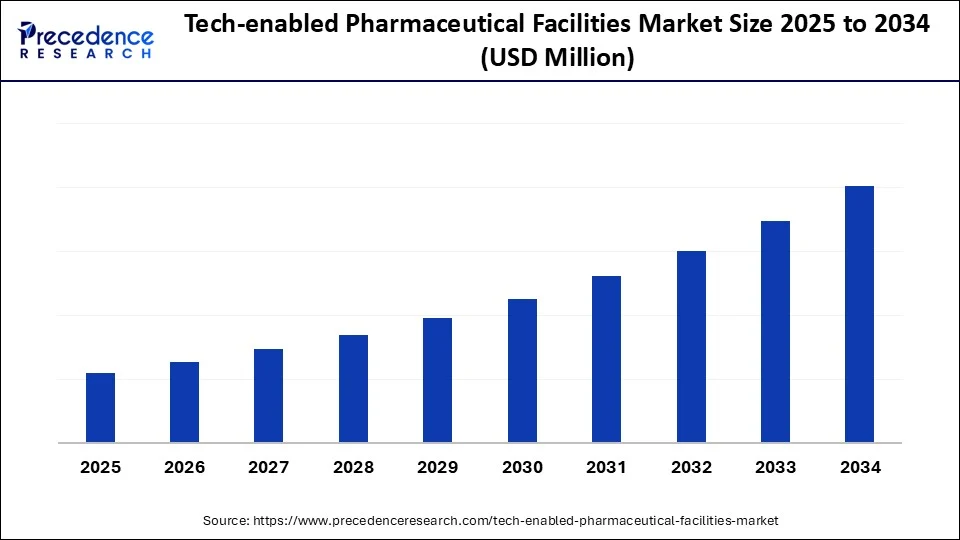

Tech-enabled Pharmaceutical Facilities Market Size and Forecast 2025 to 2034

The tech-enabled pharmaceutical facilities market leverages digital technologies such as AI, robotics, and advanced analytics to optimize drug manufacturing processes. This market is growing rapidly as pharma companies aim for greater efficiency, precision, and real-time monitoring in production environments. The tech-enabled pharmaceutical facilities market is developing fast due to demands for growing automation, AI-based manufacturing integration, and increasing quality drug production. This development is fueled by digital transformation, compliance with regulations, and an increased global need for today's healthcare.

Tech-enabled Pharmaceutical Facilities Market Key Takeaways

- North America dominated the tech-enabled pharmaceutical facilities market in 2024.

- Asia Pacific is estimated to expand the fastest CAGR in the market between 2025 and 2034.

- By facility type, the manufacturing facilities segment held the biggest market share in 2024.

- By facility type, the modular and mobile pharma facilities segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By technology, the IoT and smart sensors segment led the market share in 2024.

- By technology, the AI & machine learning segment is expected to expand at a notable CAGR over `the projected period.

- By application, the drug manufacturing (API & formulations) segment captured highest market share in 2024.

- By application, the personalized/precision medicine manufacturing segment is expected to expand at a notable CAGR over `the projected period.

- By end user, the pharmaceutical manufacturers segment contributed the largest market share in 2024.

- By end user, the contract development & manufacturing organization (CDMOs)segment is expected to expand at a notable CAGR over the projected period.

- By deployment type, the retrofit/upgrade of existing facilities segment generated the major revenue share in 2024.

- By deployment type, the modular/plug-and-play smart units segment is expected to expand at a notable CAGR over the projected period.

How Is AI Transforming Tech-Enabled Pharmaceutical Facilities?

Artificial Intelligence is moving from being a supporting tool to become the principal enabler in technology-enabled pharmaceutical facilities. It is delivering efficiencies in R&D, manufacturing, and patient engagement. In February 2025, the substantiated claim from the EY-Parthenon and Microsoft report noted that 75% leaders of pharma in India, have experienced tangible benefits including lower operational expenses, faster clinical trials and improved patient accessibility by arbitraging AI at scale. (Source:https://www.ey.com)

For example, Eli Lilly demonstrates enterprise-level adoption of AI through its partnership with Creyon Bio, its leveraging generative AI and quantum computing to accelerate RNA drug design. Pfizer is utilizing generative AI to support both its internal operations and its patient-facing services. Pfizer's "Health Answers" platform and "Charlie," an AI assistant for its commercial groups, demonstrate how pharma companies are progressing through intelligent automation and faster decisions to enhance personalized experience or offerings.These initiatives signal that AI isn't simply supporting pharma infrastructure it is altering or overturning it from the ground up.(Source: https://www.cio.inc)

Market Overview

The Tech-enabled Pharmaceutical Facilities Market refers to the global landscape of pharmaceutical manufacturing, R&D, and distribution infrastructure that integrates advanced digital technologies and automation to optimize operations, improve drug quality and safety, accelerate time-to-market, and ensure regulatory compliance. These facilities leverage technologies such as Industrial internet of things (IIoT), Artificial Intelligence (AI), Machine Learning (ML), Robotics, Digital Twins, Cloud Computing, Advanced Data Analytics, Cyber security, and Blockchain to drive smart pharma manufacturing, intelligent facility management, and real-time compliance monitoring.

Tech-enabled Pharmaceutical Facilities Market Growth Factors

- Increased adoption of pharma 4.0 standards: Pharma companies are investing in Industry 4.0 tools to modernize their operations. Leveraging AI, robotics and IoT provides a higher level of traceability, quality assurance and efficiency and addresses the global regulatory expectations.

- Accelerated demand for flexible drug manufacturing: The need for flexibility to meet pandemics, personalized medicine, and therapies for rare diseases is forcing companies to invest in modular and technology-driven facilities for future purposes.

- Regulatory encouraging data integrity and compliance: Regulatory agencies (FDA, EMA) are calling for more data transparency and real-time monitoring which supports and encourages companies to implement a digital system and automation.

- Expansion of biopharma and cell: These very complex therapies demand facilities with tight control and highly regulated environments and these are dependent on digitally mature infrastructure to utilize smart manufacturing solutions.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Facility Type, Technology, Application, End User, Deployment Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the Upward Trend of Personalized Medicine Accelerating the Technological Integration of Pharmaceutical Facilities?

The shifting trend of personalized and precision medicine provides a considerable force to take pharmaceutical companies to a tech-enabled facility. As therapies are becoming more related to the genetic backgrounds of patients, traditional manufacturing paradigms are beginning to lack relevance. New paradigms require flexible, data-driven manufacture areas including automation, real-time analytics, and digital batch records for operating in this area. The U.S. FDA continues to push for pharma companies to adopt manufacturing technologies for the manufacture of personalized therapies in this area, particularly oncology and rare disease.

The pharma industry has reacted to this version of personalization with investments by company names like Novartis and Roche in modular and smart manufacturing platforms and the ability to manufacture smaller batches of many different drugs. These facilities incorporate single-use systems, robotics, and digital twins to adapt more readily to changing clinical needs. This method of personalization has to be agile and nothing less than smart and tech-integrated facilities can provide largescale agility.

What is Driving the Recent Boom in Tech‑Enabled Pharma Facilities?

An important contributor to the growth of tech-enabled pharmaceutical facilities is government led regulatory and incentive programmes focusing on upgrading pharmaceutical manufacturing to global standards. For instance, the new and improved Pharmaceuticals Technology Upgradation Assistance Scheme (RPTUAS) rolled out in India for 2023–24 will offer subsidies and interest assistance to pharmaceutical units, and in particular MSMEs, to upgrade their manufacturing infrastructure to comply with the new Schedule M and WHO-GMP requirements . Under the RPTUAS, eligible units will get up to 20% reimbursement of investments or an interest subvention, which will support acquiring clean rooms, testing labs, HVAC systems and QA systems.

At the same time, the virtually new Schedule M, which comes into effect on June 29, 2024, imposes new digital traceability requirements (QR/barcodes), an upgraded Facility standard (for only manufacturers with a turnover of more than ₹250 crore), which equally drives labour savings through automation and Digital tech and tech-integrated processes. These will provide increased assurance to pharma manufacturers to invest in all things automation, digital platforms and smart factory infrastructure thereby accelerating the growth of tech enabled pharmaceutical facilities.

Restraint

Is Regulatory Uncertainty the Greatest Impediment for Tech-Enabled Pharmaceutical Facilities?

One significant limiting factor is regulatory uncertainty with respect to advanced manufacturing technologies. The U.S. Government Accountability Office (GAO) stated in a 2023 report that, the FDA supported advanced manufacturing to enhance supply‑chain resilience, but there were only a few drugs manufactured utilizing advanced manufacturing technologies, as the FDA did not establish requirements, targets, or metrics to evaluate its initiatives. GAO interviews with 15 industry stakeholders indicated that uncertainty regarding the FDA review length and the reviewer's knowledge of the technology weakens the business case and slows adoption.

Similarly, a peer‑reviewed study stated that perceived and measured regulatory risk was one of the key barriers, and global harmonization differences complicate post‑approval changes making it less likely that particular technology will be adopted.

Opportunity

What's the Greatest Opportunity in Tech‑Enabled Pharmaceutical Facilities Market?

A major opportunity exists to combine AI‑driven automation with Pharma 4.0 digital platforms to create ultra‑efficient manufacturing workflows. Just in recent months, industry leaders have pointed out how AI combined with RPA and digital twins, driven by AI, are substantially improving quality, speed, and resilience in pharma facilities.

For instance, in July 2025, the Indian firm Eisai Pharma, is about to launch a global capability centre that focuses on digital innovation, signalling a growing demand for in‑country technical infrastructure and joint ventures with academia. These trends unequivocally signal an opportunity for facilities that leverage AI, IoT, digital twins, and RPA, producing productivity gains, regulatory compliance, and faster throughput without relying on conventional measures like market size or CAGR.

(Source: https://timesofindia.indiatimes.com)

Facility Type Insights

Why Manufacturing Facilities Have the Largest Share of Facility Type?

The manufacturing facilities dominates the facility type segment of the tech-enabled pharmaceutical facilities market in 2024, as these facilities primarily manufacture active pharmaceutical ingredients (APIs), formulations, and finished drug products. The use of smart technologies like IoT, robotics, and automated control helped improve the operational efficiencies, minimize human error, and assure compliance with the strict "quality by design" expectations outlined in regulations.

For the future, modular and mobile pharmaceutical facilities segment is expected to be the fastest-growing markets. Their sales will be based on their scalability, ease of implementation, and location flexibility. This flexibility allows maximum adaptability in the context of changing production needs and, in the case of emergencies like a pandemic, allows manufacturing capacity to be rapidly implemented in a variety of locations. The inherent compact, pre-fab design of modular and mobile facilities allows for quick installation with lower infrastructure development costs. Modular also brings additional advantages with ease of standardization and maintenance and meets new trends in decentralized manufacturing and personalized medicine.

Technology Insights

How did IoT and Smart Sensors Segment Lead the Tech-enabled Pharmaceutical Facilities Market?

The IoT and smart sensors segment was the leading technology in tech-enabled pharmaceutical facilities market in 2024 owing to the capability of these technologies that is crucial in improving process visibility, equipment performance, and environmental monitoring. IoT devices can collect real-time data and monitor remote equipment, allowing users to perform predictive maintenance and reduce operational downtime, in addition to ensuring product consistency. Smart sensors are especially common for tracking temperature, humidity, pressure, and contamination, all of which are important in regulated pharma environments.

AI and machine learning are likely to have the highest growth rate in this segment during the forecast period. These technologies are fundamentally changing the production of pharmaceuticals in that they enable advanced analytics, predictive modeling, and automated decision-making. AI-enabled systems can optimize production planning and scheduling, quickly identify deviations in processes, and strengthen quality assurance via pattern recognition. As the demand for more intelligent and responsive systems continues to grow, AI and ML are being adopted at an increasing rate in next generation pharmaceutical facilities for the purpose, among others, of expediting measures of precision, efficiency, and scalability.

Application Insights

How Did Drug Manufacturing Dominate the Market in 2024?

The drug manufacturing (API & formulations) became the dominant application segment of tech-enabled pharmaceutical facilities market owing to the development of drug manufacturing that adds up active pharmaceutical ingredients and formulates them into drug products. The application of smart technologies in drug manufacturing enables precision, consistency, and compliance with regulatory requirements. Probably the most impactful show of smart technology in this application area is the worldwide adoption of automation, IoT-enabled equipment, real-time monitoring, and many other systems that focus on batch production to reduce waste and improve quality control.

The personalized or precision medicine manufacturing is expected to grow at the fastest rate. This segment focuses on producing therapies developed for individual patient profiles such as the patient's genetic makeup, or specific disease conditions. Tech-enabled facilities employ technology (AI, robotics, and digital twins) to support small-batch, high-complexity manufacturing of personalized treatments. The use of modular systems and flexible manufacturing lines is critical to develop personalized treatments because this provides agile production capabilities for fast movement between different therapies or production processes.

End User Insights

How did Pharmaceutical Manufacturers Become Most Dominant Distribution Channel?

The pharmaceutical manufacturers continued to be the dominant end user segment in-tech enabled pharmaceutical facilities market in 2024 as these companies are making large investments in smart technologies for increased production efficiency, regulatory compliance, or product consistency. Existing plants are upgrading with IoT, automation, and digital monitoring systems to enhance operations, limit human errors, and allow for continuous production. Large-scale manufacturers are heavily driving the industry-level push toward digital transformation to future proof their investments against increasingly complex regulations and evolving technologies.

The contract development and manufacturing organizations (CMDOs) is projected to be the fastest growing end user segment. CMDOs are increasingly using technologies to operate production services to pharmaceutical clients. The technologies high demand and complex services drive notation availability now-more than ever, providing pharmaceutical clients with agile and scalable production support. CMDOs use smart units, AI, and flexible facility designs to produce a range of drug types fast, including biologics or personalized medicines.

Deployment Type Insights

How did Retrofit/Upgrade Segment Lead the Tech-enabled Pharmaceutical Facilities Marker in 2024?

The retrofit/upgrade of existing facilities segment took the lead in deployment types in 2024 because multiple pharmaceutical companies are updating their existing facilities with new smart technologies, such as IoT sensors, automated systems, and digital control platforms. This retrofitting allows them to improve efficiencies, continue compliance with changing regulations, and to extend the lifecycle of operating plants without total rebuild. This is particularly supported by larger manufacturers adopting digital tools with less disruption and capital outlay.

The modular/plug-and-play smart units segment is expected to experience the highest growth rate. Plug-and-play systems allow for flexibility, scale, and decreased time to deploy pre-engineered, ready-to-deploy systems. This also helps to address rapidly changing needs in traditional pharmaceutical organizations. Such systems may apply to companies producing small batch or specialized drugs, and those operating within remote or temporary locations. Because remote monitoring and AI-driven automations is compatible with these units, they support efficient modern and tech-forward production.

Regional Insights

How is North America Taking the Lead in the Tech-Enabled Pharmaceutical Facilities Market?

North America is leading the tech-enabled pharmaceutical facilities market in 2024. Reasons include rapid modernization of the pharmaceutical industry, a foundation of infrastructure in the space, and increased adoption of digital identity manufacturing technologies. In both the public and private sector, there are upgrading legacy systems to smart automation, modular cleanrooms, and AI-based quality monitoring.

Continuous manufacturing and digitization being encouraged by the U.S. FDA has created over 1,200 facilities that are being taken to a more technology-enhanced level and capability since early 2023. Meanwhile growth capital is made available for multinational drug makers as Johnson& Johnson, and GlaxoSmithKline, announced major expansions of production facilities with investments aimed at improving precision, speed, and reliability of pharma products.

The U.S. is leading the market in North America region. In 2024, Eli Lilly doubled the investment for a new API facility in Indiana, bringing the total to US$9 billion to enhance the capacity for domestic production, rather than depending on foreign markets. Thermo Fisher Scientific also expanded sterile injectable capacity, while Amgen and Pfizer announced digitalized pilot plants for biotech production, i.e in advance of moving products to commercial production. U.S. policy initiatives designed to increase reshoring and supply chain security have accelerated the adoption of smart technologies and positioned the U.S. as a first mover in next-generation pharmaceutical facility development.

What Makes Asia Pacific the Fastest Growing Region in Tech-Enabled Pharmaceutical Facilities Market?

Asia Pacific region shows the fastest growth in the tech-enabled pharmaceutical facilities market in forecasted period, supported by government strategies geared towards advancing healthcare investments, growing adoption of smart technologies, and substantial growth in pharmaceutical manufacturing capacity. Concurrently, South Korean government is investing $585 million in domestic AI research and development in 2024. Consolidated firms like AstraZeneca, expanded into Asia with high-technology production and research investments, demonstrating the increasing belief in Asia as an esoteric pharmaceutical ecosystem.

China is importantly positioned with a unique mix of robust government support and international collaboration for Asia Pacific's development. In March 2025, AstraZeneca committed to extending its smart pharmaceutical campus located in Beijing with a $2.5 billion investment, specifically focusing on AI-enabled drug discovery and digitized manufacturing.

At the same time, WuXi Biologics, continue to develop throughout Wuxi, Shanghai, Hangzhou, and Chi Chang, expanding several advanced features relevant to biomanufacturing as manufacturing of biopharma drugs are projected to exceed temporary biomanufacturing lines utilizing single-use bioreactors and data-supported quality controls.

Tech-enabled Pharmaceutical Facilities Market Companies

- Siemens Healthineers

- GE HealthCare

- Schneider Electric

- Honeywell International Inc.

- Bosch Rexroth

- IBM Watson Health

- Rockwell Automation

- ABB Group

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Thermo Fisher Scientific

- Sartorius AG

- Cytiva (Danaher)

- Lonza Group

- WuXi AppTec

- Pfizer Global Supply

- GEA Group

- Tetra Pak Pharma

- Merck KGaA (MilliporeSigma)

- Optel Group

Latest Statements and Investments by Major Players

- In July 2025, JCR Pharmaceuticals and Acumen Pharmaceuticals announced a collaboration to develop Alzheimer's treatments using JCR's J-Brain Cargo technology, aiming to improve drug delivery across the blood-brain barrier for neurological therapies.(Source:https://www.businesswire.com)

- In February 2025, Fengate and eMAX Health formed a strategic partnership to accelerate innovation in healthcare technology, focusing on modernizing care delivery and supporting the development of data-driven, tech-enabled medical infrastructure.

Recent Developments in Tech-enabled Pharmaceutical Facilities Market

- In April 2025, Novartis announced a $2.3 billion investment to expand its U.S.-based manufacturing and R&D facilities, reinforcing its commitment to advanced production capabilities and innovative pharmaceutical development in North America.(Source:https://www.indianpharmapost.com)

- In October 2024, Zephyr, a tech-enabled home services platform, launched with nearly $100 million in capital. The platform plans to expand its digital infrastructure and integrate advanced technology for service optimization and user experience.(Source:https://www.prnewswire.com)

Segments Covered in the Report

By Facility Type

- Manufacturing Facilities

- Research & Development (R&D) Facilities

- Packaging & Labeling Units

- Distribution Centers

- Quality Control & Assurance Labs

- Modular & Mobile Pharma Facilities

- Contract Manufacturing/Outsourced Facilities

By Technology

- Internet of Things (IoT) and Smart Sensors

- Artificial Intelligence & Machine Learning

- Robotics & Process Automation

- Digital Twin Technology

- Advanced Process Control (APC)

- Cloud-Based Manufacturing Execution Systems (MES)

- Blockchain for Supply Chain and Compliance

- Cybersecurity & IT Infrastructure

- AR/VR for Remote Monitoring and Training

- Edge Computing and Data Analytics

By Application

- Drug Manufacturing (API & Formulations)

- Clinical Trials & Research

- Biologics & Biosimilars Production

- Personalized/Precision Medicine Manufacturing

- Pharmaceutical Packaging & Serialization

- Cold Chain & Temperature-Controlled Logistics

- Regulatory & Quality Compliance Monitoring

- Process Optimization & Predictive Maintenance

By End User

- Pharmaceutical Manufacturers (Branded & Generic)

- Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Contract Research Organizations (CROs)

- Regulatory & Government Agencies

- Academic & Clinical Research Institutes

By Deployment Type

- New Build (Greenfield Facilities)

- Retrofit/Upgrade of Existing Facilities

- Modular/Plug-and-Play Smart Units

- Hybrid Deployment (Digital Layer over Legacy Systems)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting