What is the Conductive Ink Market Size?

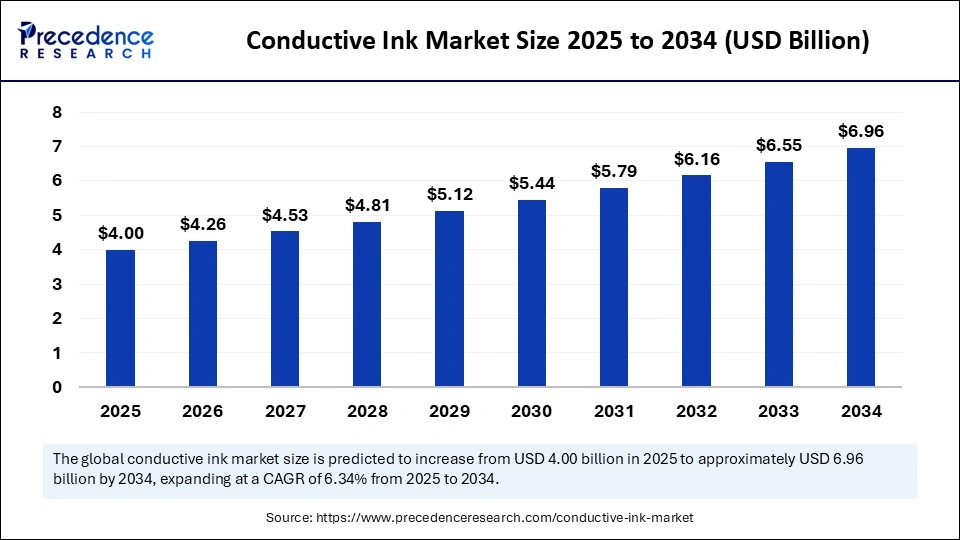

The global conductive ink market size is calculated at USD 4.00 billion in 2025 and is predicted to increase from USD 4.26 billion in 2026 to approximately USD 6.96 billion by 2034, expanding at a CAGR of 6.34% from 2025 to 2034.The market is experiencing strong growth, driven by rising demand for advanced printed electronics, flexible devices, and renewable energy solutions. Conductive inks, formulated with materials such as silver, copper, carbon, and conductive polymers, enable efficient electrical conductivity in lightweight and flexible applications. Their use in photovoltaics, RFID tags, and printed circuit components of modern electronics manufacturing.

Conductive Ink Market Key Takeaways

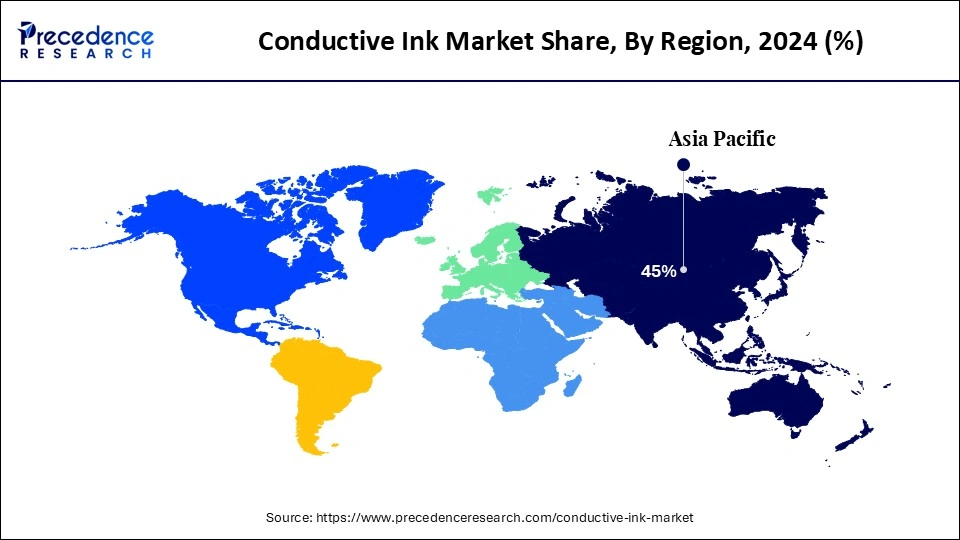

- Asia Pacific dominated the conductive ink market with the largest market share of 45% in 2024.

- North America is set to experience the fastest growth at a CAGR of 8.7% from 2025 to 2034.

- By type, the silver-based conductive inks segment captured the biggest market share of 42% in 2024.

- By type, the copper-based conductive inks segment is projected to experience the highest growth at a CAGR of 8.5% between 2025 and 2034.

- By application, the photovoltaics (solar panels) segment contributed the highest market share of 37% in 2024.

- By application, the flexible displays and touchscreens segment is expected to grow at the fastest CAGR of 9.1% in the market.

- By technology, the screen printing segment held the maximum market share of 46% in 2024.

- By technology, the inkjet printing segment is anticipated to grow with the highest CAGR of 9.4% during the studied years.

- By substrate, the glass substrates segment accounted for a considerable share of 41% in 2024.

- By substrate, the flexible plastics segment is projected to expand rapidly with a CAGR of 8.8% during the forecast period.

- By end-use industry, the consumer electronics segment generated the major market share of 41% in 2024.

- By end-user industry, the automotive segment is predicted to witness a CAGR of 9.2% during the forecast period.

What is Conductive Ink?

The conductive ink market is poised for rapid transformation as industries shift toward cost-effective, sustainable, and flexible solutions. Copper-based conductive inks are expected to grow at the fastest rate owing to their affordability and eco-friendly profile. Likewise, applications in flexible displays, touchscreens, and automotive electronics will expand significantly. Supported by the growth of wearables, electric vehicles, and advanced driver assistance systems. North America is projected to be the fastest-growing regional market, driven by innovation in flexible electronics, EV adoption, and renewable energy expansion. With technological advancements and sustainability trends accelerating, the market is set to witness robust growth from 2025 to 2034.

- In 2024, silver-based conductive inks dominated the market due to their superior conductivity and stability, while photovoltaic applications held a major share, fuelled by the increasing adoption of solar energy technologies worldwide. Screen printing remained the leading technology because of its reliability in mass production, particularly for solar panels and RFID tags. Regionally, the Asia Pacific led the market, supported by large-scale electronics and solar manufacturing hubs in China, Japan, and South Korea.

How has AI affected the market?

Artificial intelligence is making inroads into the conductive ink sector by introducing data-driven intelligence into materials development. For instance, materials informatics platforms, essentially AI-powered modelling systems, are helping companies rapidly optimize ink formulations, refining properties like resistivity and curing temperature more efficiently than traditional trial and error testing.

AI-enhanced manufacturing techniques, such as machine learning assisted printing, are being deployed to fine-tune the deposition of conductive inks, adjusting parameters in real time to improve print quality and electrical performance. These AI-infused approaches enhance both the speed and precision of innovation, enabling more tailored conductive ink solutions for cutting-edge applications.

Market Outlook

- Industry Growth Overview

The conductive ink market is growing, driven by the increasing demand from consumer electronics and automotive manufacturing, development in renewable energy services such as solar cells, and inventions in printed and flexible electronics - Global Expansion

The conductive ink market is experiencing global expansion, as various businesses expanding internationally are increasing the complication of their supply chains, which drives the requirement for more sophisticated inbound logistics services. North America is dominated by strong manufacturing and well-developed organizations. - Major investors

Major investors in the conductive ink market comprise large chemical and technology organizations that have in-house advancement and strategic venture capital arms, as well as specialized venture capital organizations.

Market Trends

- To mitigate the high costs associated with silver-based inks, manufacturers are increasingly exploring alternatives like graphene, copper, and carbon nanotube (CNT) based inks. These materials offer comparable conductivity and flexibility, making them suitable for applications in wearable electronics and flexible displays.

- The development of nanomaterial-based conductive inks is enabling the production of high-resolution, flexible, and stretchable electronic components. This advancement is particularly beneficial for applications in smart textiles and wearable devices.

- Conductive inks are playing a crucial role in the advancement of printed electronics, including the development of RFID tags, sensors, and flexible displays.

- There is a growing emphasis on developing eco-friendly conductive inks. Innovations include recyclable formulations and the use of water based dispersions, which reduce recyclable formulations and the use of water-based dispersions, which reduce environmental impact and align with global sustainability initiatives.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.96 Billion |

| Market Size in 2026 | USD 4.26 Billion |

| Market Size in 2025 | USD 4.00 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.34% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Technology, Substrate, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Adoption of Renewable Energy and Solar Photovoltaics

One of the primary drivers of the conductive is the rapid expansion of renewable energy, particularly solar photovoltaics. Conductive inks are essential in the production of solar cells, where they are used to print fine conductive lines on photovoltaic panels that capture and transmit energy efficiently. With governments worldwide implementing clean energy policies and offering subsidies for solar adoption, demand for efficient and scalable materials like conductive inks is surging. Additionally, as solar panel manufacturers focus on reducing production costs while improving energy conversion efficiency, silver and copper-based conductive inks are being increasingly adopted for their superior conductivity and reliability. The push toward decarbonisation and the rising need for sustainable energy infrastructure will continue to strengthen this driver in the coming decade.

Rising Demand for Flexible and Wearable Electronics

Another major driver is the growing popularity of flexible, lightweight, and wearable electronic devices. Conductive inks allow manufacturers to print circuits directly onto flexible substrates such as plastics, textiles, or paper, enabling the creation of foldable smartphones, smartwatches, medical patches, and other next-generation devices. The surge in consumer demand for smart wearables, coupled with healthcare's shift toward remote monitoring devices, is accelerating the adoption of printed and stretchable electronics. Moreover, advancements in materials science, including graphene and carbon-based inks, are enhancing the durability and conductivity of these flexible devices. This trend is particularly strong in consumer electronics and healthcare, where the need for portability, miniaturization, and design flexibility aligns perfectly with the benefits of conductive inks.

Restraints

High Cost of Raw Materials, Especially Silver, Silver-Based Inks

A significant restraint in the conductive ink market is the high cost of raw materials, particularly silver, which is the most widely used material due to its superior conductivity and stability. However, silver prices are volatile and subject to fluctuations in global commodity markets, directly impacting production costs for conductive inks. This makes it difficult for manufacturers to offer competitive pricing in cost-sensitive applications such as RFID tags, packaging, or disposable medical devices. While alternatives like copper and carbon-based inks are emerging, silver inks still dominate critical applications like photovoltaics and high-performance electronics, limiting cost reduction in the short term. This dependency on an expensive and unstable raw material continues to challenge profitability and adoption across price-sensitive industries.

Technical Limitations and Performance Trade-Offs

Another major challenge is the technical limitations associated with conductive inks, particularly inks, particularly when balancing conductivity, adhesion, flexibility, and durability. For instance, copper inks, though more affordable than silver, are prone to oxidation, which reduces their long-term reliability in outdoor or high-moisture environments. Similarly, carbon and graphene inks may provide flexibility but often lack the same level of conductivity as metal-based inks, restricting their use in high-power applications. Achieving consistent performance across different substrates such as plastics, glass, or textiles also requires complex formulations and processing methods, which increases production complexity. These trade odds make it difficult for manufacturers to scale solutions across diverse industries without sacrificing performance or cost effectiveness, slowing widespread adoption.

Opportunity

Expansion of Electric Vehicles and Smart Automotive Electronics

The accelerating shift toward electric vehicles (EVs) and connected automotive technologies presents a major opportunity for conductive inks. Modern vehicles increasingly rely on lightweight, flexible, and cost-efficient electronic components for battery management systems, advanced driver assistance systems (ADAS), sensors, and touch interfaces. Conductive inks allow circuits and sensors to be printed directly into flexible substrates, reducing weight and enabling compact designs that traditional wiring cannot achieve. As automakers strive to extend EV range and improve efficiency, the demand for lightweight printed electronics integrated with conductive inks is expected to rise sharply. Additionally, the integration of smart surfaces, such as touch-sensitive dashboards and heating elements in windows, further opens the door for conductive inks in the automotive sector.

Growth of Healthcare and Wearable Medical Devices

Another promising opportunity lies in the healthcare industry, particularly in wearable medical devices and biosensors. Conductive inks enable the development of disposable, flexible, and skin-friendly electronics used for monitoring vital signs, glucose levels, or cardiac activity. With the increasing global focus on personalized medicine and remote patient monitoring, demand for printed biosensors and smart patches is growing rapidly. These applications require low-cost, biocompatible materials. And reliable conductive materials, which conductive inks are well-positioned to deliver. As healthcare systems expand their use of digital tools for preventive care and chronic disease management, conductive inks can play a crucial role and are well-positioned to deliver. As healthcare systems expand their use of digital tools for preventive care and chronic disease management, conductive inks can play a crucial role in scaling affordable and accessible health technologies.

Segmental Insights

Type Insights

In 2024, silver-based conductive inks maintained a leading position in the conductive ink market due to their superior electrical conductivity, stability, and long-standing use in high-performance applications. These inks are widely employed in photovoltaics, RFID tags, and printed electronics, where consistent performance and reliability are critical. Despite their higher cost compared to other alternatives, silver inks remain the go-to choice for industries requiring precision and durability, reinforcing their dominance in the global market.

Looking ahead, the copper-based conductive inks segment is projected to experience the highest growth rate between 2025 and 2034. Copper is significantly more cost-effective than silver, making it attractive for large-scale applications such as printed circuit boards and emerging flexible electronics. Advances in coating technologies and anti-oxidation treatments are addressing copper's susceptibility to corrosion, unlocking opportunities for broader adoption in consumer electronics, energy, and automotive sectors.

Application Insights

The photovoltaics (solar panels) segment captured a significant portion of the conductive ink market in 2024, fuelled by the accelerating global transition toward renewable energy. Conductive inks are essential in solar cells for forming fine conductive lines that enable efficient electron flow, and as governments and industries increase investments in solar energy projects, demand for these inks remains strong. This dominance underscores the role of conductive inks as a key enabler of sustainable energy infrastructure.

Meanwhile, the flexible displays and touchscreens segment is expected to grow at the fastest rate during 2025-2034. The surge in foldable smartphones, wearable devices, and next-generation consumer electronics is creating a massive need for highly conductive yet flexible inks. Conductive inks allow manufacturers to produce lightweight, bendable circuits directly onto plastic substrates, supporting the design of innovative products that traditional electronics manufacturing methods cannot deliver.

Technology Insights

In terms of technology, the screen printing segment registered its dominance over the conductive ink market in 2024. Screen printing is a well-established technique widely used in the production of solar cells and RFID tags due to its ability to deposit thick, uniform ink layers with excellent adhesion. Its cost-effectiveness and reliability in mass production make it the preferred choice for high-volume applications, reinforcing its leadership in the market.

However, the inkjet printing segment enables precise, high-resolution deposition of conductive inks, supporting the development of miniaturized and customized electronic components. Its non-contact nature reduces material waste and allows for printing on delicate or irregular substrates, making it increasingly valuable for advanced applications such as flexible electronics, sensors, and medical devices.

Substrate Insights

The glass substrates segment accounted for a considerable share of the conductive ink market in 2024, driven by its extensive use in solar panels and touchscreens. Glass offers superior thermal and chemical stability, ensuring durability and performance in demanding applications. Its established role in photovoltaics, couples with its compatibility with screen printing processes, cements its position as the dominant substrate in the conductive ink market.

In contrast, the flexible plastics segment is projected to expand rapidly in the coming years. With the rise of wearable devices, foldable displays, and flexible medical sensors, plastic substrates are gaining prominence for their lightweight properties. Bendable and low-cost properties. Advances in conductive ink formulations that adhere well to flexible materials are enabling broader adoption, particularly in consumer electronics and healthcare.

End Use Industry Insights

In 2024, the consumer electronics segment enjoyed a prominent position in the conductive ink market, driven by strong demand for smartphones, tablets, wearables, and the flexibility required in modern gadgets. As the electronics industry continues to innovate toward thinner, lighter, and more efficient devices, their use remains indispensable.

The automotive segment is predicted to witness significant growth over the forecast period. The rapid adoption of electric vehicles (EVs), along with advanced driver assistance systems (ADAS) and in-car touch interfaces, is creating new opportunities for conductive inks. Lightweight printed electronics help reduce wiring complexity while supporting sensors, battery management systems, and interactive surfaces in next-generation vehicles.

Regional Insights

Asia Pacific Conductive Ink Market Size and Growth 2025 to 2034

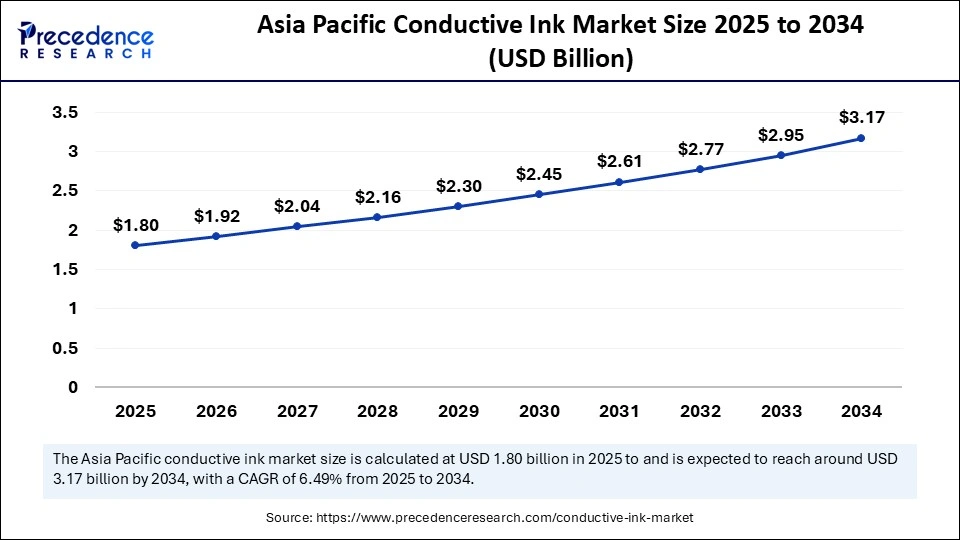

The Asia Pacific conductive ink market size is evaluated at USD 1.80 billion in 2025 and is projected to be worth around USD 3.17 billion by 2034, growing at a CAGR of 6.49% from 2025 to 2034.

Asia Pacific dominated the conductive ink market in 2024, holding the largest share due to its role as a global hub for electronics and solar manufacturing. Countries like China, Japan, and South Korea lead in the production of solar panels, smartphones, and advanced consumer electronics, all of which heavily rely on conductive inks. The presence of large-scale manufacturers and strong government support for renewable energy projects further reinforces APAC's dominant position.

India: Large Consumer Base and Economic Growth

In India, high economic progress, growing disposable incomes, and massive urbanization in India have led to a drive the demand for automotive, electronics components, and smart machinery that use conductive inks, which contributes to the growth of the market.

North America is set to experience the fastest rate of market growth from 2025 to 2034. The region is seeingrising investments in electric vehicles, renewable energy, and research into flexible electronics. Strong innovation ecosystems, particularly in the U.S., are driving the adoption of conductive inks across automotive, healthcare, and defense applications. This innovation-driven growth positions North America as a key future market for conductive inks.

U.S.: Government Support and Funding

The U.S. is a hub for major key players and startups such as DuPont, Sun Chemical, NovaCentrix, Vorbeck Materials, which invest profoundly in research and development to create advanced ink formulations, like stretchable, particle-free, and 3D-printable inks. U.S. government agencies, like the Department of Energy (DOE) and the Air Force, offer important grants for research projects in robust materials.

Europe: Technological advancement

Europe has extensive renewable energy targets and is a significant producer of electric vehicles, both of which are predominant drivers of demand for high-performance conductive inks applicable in solar cells and battery machinery. The EU's rigorous environmental guidelines, like REACH and RoHS, encourage the advancement and use of eco-friendly, water-driven conductive inks.

UK: Extensive infrastructure

The UK has a robust focus on high-value uses, such as published sensors for the industrial and healthcare sectors, as well as the aerospace and automotive sectors, which need dedicated conductive inks. The UK has advanced research institutions and startups that contribute to novelty, specifically in evolving areas such as graphene and other progressive material inks.

Conductive Ink Market- Value Chain Analysis

- Raw Material Sourcing

Raw materials for conductive ink comprise conductive particles such as silver, copper, carbon, graphene, or PEDOT: PSS, a binder like gum arabic or ethyl cellulose, and a solvent or carrier such as terpine or water.- Key Players:FedEx and Ryder System

- Key Players:FedEx and Ryder System

- Material Processing

Conductive ink material processing includes making the ink by mixing conductive particles such as silver and carbon with solvents and binders, and then printing it into a substrate.- Key Players: Kuehne + Nagel, DSV

- Key Players: Kuehne + Nagel, DSV

- Waste Management

Waste management process for conductive inks comprises characterization, collection, treatment (including recycling and resource recovery, and last disposal- Key Players: Deutsche Post DHL Group and Maersk

Top Vendors in the Conductive Ink Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Henkel AG & Co. KGaA |

Germany |

Strong and well-known brands |

In February 2025, Henkel launched novel industry-first silver inks and highly conductive silver inks based on recycled silver as raw material. |

|

DuPont de Nemours, Inc. |

Wilmington, Delaware, US |

high-margin sectors |

DuPont Artistri water-based pigment inks for commercial printing enable digital printers to achieve the speed and quality needed for their products. |

|

Sun Chemical Corporation |

United States |

Global reach and supply chain |

Sun Chemical develops a wide range of pigments and color materials for architectural, automotive, and industrial coatings, cosmetics, and plastics. |

|

Heraeus Holding GmbH |

Germany |

Extensive innovation and R&D |

Heraeus Printed Electronics provides a solution for maskless deposition of MOD metal inks for semiconductor applications. |

|

Johnson Matthey Plc |

United Kingdom |

Advanced and world-class expertise |

Johnson Matthey Plc continues to be a player in the broader conductive materials. |

Other Major Companies

- NovaCentrix

- Poly-ink

- Applied Ink Solutions

- Vorbeck Materials Corporation

- Creative Materials Inc.

- Intrinsiq Materials

- PPG Industries Inc.

- Nagase & Co., Ltd.

- Toyo Ink SC Holdings Co., Ltd.

- Methode Electronics, Inc.

Recent Developments

- In June 2025, researchers at KAIST unveiled a novel gallium-based “electronic ink” detailed in Science Advances that could revolutionize flexible electronics, wearables, medical implants, and robotics. The technology could pave the way for next-generation electronic devices that change shape or stiffness depending on how and where they're used, from medical implants that soften inside the body to flexible robotics.

(Source: https://www.livescience.com) - In June 2025, BITS Pilani scientists developed a food-based. Biodegradable conductive paste (FN-CoP) composed of activated carbon, gelatine binder, and oral rehydration solution. AT just Rs. 129 per 100 g, it offers scalable, nontoxic conductivity for ingestible or wearable bioelectronics, marking a significant stride in sustainable electronics.

(Source: https://timesofindia.indiatimes.com)

Segment Covered in the Market

By Type

- Silver-Based Conductive Inks

- Copper-Based Conductive Inks

- Carbon/Graphene-Based Inks

- Conductive Polymers

- Other Hybrid Conductive Inks

By Application

- Photovoltaics (Solar Panels)

- Flexible Displays & Touchscreens

- Printed Circuit Boards (PCBs)

- RFID Tags & Smart Packaging

- Automotive Sensors

- Bio-Sensors & Medical Devices

By Technology

- Screen Printing

- Inkjet Printing

- Flexographic Printing

- Gravure Printing

By Substrate

- Glass Substrates

- Flexible Plastics

- Paper-Based Substrates

- Other Specialized Materials

By End-Use Industry

- Consumer Electronics

- Automotive

- Energy & Power (Solar & Storage)

- Healthcare & Medical Devices

- Packaging & Smart Labels

- Aerospace & Defense

By Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting