What is the Healthcare Supply Chain Management Market Size?

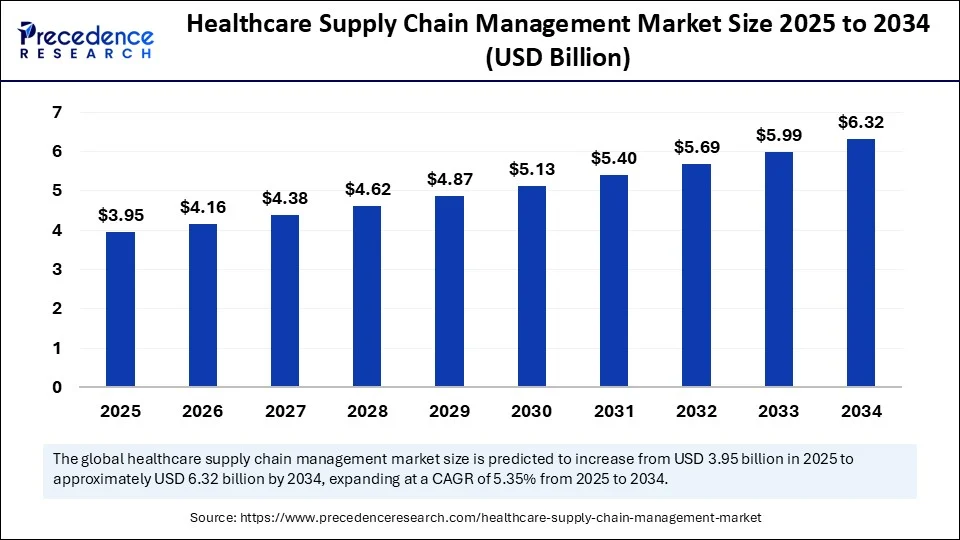

The global healthcare supply chain management market size is calculated at USD 3.95 billion in 2025 and is predicted to increase from USD 4.16 billion in 2026 to approximately USD 6.32 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034. The growth of the market is driven by rising demand for medical products and transparency in supply chains. Additionally, the rising adoption of AI, IoT, cloud, and blockchain technologies to enhance security in supply chains contributes to market growth.

Healthcare Supply Chain Management Market Key Takeaways

- In terms of revenue, the global healthcare supply chain management market was valued at USD 3.75 billion in 2024.

- It is projected to reach USD 6.32 billion by 2034.

- The market is expected to grow at a CAGR of 5.35% from 2025 to 2034.

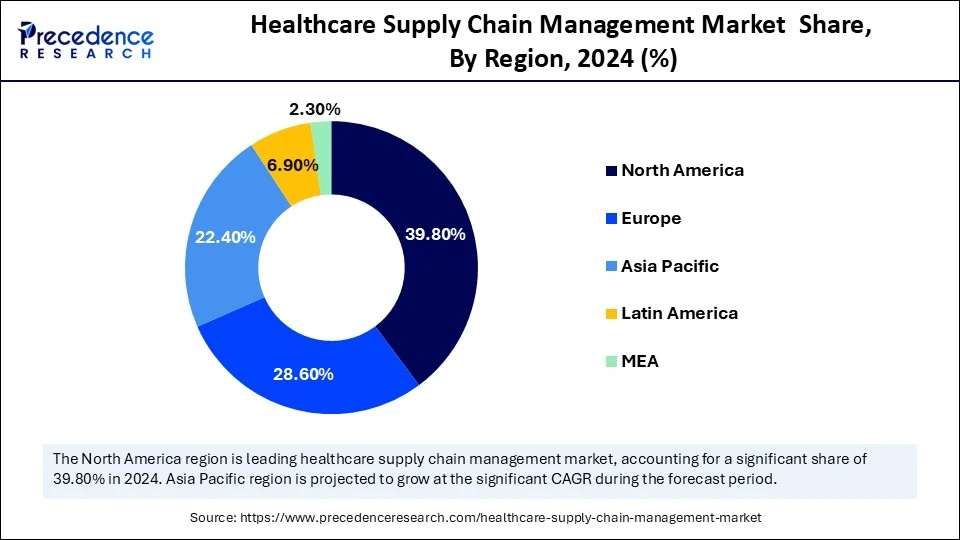

- North America dominated the healthcare supply chain management market with the largest market share of 39.8% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component, the software segment dominated the market, under which the inventory management sub-segment held the maximum market share in 2024.

- By component, the analytics and reporting sub-segment is expected to expand at a notable CAGR over the projection period.

- By delivery mode, the cloud-Based segment captured the biggest market share of 51.3% in 2024.

- By end user, the healthcare providers segment contributed the highest market share of 34.7% in 2024.

- By end user, the healthcare manufacturers segment is expected to expand at the highest CAGR over the forecast period.

- By function, the inventory management segment held the largest market share of 22.1% in 2024.

- By function, the compliance and risk management segment is expected to expand at the fastest CAGR over the projected period.

- By technology, the RFID segment generated the major market share of 26.4% in 2024.

- By technology, the AI & machine learning segment is expected to expand at a notable CAGR over the projected period.

- By deployment size, the large enterprises segment accounted for the significant market share of 41.9% in 2024.

- By deployment size, the mid-sized organizations segment is expected to expand at a notable CAGR over the projected period.

Market Overview

The healthcare supply chain management market refers to the systems, solutions, and services designed to optimize the flow of pharmaceuticals, medical devices, hospital supplies, and healthcare services from manufacturers to end users such as hospitals, pharmacies, and patients. This includes logistics, procurement, inventory management, and data management across the healthcare ecosystem. The goal is to enhance efficiency, reduce operational costs, ensure regulatory compliance, and improve patient outcomes by maintaining the integrity and availability of healthcare products throughout the supply chain.

Healthcare Supply Chain Management Market Growth Factors

- Need for Cost Efficiency: Healthcare providers face pressure to cut operational costs. SCM systems help reduce inventory waste, streamline procurement, and improve budgeting. This makes operations more efficient and financially sustainable.

- Integration of AI and IoT: Technologies like AI, IoT, and predictive analytics improve demand forecasting. They enable real-time inventory tracking and reduce supply disruptions. This leads to better responsiveness and fewer shortages or excess stock.

- Shift to Cloud-Based Solutions: Cloud platforms provide scalable, centralized control over sourcing, inventory, and logistics. They simplify implementation, improve data access, and lower infrastructure costs. These features make them ideal for modern healthcare networks.

- Regulatory Compliance and Traceability: Growing requirements for product traceability, serialization, and anti-counterfeiting measures drive the use of SCM tools. These tools ensure transparency, meet regulatory standards, and enhance patient safety throughout the healthcare value chain.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.32 Billion |

| Market Size in 2025 | USD 3.95 Billion |

| Market Size in 2026 | USD 4.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.35% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Delivery Mode, End-User, Function, Technology, Deployment Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global Regulations Regarding Pharmaceutical Traceability

A major factor driving the growth of the healthcare supply chain management market is the global adoption of stringent pharmaceutical traceability regulations. The EU's Falsified Medicines Directive (FMD) mandates serialization and a centralized verification database, enhancing counterfeit detection and product integrity. Similarly, the U.S. Drug Supply Chain Security Act (DSCSA) mandates prescription drugs to be electronically traceable using serialized identifiers at the package level.

Countries like India, China, and Brazil have also implemented track-and-trace systems, using barcodes and QR codes to secure pharmaceuticals in both export and domestic markets. Moreover, the WHO's Global Health Logistics Transformation Agenda integrates real-time tracking tools and dashboards. This aims to improve global procurement and ensure accountability during public health emergencies. These global policy shifts compel healthcare providers, manufacturers, and logistics partners to adopt digital platforms. This creates strong demand for compliant, traceable, and efficient supply chain management solutions across the industry.

Restraint

Supply Chain Disruptions and Drug Shortages

A significant factor restraining the growth of the healthcare supply chain management market is the instability caused by frequent drug shortages and logistics issues. Recent data from the American Society of Health-System Pharmacists (ASHP) indicates that over 323 active drug shortages were reported in Q1 2024, the highest level ever recorded. Hospitals are also facing more delays in patient care and procedure cancellations due to missing medications and materials.

(Source: https://www.ashp.org)

- For example, Hurricane Helene in September 2024 disrupted IV fluid production at Baxter's North Carolina facility, a major supplier to U.S. hospitals. Such challenges, often exacerbated by geopolitical tensions or natural disasters, reduce confidence in digital SCM. Moreover, managing complex supply chains with multiple stakeholders and regulations is challenging, hampering the growth of the market.(Source: https://catalyst.nejm.org)

Opportunity

Is the Surge in Cloud-Based Adoption a Game-Changer in Healthcare Supply Chain Management?

One of the most promising opportunities in the healthcare supply chain management market lies in the growing shift toward cloud-based platforms. Cloud solutions allow hospitals and healthcare networks to centralize and automate operations. They provide real-time visibility into inventory levels, supplier performance, and delivery timelines across different facilities. This improves decision-making, reduces manual errors, and lowers operational costs. The U.S. Department of Health and Human Services (HHS) is promoting digital modernization to create more responsive, secure, and scalable supply systems, especially after recent global disruptions. This, in turn, increases interest in cloud adoption, creating new growth opportunities for vendors offering customized healthcare SCM solutions.

Component Insights

What Made Software the Dominant Segment in the Market in 2024?

The software segment dominated the healthcare supply chain management market, under which the inventory management software sub-segment held the maximum share in 2024, it is the main part of the healthcare supply chain management. Its widespread use is attributed to the increased need to optimize inventory levels, prevent stockouts, and improve operational efficiency. Healthcare providers depend on these tools to keep accurate stock records, cut waste, and ensure a steady supply of essential medical items and equipment.

Meanwhile, the analytics & reporting software sub-segment is expected to grow at the fastest CAGR over the next few years. This is mainly due to the rising need for data-driven decisions, predictive analytics, and performance tracking in the supply chain. As healthcare organizations try to improve efficiency and follow strict regulations, they are increasingly putting money into analytical tools to get real-time insights.

Delivery Mode Insights

Which Delivery Mode Segment Dominate the Market in 2024?

The cloud-based segment led the healthcare supply chain management market in 2024 and is expected to sustain its growth trajectory over the projection period. This is because of its scalability, remote access, and cost savings. Healthcare organizations increasingly favor cloud solutions since they support easy data sharing, allow centralized inventory management, and enable quick software updates without needing large infrastructure investments.

The trend toward digital transformation, a rise in telehealth services, and the demand for systems that work well together is leading to a rapid shift toward a cloud environment. As providers look for secure, real-time access to supply chain data across various locations, cloud platforms provide flexibility and integration advantages that traditional on-premise systems cannot offer.

End User Insights

Why Did the Healthcare Providers Segment Dominate the Market in 2024?

The healthcare providers segment dominated the healthcare supply chain management market in 2024. This is mainly because they handle a large volume of medical supplies, have complex purchasing needs, and face pressure to reduce operational costs while ensuring the timely delivery of essential materials. Hospitals depend on improved supply chain solutions to manage inventory effectively and keep patient care consistent.

The healthcare manufacturers segment is expected to grow at the fastest rate during the forecast period. Biotech firms in the healthcare manufacturers category are expected to lead the charge. This growth stems from the increasing demand for precision medicine, biologics, and personalized therapies. These firms need a specialized and traceable supply chain, which leads them to adopt advanced analytics, compliance tools, and integrated systems to meet regulatory and quality standards.

Function Insights

How Does the Inventory Management Segment Dominate the Market?

The inventory management segment sustained dominance in the healthcare supply chain management market in 2024. The segment's dominance stems from the need to keep stock levels right, reduce waste, and prevent supply shortages in hospitals and clinics. Good inventory systems help healthcare providers ensure that essential medical supplies and pharmaceuticals are available on time. This, in turn, improves patient care and operational efficiency.

The compliance & risk management segment is expected to expand at the highest CAGR in the upcoming period. The rising complexities of healthcare regulations and increased focus on patient safety and supply authenticity have made compliance a key concern. Organizations are using better tools to handle regulatory paperwork, monitor supplier risks, and ensure they meet changing national and international healthcare standards.

Technology Insights

Why Did the RFID Segment Dominate the Market in 2024?

The RFID segment dominated the healthcare supply chain management market in 2024. The dominance of the RFID technology stems from its ability to provide real-time tracking, reduce human error, and improve inventory visibility. RFID helps healthcare organizations reduce losses from misplaced items, streamline asset management, and enhance overall supply chain efficiency, especially in large hospital systems.

The AI and machine learning segment is expected to grow at the fastest rate in the coming years. The growth of the segment is attributed to the rising demand for predictive maintenance. AI and ML tools are being quickly adopted to predict demand trends, automate procurement, and improve decision-making. With rising data complexity and the need for predictive analytics, AI and ML provide significant benefits in optimizing supply chain performance and lowering operational costs in healthcare networks.

- On August 12, 2023, Dimensionless Technologies launched AushadhAI, an AI platform intended to simplify returns management, automate credit note generation, and prevent medicine expiry by identifying geographic patterns in stock expiration. (Source: https://www.indianpharmapost.com)

Deployment Size Insights

How Does the Large Enterprises Segment Dominate the Market in 2024?

The large enterprises segment dominated the healthcare supply chain management market in 2024 because of their robust infrastructure and better financial resources. These organizations usually handle large inventories and need complete supply chain solutions. Their need for better software tools to simplify procurement, manage risks, and improve overall supply chain transparency drives the segment's ongoing leadership in the market.

The mid-sized organizations segment is expected to experience the fastest growth during the forecast period. This is mainly due to their high need to modernize operations, boost efficiency, and stay competitive, resulting in more investments in cloud-based and modular supply chain solutions. These flexible systems allow mid-sized firms to adopt new technologies without facing high upfront costs, which supports smarter inventory and compliance management practices.

Regional Insights

U.S. Healthcare Supply Chain Management Market Size and Growth 2025 to 2034

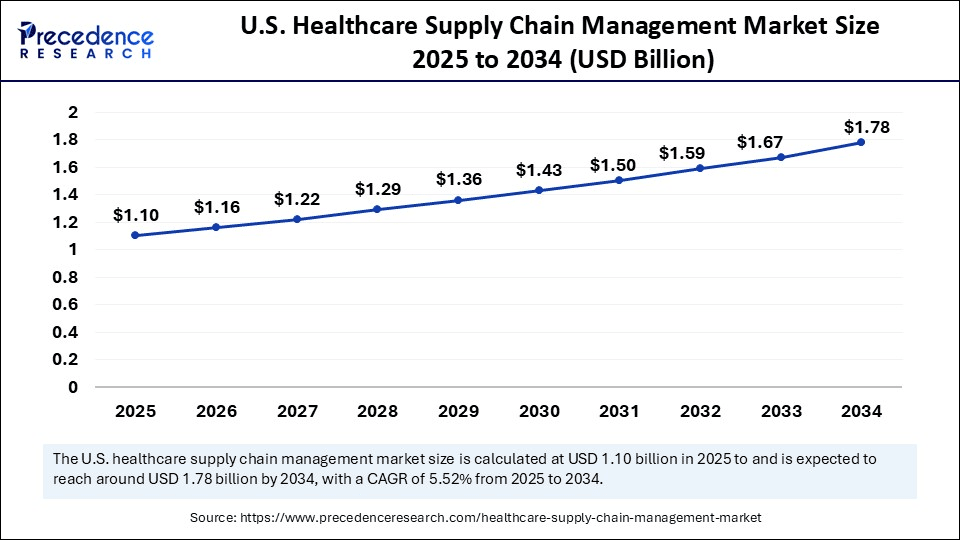

The U.S. healthcare supply chain management market size is evaluated at USD 1.10 billion in 2025 and is projected to be worth around USD 1.78 billion by 2034, growing at a CAGR of 5.52% from 2025 to 2034.

What Made North America the Dominant Region in the Healthcare Supply Chain Management Market in 2024?

North America led the healthcare supply chain management market while holding the largest share in 2024. This is because of its high digital maturity, established healthcare infrastructure, and proactive use of cloud-based inventory and logistics systems. The region's focus on improving patient outcomes while reducing operational costs has driven the rapid deployment of AI-driven supply chain tools. Government initiatives that promote interoperability and data sharing among healthcare providers also support the region's leadership. Additionally, strong investments by pharmaceutical and medtech companies in automation andpredictive analytics have improved visibility and efficiency across the supply network.

The U.S. continues to lead innovation in healthcare supply chain management by integrating technologies like blockchain, IoT-enabled tracking, and cloud-based logistics. In 2024, several major U.S. hospitals and health systems increased their use of real-time analytics and automated procurement to address drug shortages and optimize distribution during supply disruptions. The FDA's Drug Supply Chain Security Act (DSCSA) compliance deadline in late 2024 accelerated digitization efforts, with many healthcare organizations updating their systems to ensure traceability and meet regulatory requirements. These factors strengthen the U.S. position as a regional leader in smart healthcare supply chain transformation.

What Makes Asia Pacific the Fastest-Growing Region in the Healthcare Supply Chain Management Market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years due to the increasing healthcare spending, the growth of pharmaceutical manufacturing, and higher demand for better logistics systems. Governments in the region are investing in digital health infrastructure and working to improve transparency and efficiency in supply chains. The growth of telemedicine, online pharmacies, and e-health platforms is also creating a need for flexible, data-driven inventory and distribution systems. Furthermore, international healthcare and logistics companies are setting up regional hubs to strengthen their presence in emerging markets like India, Southeast Asia, and Australia.

India is leading the transformation of healthcare supply chains in Asia Pacific because of its large pharmaceutical production and rising investment in healthcare digitization. In 2024, India advanced its National Digital Health Mission, which promotes digital record-keeping, logistics tracking, and automated inventory management in hospitals and drug distributors. Leading private healthcare providers have started using AI-powered procurement and forecasting systems to cut waste and ensure the timely delivery of medicines. At the same time, the rapid growth of e-pharmacy platforms and third-party logistics companies has improved last-mile distribution efficiency. These changes have made India a key player in the Asia Pacific healthcare supply chain management market.

Healthcare Supply Chain Management Market Companies

- Oracle Corporation

- SAP SE

- McKesson Corporation

- Cardinal Health

- Tecsys Inc.

- Infor, Inc.

- Manhattan Associates

- Global Healthcare Exchange (GHX)

- JDA Software (Blue Yonder)

- Smith & Nephew

- Jump Technologies

- LogiTag Systems

- Syft (a GHX company)

- Hybrent, Inc.

- Premier, Inc.

- IBM Corporation

- Kinaxis Inc.

- Oracle Cerner

- Zebra Technologies

- Medtronic Supply Chain Solutions

Recent Developments

- On July 22, 2025, COSMOS Pharmaceutical partnered with RELEX Solutions to integrate AI-powered supply chain optimization into its operations. Using machine learning and analytics, the platform will improve demand forecasting, automate replenishment, and increase inventory accuracy to support scalable, data-driven growth in pharmaceutical distribution.(Source: https://www.businesswire.com)

- In July 2025, Compass Group Equity Partners, a St. Louis-based private equity firm, partnered with The Illuminate Group to launch a next-generation cold chain platform. The solution combines tracking, predictive analytics, and real-time monitoring to improve temperature-sensitive pharmaceutical logistics and reduce spoilage risks in global supply networks.(Source: https://www.businesswire.com)

- In May 2025, Tjoapack introduced a new customer dashboard to improve visibility in pharmaceutical packaging. The tool provides real-time supply chain tracking, production updates, and performance metrics to enhance communication, forecasting accuracy, and decision-making for drug manufacturers and distributors.(Source: https://pharmaceuticalmanufacturer.media)

- In February 2025, Cencora expanded its Drug Shortages Mitigation Program to tackle critical supply gaps in the pharmaceutical sector. The initiative includes strategic inventory planning, better supplier engagement, and data-driven risk assessment to strengthen supply chain resilience in the U.S. healthcare system.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Component

- Software

- Inventory Management Software

- Procurement Software

- Order Management Software

- Logistics Management Software

- Supplier Relationship Management Software

- Analytics & Reporting Software

- Others

- Hardware

- Barcode Scanners

- RFID Tags & Readers

- Mobile Devices (Handhelds/Tablets)

- Warehouse Automation Equipment

- Others

- Services

- Consulting

- Implementation & Integration

- Maintenance & Support

- Training & Education

- Managed Services

- Others

By Delivery Mode

- On-Premises

- Cloud-Based

- Hybrid

By End-User

- Healthcare Providers

- Hospitals

- Clinics

- Diagnostic Laboratories

- Others

- Healthcare Manufacturers

- Pharmaceutical Companies

- Medical Device Manufacturers

- Biotech Firms

- Others

- Distributors & Logistics Companies

- Pharmacies

- Others (GPOs, Government Bodies, CROs)

By Function

- Procurement

- Inventory Management

- Transportation & Logistics

- Order Management

- Demand Forecasting

- Compliance & Risk Management

- Supplier Collaboration

- Analytics & Reporting

- Others

By Technology

- RFID

- Barcoding

- IoT & Sensor-Based Tracking

- AI & Machine Learning

- Blockchain

- Cloud Computing

- EDI (Electronic Data Interchange)

- ERP Integration

- Others

By Deployment Size

- Large Enterprises

- Mid-Sized Organizations

- Small Healthcare Facilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting