, durable, and thermally-efficient materials that accompany urbanization and mass infrastructure construction. Lightweight concrete, panels, and insulation boards that are embedded with chemical foaming agents are highly useful in energy-efficient buildings.

- Packaging Industry Growth: E-commerce and food delivery services have increased such that the booming packaging industry requires packaging that is protective, lightweight, cost-effective, and requires foamed plastics. Packing materials made with the help of chemical foaming agents are more cushioned or insulated, and use less material and cost.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.74 Billion |

| Market Size in 2025 | USD 4.84 Billion |

| Market Size in 2024 | USD 4.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.36% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type,Form, Material Compatibility, Decomposition Temperature, Application, End-use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Water Sports Participation:

The global participation in water sports activities is currently undergoing a significant boost due to the rise in purchasing power, and consequently, a rise in adventure travel. Sports like surfing, paddleboarding, and sailing are appealing. The tendency has subsequently offered the scope to innovative machinery manufacturing, where the use of lightweight and durable materials is critical. There is a trend in using electric hydrofoil surfboards to guarantee an impressive ride with a low degree of physical activity. Such boards are designed to require materials that will provide buoyancy, strength, and resistance to a tough marine environment, increasing the interest in higher-performance foamed materials. Chemical foaming agents are also vital in the generation of such components so that there is optimum weight loss and integrity.

Restraint

High Initial Purchase Cost:

High-performance electric propulsion systems, precision engineering, and advanced materials enable its products to be costly to produce. As a result, they become available to individuals with strong incomes and active consumers of water sports with large disposable incomes. Major investments required to start the operation in emerging markets are a major challenge that makes potential entrants wary. This economic hindrance is also compounded by the fact that it requires proper advertisement strategies, which portray the distinctive benefits of the products. There is also low awareness by consumers and limited channels of distribution; hence, constrained market expansion.

Opportunity

Environmental Consciousness and Sustainable Recreation:

The increasing interest in environmental concerns is creating the need to switch to greener ways of recreation, thus opening potential services in the production of sustainable products. Electric hydrofoil surfboards are also being marketed as more environmentally friendly than fuel-driven watercraft since they produce a minimal carbon footprint, their sound range is low, and little to no disturbance is caused on ocean ecosystems. This provides them with a competitive edge over environmentally conscious consumers, tourist operators that have beaches, and the regulators who promote sustainable behaviors in water sports. This association with global sustainability initiatives will provide growth of the market, as well as other possible investments, such as government subsidies and green tourism projects.

Product Type Insights

Why Did the Endothermic Segment Lead the Chemical Foaming Agent (CFA) Market in 2024?

The endothermic segment led the market in 2024, with the Azodicarbonamide (ADC) sub-segment holding a 42% revenue share. The advantages of ADC are its relatively low cost, good gas production, and extremely consistent foam, spanning a range of applications, including automotive, construction, packaging, and consumer goods. The effectiveness of the material in the reduction of density without structural limitations makes it suitable to be used in the manufacturing of lightweight, sturdy, and insulating goods. The demand for regulatory compliance in some areas has also led to constant refinements of formulations in ADCs, which further increases their attraction to the world markets. Despite environmental issues, newer and safer eco-friendly versions are being introduced due to continued R&D.

The hybrid/blended foaming agents segment is expected to grow at a significant CAGR over the forecast period, powered by a growing market, and needs to have both endothermic and exothermic agent advantages in a single, customized foaming solution. These are designed to optimize cell structure, density reduction, and mechanical attributes to meet the performance needs of an industry like the automotive industry, the footwear industry, and the packaging industry. Hybrid agents are more flexible in processing, and manufacturers can optimize the foaming behaviour of different polymers and applications. They are also giving the chance to comply with stricter environmental requirements because we can also afford to build in safer, low-emission parts with efficiency. Furthermore, the increased use of lightweight high-strength materials in electric vehicles and sustainable building products is forcing the pace of their usage.

Form Insights

Why Did the Powder Segment Capture the Largest Revenue Share in 2024?

The powder segment held a 48% market share in 2024. Powdered foaming agents are popularly used in the automotive, construction, and packaging industrial applications owing to matching a wide variety of polymers, such as polyethylene, polypropylene, PVC, and EVA. Moreover, the polyethylene powders allow optimal density reduction and the formation of the structure of foam cells, which ensures the quality of final products. The segment has its advantages in that it has established supply chains with mature production technologies and low manufacturing costs relative to other forms. Moreover, they are very adaptable to both extrusion and injection molding processes, which strengthens their leadership in the market.

The microencapsulated forms segment is expected to grow substantially in the chemical foaming agent (CFA) market, due to the increased demand concerning accuracy, safety, and improved product performance. The microencapsulation method consists of wrapping the active foaming agent in a protective compound-this makes sure that the agent is released at an appropriate rate during processing and that decomposition does not occur prematurely. Also, there are microencapsulated varieties that reduce dust emission and exposure to unsafe chemicals used in handling during manufacture. They are ideally suited to high-performance applications in the automotive, electronic, aerospace, and medical device industries because they can be engineered to a specific activation temperature. Adoption is being rapidly driven by the increased need to have components that are light, sturdy, and by the presence of high standards of environmental and workplace safety.

Material Compatibility Insights

Why Did the Thermoplastics Segment Dominate the Chemical Foaming Agent (CFA) Market in 2024?

The thermoplastics (polypropylene - PP) segment led the chemical foaming agent (CFA) market in 2024, with the polypropylene (PP) sub-segment holding a 36% share in 2024. The PP foams find extensive application in the automotive industry in cabin, bumpers, chassis, etc., to make the vehicles lighter and increase the fuel efficiency, which is in line with the international sustainability agenda. PP foams are useful in industry with good chemical resistance, dimensional stability, and thermal insulating properties that make them applicable throughout their lifetime as protective packaging, insulation panels, and consumer products. PP also has compatibility with several foaming agents, especially endothermic ones, required to maintain the quality of the foam and an affordable process. Mechanical properties are also being improved through continuous developments in foaming technology to increase the range of PP applications in high-performance fields.

The polyethylene (PE) sub-segment of the thermoplastics segment is anticipated to show considerable growth over the forecast period, backed by its versatility, chemical resistance, and flexibility. PE Foams used are very common in the packaging industry, sports equipment, construction insulation, and the marine sector, as it is buoyant, cushioning, and moisture-proof. The increase in demand for light, protective, and energy-friendly materials in e-commerce packaging and construction insulation is also stimulating the use of PE foams. PE foams made using eco-friendly foaming agents are gaining popularity due to increased attention on recyclability and sensitivity to the environment.

Decomposition Temperature Insights

Why Did the Medium Temperature (150–200°C) Segment Lead the Chemical Foaming Agent (CFA) Market in 2024?

The medium temperature (150–200 °C) segment led the chemical foaming agent (CFA) market while holding a 45% share in 2024, due to its flexibility and the ability to be used across multiple polymering processes, e.g., injection molding, extrusion, and blow molding. The medium-temperature foaming agents find wide usage in the manufacture of auto parts, construction products, and packaging products since they demonstrate optimal results, stability, and volume of the gas. They are also quite compatible with polypropylene (PP) and polyethylene (PE) thermoplastics, in which a flat foam structure is realised and minimised without causing profiles of materials to lose mechanical properties. With the industries still looking out to use materials that provide lightweight, good insulation, and sustainability, medium temperature foaming agents have continued to be the standard solutions, further strengthening them as leaders.

The low temperature (<150 °C) segment is expected to grow at a significant CAGR over the forecast period, promoted by its applicability in heat-sensitive materials and special applications. Such foaming agents are perfectly suited to polymers like PVC, EVA, and some thermoplastic elastomers, whose process temperatures cannot be raised too high because they will cause degradation of the materials. Energy savings are also possible with low-temperature foaming agents because they save on processing heat, supporting the objectives entailed by manufacturers to lower costs and improve sustainability. Also, they perform well in terms of being compatible with the efforts of the advanced microencapsulation methodologies, where they result in controlled gas release and increased safety of handling the substance.

Application Insights

Automotive and Transportation Segment Holds the Largest Market Share

The automotive and transportation segment dominated the global market in 2024, with the interior components sub-segment holding a 32% of the revenue share. This is caused by the industry imperative of light, durable, and cheap materials. The foamed plastic materials made with the help of chemical foaming agents are being utilized more in dashboards, door panels, seating, headliners, and trim parts to decrease the weight of vehicles, better fuel efficiency, and increase passenger comfort. These materials provide good acoustic insulation, thermal resistance, and flexibility in design to enable the manufacturers to meet their performance and aesthetic needs. Moreover, the increased use of electric cars (EVs) has exacerbated the necessity to roll up lightweight interior components to have longer driving distances. The change to recyclable foamed materials is also driven by complying with strict standards of emission and sustainability projects.

The insulation boards sub-segment of the automotive segment is anticipated to show considerable growth over the forecast period, backed by the growth in demand for energy-efficient and sustainable building materials. Insulation boards can provide superior thermal insulation, moisture resistance, and durability through foaming of polyurethane, polystyrene, and polyethylene plastics, which makes them important in the construction of residential, commercial, and industrial developments. With chemical foaming agents, light yet powerful boards with distinct cell structures are manufactured, which are more efficient in insulation. The trend towards the standards of green buildings, which is supported by the governmental rules stimulating energy, is speeding up the process of adoption. Increased demand is further heightened by urbanization as well as expansion or retrofitting of infrastructure, especially in the emerging economies.

End-Use Industry Insights

Why Did the Automotive Segment Hold the Largest Chemical Foaming Agent (CFA) Market Share in 2024?

The automotive segment held a 38% market share in 2024, fuelled by the increased importance of the use of lighter materials by the industry to enhance fuel efficiency and address tough industry environmental rules. During the manufacturing of interior parts, as well as seats, headliners, dashboards, and sound insulation material, foaming agents provide weight reduction and strength, and comfort of the material in use. Foaming agents may promote vehicle performance and reduce fuel consumption and resulting in increased passenger safety by making it possible to decrease density levels of the metals lacking the ability to affect their strength values. Moreover, the progress in the spheres of compatibility as well as processing technologies would allow the creation of more complex designs and better automotive interior acoustics.

The construction segment is expected to grow substantially in the chemical foaming agent (CFA) market. Foaming agents are common in the manufacture of lightweight concrete, insulation panels, roofing, and prefabricated elements of buildings. These materials improve thermal insulation, lessen the physical weight of the structure, and decrease the total cost of construction; hence, they are appealing to residential and business development. The emergence of the green building approach with the sustainable development of infrastructure is supporting the use of environmentally friendly foaming agents, such as bio-based and low-emission formulations. Also, the rising trend of using prefabricated and modular frameworks is driving the demand for lightweight and high-performance foamed-based materials that will provide durability and ease of installation.

Chemical Foaming Agent (CFA) Market Companies

- Bergen International LLC

- Tramaco GmbH

- HDC Chemical Co., Ltd.

- CelChem LLC

- Foam Supplies, Inc.

- Arkema S.A.

- Dongjin Semichem Co., Ltd.

- LANXESS AG

- Reedy Chemical Foam

- Kumyang Co., Ltd.

- Otsuka Chemical Co., Ltd.

- Clariant AG

- Zibo Aohong Chemical Co., Ltd.

- AkzoNobel Specialty Chemicals

- Cabot Corporation

- Tosoh Corporation

- Polytechs S.A.S.

- Haihong Fine Chemical

- Jiangxi Selon Industrial Stock Co., Ltd.

- Trecora Resources

Recent Developments

- In August 2024, ADEKA introduced two new chemical foaming agents that were aimed at the automotive industry. ADEKA Polymer Additives Europe had experience of 25 years in chemical foaming agents, and they manufactured masterbatches and powder blends with chosen ingredients in order to ensure their optimum performance.(Source:https://www.specialchem.com)

- In July 2024, Celanese Corporation announced a new biobased Hytrel TPC RS40F2 that could be foamed, paired with athletic footwear. It had a minimum 20 percent segregated bio-content that was foamed as a physical supercritical fluid (SCF) foaming process. This aided in justifying the sustainable development objectives of athletic shoe brands, and the bio-content could be proven using the C14 technique. (Source: https://www.specialchem.com)

- In April 2024, Solvay, a world-leading provider of essential chemistry, commissioned its Alve-One plant in Rosignano, Italy. This was a milestone since it introduced a major European production facility of Alve-One, which will sustainably redefine the thermoplastic foam market through a chemical blowing agent.(Source:https://www.indianchemicalnews.com)

Segments Covered in the Report

By Product Type

- Endothermic Chemical Foaming Agents

- Azodicarbonamide (ADC)

- Sodium Bicarbonate

- Citric Acid-based Blends

- Others (e.g., Urea-based, Hydrazide-based)

- Exothermic Chemical Foaming Agents

- Hydrazine-based

- Semicarbazide-based

- N-Nitroso Compounds

- Others (e.g., Sulfohydrazide-based)

- Hybrid/Blended Foaming Agents

- Endothermic-Exothermic Blends

- Proprietary Formulations

By Form

- Powder

- Granules/Pellets

- Liquid

- Microencapsulated Forms

- Others (e.g., Paste, Solid Tablets)

By Material Compatibility

- Thermoplastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others (e.g., PET, ABS)

- Thermosetting Plastics

- Polyurethane (PU)

- Epoxy

- Phenolic

- Others (e.g., Melamine)

- Elastomers and Rubber

- Natural Rubber

- Synthetic Rubber (SBR, NBR, EPDM)

- Silicone Rubber

- Others (e.g., Composite Materials)

By Decomposition Temperature

- Low Temperature (<150°C)

- Medium Temperature (150–200°C)

- High Temperature (>200°C)

By Application

- Automotive and Transportation

- Interior Components (e.g., dashboards, armrests)

- Exterior Panels

- Seating Cushions

- Others (e.g., Headliners)

- Building and Construction

- Insulation Boards

- Flooring Materials

- Panels and Decorative Elements

- Others (e.g., Roofing Foams)

- Packaging

- Protective Packaging Foams

- Food Packaging

- Others (e.g., Transport Crates)

- Footwear

- Midsoles

- Insoles

- Outsoles

- Furniture and Bedding

- Mattress Foams

- Cushioning Foams

- Others (e.g., Office Seating)

- Others

- Sports Goods

- Toys

- Marine Products

By End-use Industry

- Automotive

- Construction

- Consumer Goods

- Electronics and Electricals

- Industrial Manufacturing

- Others (e.g., Aerospace, Marine)

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting