What is the Multiprotocol Storage Market Size?

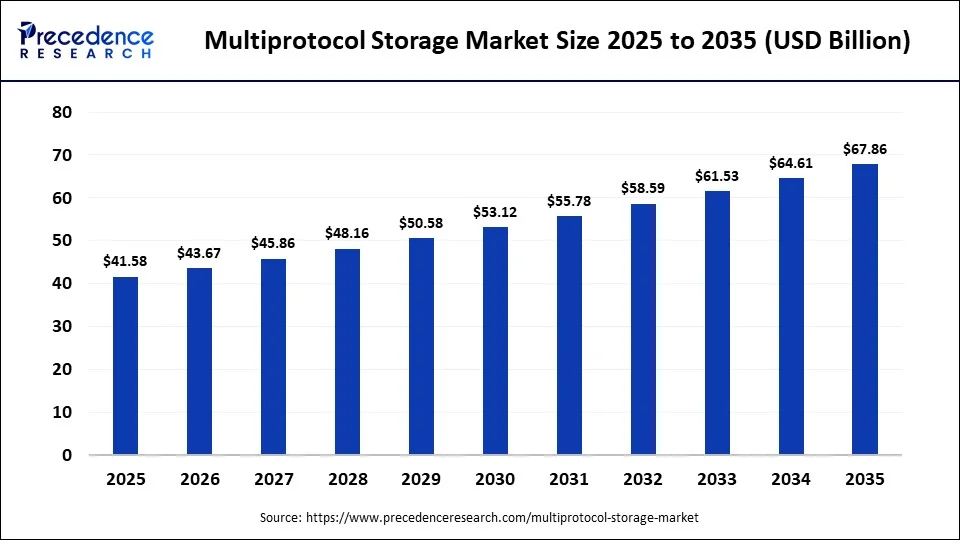

The global multiprotocol storage market size is calculated at USD 41.58 billion in 2025 and is predicted to increase from USD 43.67 billion in 2026 to approximately USD 67.86 billion by 2035, expanding at a CAGR of 5.02% from 2026 to 2035. The market is experiencing rapid growth due to stringent regulations on data access and security, and the explosive growth of AI/ML, IoT, and big-data-like technologies that require robust data management and storage systems that can be accessed safely.

Market Highlights

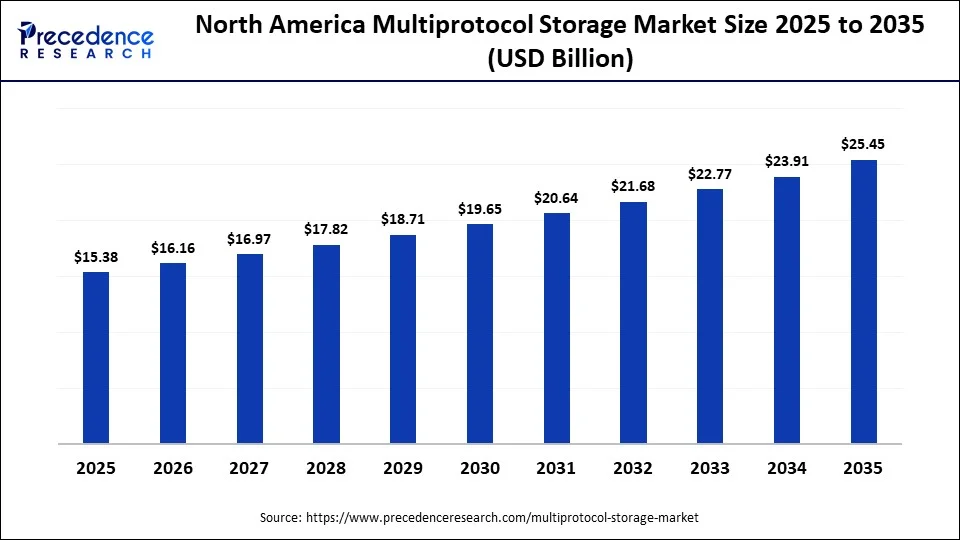

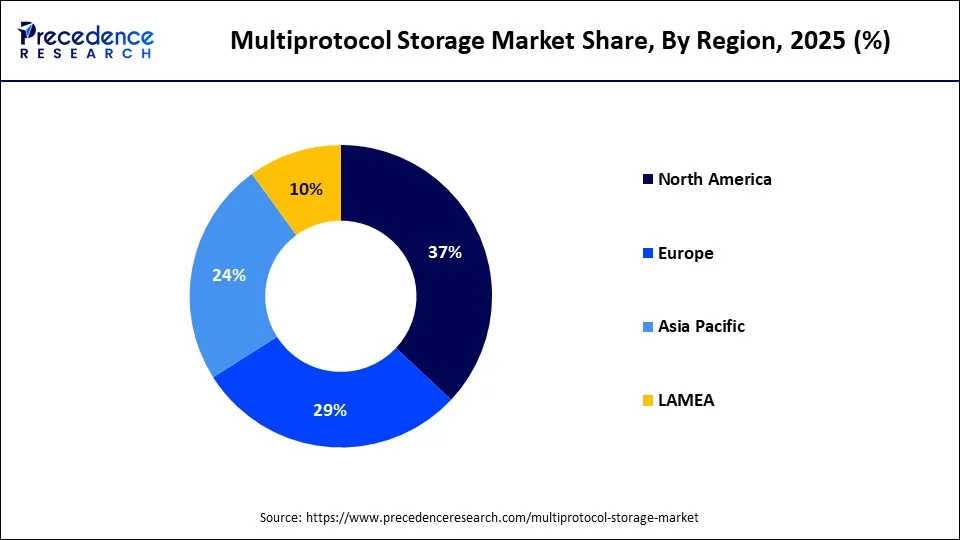

- North America accounted for the largest market share of 37% in 2025.

- The Asia Pacific is projected to grow at the fastest CAGR from 2026 to 2035.

- By storage, the file storage segment held the largest share in 2025.

- By storage, the object storage segment is grow at the fastest CAGR from 2026 to 2035.

- By protocol type, the NFS (network file system) segment held the largest market share in 2025.

- By protocol type, the NVMe-oF segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By deployment model, the on-premises segment contributed the highest market share in 2025.

- By deployment model, the hybrid segment is projected to grow at the fastest CAGR from 2026 to 2035.

- By architecture, the unified storage systems segment held the major market share in 2025.

- By architecture, the software-defined segment is expanding at a strong CAGR from 2026 to 2035.

- By component, the hardware segment captured the biggest market share in 2025.

- By component, the software segment is projected to grow at the fastest CAGR from 2026 to 2035.

- By application, the data centers segment generated the largest market share in 2025.

- By application, the AI/ machine learning workloads segment is projected to grow at the fastest CAGR from 2026 to 2035.

- By end user, the IT& telecommunications segment held the largest market share in 2025.

- By end user, the healthcare and life sciences segment is projected to grow at the fastest CAGR from 2026 to 2035.

Multiprotocol Storage Market

The global multiprotocol storage market comprises data storage systems and platforms designed to support multiple storage access protocols, including file, block, and object storage, within a single unified architecture. These solutions allow enterprises to consolidate storage infrastructure, improve utilization, and simplify data management across heterogeneous IT environments.

Multiprotocol storage platforms support a wide range of enterprise workloads, including transactional databases, virtualized environments, cloud-native applications, big data analytics, AI and machine learning workloads, as well as backup and disaster recovery operations. By enabling different applications to access the same storage system through their preferred protocol, organizations can reduce infrastructure silos and improve operational efficiency.

Market growth is driven by the rapid increase in enterprise data volumes, the expansion of hybrid IT and multi-cloud environments, and rising demand for flexible, scalable, and cost-efficient storage architectures. Organizations are increasingly adopting multiprotocol storage to modernize legacy systems, support diverse workload requirements, and reduce the complexity and cost associated with managing separate storage platforms.

How AI Is Transforming Multiprotocol Storage: Self-Optimizing Systems and Workload-Aware Management

The integration of artificial intelligence is deeply transforming the multiprotocol storage market with smarter management and automation. AI-powered analytics provide real-time insights into storage performance, improved capacity utilization, and proactive maintenance to reduce potential failures and minimize downtime. Moreover, AI helps handle complex workloads by simultaneously supporting multiple protocols, ensuring optimal resource use. Machine learning models, integrated with multiprotocol systems, further assist in predicting hardware failures, enable proactive replacement, and help the IT team focus on core work by handling repetitive tasks.

AI-driven management layers increasingly sit above unified file, block, and object storage architectures, continuously ingesting telemetry data, including latency, throughput, IOPS, error rates, and access patterns across protocols. These systems use pattern recognition to dynamically rebalance workloads, optimize tiering between flash and disk, and adjust quality-of-service parameters based on application priority and real-time demand. AI-enabled multiprotocol storage platforms support automated policy enforcement across enterprise and data center environments, especially with heterogeneous workloads, including databases, virtual machines, containers, and AI training pipelines.

Understanding the Multiprotocol Storage Market: Interoperability, Scalability, and Enterprise Data Management

- Industry Growth Overview: The multiprotocol storage market is expanding due to accelerating demand for hybrid and multi-cloud environments that require seamless data operations across multiple platforms. The growing adoption of AI, IoT, and big data analytics is further driving market growth, as these workloads generate large volumes of unstructured and semi-structured data. Enterprises are increasingly adopting multiprotocol storage to reduce data silos and enable consistent access across on-premise and cloud infrastructure.

- Sustainability Trends: The market is witnessing sustainability-focused trends, including improved energy efficiency, expansion of green data centers, intelligent data lifecycle management, and the deployment of NVMe-based flash storage to reduce power consumption per workload. Cloud service providers are investing heavily in renewable energy sources such as solar and wind to support low-carbon data center operations. Storage vendors are also optimizing software-defined storage architectures to improve utilization and reduce hardware overprovisioning.

- Major Investors: The market is driven by the convergence of venture capital, private equity, and established enterprise technology providers such as IBM, NetApp, and Dell Technologies. These players are strengthening their portfolios through investments in AI-enabled data management, software defined storage, and unified storage platforms. Strategic acquisitions and sustained R&D spending are focused on enhancing multiprotocol capabilities, automation, and scalability across enterprise and cloud environments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 41.58 Billion |

| Market Size in 2026 | USD 43.67 Billion |

| Market Size by 2035 | USD 67.86 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.02% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Storage Type, Protocol Type, Deployment Model, Architecture, Component, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Storage Insights

How Is File Storage Supporting the Growth of the Multiprotocol Storage Market?

File Storage: The segment held the largest market share in 2025. The segment is dominating due to rising demand for high-resolution content/data and the adoption of collaborative workflows. File storage can organize data in a structured, hierarchical format. It is primarily used for document and image management, as well as for managing even unstructured data. Hence, it is increasingly adopted in sectors such as media and entertainment, where large volumes of data files need to be handled.

Object Storage: The segment is projected to grow at the fastest CAGR during the foreseeable period. The segment is expanding because it is specifically designed to handle large-volume data, such as videos, images, and backup files. Its ability to integrate with multiple cloud platforms and support various data protocols makes it a popular storage solution. Object storage is widely adopted in cloud-native and data-intensive environments due to its scalability, durability, and cost efficiency compared to traditional storage architectures. Growing use cases in data lakes, AI and machine learning workloads, and long-term archival storage further support strong adoption across enterprises and cloud service providers.

Protocol Type Insights

Why Does NFS Protocol Make Up the Largest Share in the Multiprotocol Storage Market?

NFS (Network File System): The segment held the largest market share in 2025, dominating due to broad compatibility with Linux/UNIX environments, simple yet high-performance capabilities, and robust scalability, all of which are highly anticipated in the HPC environment. Also, modern advancements such as NFS-over-RDMA have improved performance at scale by enabling direct memory access. NFS remains a preferred protocol in enterprise data centers and research institutions due to its maturity, stability, and widespread support across operating systems and applications. Its continued adoption in HPC clusters, AI training environments, and large-scale file-sharing workloads sustains strong demand within multiprotocol storage deployments.

NVMe-oF: The segment is projected to grow at the fastest CAGR during the foreseeable period. The non-volatile memory express over fabrics is primarily preferred due to its offerings, such as significantly lower latency, high performance, and better CPU efficiency compared to other protocols. NVMe-oF enables storage systems to fully leverage high-speed flash media across networked environments, making it well-suited for latency-sensitive workloads such as real-time analytics and AI inference. Increasing adoption of high-bandwidth network fabrics and all-flash data centers further supports accelerated growth of this protocol.

Deployment Model Insights

Why Is On-Premises Deployment Highly Advisable in the Multiprotocol Storage Market?

On-Premise: This segment held the largest market share in 2025. The segment is dominating, as this mode offers greater control over data privacy and a range of advantages tailored to enterprises' needs, including compliance with strict data security regulations such as GDPR. Thus, industries like healthcare and finance, which are highly data-sensitive, strongly prefer on-premises deployment. On-premises deployment also enables organizations to maintain direct control over storage performance, latency, and system customization. Enterprises with legacy infrastructure and predictable workloads continue to rely on on-premises systems to ensure operational stability and regulatory assurance.

Hybrid: The segment is projected to grow at the fastest CAGR during the foreseeable period. The segment is growing largely because it offers the benefits of both on-premises and cloud deployment by customizing to each enterprise's requirements, giving it maximum flexibility to handle data and optimize its strategies, and helping balance data security with cost efficiency.

Hybrid deployment allows enterprises to dynamically allocate workloads between on-premises infrastructure and cloud platforms based on performance, compliance, and cost considerations. Increasing adoption of hybrid IT and multi-cloud strategies across large enterprises further accelerates demand for hybrid multiprotocol storage solutions.

Architecture Insights

What Are the Benefits of Unified Storage Systems in the Multiprotocol Storage Market?

Unified Storage Systems: The segment held the largest market share in 2025. The segment is dominant because it consolidates blocks, files, and object storage on a single platform. It's highly useful for significant cost savings, power management, and operational ease. Unified storage helps manage various workloads on a single platform, reducing complexity and simplifying task performance. These systems are widely adopted by enterprises seeking to streamline storage administration and reduce infrastructure sprawl across data centers. Unified storage also enables faster provisioning and centralized management, improving operational efficiency for IT teams managing mixed workloads.

Software-Defined Storage (SDS): The software-defined segment is projected to grow at the fastest CAGR during the foreseeable period. The segment is expanding rapidly due to its built-in enterprise-grade data services like synchronous and asynchronous replication, compression, and encryption. This availability ensures data resilience and recovery from disastrous events. Software-defined storage decouples storage software from the underlying hardware, enabling organizations to deploy scalable, cost-effective storage on commodity infrastructure. Growing adoption of cloud-native architectures and virtualization further accelerates demand for flexible, software-driven storage solutions.

Component Insights

Why Does Hardware Play a Crucial Role in the Multiprotocol Storage Market?

Hardware (Storage Arrays, Controllers): The hardware segment held the largest market share in 2025. The segment is dominating in the market as it offers a strong foundation for software scalability, security, and robust performance. How data can be manipulated and processed depends on the hardware and the availability of high-capacity RAM. Also, durable and proper hardware plays a critical role in ensuring stable operations and protects against data loss. Hardware such as RAID, backup hardware, and error-correction mechanisms is essential.

Software (Storage OS, Management Software): The segment is projected to grow at the fastest CAGR during the foreseeable period. The segment is expanding due to software offerings for multiprotocol storage, including simplified management, unified access, and greater flexibility for data storage and access. Also, the software is a basic yet intelligent management layer for multiprotocol systems. These software platforms enable centralized control over file, block, and object storage environments, reducing administrative complexity across heterogeneous infrastructure. Increasing emphasis on automation, policy-based management, and integration with hybrid and multi-cloud environments further supports strong adoption of storage operating systems and management software.

Application Insights

Why Do Data Centers Dominate Applications in the Multiprotocol Storage Market?

Data Centers: The data centers segment held the largest market share in 2025. The segment is dominating due to the huge data management and workload that need to be handled efficiently by data centers without potential failure or downtime. Modern data centers support a wide range of applications, such as AI/ML GenAI, Databases, and more, that generate large volumes of data that require a separate storage system. Multiprotocol storage systems can support various data access requirements within data centers.

AI/Machine Learning Workloads: The workloads related to the AI and machine learning segment are projected to grow at the fastest CAGR during the foreseeable period. The segment is expanding largely due to the massive data generation from AI/ML workloads, which require efficient handling and access without data loss. Multiprotocol storage systems effectively manage this crucial factor and support AI/ML adoption at scale across several sectors.

End-User Industry Insights

Why Does the IT & Telecommunications Sector Lead in the Multiprotocol Storage Market?

IT & Telecommunications: The segment held the largest market share in 2025. The segment is dominating, as the IT& telecommunications sector needs robust data storage solutions for seamless data processing and high performance computing. Multiprotocol storage allows the IT & Telecommunication sector to effectively manage data processing with advanced analytics and improve network performance. The sector also requires high-availability, low-latency storage to support large-scale network operations, data centers, and cloud service delivery platforms. Theincreasing deployment of 5G infrastructure and edge computing further strengthens demand for scalable, protocol-flexible storage systems.

Healthcare & Life Sciences: The life sciences and healthcare-related segment is projected to grow at the fastest CAGR during the foreseeable period. The segment is growing largely due to the growing need to store patients' data, records, medical images, and other crucial data, which can be accessed safely when required. The growing adoption of EHR and telemedicine further supports the utility of multiprotocol storage in the healthcare sector. Multiprotocol storage enables healthcare providers to manage structured and unstructured data across clinical, imaging, and research workflows within a unified environment. Rising focus on data interoperability, regulatory compliance, and secure long-term data retention continues to accelerate adoption across hospitals, research institutes, and life sciences organizations.

Regional Insights

How Big is the North America Multiprotocol Storage Market Size?

The North America multiprotocol storage market size is estimated at USD 15.38 billion in 2025 and is projected to reach approximately USD 25.45 billion by 2035, with a 5.17% CAGR from 2026 to 2035.

What Made North America a Dominant Player in the Multiprotocol Storage Market?

North America held the largest market share in 2025. The region is dominant due to the convergence of factors, including the presence of leading tech enterprises actively leveraging multiprotocol storage systems, growing adoption of advanced IT infrastructure, and substantial investments in cloud and big data technologies. Leading sectors like finance and healthcare are highly regulated in the region due to stringent data security and privacy requirements, supported by robust data storage systems, including multiprotocol storage.

The region also benefits from early adoption of hybrid and multi-cloud architectures across large enterprises and cloud service providers. Strong demand for high-performance computing, AI-driven analytics, and data-intensive workloads further reinforces the need for flexible, protocol-agnostic storage platforms. In addition, continuous investments in data center expansion and modernization support the sustained adoption of multiprotocol storage across the United States and Canada.

What is the Size of the U.S. Multiprotocol Storage Market?

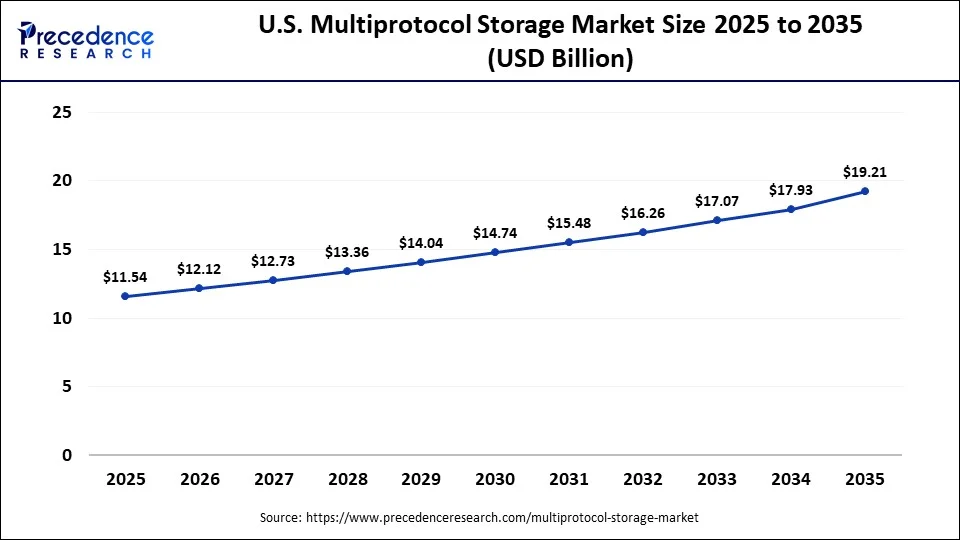

The U.S. multiprotocol storage market size is calculated at USD 11.54 billion in 2025 and is expected to reach nearly USD 19.21 billion in 2035, accelerating at a strong CAGR of 5.23% between 2026 and 2035.

U.S. Multiprotocol Storage System Market Analysis

The rapidly evolving regulatory landscape is a major driver of the expansion of the Multiprotocol storage systems market in the U.S. Many vendors and enterprises are adopting innovative solutions to meet industry-specific standards and comply with data privacy regulations. Emerging industry innovations in the U.S. include AI/ML integration, NVMe-over fabrics and high-speed interfaces, software-defined storage, and hybrid cloud integration, supporting the market's large-scale expansion in the U.S. Strict compliance requirements across sectors such as finance, healthcare, and government are pushing organizations to adopt storage systems that provide greater control, auditability, and data governance. Enterprises increasingly require multiprotocol platforms that support encryption, access controls, and policy-based data management across environments.

What Factors Support the Fastest Growth of the Asia Pacific Multiprotocol Storage Market?

Asia Pacific is projected to grow at the fastest CAGR during the foreseeable period. Growth in the region is driven by large-scale data center deployments and hybrid IT adoption across China, India, Japan, South Korea, and Southeast Asian economies, where enterprises are managing increasing volumes of structured and unstructured data across on-premises systems and public cloud platforms. Organizations in sectors such as telecommunications, e-commerce, manufacturing, and financial services are adopting multiprotocol storage to support mixed workloads that require simultaneous access through file, block, and object protocols.

In China and India, hyperscale cloud providers and domestic data center operators are deploying multiprotocol storage to support AI model training, large-scale analytics, and enterprise cloud services while meeting local data residency requirements. Japan and South Korea are seeing strong adoption in high-performance computing, semiconductor design, and advanced manufacturing environments, where low-latency access across multiple protocols is critical. Government-backed cloud programs, data localization policies, and increased use of AI, IoT sensor data, and analytics platforms across enterprises continue to drive demand for flexible, protocol-agnostic storage systems across the Asia Pacific region.

China Multiprotocol Storage Market Trends

The region is proliferating on a large scale due to the accelerated adoption of hybrid cloud environments, expansion of AI/ML and big data applications, and government-backed digital initiatives. Stringent data localization regulations and growing concerns about data privacy have prompted the Chinese government to implement robust data storage solutions, fueling the growth of the multiprotocol storage market in the region.

China's Cybersecurity Law and the Data Security Law enacted in 2021 require critical data generated by sectors such as finance, telecommunications, and public services to be stored and processed domestically, increasing demand for on-premises and hybrid multiprotocol storage systems. Large cloud providers and state-owned enterprises are deploying unified file, block, and object storage platforms to support AI model training, video analytics, and transaction-heavy workloads while maintaining regulatory compliance. The need to manage structured banking data alongside unstructured video and sensor data further reinforces adoption of multiprotocol architectures across Chinese data centers.

How Is the European Multiprotocol Storage Market Significantly Expanding?

The European multiprotocol market is witnessing rapid growth driven by industrial automation and the expansion of Industry 4.0, which requires seamless data access across platforms and enterprise-level data management with greater accountability. Government initiatives and EU regulations further support rapid digitalization, driven by data security laws such as GDPR. Thus, sustainable practices and the expansion of AI/ML across several industrial processes have prompted the European region to leverage multiprotocol storage systems on a large scale. In Germany, multiprotocol storage is increasingly deployed across automotive manufacturing, industrial robotics, and factory automation environments to manage machine data, production analytics, and quality inspection workloads across file and object interfaces.

France and the Nordic countries are adopting similar architectures in energy management and smart grid deployments, where sensor data, operational records, and analytics outputs must coexist on unified storage platforms. GDPR enforcement since 2018 has pushed enterprises to retain tighter control over data location, access logs, and audit trails, favoring on-premises and hybrid multiprotocol systems. Additionally, European data center operators are deploying unified and software-defined storage to support AI-driven industrial inspection and predictive maintenance while meeting sustainability and compliance requirements.

UK Multiprotocol Storage Market Analysis

The UK's shift towards the Industry 4.0 revolution has prompted entrepreneurs to leverage robust storage solutions, such as multiprotocol storage systems, to securely handle the massive volume of data generated across the country. Also, the development of innovations based on improved cybersecurity features to protect sensitive data is fueling the market's growth. In the UK, manufacturing, financial services, and healthcare organizations are deploying multiprotocol storage to manage operational data, transactional records, and unstructured datasets within hybrid environments. Compliance with data protection requirements under the UK GDPR and sector-specific regulations has increased demand for storage systems that support encryption, access controls, and auditability across file, block, and object data. In addition, growing adoption of AI-driven analytics in smart manufacturing and financial risk modeling is reinforcing the need for high-performance, protocol-flexible storage architectures.

Why Do Middle East & Africa see a Notable Growth in the Multiprotocol Storage Market?

The region is notably expanding due to rapid digitalization across industries, which increases data generation and necessitates flexible, scalable storage solutions to support protocols such as NFS, SMB, and iSCSI. Organizations in the region are seeking to optimize their data infrastructure to enable multiprotocol storage solutions at scale. Moreover, Middle East and Africa governments are seeking to diversify their economy by leveraging technological solutions and adopting cutting-edge technologies in their leading sector's workflow, further fueling the market's growth.

In the Middle East, countries such as the United Arab Emirates and Saudi Arabia are deploying multiprotocol storage across banking, oil and gas, and smart city infrastructure to manage transactional data, sensor outputs, and analytics workloads within hybrid environments. National initiatives such as Saudi Arabia's Vision 2030 have increased investments in data centers and cloud infrastructure, driving demand for unified file, block, and object storage systems. In Africa, growing adoption of multiprotocol storage is observed in telecommunications and government IT systems, where operators manage subscriber data, network logs, and digital public services across centralized and edge data centers. The need to support mixed legacy and modern workloads further reinforces adoption of protocol-flexible storage architectures across the region.

UAE Multiprotocol Storage Market Analysis

The UAE multiprotocol storage market is notably expanding due to the massive data generation by leading sectors adopting digitalization and integrating AI/ML into their workflows. Technologies like IoT, 5G, and big data analytics further transform the regions' technological landscape, which needs a robust data storage and handling solution, fueling the UAE multiprotocol storage market. In the UAE, multiprotocol storage is being deployed across banking, aviation, oil and gas, and smart city platforms to manage transaction records, sensor data, video surveillance feeds, and analytics outputs within unified environments. National initiatives such as Smart Dubai and large-scale data center investments by regional cloud and telecom operators are increasing demand for storage systems that support file, block, and object access under strict data governance requirements. The need to balance low-latency performance with regulatory control over data residency further accelerates the adoption of hybrid multiprotocol storage architectures nationwide.

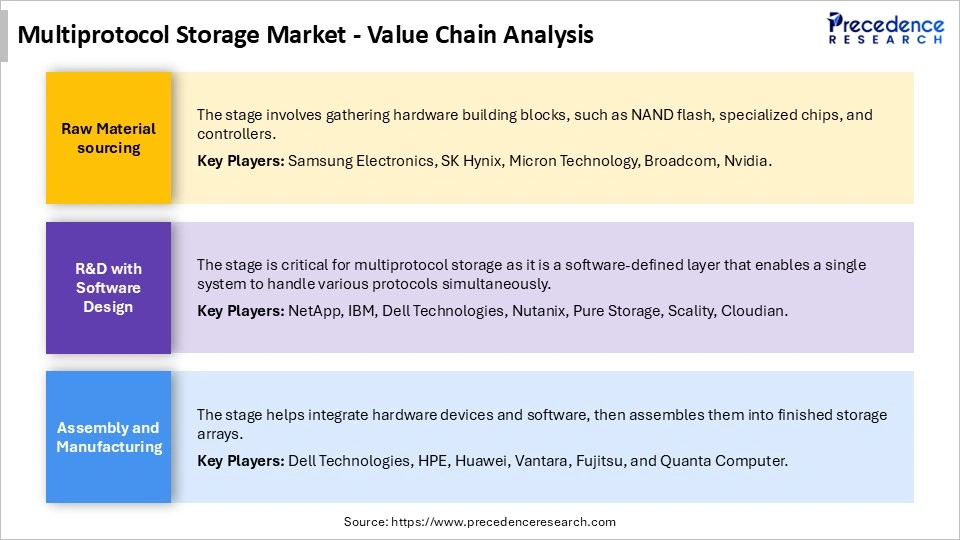

Multiprotocol Storage Market Value Chain

Top Companies in Multiprotocol Storage Market & their Offerings

- Dell Technologies

- Hewlett Packard Enterprise

- NetApp

- IBM Corporation

- Hitachi Vantara

- Pure Storage

- Cisco Systems

- Fujitsu Limited

- Huawei Technologies

- Western Digital Corporation

- Oracle Corporation

- Infinidat

- Quantum Corporation

- DataDirect Networks (DDN)

- Nutanix

- Tintri

- Qumulo

- Panasas

- Synology

- Lenovo Group Limited

Recent Developments

- In February 2025, the AI data platform company, VAST Data, revealed two significant advancements for its multiprotocol storage platform, including block storage functionality for VAST DataStore and the new VAST Event Broker. These additions are aimed at accommodating the complex data processing needs of analytics and AI while maintaining a universal, multiprotocol storage platform.(Source: https://www.dbta.com)

- In May 2025, NetApp announced an update to its AIPod solution that integrates the NVIDIA AI Data Platform, creating a reference architecture aimed at simplifying large-scale deployment of agentic AI. This development addresses growing enterprise demand for a unified and well-governed data infrastructure as organizations increase investment in AI-driven workloads. The collaboration focuses on retrieval-augmented generation and inference, which are critical to enabling generative and agentic AI systems to operate reliably on enterprise-owned data.(Source: https://www.peersoftware.com)

Segments Covered in the Report

By Storage Type

- File Storage

- Block Storage

- Object Storage

By Protocol Type

- NFS (Network File System)

- SMB/CIFS

- iSCSI

- Fibre Channel (FC)

- NVMe-oF

- S3-Compatible Object Protocol

By Deployment Model

- On-Premises

- Cloud-Based

- Hybrid

By Architecture

- Unified Storage Systems

- Hyper-Converged Infrastructure (HCI)

- Software-Defined Storage (SDS)

By Component

- Hardware (Storage Arrays, Controllers)

- Software (Storage OS, Management Software)

- Services (Deployment, Support, Managed Services)

By Application

- Data Centers

- Virtualization & Cloud Workloads

- Big Data & Analytics

- AI / Machine Learning Workloads

- Backup & Disaster Recovery

- Media & Content Storage

By End-User Industry

- IT & Telecommunications

- BFSI

- Healthcare & Life Sciences

- Government & Defense

- Media & Entertainment

- Manufacturing

- Retail & E-Commerce

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting