Digital Twin As-a-Service Market Size and Forecast 2025 to 2034

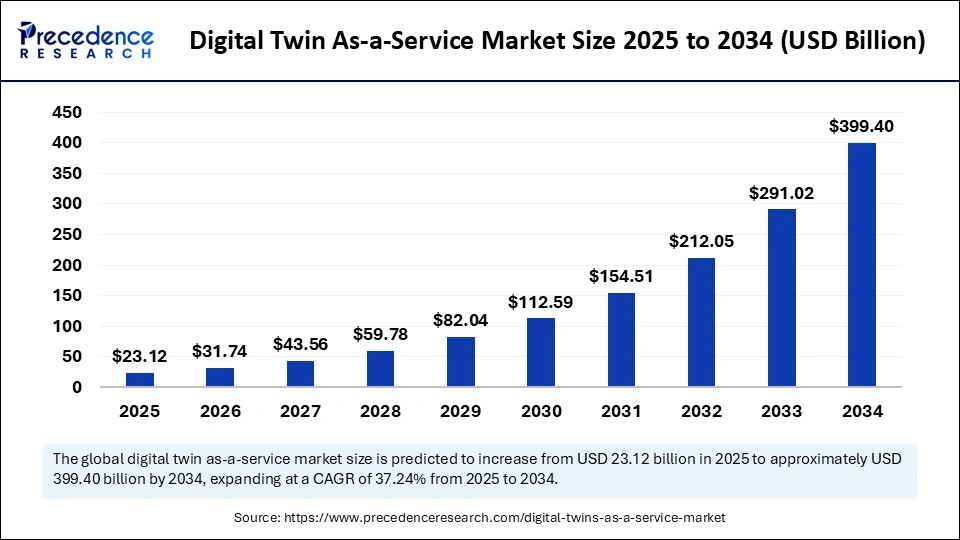

The global digital twin-as-a-service market size accounted for USD 16.85 billion in 2024 and is predicted to increase from USD 23.12 billion in 2025 to approximately USD 399.40 billion by 2034, expanding at a CAGR of 37.24% from 2025 to 2034. The advent of digital twin as-a-service (DTaaS) is redefining how enterprises design, monitor, and optimize assets by combining real-world data with virtual simulations. It provides organizations with a scalable, cloud-based approach to harnessing digital twin technology without heavy upfront investment. From manufacturing and energy to healthcare and smart cities, it is enabling businesses to drive efficiency, predictive maintenance, and innovation. This model reduces barriers to entry by offering subscription-based access to advanced simulation and analytics. As industries become increasingly data-driven, the ecosystem is expanding rapidly. The market is on a trajectory where flexibility, interoperability, and performance monitoring converge to create significant value.

Digital Twin As-a-Service Market Key Takeaways

- In terms of revenue, the global digital twin-as-a-service market was valued at USD 16.85 billion in 2024.

- It is projected to reach USD 399.40 billion by 2034.

- The market is expected to grow at a CAGR of 37.24% from 2025 to 2034.

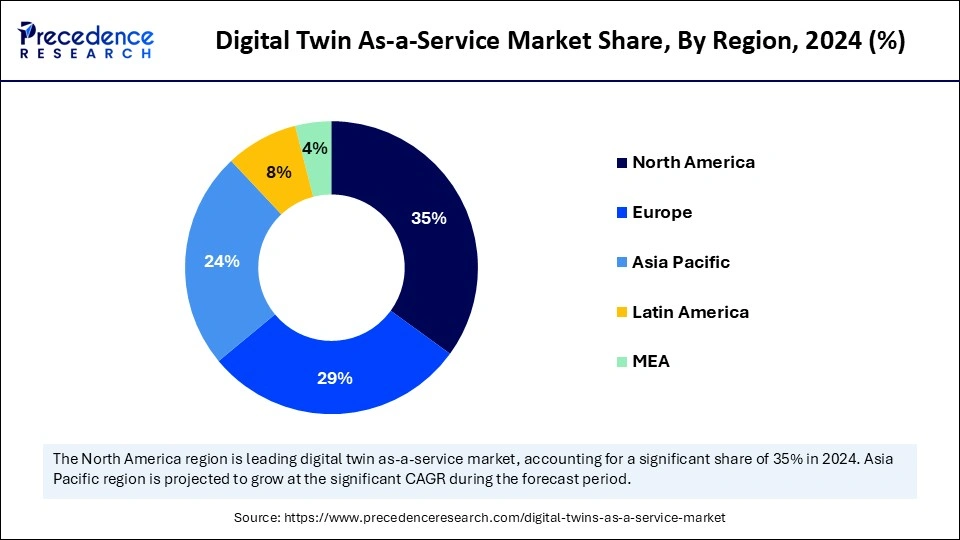

- North America dominated the digital twin-as-a-service market with the largest market share of 35% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By component, the platform segment led the market in 2024.

- By component, the data & analytics layer segment is expected to grow at the fastest rate in the market during the forecast period.

- By technology type, the IoT & sensors segment held the biggest market share in 2024.

- By technology type, the AI/ML & predictive analytics segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By deployment model type, the public cloud segment captured the highest market share in 2024.

- By deployment model type, the hybrid cloud segment is set to experience the fastest CAGR from 2025 to 2034.

- By application type, the predictive maintenance segment contributed the maximum market share in 2024.

- By application type, the supply chain & logistics management is the fastest growing from 2025 to 2034.

- By industry vertical type, the manufacturing segment accounted for the significant market share in 2024.

- By industry vertical type, the healthcare & life sciences segment is the fastest growing from 2025 to 2034.

- By end-user type, the large enterprises segment held the largest market share in 2024.

- By end-user type, SMEs segment is the fastest growing during the forecast period.

- By service model type, the subscription-based segment generated the major market share in 2024.

- By service model type, pay-per-use is the fastest-growing segment during the forecast period.

Market Overview

Digital Twin as-a-Service (DTaaS) refers to cloud-based platforms and services that enable organizations to create, deploy, and manage digital replicas of physical assets, processes, or systems on a subscription or pay-per-use basis. Unlike on-premises digital twin solutions, DTaaS leverages cloud computing, IoT connectivity, AI/ML, and advanced analytics to provide scalable, real-time monitoring, simulation, predictive maintenance, and optimization without heavy upfront infrastructure investments.

The global DTaaS market is witnessing strong adoption across diverse verticals. Industries are leveraging it to create virtual replicas of equipment, supply chains, and even human health systems. Demand is rising as companies seek to minimize downtime, optimize energy use, and accelerate product development cycles. This growing reliance on digital infrastructure underscores the strategic importance of DTaaS in the era of Industry 4.0. Cloud scalability and integration with IoT platforms are strengthening its penetration in both mature and emerging economies. Overall, the market is evolving from pilot projects into enterprise-wide deployments.

How AI Impacted the Digital Twin As-a-Service Market?

Artificial Intelligence (AI) has significantly accelerated the growth of the digital twin as-a-service market by enhancing predictive accuracy and decision-making capabilities. AI-driven models enable digital twins to analyze vast datasets in real time, identifying inefficiencies or potential failures before they occur. Through machine learning, these digital twin systems continuously adapt and improve, making digital twins smarter and more reliable over time. Natural language processing and computer vision further expand the use cases of DTaaS, such as in the healthcare and automotive sectors. The integration of artificial intelligence and machine learning also makes simulations more realistic, supporting complex scenarios and autonomous operations. Together, AI and DTaaS have the potential to create a real-time synergistic ecosystem where virtual models become intelligent advisors for businesses.

Market Key Trends

- A major trend is the shift toward cloud-native platforms that democratize access to digital twin technology. Subscription-based DTaaS models are replacing capital-intensive infrastructure setups. Integration with edge computing is another rising trend, enabling real-time insights closer to the source of data.

- Cross-industry applications from renewable energy optimization to smart building management are expanding the market's scope. Cybersecurity and interoperability are emerging as top priorities as enterprises rely more on digital replicas of critical systems.

- Sustainability goals are driving companies to use DTaaS for carbon footprint tracking and green innovation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 399.40 Billion |

| Market Size in 2025 | USD 23.12 Billion |

| Market Size in 2024 | USD 16.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 37.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Deployment Model, Application, Industry Vertical, End-User Size, Service Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Reduced Expenditure in R&D Is a Major Driver of the Digital Twin As-a-Service Market

The primary driver for the digital twin as-a-service market is the need for predictive maintenance to reduce costly equipment downtime. Companies are also motivated by the ability of DTaaS to accelerate R&D cycles and shorten time-to-market for new products. The rise of IoT devices and connected infrastructure generates massive data streams, which digital twins transform into actionable insights. Regulatory pressures in industries like healthcare and energy are pushing firms to adopt advanced monitoring solutions. Global competitiveness is driving organizations to adopt more informed, data-driven decision-making frameworks. Lastly, the increasing adoption of cloud technology is making DTaaS more affordable and accessible for businesses of all sizes.

Restraints

Complexity of Implementation and Lack of Trained Professionals Impede the Market for Digital Twins As-a-Service

Despite rapid growth, high implementation complexity remains a restraint in the digital twin as-a-service market. Many industries face challenges with integrating legacy systems into DTaaS platforms. Concerns over data security and privacy also limit adoption in sensitive sectors such as defense and healthcare. The requirement for high-quality, real-time data streams can be difficult to achieve in fragmented digital ecosystems. Additionally, the lack of standardized frameworks for digital twins slows interoperability between vendors. Cost concerns persist for smaller firms, despite the subscription model's affordability.

Opportunities

Growing Need for Cost-Cutting and Timeline Management for Pharmaceuticals and Manufacturing Industries

There is a vast opportunity for DTaaS in emerging industries such as precision medicine, smart agriculture, and renewable energy. Expansion into mid-sized enterprises, previously excluded due to high costs, presents a strong growth frontier. Integration with blockchain can open opportunities for secure data exchange and trusted simulations. Governments investing in smart city infrastructure create significant potential for digital twin deployments. Cross-industry collaborations are expected to generate innovative use cases, from logistics optimization to climate modeling. As industries embrace sustainability, DTaaS stands poised to be a catalyst for energy-efficient operations.

Component Insights

Why Does the Platform Segment Dominate the Market?

The platform segment dominates the digital twin as-a-service market as it forms the foundation layer, enabling integration, visualization, and orchestration of virtual models. These platforms allow enterprises to build scalable and interoperable twins across assets, processes, and systems. Their dominance stems from the need for unified control systems that consolidate real-world data into a seamless digital environment. With vendors offering flexible APIs and compatibility with existing infrastructure, platforms continue to be the go-to starting point for organizations. Large enterprises prioritize platforms to achieve consistency across global operations. As digital twins evolve, platforms continue to serve as the backbone of enterprise-wide adoption.

The data analytics layer is emerging as the fastest-growing component due to its role in transforming raw data into actionable insights. This layer integrates advanced visualization. The data analytics layer is emerging as the fastest-growing component due to its role in transforming raw data into actionable insights. This layer integrates advanced visualization, anomaly detection, and prescriptive modeling capabilities. Enterprises value the analytics-driven digital twin-as-a-service market for its ability to predict failures, optimize resources, and support decision-making. With AI and ML embedded in analytics tools, the layer adds intelligence beyond traditional monitoring. Its rapid growth reflects the market's pivot from just replication to predictive and prescriptive simulation. As industries demand deeper insights, the analytics layer is becoming the critical differentiator.

Technology Insights

Why Are IoT & Sensors Dominating the Market for Digital Twin As-a-Service Market?

IoT sensors dominate as the backbone technology powering the digital twin-as-a-service market, providing real-time streams of physical-world data. They enable digital replicas to remain synchronized with their physical counterparts across industries such as manufacturing, utilities, and automotive. Sensor proliferation and cost reductions are accelerating adoption at scale. The richness of IoT data allows enterprises to monitor performance, detect anomalies, and enhance operational safety. With billions of connected devices worldwi de, IoT sensors remain indispensable for building robust digital twins. This entrenched role secures their continued dominance in the market.

Artificial Intelligence/machine learning and predictive analytics represent the fastest-growing technology segment in digital twin-as-a-service. These technologies empower digital twins to evolve from static models into adaptive, self-learning systems. Machine learning enhances predictive maintenance by identifying subtle patterns invisible to traditional analysis. Predictive analytics also supports scenario testing, enabling businesses to forecast outcomes and mitigate risks. As industries move toward autonomous operations, the artificial intelligence/machine learning-driven digital twin-as-a-service market is accelerating rapidly. This growth trajectory ensures AI will play a central role in shaping the market's next phase.

Deployment Model Insights

How Did the Public Cloud Segment End Up Leading the Digital Twin As-a-Service Market?

The public cloud remains the dominant deployment segment in the market for the digital twin as-a-service sector, due to its scalability, accessibility, and cost efficiency. Enterprises rely on public cloud platforms for seamless integration with existing digital infrastructure. The model reduces upfront capital expenses while providing virtually limitless computing resources. Leading cloud providers are embedding modules directly into their offerings, fueling adoption. Its flexibility makes public cloud particularly attractive to large enterprises and small and medium-sized enterprises alike. This entrenched dominance is unlikely to diminish as digital ecosystems continue to scale globally.

Hybrid cloud is the fastest-growing deployment mode, bridging the gap between public scalability and private security. Enterprises increasingly prefer hybrid models to balance sensitive on-premises data with the elasticity of public resources. This setup is particularly appealing for industries such as healthcare, finance, and defense, where compliance is a top priority. Hybrid cloud enables organizations to localize critical workloads while still benefiting from global connectivity. Flexibility, data sovereignty concerns, and the rise of multi-cloud strategies drive its rapid adoption. As enterprise IT becomes increasingly complex, hybrid deployments are expected to surge.

Application Insights

How Did the Predictive Maintenance Segment End Up Capturing Such a Significant Share of the Digital Twin as-a-Service Market?

The predictive maintenance segment captured the largest share of the digital twin as-a-service market due to varied applications, because of its immediate impact on reducing downtime and operational costs. By leveraging real-time data and simulations, organizations can anticipate equipment failures before they occur. Industries such as manufacturing, aviation, and energy prioritize predictive maintenance for its cost-saving benefits. It directly enhances asset lifespan, productivity, and safety. With its clear return on investment, predictive maintenance remains the most widely adopted use case of DTaaS. This application forms the bedrock of adoption strategies across sectors.

Meanwhile, the supply chain and logistics management segment is the fastest-growing application area as global disruptions highlight the need for resilience. The digital twin-as-a-service market enables enterprises to simulate and optimize supply chain networks under varying conditions. Real-time tracking of shipments and inventory creates agility and reduces bottlenecks. The use of twins for warehouse automation and last-mile delivery optimization is gaining traction. As e-commerce and global trade expand, logistics-focused digital twins will scale rapidly. This segment's growth is propelled by its ability to drive efficiency in a volatile environment.

Industry Vertical Insights

How Did Manufacturing Fare in the Market for Digital Twin As-a-Service in 2024?

Manufacturing dominated DTaaS adoption in 2024, as organizations leveraged digital twins to simulate assembly lines, equipment, and product lifecycles. The sector benefits from cost reduction, defect minimization, and faster time-to-market. Manufacturers utilize virtual prototyping to optimize their design processes, enabling them to create prototypes before production. It also enhances worker safety by modeling hazardous conditions in a controlled environment. With Industry 4.0 initiatives accelerating, manufacturing remains the largest user base for digital twins. This dominance reflects its maturity in integrating digital technologies into core processes.

The healthcare and life sciences sectors are the fastest-growing verticals for the digital twin as-a-service market, driven by personalized medicine and precision diagnostics. Digital twins are being used to simulate human organs, treatment responses, and patient-specific therapies. Hospitals adopt operational efficiency measures, such as optimizing patient flow and equipment usage. Pharmaceutical companies employ twins for drug discovery and clinical trials. The push toward digital health ecosystems is accelerating adoption in this sector. Its potential to transform patient outcomes makes healthcare the most dynamic growth frontier.

End-User Size Insights

How Did Large Enterprises Lead the Digital Twin As-a-Service Market in 2024?

Large enterprises led the digital twin-as-a-service market in 2024 due to their greater resources and complex operational needs. They deploy digital twins at scale across plants, offices, and supply chains. These organizations seek enterprise-wide standardization and predictive insights to maintain competitiveness. Large firms also benefit from partnerships with cloud providers and solution vendors. Their budgets allow for continuous innovation, reinforcing their dominance. As global corporations pursue digital transformation, the digital twin-as-a-service market is becoming central to their strategies.

Small & medium enterprises represent the fastest-growing end-user segment as the digital twin as-a-service market lowers barriers to advanced digital solutions. The subscription-based model makes digital twins financially viable for smaller firms. SMEs adopt to enhance efficiency, cut costs, and gain insights previously reserved for large players. The agility of SMEs allows faster experimentation with new tools. Many startups are leveraging niche applications, fueling rapid adoption. As awareness spreads, SMEs will account for a growing share of the market.

Service Model Insights

What Is Driving the Dominance of Subscription-Based Services in the Digital Twin As-a-Service Market?

Subscription-based models dominate the digital twin as-a-service market due to predictable costs and scalability in 2024. Enterprises prefer monthly or annual plans that align with budget cycles. This model allows flexibility to expand usage as organizational needs grow. Vendors also benefit from recurring revenue streams, strengthening the ecosystem. The subscription format reduces entry barriers for both large and small organizations. Its widespread acceptance cements its place as the leading service model.

Pay-per-use is the fastest-growing service model, appealing to firms seeking granular control over costs. It provides flexibility by charging only for actual usage, making it ideal for seasonal or project-based demands. Startups and SMEs, in particular, benefit from this consumption-based model. The approach encourages experimentation with digital twins without long-term commitments. As enterprises prioritize cost optimization, the adoption of pay-per-use models is surging. Its rise signals a shift toward more democratized access to digital twin-as-a-service.

U.S. Digital Twin As-a-Service Market Size and Growth 2025 to 2034

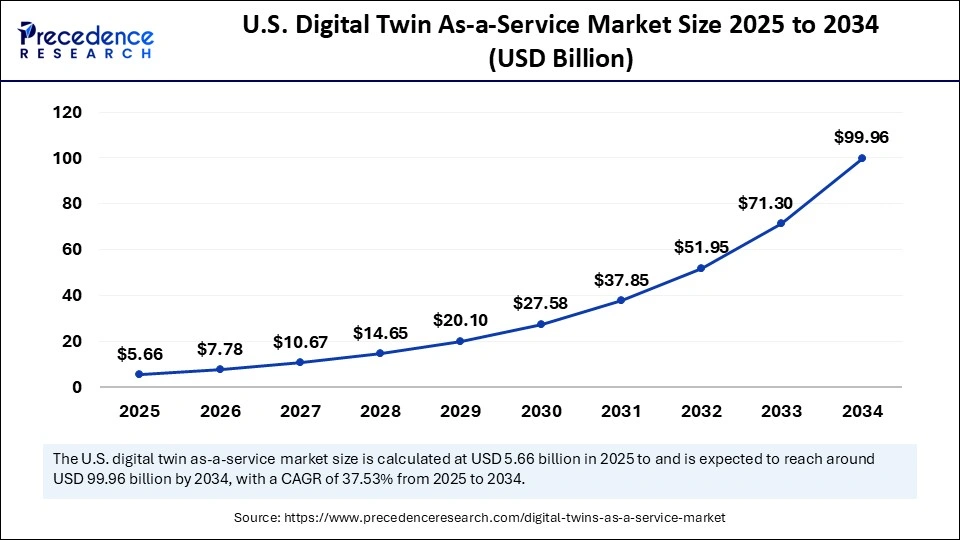

The U.S. digital twin-as-a-service market size was exhibited at USD 4.13 billion in 2024 and is projected to be worth around USD 99.96 billion by 2034, growing at a CAGR of 37.53% from 2025 to 2034.

Why Is North America Dominating the Digital Twin As-a-Service Market?

North America dominates the DTaaS market due to its robust digital infrastructure and early adoption of Industry 4.0 technologies. The presence of leading cloud providers and tech innovators strengthens the region's ecosystem. Strong investment in healthcare, aerospace, and automotive sectors accelerates market penetration. Regulatory frameworks that emphasize efficiency and sustainability further fuel adoption. U.S.-based enterprises are also pioneering in AI integration with DTaaS, giving them a global competitive edge. Canada's growing smart city initiatives add to regional leadership.

North America's leadership is reinforced by heavy investment in R&D and collaborations between technology firms and academia. Cloud adoption rates are among the highest globally, facilitating seamless deployments of DTaaS. The region's enterprises are also prioritizing predictive analytics and modernizing their digital infrastructure. With robust cybersecurity measures, North America is addressing a key concern that restrains other markets. Venture capital funding for DTaaS startups is thriving, accelerating innovation. Overall, the region is expected to maintain its dominant position over the next decade.

Why is Asia Pacific the Fastest-Growing Region in the Digital Twin As-a-Service Market?

Asia Pacific and Europe are emerging as the fastest-growing DTaaS markets, fueled by industrial modernization and sustainability agendas. In the Asia Pacific, rapid digital transformation across China, India, and Southeast Asia is driving adoption. Governments in the region are heavily investing in smart manufacturing and smart cities. Europe, on the other hand, leads in sustainability-driven applications, such as energy optimization and climate-neutral infrastructure. Both regions benefit from strong 5G rollouts that enable real-time data integration. Together, they represent the next frontier for large-scale DTaaS deployment.

Asia Pacific's growth is further accelerated by booming e-commerce logistics and healthcare innovation. Europe's stringent regulations around environmental impact are pushing industries toward digital optimization. Collaborations between tech vendors and local enterprises are creating new opportunities for scaling DTaaS. Rapid urbanization in Asia drives demand for infrastructure management solutions powered by digital twins. The European Union's digital sovereignty push is encouraging adoption of secure, localized DTaaS platforms. Overall, both regions are poised to outpace North America in growth momentum, even as the U.S. maintains its dominance in market share.

Digital Twin As-a-Service Market Companies

- Altair Engineering

- Ansys

- AWS (Amazon Web Services)

- Bentley Systems

- Bosch.IO

- Dassault Systèmes

- General Electric (Predix)

- IBM

- Microsoft Azure Digital Twins

- Oracle

- PTC (ThingWorx)

- SAP

- Siemens Digital Industries Software

- Software AG

- Uptake Technologies

Recent developments

- In September 2025, the global AI landscape will have made a significant breakthrough, and India is poised to reap major benefits. TwinMind, a tech innovator founded by three former Google X AI scientists, has introduced its new Ear–3 speech-recognition model, breaking records for speech-to-text accuracy, local-language support, and affordability. (Source: https://www.hindustantimes.com)

- In September 2025, the Indian government took major steps to become a fully developed economy by 2047, its 100th year of independence. This ambitious journey towards 'Viksit Bharat' demands unparalleled levels of planning, execution, and governance. Central to this transformation is the power of geospatial intelligence, the ability to understand the “where” behind assets, people, risks, and opportunities. From building integrated infrastructure to enhancing climate resilience, geospatial data is emerging as the foundational technology driving India's remarkable growth story.(Source: https://www.businessworld.in)

Segments Covered in This Report

By Component

- Platform (cloud-native DT platforms, integration frameworks)

- Services

- Implementation & Integration

- Consulting & Advisory

- Support & Managed Services

- Data & Analytics Layer (AI/ML models, simulation engines, visualization)

By Technology

- IoT & Sensors

- AI/ML & Predictive Analytics

- Cloud Computing & Edge Computing

- AR/VR for Visualization

- Blockchain (security & trust for DTaaS ecosystems)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Asset Monitoring & Management

- Predictive Maintenance

- Process & Operations Optimization

- Supply Chain & Logistics Management

- Product Design & Prototyping

- Energy & Resource Optimization

By Industry Vertical

- Manufacturing

- Energy & Utilities

- Healthcare & Life Sciences

- Automotive & Transportation

- Aerospace & Defense

- Smart Cities & Infrastructure

- Retail & Consumer Goods

- IT & Telecom

By End-User Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Service Model

- Subscription-based (SaaS model)

- Pay-per-use / On-demand

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting