What is the Real World Evidence Solutions Market Size?

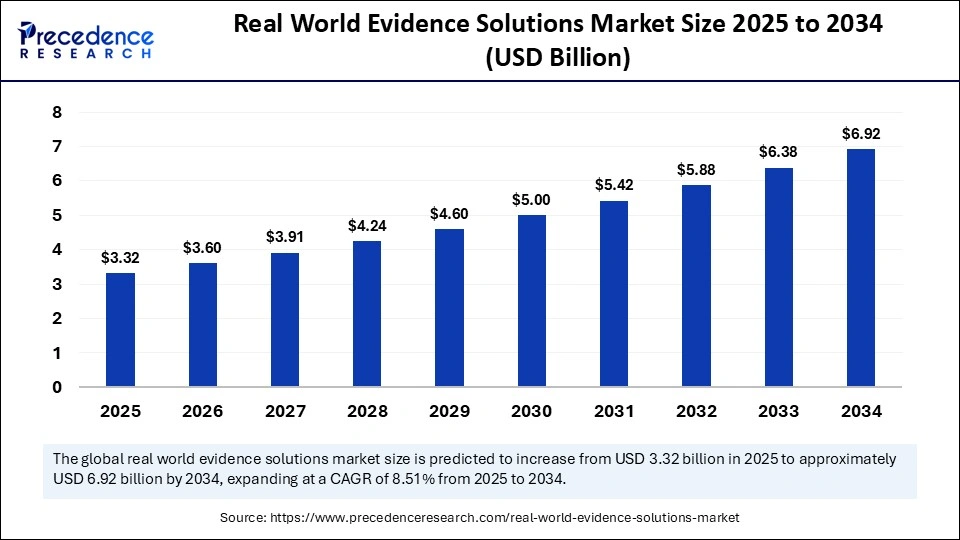

The global real world evidence solutions market size is calculated at USD 3.32 billion in 2025 and is predicted to increase from USD 3.60 billion in 2026 to approximately USD 7.43 billion by 2035, expanding at a CAGR of 8.39% from 2026 to 2035. The market is driven by the increasing adoption of data-driven decision-making in drug development, regulatory approvals, and healthcare outcomes optimization.

Market Highlights

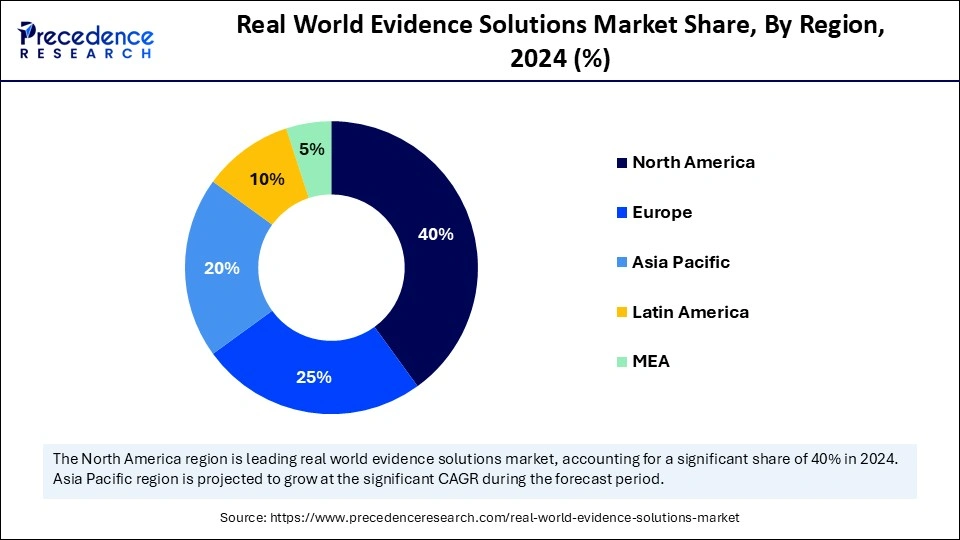

- North America accounted for the largest market share of 40% in 2025.

- The Asia- Pacific is expected to grow at a significant CAGR between 2026 and 2035.

- The product type, the data solutions segment held the major market share of 55% in 2025.

- By service type, the observational studies segment contributed the highest market share of 50% in 2025.

- By end user, the pharmaceutical companies segment generated the biggest market share of 45% in 2025.

- By therapeutic area, the oncology segment accounted for the largest market share of 30% in 2025.

- By deployment model, the cloud-based solutions segment held the biggest market share in 2025.

Market Size and Forecast

- Market Size in 2025: USD 3.32 Billion

- Market Size in 2026: USD 3.60 Billion

- Forecasted Market Size by 2035: USD 7.43 Billion

- CAGR (2025-2034): 8.39%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Real World Evidence Solutions Market?

Real World Evidence solution (RWE) refers to clinical insights derived from analyzing Real World Data (RWD), which encompasses information collected from various sources outside traditional randomized controlled trials. These sources include electronic health records (EHRs), insurance claims, patient registries, and data from digital health technologies. Real world evidence solution is instrumental in assessing the usage, effectiveness, safety, and value of medical products, treatments, and healthcare interventions in real-world settings. It aids stakeholders such as pharmaceutical companies, healthcare providers, payers, and regulatory bodies in making informed decisions regarding treatment outcomes, patient care optimization, and policy formulation.

The real-world evidence solutions market is gaining strong momentum as healthcare systems increasingly rely on real world data to enhance clinical decision-making, regulatory approvals, and personalized medicine. The market growth is fueled by the rising demand for data-driven insights in drug development and post-market surveillance. Pharmaceuticals and biotechnology companies are leveraging Real world e to accelerate product pipelines and demonstrate the value of therapies in real-life settings. Moreover, the integration of artificial intelligence and machine learning in analytics has significantly improved the accuracy and scalability of data interpretation. Governments and regulatory agencies such as the FDA and EMA are also promoting the adoption of evidence-based policy formulation. Overall, the market is transitioning from experimental data usage to a structured and regulated evidence-based healthcare ecosystem.

Key Technological Shifts in the Real World Evidence Solutions Market

The RWE market is undergoing a technological revolution marked by AI-driven analytics, blockchain-based data integrity systems, and edge computing for real-time data capture. Machine learning algorithms now enable predictive insights from unstructured datasets, while natural language processing (NLP) helps extract valuable information from clinical notes and patient feedback. Cloud computing ensures scalability, while federated learning enhances data privacy by allowing analysis without data movement. Digital twin technology and synthetic data generation are emerging to simulate clinical outcomes efficiently. These technological advancements are collectively reshaping how evidence is generated, shared, and applied across healthcare decision-making frameworks.

Market Key Trends in Real World Evidence Solutions Market

- The rise of decentralized clinical trials, increased use of patient-generated health data, and expanding regulatory acceptance of real-world evidence solutions.

- The growing collaboration between payers and providers for outcome-based contracting is also driving demand for real-world evidence solutions and insights. Another prominent trend is the integration of genomics and digital biomarkers into evidence-generation frameworks. Companies are also focusing on improving data interoperability through API-driven data sharing and standardized ontologies.

- Furthermore, the rise of AI-based real-world evidence solutions analytics platforms is democratizing access to insights, empowering smaller biopharma players. Collectively, these trends position RWE as a cornerstone of future healthcare innovation.

Real World Evidence Solutions MarketOutlook

The RWE industry operates at the intersection of healthcare, technology, and analytics, involving data aggregators, technology vendors, CROs (Contract Research Organizations), and life sciences companies. The ecosystem relies on diverse data sources, including claims databases, EHRs, genomics data, and patient registries.

The industry's value creation is based on the ability to generate actionable insights from massive, unstructured datasets. As healthcare moves toward precision medicine, RWE has evolved into a strategic necessity rather than a supporting function. Key industry players are focusing on developing interoperable data platforms and privacy-preserving analytics. The growing collaboration between regulatory bodies and private enterprises is strengthening the legitimacy and scalability of RWE-based solutions.

Sustainability in the RWE market revolves around ethical data usage, energy-efficient cloud infrastructure, and equitable access to healthcare data systems. Companies are investing in green data centers to reduce the environmental footprint of large-scale data processing. The use of blockchain technology for data provenance ensures transparency and prevents unethical data manipulation.

In addition, social sustainability is emphasized through data democratization, ensuring that insights derived from RWE benefit all patient groups, not just those in high-income regions. Sustainable RWE practices are being built around data privacy, inclusivity, and responsible AI governance. These principles are becoming central to long-term competitiveness and compliance.

Investments in the RWE solutions market have surged, primarily driven by venture capital funding, strategic collaborations, and acquisitions. Leading pharmaceutical companies are establishing long-term partnerships with analytics firms to enhance their evidence-generation capabilities. Technology giants are also entering the space by offering data integration and AI-based analytics tools tailored for healthcare applications.

Governments are funding national data registries and real-world data networks to promote evidence-based public health decisions. Additionally, several CROs have expanded their RWE divisions through targeted acquisitions of data companies. This financial momentum underscores the growing confidence in RWE as a transformative driver of healthcare innovation.

Startups play a crucial role in the RWE ecosystem by introducing advanced data analytics tools, interoperable platforms, and AI-driven modeling systems. Many emerging companies are focused on creating privacy-preserving data-sharing mechanisms and scalable solutions for smaller healthcare systems. The ecosystem's sustainability is reinforced through collaborations between startups, academic research institutions, and healthcare providers. These partnerships ensure ethical data use and equitable representation of diverse populations in clinical studies.

Governments and accelerators are also launching funding programs to nurture RWE-based startups. The long-term sustainability of the ecosystem depends on balancing innovation with regulatory compliance and ethical responsibility.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.32 Billion |

| Market Size in 2026 | USD 3.60 Billion |

| Market Size by 2035 | USD 7.43 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.39% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Service Type, End User, Therapeutic Area, Deployment Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Real World Evidence Solutions MarketSegment Insights

Product Type Insights

The data solutions segment in the real world evidence solutions market is dominating it by holding a share of 55%, due to its central role in data aggregation, cleaning, and standardization. These solutions serve as the foundation for all evidence-generation processes, enabling healthcare organizations to transform raw data into actionable insights. Pharmaceutical and regulatory bodies rely on high-quality data solutions to ensure accuracy in post-marketing surveillance and clinical evaluations. The growing integration of multiple data sources, such as EHRs, claims, and genomics data, further strengthens this segment. Data platforms also support interoperability, which is crucial for connecting global healthcare systems. As the healthcare sector continues its digital transformation, robust data solutions remain indispensable for RWE operations.

The dominance of this segment is also reinforced by the rising need for structured data to support AI and machine learning analytics. Companies are heavily investing in advanced databases that comply with global privacy laws while maintaining analytical flexibility. Hospitals and research institutions prefer end-to-end data management systems that streamline RWE studies across multiple geographies. Moreover, the demand for real-time data accessibility and cloud integration continues to propel the adoption of enterprise-level data solutions. The focus on data accuracy, scalability, and compliance keeps this segment at the forefront of market leadership. In the coming years, the evolution of intelligent data lakes will further expand the strategic role of data solutions in evidence generation.

The analytics & software platforms are the fastest growing in the real world evidence solutions market by holding a share of 30%, due to their ability to translate massive datasets into clinical intelligence. These platforms utilize AI, predictive modeling, and visualization tools to support decision-making across the healthcare value chain. Pharmaceutical and biotech firms are increasingly adopting these solutions to identify patient populations, forecast treatment outcomes, and evaluate real-world drug performance. The integration of cloud-based analytics with wearable device data has enhanced the depth and precision of insights. Advanced platforms are also enabling adaptive trial design and real-time safety monitoring. Their increasing sophistication makes them essential tools for both regulators and innovators.

The growth of analytics platforms is further fueled by the industry's shift toward value-based care and precision medicine. Customizable dashboards allow stakeholders to visualize longitudinal data trends, improving healthcare outcomes and cost efficiency. Companies are also focusing on AI-driven platforms that can process unstructured clinical data with high accuracy. The ability of these systems to handle complex datasets spanning clinical, genomic, and behavioral information gives them a competitive edge. Moreover, partnerships between software developers and life sciences firms are leading to more specialized, disease-focused platforms. This convergence of technology and healthcare is expected to sustain the segment's rapid growth trajectory.

Service Type Insights

The observational studies in the real world evidence solutions market are dominating it by holding a share of 50%, as they form the foundation of evidence generation from real-world patient experiences. These studies use retrospective and prospective data to assess treatment effectiveness, adherence, and long-term outcomes. Pharmaceutical companies rely on observational data to evaluate post-marketing drug performance beyond controlled clinical environments. Such studies also help identify population-specific responses, contributing to precision medicine and regulatory submissions. The cost-effectiveness and wide applicability of observational research make it a preferred choice for real-world evidence solutions programs. Moreover, the rise in electronic health record availability has made these studies more accurate and scalable.

The dominance of observational studies is further reinforced by their growing use in value demonstration and reimbursement negotiations. Regulators and payers increasingly depend on this data to validate therapy efficacy under real-life conditions. With expanding global patient registries and digital health databases, the quality and diversity of observational insights continue to improve. These studies are also crucial in rare disease research, where traditional trials face recruitment limitations. The incorporation of digital health tools, AI analytics, and mobile data capture enhances the reliability of findings. Overall, observational studies remain the backbone of real-world evidence solutions strategies for their ability to provide comprehensive, real-world insights at scale.

The pragmatic/hybrid clinical trials are the fastest growing in the real-world evidence solutions market by holding a share of 30%, as these trials combine traditional randomized control methods with real-world data to assess treatment effectiveness in routine clinical settings. Pharmaceutical and biotech companies are adopting this approach to reduce trial costs and accelerate regulatory approval. The integration of telemedicine and wearable data has made hybrid trials more dynamic and representative of real-world conditions. Moreover, the flexibility of design enables continuous monitoring and adaptive endpoints. This makes them particularly valuable for evaluating complex therapies and personalized medicine.

Their rapid growth is driven by the industry's shift toward patient-centric, decentralized clinical models. Hybrid trials also align with regulators' increasing acceptance of real-world evidence solutions in approval processes, further boosting adoption. The use of AI-driven patient recruitment and remote data capture minimizes geographic limitations and enhances efficiency. Pharmaceutical sponsors benefit from reduced time-to-market and broader population insights. Additionally, hybrid trials promote inclusivity by engaging diverse patient demographics. As technology continues to enhance virtual monitoring and data collection, pragmatic trials will increasingly define the future of clinical research.

Therapeutic Area Insights

The oncology segment is dominating the real world evidence market by holding a share of 30%, driven by the high demand for real-world data in cancer research, therapy optimization, and post-market surveillance. Cancer treatments often involve complex, multi-modal therapies requiring continuous monitoring beyond clinical trials. RWE provides valuable insights into treatment response, toxicity, and patient quality of life in actual clinical practice. Pharmaceutical companies rely on oncology RWE to evaluate comparative effectiveness across different drug classes. The availability of large oncology registries and EHR-integrated datasets further enhances data accuracy. With the rise of precision oncology, RWE plays a pivotal role in supporting personalized treatment pathways.

The dominance of oncology is also attributed to increasing collaboration between hospitals, research networks, and data analytics firms. Governments and regulatory agencies prioritize oncology data initiatives due to the global cancer burden. RWE in oncology is being utilized for label expansion, drug repositioning, and treatment sequencing analysis. Advanced analytics enable real-time monitoring of tumor response and survival outcomes. Moreover, the integration of genomic, imaging, and clinical data enhances understanding of disease heterogeneity. As cancer remains a leading cause of mortality, the oncology segment will continue to anchor the RWE market's growth trajectory.

The rare/orphan is the fastest growing in the real world evidence market by holding the share of 20%, as these conditions often lack a clinical trials database, making real-world data essential for understanding treatment outcomes. Real-world evidence market provides valuable insights into disease prevalence, patient journey mapping, and therapy response across small populations. Regulatory agencies increasingly accept real-world evidence for approval and reimbursement of orphan drugs. Pharmaceutical and biotech companies are using real-world registries to monitor safety and long-term efficacy. The rising number of targeted therapies and gene treatments further enhances the need for continuous, real-world data collection.

End User Insights

The pharmaceutical companies are dominating the market by holding a share of 45%, as they are the primary consumers of real-world data for drug development and commercialization. RWE helps pharma companies demonstrate drug value, support market access, and enhance post-launch monitoring. These insights are crucial for understanding long-term safety profiles and comparative effectiveness across patient groups. With regulatory agencies now accepting real world evidence solutions market for label expansion and post-approval studies, pharma adoption has intensified. Additionally, companies are using real-world evidence solutions to identify new therapeutic opportunities through retrospective data mining. The emphasis on data-driven strategies is reshaping how the pharmaceutical sector manages innovation and compliance.

The biotechnology companies is the fastest growing in the market by holding a share of 25%, fueled by the rapid evolution of advanced therapy medicinal products (ATMPs), which require long-term follow-up and real-world outcome tracking. RWE supports post-launch surveillance and helps biotech firms demonstrate real-world treatment durability. Many small- and mid-sized biotechs are outsourcing analytics functions to specialized RWE platforms for scalability. The trend of integrating genomic data into real-world frameworks also aligns closely with biotech innovation goals. Additionally, as reimbursement models increasingly depend on evidence-based outcomes, biotechs are compelled to strengthen their RWE capabilities. This convergence of innovation and evidence-based validation ensures sustained segment growth.

Deployment Mode Insights

The cloud based solution is dominating and the fastest growing in the real world market evidence solutions with a 60% share, driven by its scalability, flexibility, and cost efficiency. Cloud platforms allow healthcare organizations to integrate, store, and analyze massive volumes of real-world data across geographies. They facilitate real-time collaboration between stakeholders while ensuring high security and compliance with global regulations.

The ability to deploy AI and machine learning tools directly within cloud infrastructures enhances analytical speed and accuracy. Moreover, the pay-as-you-go model makes cloud adoption cost-effective for both large enterprises and startups. The widespread shift toward digital health ecosystems has firmly positioned cloud-based models as the industry standard.

Real World Evidence Solutions MarketRegional Insights

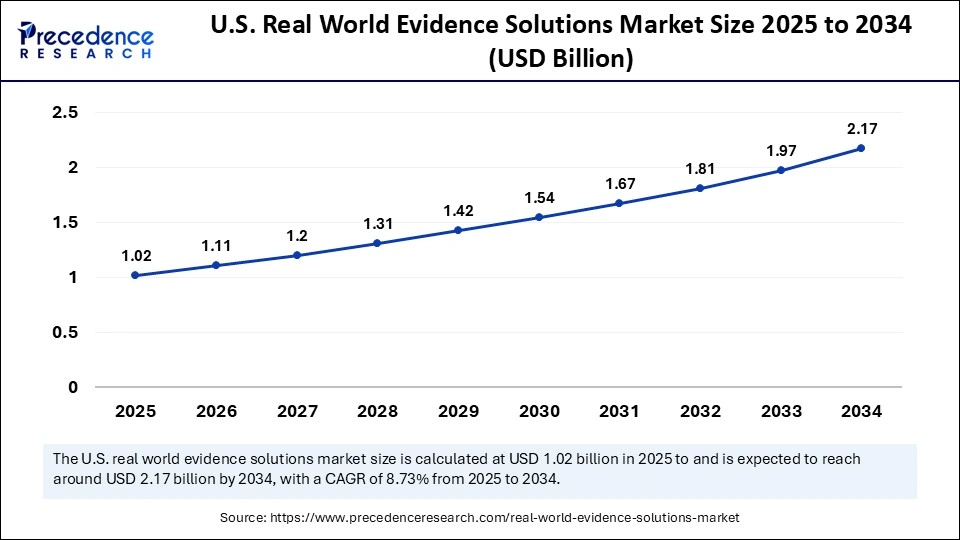

The U.S. real world evidence solutions market size is exhibited at USD 1.02 billion in 2025 and is projected to be worth around USD 2.34 billion by 2035, growing at a CAGR of 8.66% from 2026 to 2035.

Why North America is Leading the Real World Evidence Solutions Market?

North America is dominating the real-world evidence solution market by holding the share of 40%, due to its robust healthcare infrastructure, strong regulatory frameworks, and advanced data interoperability standards. The U.S. leads the region, supported by high EHR adoption, significant R&D spending, and early acceptance of RWE in FDA submissions. Canada's focus on value-based healthcare and digital health initiatives further complements market expansion. Major technology and life sciences companies headquartered in the U.S. are continuously innovating RWE analytics platforms. The integration of cloud-based solutions with public health databases has accelerated evidence generation efficiency. Government-backed data sharing initiatives are further solidifying North America's leadership position.

Why U.S. Is the Energy Booster of the Vectors in North America?

In the U.S., initiatives like the FDA's Sentinel System and CMS data programs are key enablers of RWE adoption. Canada is investing in interoperable health networks under its Pan-Canadian Health Data Strategy. The U.S. also witnesses growing collaborations between pharmaceutical giants and tech firms like IBM and Google Health. Clinical research hubs such as Boston and San Francisco serve as innovation epicenters for RWE startups. Additionally, data governance laws ensure the ethical use of health data, making North America a model for RWE integration. Together, these factors contribute to the region's dominance in technological advancement and global RWE leadership.

Asia Pacific represents the fastest-growing region in the real-world evidence solutions market, holding a share of 20%, propelled by expanding healthcare digitization, government reforms, and growing clinical research outsourcing. Countries in the region are embracing RWE to strengthen healthcare access and optimize resource allocation. The rising prevalence of chronic diseases and increasing adoption of digital health tools create fertile ground for evidence generation. Multinational pharmaceutical companies are partnering with Asian CROs to leverage diverse patient datasets. Furthermore, the integration of AI Real World Evidence Solutions Market RWE analytics is gaining traction across emerging economies. Rapid economic development and increased healthcare spending underpin this accelerated regional growth.

China's Contribution to the Real World Evidence Solutions Market

China is at the forefront of the real-world evidence solutions market surge, driven by government-backed big data healthcare programs. Japan's PMDA is actively promoting the use of RWE in regulatory evaluations. India's massive patient pool and rapid digital health transformation offer strong growth potential for RWE studies. South Korea and Singapore are emerging as data analytics and medical AI hubs, attracting global investments. Regional collaborations between universities, hospitals, and startups are fostering innovation ecosystems. As these countries continue to build robust data governance frameworks, the Asia-Pacific is poised to emerge as the new epicenter for scalable, patient-centric real-world evidence solutions.

Europe is set to experience significant growth in the market throughout the forecast years. This growth is due to an increase in hospital visits due to the rising prevalence of chronic and infectious diseases, as well as the rapidly growing population across the region. Major market players in the region are focused on various business strategies, such as product launches, to help expand their product portfolios.

UK Real World Evidence Solutions Market Trends: The region's market is expected to grow significantly during the forecast period. This is due to increasing government support in the form of initiatives that are aimed at promoting the adoption of RWE.

What are the Key Trends in the Real-World Evidence Solutions Market in Latin America?

Latin America is set to witness substantial growth throughout the forecast years. This growth is due to various factors, such as the rising adoption of digital health technologies, including electronic health records (EHRs) and wearable sensors, which provide an unprecedented volume of readily accessible patient data, and regulatory bodies like the FDA, which are increasingly incorporating RWE into drug approval processes, further bolstering market demand.

Brazil Real World Evidence Solutions Market Trends: The country's market landscape is gradually gaining traction, fueled by growing interest from health technology assessment bodies and life-science firms to use locally generated RWD for decision-making. Key drivers include a high burden of chronic diseases, broader digital health adoption, and investment in data infrastructure that enhances research and treatment insights across public and private healthcare systems.

How is the Middle East and Africa in the Real-World Evidence Solutions Market?

The Middle East & Africa real‑world evidence solutions industry is growing at a steady pace, as governments and healthcare systems increasingly invest in digital health and data infrastructure to support value-based care and informed decision-making. It also has an expanding healthcare infrastructure and is witnessing rising investments in digital health. Countries such as Saudi Arabia, the UAE, AND South Africa are leading players in the region.

Saudi Arabia Real World Evidence Solutions Market Trends: The regional expansion is driven by increased adoption of digital health technologies, rising cancer prevalence, and supportive government initiatives that are aimed at improving healthcare quality. Demand for RWE is rising, particularly in chronic disease management, oncology, and pharmacoeconomics, where real-world insights help optimize treatment pathways and resource allocation.

Real World Evidence Solutions MarketValue Chain

In the real-world evidence solutions context, raw materials refer to data sources EHRs, claims data, wearable device outputs, lab test results, and patient-reported outcomes. These data streams are sourced from hospitals, insurance databases, telemedicine platforms, and health apps. Ensuring high-quality, standardized, and bias-free data is crucial for reliable evidence generation. Data interoperability remains a major challenge, leading to investments in structured data pipelines and cloud-based data warehouses. Partnerships between data vendors and healthcare institutions ensure a continuous and ethical data supply. Privacy-preserving frameworks such as HIPAA and GDPR compliance are essential to sustainable data sourcing practices.

Core technologies include AI, ML, NLP, blockchain, and cloud computing, which collectively enable real-time, scalable, and privacy-compliant data analytics. Cloud infrastructure supports secure data integration across multiple healthcare ecosystems. Blockchain enhances data transparency and immutability, ensuring tamper-proof evidence trails. Advanced analytics tools allow predictive modeling for disease outcomes and therapy efficacy. Additionally, IoT-enabled health monitoring devices feed continuous real-world data into analytical frameworks. These technologies, when combined, provide an end-to-end digital ecosystem for evidence generation and interpretation in healthcare.

Investors are increasingly drawn to the real-world evidence solutions sector for its potential to transform healthcare decision-making and reduce R&D costs. Venture capital firms are backing startups focused on AI-driven real-world evidence solutions, analytics, and patient engagement platforms. Private equity investors are targeting established data platforms and CROs to expand their service portfolios. Strategic investments from pharmaceutical companies often involve co-development agreements for proprietary data solutions. Institutional investors are supporting long-term infrastructure projects, such as national RWE databases and interoperable cloud systems. The investment landscape reflects growing recognition of real-world evidence solutions' ability to generate clinical and economic value simultaneously.

Real World Evidence Solutions Market Companies

IQVIA is a global leader in health data analytics and clinical research, leveraging its Real World Data (RWD) and AI-driven technologies to support pharmaceutical development and evidence generation. Its integrated platform, combining analytics, technology, and clinical expertise, enables faster drug approvals and better patient outcomes. IQVIA’s vast data ecosystem positions it at the forefront of real-world evidence (RWE) and healthcare insights.

Merative (formerly IBM Watson Health) provides advanced data analytics and cloud-based solutions to enhance healthcare decision-making. Its offerings in real-world evidence, clinical data integration, and population health analytics support life sciences companies and healthcare providers in improving outcomes through actionable insights.

Optum, a subsidiary of UnitedHealth Group, combines clinical data analytics, health management, and technology to improve patient care and operational efficiency. Its extensive RWD network and predictive analytics capabilities empower healthcare stakeholders to make informed, value-based decisions.

ICON is a leading clinical research organization (CRO) specializing in clinical trial management, RWD analytics, and commercialization support. Its expertise in leveraging real-world evidence enhances clinical efficiency and supports pharmaceutical companies in accelerating drug development and market access.

Syneos Health integrates clinical research and commercial solutions with advanced data analytics to optimize clinical trials and real-world evidence generation. Its data-driven approach bridges research and commercialization, helping biopharma companies deliver therapies more efficiently.

Parexel provides global clinical research and real-world data services that accelerate drug development. The company leverages advanced analytics and decentralized trial technologies to improve patient access and trial efficiency.

TCS delivers data analytics and digital transformation solutions for healthcare and life sciences, including RWD integration and AI-powered decision support. Its technology expertise enables scalable real-world evidence platforms for global clients.

Oracle offers advanced clinical trial and data management solutions through Oracle Health Sciences, providing cloud-based analytics to support RWD and RWE studies. Its systems enhance regulatory compliance and research efficiency for biopharma companies.

Elevance Health, formerly Anthem, utilizes real-world data analytics to improve patient care outcomes and healthcare delivery. Its integrated health solutions leverage predictive analytics to drive precision medicine and value-based care.

SAS is a global leader in advanced analytics and AI, providing data management and statistical software widely used in RWD and RWE studies. Its platforms enable regulatory-grade evidence generation and clinical data analysis for healthcare research.

Aetion specializes in real-world evidence generation, offering the Aetion Evidence Platform to analyze healthcare data for regulatory and payer decision-making. Its collaborations with the FDA and EMA highlight its leadership in evidence-based healthcare analytics.

TriNetX provides a global real-world data network connecting healthcare organizations, life sciences companies, and researchers. Its federated data platform supports clinical trial feasibility, observational research, and RWE studies.

Cognizant delivers data integration, analytics, and digital transformation services for healthcare and life sciences clients. Its RWE solutions help biopharma companies leverage data to accelerate trials and enhance patient outcomes.

Cegedim Health Data offers longitudinal patient data and analytics tools across Europe, supporting real-world studies and health economics research. Its anonymized datasets help clients evaluate treatment outcomes and optimize care strategies.

Verantos develops high-accuracy real-world evidence platforms using AI and natural language processing to extract insights from unstructured clinical data. Its validated evidence systems are trusted by regulators and payers for precision analytics.

Medpace provides clinical research and real-world data analytics services for biopharma and medical device industries. Its integrated approach ensures high-quality data generation and efficient trial management.

HealthVerity offers one of the largest healthcare data ecosystems, enabling secure, privacy-compliant real-world data exchange. Its data-linking technology connects claims, EHR, and lab data to support RWE and market access studies.

Flatiron Health, a subsidiary of Roche, focuses on oncology-specific real-world evidence derived from electronic health records. Its data analytics platform supports cancer research, regulatory submissions, and clinical insights.

Tempus Labs harnesses AI and molecular data to provide precision oncology and clinical decision support. Its real-world data platform integrates genomic, clinical, and imaging data to accelerate personalized medicine and therapeutic discovery.

Recent Developments

- In October 2025, Kenvue India released its latest scientific research focusing on real-world evidence (RWE) related to dehydration in non-diarrheal conditions. The findings have been published in the Journal of the Association of Physicians of India (JAPI). The study highlights that in conditions such as fever, infections, nausea, vomiting, heat-related illnesses, and tropical diseases like dengue and malaria, individuals experience a significant rise in insensible fluid and electrolyte loss, increasing their vulnerability to dehydration.

- For instance, during fever, every 1°C rise in body temperature above 39°C (102°F) results in an estimated 25% increase in insensible fluid loss, around 30 ounces (approximately 900 ml) within 24 hours, along with an additional 3 ounces (about 30 ml) lost through breathing and coughing.

- In August 2023, Target RWE announced the launch of its new analytical suite called Syndicated Science™ Insights, designed to bolster the generation of real-world evidence (RWE) by enabling pharmaceutical firms to answer strategic product lifecycle and unmet-need questions through advanced epidemiologic methods and enhanced data visualization. (Source: https://www.targetrwe.com)

Real World Evidence Solutions Market Segments Covered in the Report

By Product Type

- Data Solution

- Electronic Health Records (EHR) Data

- Claims & Billing Data

- Patient Registries & Longitudinal Data

- Analytics & Software Platform

- AI/ML-Based Analytics Tools

- Data Visualization & Reporting Tools

- Consulting & Managed Service

- Study Design & Protocol Development

- Real-World Evidence Study Execution

By Service Type

- Observational Studie

- Retrospective Cohort Studies

- Case-Control Studies

- Pragmatic / Hybrid Clinical Trial

- Pragmatic Trials

- In-Silico Trials

- Health Economics & Outcomes Research (HEOR)

- Cost-Effectiveness Analysis

- Quality-of-Life Assessment

By End User

- Pharmaceutical Companies

- Large Pharma

- Specialty Pharma

- Biotechnology Companies

- Mid-Sized Biotech

- Small Biotech

- Medical Device & Diagnostics Companie

- Contract Research Organizations (CROs)

- Payers / Health Systems

By Therapeutic Area

- Oncology

- Solid Tumors

- Hematologic Cancers

- Rare / Orphan Diseases

- Hematology Disorders

- Genetic Disorders

- Cardiovascular & Metabolic Diseases

- Immunology & Autoimmune Disorders

- Neurology / CNS Disorders

- Other Therapeutic Areas

By Deployment Model

- On-Premise Solutions

- Enterprise EHR Integration

- Internal Analytics Infrastructure

- Cloud-Based Solutions

- SaaS RWE Platforms

- Data-as-a-Service (DaaS)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting